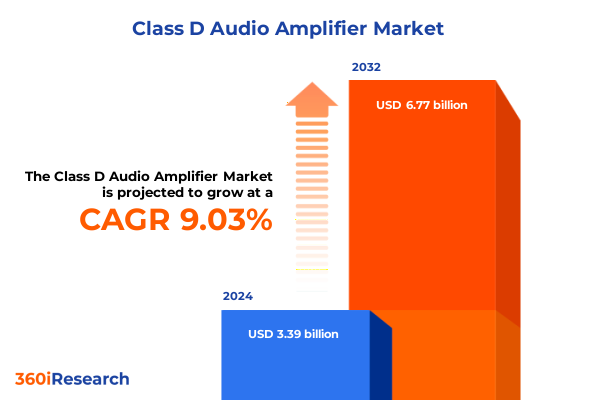

The Class D Audio Amplifier Market size was estimated at USD 3.67 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 9.11% to reach USD 6.77 billion by 2032.

Pioneering the Next Generation of Audio Excellence with Class D Amplifiers Revolutionizing Efficiency, Performance, and Sustainability in Modern Electronics

Class D audio amplifiers are redefining the boundaries of audio performance and energy efficiency across a diverse array of electronic applications. These switching amplifiers leverage pulse-width modulation to minimize heat dissipation and maximize power conversion, enabling sleek industrial designs and prolonging battery life in portable devices. Their growing ubiquity is fueled by a continuous pursuit of higher fidelity, lower footprint, and greener operation-factors that have become indispensable in automotive audio, consumer electronics, and professional sound reinforcement. As audio consumers demand immersive experiences alongside OEMs seeking compact, cost-effective modules, Class D technology emerges as the optimal solution that aligns performance with sustainability.

The evolution of digital audio streams, coupled with the rise of smart speakers, wireless earbuds, and advanced infotainment systems, has propelled Class D amplifiers into the spotlight. These amplifiers optimize efficiency by adjusting switching frequencies in real time and integrating digital signal processing to enhance sound quality. Consequently, manufacturers are accelerating investments in R&D to further shrink form factors, integrate system-on-chip capabilities, and adhere to stringent environmental standards. This introduction sets the stage for a deep dive into how Class D amplifiers are shaping the future of audio delivery and the critical factors driving their rapid adoption across industries.

Disruptive Technological Advances and Converging Trends Are Transforming Audio Amplifiers into Highly Integrated, Intelligently Connected, Ultra-Efficient Solutions

A wave of disruptive technological advances has accelerated the transformation of the audio amplifier landscape. Innovations in mixed-signal integration now embed digital signal processors and power management directly alongside Class D output stages, forging compact, multifunctional modules. Meanwhile, semiconductor process optimizations have pushed switching frequencies ever higher, reducing audible noise and electromagnetic interference-improvements that once seemed unattainable. Such convergence of high-speed digital control and power electronics has unlocked unprecedented fidelity and adaptability, positioning Class D amplifiers as the linchpin of next-generation audio solutions.

Beyond raw performance boosts, the market is witnessing a paradigm shift toward connected, software-defined audio systems. Amplifiers are being equipped with network interfaces and cloud-based analytics to monitor performance and enable over-the-air firmware updates. This intelligent connectivity facilitates predictive maintenance, dynamic equalization, and seamless integration with home automation or vehicle telematics. As a result, manufacturers are not merely selling amplifier chips; they are delivering holistic audio platforms. This shift underscores how Class D amplifier suppliers must blend hardware prowess with software capabilities to meet rising expectations for seamless, personalized listening experiences.

Assessing the Cumulative Effects of Recent United States Tariff Policies on the Class D Audio Amplifier Supply Chain, Manufacturing Costs, and Strategic Sourcing Decisions

The imposition of new United States tariff measures in early 2025 has exerted profound effects on the Class D audio amplifier supply chain. By levying additional duties on specific semiconductor imports and related electronic components, these policies have increased landed costs for amplifier ICs and associated passive elements. Such cost pressures have rippled through manufacturing operations, prompting many OEMs to reassess build locations and vendor partnerships. In response, stakeholders have negotiated longer-term contracts, absorbed initial cost spikes, and sought alternative component sources to preserve margin structures.

Simultaneously, the tariffs have catalyzed a strategic pivot toward regionalized production. Amplifier manufacturers are exploring nearshoring initiatives, forging alliances with North American foundries and packaging houses to mitigate exposure to cross-border levies. This localized approach not only reduces supply chain complexity but also aligns with growing corporate commitments to domestic sourcing and resilience. Yet the transition requires substantial capital and process requalification, underscoring the delicate balance between tariff avoidance and manufacturing proficiency. As 2025 progresses, the lasting impact of these tariffs will hinge on policymakers’ stances, technology roadmaps, and the agility of amplifier vendors to retool operations under evolving trade landscapes.

