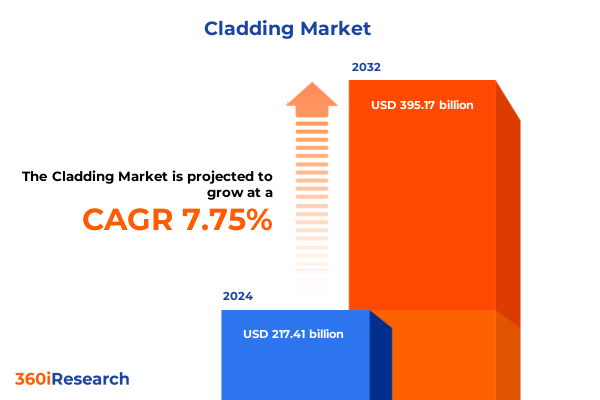

The Cladding Market size was estimated at USD 234.48 billion in 2025 and expected to reach USD 249.68 billion in 2026, at a CAGR of 7.74% to reach USD 395.17 billion by 2032.

Exploring the Evolving Dynamics of the Cladding Landscape Driven by Sustainability Innovation and Architectural Demand Worldwide

The cladding industry stands at a pivotal juncture as architectural innovation and sustainability imperatives converge to redefine building envelopes worldwide. Advances in material science have expanded the palette of options beyond traditional stone and metal, ushering in engineered composites and high-performance coatings that optimize energy efficiency and meet rigorous environmental regulations. Concurrently, heightened awareness of climate resilience is driving architects, developers and policymakers to prioritize façade systems that withstand extreme weather events while contributing to overall building performance. Against this backdrop, stakeholders across the value chain are seeking comprehensive insights to navigate the complexity of evolving specifications and competitive dynamics.

As emerging economies invest heavily in urban infrastructure and renovation projects accelerate in established markets, demand for cladding solutions has diversified in both application and performance expectations. Facade designers are integrating digital tools and parametric design methodologies that enable bespoke geometries and rapid prototyping. Meanwhile, regulatory frameworks such as the latest edition of the International Energy Conservation Code (IECC) and European Union’s Energy Performance of Buildings Directive (EPBD) are imposing stricter thermal and fire safety requirements. This section provides a foundational overview of these catalytic trends, setting the stage for an in-depth examination of transformative shifts, tariff impacts and segmentation insights that will shape strategic decision-making throughout the remainder of the summary.

Uncovering Transformative Shifts Reshaping Cladding Technologies and Industry Practices in Response to Environmental and Performance Imperatives

The cladding sector has experienced transformative shifts as stakeholders embrace digital integration and circular economy principles. Building Information Modeling (BIM) platforms now facilitate end-to-end coordination among architects, fabricators and contractors, reducing design-to-construction cycles and minimizing material waste. Prefabrication techniques, once confined to modular building components, have expanded to include curtain wall assemblies and rainscreen panels produced off-site with high precision. This evolution has driven cost efficiencies while enhancing quality control and accelerating project timelines.

Moreover, growing recognition of environmental footprints has propelled the adoption of low-carbon materials such as bio-based composites and recycled metal alloys. Sustainability certifications like LEED v5.0 and BREEAM Communities demonstrate that façade performance extends beyond aesthetics to encompass lifecycle impacts and recyclability. Manufacturers are investing in research partnerships to develop next-generation coatings that offer self-cleaning and antimicrobial properties, addressing both maintenance and occupant wellness. Regulatory updates across North America, Europe and Asia have reinforced these priorities, urging industry participants to recalibrate product portfolios and supply chain strategies in response to energy codes and circularity mandates.

Assessing the Multifaceted Impact of United States Tariffs in 2025 on Cladding Supply Chains Cost Structures and Market Adaptations

The implementation of targeted import tariffs by the United States in early 2025 has introduced multifaceted challenges for cladding supply chains and project economics. Tariffs levied on aluminum panels and steel framing components have directly increased landed costs, prompting fabricators to reassess their sourcing strategies and explore duty mitigation measures. Fabrication facilities in Mexico and Canada have seen renewed interest as stakeholders leverage North American Free Trade Agreement provisions to offset tariff burdens and maintain just-in-time delivery schedules.

In addition, composite materials such as fiber reinforced polymer products have become subject to classification reviews, creating temporary compliance delays at customs entry points. To counteract these disruptions, manufacturers are diversifying their supplier base by forging partnerships in Southeast Asia and Eastern Europe, where production capabilities have matured and logistical networks have strengthened. These adaptations are not solely reactive; forward-looking companies are also localizing critical downstream operations to reduce exposure to cross-border policy shifts and achieve greater cost predictability. Ultimately, the tariff environment has underscored the strategic importance of supply chain agility and regulatory foresight in preserving competitive positioning.