Revealing Deep Market Dynamics through Comprehensive Multi-Dimensional Segmentation Insights Spanning Type, Power Output, Channels, Applications, and End Users

A comprehensive view of the Class D audio amplifier market reveals that segmentation by amplifier topology-encompassing Bridge Tied Load designs, Full Bridge configurations, Half Bridge modules, Multiplex architectures, and Single Ended circuits-highlights diverse performance and cost trade-offs. Each topology addresses specific demands for power density, thermal management, and output fidelity, enabling manufacturers to tailor solutions for everything from compact wearable devices to high-power industrial systems. In parallel, the market’s stratification by power output-spanning modules rated below 100 watts for portable applications, the 100-to-500-watt class favored by consumer audio, and above 500 watts for professional and automotive use-reflects the broad spectrum of required performance envelopes.

The dynamics of distribution channels further shape market accessibility, as traditional brick-and-mortar pathways through distributor sales, specialty electronics retailers, and dedicated stores coexist with online avenues via e-commerce platforms, manufacturer websites, and global third-party marketplaces. On the demand side, applications span Aerospace & Defense including avionics and military equipment, Automotive solutions encompassing both commercial vehicle and passenger car audio, Consumer Electronics such as speakers, televisions, and emerging wearable devices, Healthcare segments featuring medical imaging and patient monitoring, and Industrial Automation environments that integrate control systems and robotics. Finally, end users range from automotive systems integrators and consumer electronics manufacturers to healthcare device producers, industrial equipment firms, and telecommunications companies. This multi-dimensional segmentation underscores how agility in product development, channel strategy, and application focus is crucial for amplifiers to capture the most promising market niches.

This comprehensive research report categorizes the Class D Audio Amplifier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Output

- Distribution Channel

- Application

- End User

Uncovering Key Regional Market Nuances and Growth Catalysts across the Americas, EMEA Territories, and Asia-Pacific to Guide Strategic Investment Priorities

Regional nuances in the Class D amplifier landscape underscore divergent growth drivers and strategic considerations across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the convergence of advanced automotive infotainment requirements and robust consumer adoption of wireless audio solutions drives demand for mid-to-high-power amplifier modules. Meanwhile, government incentives for domestic electronics production have spurred nearshoring projects that prioritize resilient supply chains and reduced lead times.

In contrast, Europe, the Middle East & Africa present a fragmented yet high-value market characterized by stringent environmental regulations, aggressive sustainability targets, and a mature consumer electronics base. Amplifier vendors in EMEA place considerable emphasis on efficiency benchmarks, disclosures around ecological impact, and certifications that align with regional directives. Collaborative initiatives between manufacturers and research institutions further accelerate innovation in high-fidelity and low-power applications.

Asia-Pacific remains the largest consumption hub, bolstered by rapidly expanding mobile device penetration, burgeoning smart home ecosystems, and significant investments in industrial automation. Localized manufacturing prowess and a competitive component ecosystem in countries like China, South Korea, and Japan enable accelerated product cycles and cost advantages. However, regional geopolitical tensions and shifting trade agreements necessitate vigilant risk management. Together, these insights serve as a compass for prioritizing market entry and scaling strategies in each geographic zone.

This comprehensive research report examines key regions that drive the evolution of the Class D Audio Amplifier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscapes with In-Depth Analysis of Leading Innovators, Their Technology Portfolios, Partnerships, and Strategic Roadmaps

Leading players in the Class D audio amplifier domain are distinguishing themselves through integrated design frameworks, strategic partnerships, and a relentless focus on performance optimization. Industry stalwarts such as Texas Instruments have expanded their portfolios to include highly compact system-on-chip solutions that combine digital processing cores with high-speed switching stages. Infineon Technologies continues to pioneer GaN-based amplifier modules, promising higher power densities and reduced thermal constraints. STMicroelectronics has collaborated with automotive OEMs on bespoke amplifier arrays tailored for next-generation in-cabin audio architectures.

Simultaneously, Analog Devices has leveraged its DSP expertise to introduce adaptive equalization algorithms that dynamically compensate for speaker and enclosure variances. NXP Semiconductors has deepened alliances with major e-commerce platforms and distribution networks to enhance global reach, while smaller innovators focus on segment-specific offerings, such as military-grade amplifiers optimized for extreme environmental resilience. These competitive maneuvers illuminate a landscape in which technological breadth, ecosystem integration, and channel agility determine market leadership. Companies that can swiftly translate end-user requirements into scalable amplifier solutions will define the contours of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Class D Audio Amplifier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Cirrus Logic, Inc.

- Infineon Technologies AG

- Maxim Integrated Products, Inc.

- Microchip Technology Incorporated

- Monolithic Power Systems

- Nuvoton Technology

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- ROHM Co., Ltd.

- STMicroelectronics International N.V.