Gaining In-Depth Segmentation Perspectives Revealing How Material Types End Uses Product Designs and Distribution Networks Define Cladding Market Dynamics

A nuanced examination of cladding market segmentation reveals distinct drivers and competitive landscapes across material types, end-use applications, product configurations and distribution channels. The material spectrum encompasses traditional ceramics and glass, alongside advanced composites subdivided into fiber reinforced polymer and wood plastic composite, and a range of metals including aluminum, copper, steel and zinc, each offering unique performance attributes. Additionally, natural stone, engineered veneers, plastics and sustainably sourced wood variants continue to attract interest for premium and niche design projects.

End-use segmentation further refines market dynamics, highlighting commercial developments in hospitality, office and retail environments that demand high-traffic durability and brand-driven aesthetics. Industrial applications encompassing manufacturing and warehousing emphasize fire resistance and ease of maintenance, while educational and healthcare institutions seek hygienic surfaces and acoustic control. In residential contexts, multi-family complexes leverage prefabricated panel systems for expedited construction, whereas single-family homes often specify customizable rainscreen or board solutions to differentiate architectural character.

Product type delineation underscores the technical complexity of façade solutions. Curtain wall systems-both stick and unitized assemblies-dominate high-rise applications, while panelized configurations available in prefabricated or site-assembled forms offer versatility for mid-rise and retrofit projects. Veneer and rainscreen options deliver aesthetic variety and condensation control, and basic board systems remain cost-effective for large-scale building envelopes. Distribution networks span direct manufacturer relationships alongside localized and national distributors, complemented by digital channels such as manufacturer websites and third party platforms, all of which enhance accessibility and streamline procurement processes.

This comprehensive research report categorizes the Cladding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- End Use

- Product Type

- Distribution Channel

Examining Regional Divergence and Convergence Trends in Cladding Demand Across Americas Europe Middle East Africa and Asia-Pacific Territories

Regional insights into cladding demand demonstrate both convergence of global best practices and divergence driven by local regulatory frameworks, climate conditions and economic cycles. In the Americas, rising construction activity across North and Latin America reflects investment in renewable energy installations and urban infill projects that prioritize energy-efficient envelopes. United States energy codes are increasingly aligned with net-zero targets, prompting façade retrofits and next-generation rainscreen installations in cold and temperate climates alike.

Across Europe, the Middle East and Africa, stringent fire safety regulations and sustainability mandates, particularly within the European Union, are shaping material preferences and limiting combustible panel usage. Simultaneously, high-growth markets in the Gulf Cooperation Council (GCC) and South Africa present significant opportunities for metal and concrete-based cladding systems that withstand extreme heat and accommodate high-rise urban developments. Moreover, policies such as the EU’s Green Deal are encouraging circular economy practices, spurring innovation in recyclable and low-carbon façade materials.

The Asia-Pacific region exhibits rapid urbanization and infrastructure expansion, with China, India, Japan and Southeast Asian economies leading adoption of modular and prefabricated façade systems. Typhoon-prone and earthquake-sensitive zones demand resilient curtain wall engineering, while tropical climates drive interest in ventilated facades to improve thermal comfort. Regional manufacturing hubs have gained traction exporting to neighboring markets, supported by robust sea-freight logistics and growing e-commerce channels for specialized components.

This comprehensive research report examines key regions that drive the evolution of the Cladding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cladding Sector Players to Illuminate Competitive Strategies Technological Capabilities and Collaborative Innovations Shaping Industry Leadership

In the competitive landscape, leading cladding manufacturers are deploying differentiated strategies to capture growth and respond to evolving customer requirements. A prominent European façade specialist has leveraged vertical integration, combining raw material production with downstream fabrication to secure quality control and margin stability. Technological leaders are forging collaborations with software providers to embed smart sensors and IoT capabilities within curtain wall systems, enabling predictive maintenance and energy monitoring.

Another key player has prioritized sustainability by launching product lines made from recycled composite materials and certified low-VOC coatings, earning green building accreditations in multiple territories. Expansion through strategic acquisitions has allowed select conglomerates to broaden their geographical footprint and diversify their offering across ceramic, metal and engineered wood categories. Meanwhile, agile niche manufacturers continue to innovate with bespoke decorative finishes and CNC-cut panel geometries that resonate with high-end architectural projects.

Across these profiles, common themes emerge: an emphasis on R&D to drive product differentiation, investment in automated manufacturing to boost throughput, and proactive engagement with regulatory bodies to shape future standards. These competitive maneuvers underline the importance of aligning operational excellence with sustainability and digital transformation imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cladding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites

- AGC Inc.

- Alcoa Corporation

- Alucoil

- Arconic Corporation

- Boral Limited

- Cembrit Holding A/S

- Centria Architectural Systems

- Compagnie de Saint-Gobain SA

- CSR Limited

- Enclos Corp.

- Etex Group

- Hunter Douglas N.V.

- James Hardie Industries PLC

- Kawneer

- Kingspan Group

- Lindner Group

- Nichiha Corporation

- Permasteelisa S.p.A.

- Reynaers Aluminium

- Rockwool International

- Sto Corp.

- Swisspearl Group

- Tata Steel Ltd.

- Yaret Industrial Group

Delivering Targeted Actionable Recommendations to Empower Industry Stakeholders in Optimizing Investment Priorities and Operational Excellence in the Cladding Arena

Industry leaders can enhance resilience and capitalize on emerging opportunities by pursuing several targeted initiatives. First, accelerating the integration of sustainable raw materials and circular design principles into product development will not only meet regulatory thresholds but also appeal to environmentally conscious stakeholders. Investing in advanced digital tools such as BIM and augmented reality for project visualization can differentiate service offerings and streamline specification approvals.

Furthermore, diversifying supplier networks to include near-shore and regional fabrication partners can mitigate exposure to tariff volatility and logistical bottlenecks. Strengthening manufacturer-installer relationships through co-innovation workshops and performance guarantees will foster trust and create entry barriers for competing entrants. Emphasizing aftermarket services-ranging from thermal imaging diagnostics to façade cleaning contracts-can establish recurring revenue streams and reinforce value propositions.

Lastly, cultivating cross-industry collaborations with technology startups and research institutions will accelerate breakthroughs in fire-resistant coatings, self-healing composites and smart façade integrations. By adopting a proactive regulatory engagement strategy, businesses can influence policy direction while anticipating code changes, ensuring long-term strategic alignment with evolving building performance standards.

Detailing Rigorous Research Methodology Employed to Ensure Robust Data Integrity Analytical Transparency and Comprehensive Sector Coverage in Cladding Analysis

Our research methodology combined qualitative and quantitative approaches to ensure data integrity and comprehensive sector analysis. Primary research involved in-depth interviews with over fifty senior executives from façade manufacturers, architectural firms and industry associations, supplemented by on-site visits to leading fabrication facilities to observe production workflows and quality management systems firsthand.

Secondary research encompassed rigorous review of technical journals, regulatory documents and patent filings to map technological advancements and code developments across major markets. Competitive intelligence was derived from financial reports, public disclosures and press releases, while supply chain dynamics were evaluated through logistics data and customs records. Data triangulation processes were applied to reconcile insights from multiple sources, enhancing the reliability of key findings.

To validate our conclusions, we convened an expert advisory panel comprising façade consultants, urban planners and sustainability certifiers. Their feedback guided final adjustments to segmentation frameworks, regional assessments and strategic recommendations, ensuring our analysis reflects real-world operational contexts and emerging market trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cladding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cladding Market, by Material Type

- Cladding Market, by End Use

- Cladding Market, by Product Type

- Cladding Market, by Distribution Channel

- Cladding Market, by Region

- Cladding Market, by Group

- Cladding Market, by Country

- United States Cladding Market

- China Cladding Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Synthesis Highlighting Core Insights Strategic Imperatives and Forward-Looking Perspectives for Stakeholders in the Cladding Domain

In conclusion, the cladding industry is undergoing a fundamental transformation driven by sustainability mandates, digital innovation and shifting geopolitical landscapes. Material diversification-from advanced composites to recycled metals-is paired with regulatory imperatives that elevate performance, safety and environmental accountability. Tariff measures in the United States have underscored the critical role of agile supply chain strategies and have spurred regional manufacturing alliances that reduce risk exposure.

Segmentation insights reveal that success hinges on tailored solutions for distinct end uses, whether commercial high-rise curtain walls, industrial façades requiring ballistic resilience or residential systems prioritizing aesthetic versatility. Regional analyses highlight divergent market drivers: energy code alignment in the Americas, fire-ready solutions in EMEA and rapid modular expansion in Asia-Pacific. Leading companies are responding with integrated technology platforms, sustainable product lines and strategic acquisitions that bolster global reach.

Looking forward, stakeholders who embrace circular design, invest in digital ecosystem partnerships and maintain regulatory foresight will be best positioned to capture growth and foster innovation. This synthesis underscores the strategic imperatives confronting industry participants and offers a roadmap for navigating the next phase of façade evolution.

Connect Directly with Ketan Rohom for Tailored Access to the Definitive 2025 Cladding Market Research Report

Discover unparalleled insight into the evolving cladding ecosystem by securing the comprehensive 2025 Market Research Report directly through Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Whether you are refining strategic growth initiatives, assessing material innovations or evaluating regional supply chain dynamics, our tailored analysis delivers the actionable data you need. Connect with Ketan to explore customization options, arrange a private briefing or gain immediate access to our proprietary findings along with in-depth case studies and expert commentary. Elevate your decision-making and stay ahead of competitive shifts by leveraging our authoritative market intelligence. Reach out to Ketan today and transform your cladding strategy with the definitive resource guiding tomorrow’s architectural façades and building envelope solutions

- How big is the Cladding Market?

- What is the Cladding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?