- Texas Instruments Incorporated

Empowering Industry Leaders with Actionable Strategies to Navigate Disruption, Optimize Supply Chains, Accelerate Innovation, and Maximize Market Opportunities

Industry leaders can capitalize on evolving market dynamics by embracing several actionable strategies. First, diversifying supply chains through a judicious mix of regional partnerships and strategic inventory buffering can mitigate tariff-induced cost fluctuations and logistical disruptions. By securing relationships with multiple foundries and packaging partners, companies ensure continuity even amid geopolitical uncertainties. Next, channel strategies should be realigned to balance the strengths of heritage offline distributors with the scalability of online marketplaces. This dual focus enhances market penetration and fosters brand resilience.

Moreover, sustained investment in R&D is paramount-particularly in areas like integrated digital control, advanced materials for thermal management, and artificial intelligence-powered calibration. Collaborations with research institutions and tier-two suppliers can accelerate innovation cycles. At the same time, proactive engagement in standards bodies and regulatory forums will influence the next generation of efficiency and emissions criteria. Finally, executives should prioritize sustainability by adopting modular amplifier architectures and assessing the life-cycle impacts of components. These strategies, woven into a cohesive business roadmap, will enable amplifiers to outpace the competition and meet the exacting demands of tomorrow’s audio applications.

Detailed Research Methodology Combining Primary Interviews, Secondary Analyses, Data Triangulation Techniques, and Qualitative-Quantitative Integration for Robust Insights

This study synthesizes a robust methodological framework to ensure credibility and relevance. It began with comprehensive secondary research, tapping into public filings, patent databases, regulatory disclosures, technical journals, and industry whitepapers to map technology trajectories and policy landscapes. Concurrently, a series of in-depth interviews with senior executives, design engineers, procurement heads, and channel partners provided qualitative insights into strategic priorities and operational challenges. These firsthand perspectives enriched the narrative around innovation imperatives and market receptivity.

Quantitative data collection involved aggregating component shipment figures, pricing indices, and regional trade statistics from reputable databases, followed by rigorous data triangulation to validate consistency across sources. Advanced analytical tools enabled correlation analyses between tariff regimes and component sourcing trends, while scenario modeling shed light on potential market responses to policy shifts. Throughout the process, findings were cross-verified against real-world case studies and expert panel reviews to ensure the final deliverables accurately reflect market realities and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Class D Audio Amplifier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Class D Audio Amplifier Market, by Type

- Class D Audio Amplifier Market, by Power Output

- Class D Audio Amplifier Market, by Distribution Channel

- Class D Audio Amplifier Market, by Application

- Class D Audio Amplifier Market, by End User

- Class D Audio Amplifier Market, by Region

- Class D Audio Amplifier Market, by Group

- Class D Audio Amplifier Market, by Country

- United States Class D Audio Amplifier Market

- China Class D Audio Amplifier Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Key Takeaways Highlighting Essential Opportunities, Challenges, and Strategic Priorities in the Class D Audio Amplifier Market Journey Toward Future Success

The Class D audio amplifier ecosystem stands at the threshold of a new era defined by digital integration, energy efficiency demands, and dynamic trade environments. Key takeaways include the critical role of advanced mixed-signal integration in delivering high-fidelity audio while maintaining compact form factors. Tariffs have reshaped supply chain dynamics, prompting strategic nearshoring and supplier diversification. Segmentation insights reveal that topology distinctions, power tiers, and application focus are instrumental in identifying high-growth niches. Regional nuances across the Americas, EMEA, and Asia-Pacific underscore the importance of localized strategies and regulatory compliance.

Competitive analyses highlight that success hinges on the ability to merge hardware innovation with software-enabled features, while actionable recommendations stress the need for supply chain agility, research collaboration, and sustainability benchmarks. As this landscape continues to evolve, stakeholders equipped with a nuanced understanding of these factors will be positioned to capture emerging opportunities. Embracing the insights outlined herein can catalyze growth, fortify competitive moats, and chart a path toward enduring market leadership in Class D audio amplification.

Act Now to Engage with Ketan Rohom, Associate Director Sales & Marketing, and Secure the Definitive Class D Audio Amplifier Market Report for Strategic Advantage

If you’re seeking to stay ahead in the rapidly evolving audio amplifier sector, there is no time to wait. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can become your definitive guide to informed decision-making. By partnering with Ketan, you gain privileged access to in-depth analyses, strategic insights, and expert recommendations designed to illuminate your path toward growth. Gain clarity on supply chain navigations, product roadmap optimization, and competitive positioning as you secure a competitive edge in the Class D audio amplifier space. Whether you are evaluating new market entry, optimizing existing portfolios, or identifying emerging opportunities, this tailored report delivers the intelligence you need. Reach out today to discuss licensing options, customized data services, and volume licensing for your organization. Don’t miss the opportunity to transform uncertainty into strategic action; connect with Ketan Rohom now and ensure your organization leverages the full power of Class D audio amplifier market insights.

- How big is the Class D Audio Amplifier Market?

- What is the Class D Audio Amplifier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?