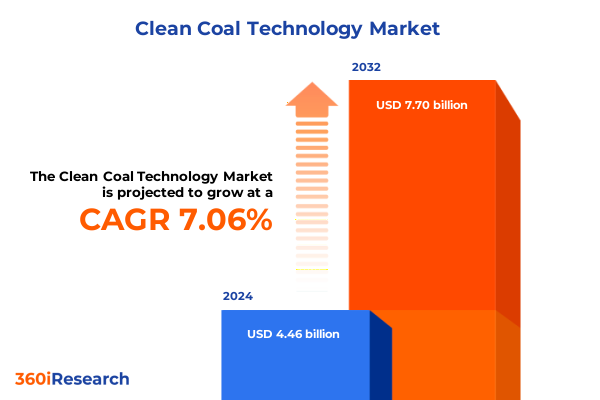

The Clean Coal Technology Market size was estimated at USD 4.76 billion in 2025 and expected to reach USD 5.08 billion in 2026, at a CAGR of 7.10% to reach USD 7.70 billion by 2032.

Unveiling the Future of Fossil Fuel Efficiency Through Advanced Carbon Management and Emission Reduction Technologies in a Decarbonizing World

The accelerating imperative to reconcile energy demand with environmental stewardship has thrust clean coal technology into the spotlight. Once perceived as an incremental improvement over traditional combustion methods, modern clean coal approaches now embody comprehensive strategies to mitigate carbon emissions while enhancing fuel efficiency. As global powers intensify their decarbonization commitments, the evolution of advanced carbon capture techniques, optimized combustion systems, and integrated gasification solutions positions this domain as a critical bridge in the transition toward a lower-carbon economy.

Throughout this report, the scope and scale of innovation in clean coal technology are examined in depth, revealing how these advancements not only address regulatory imperatives but also unlock operational advantages. From retrofitting legacy power plants with next-generation carbon capture units to deploying modular gasification systems in industrial settings, stakeholders across energy, manufacturing, and heavy industries are evaluating the trade-offs and synergies offered by these solutions. Consequently, executive teams and technical leaders alike require a clear understanding of the technology landscape, competitive dynamics, and the transformative potential that clean coal technologies can deliver in meeting both sustainability and energy security objectives.

This introduction establishes the foundation for subsequent analysis, setting the stage for a detailed exploration of market shifts, policy influences, segmentation intricacies, and region-specific dynamics. By foregrounding the strategic relevance of clean coal advancements, we aim to equip decision-makers with the context necessary to navigate an increasingly complex and opportunity-rich environment.

Catalyzing a Paradigm Shift in Energy Production Through Integration of Carbon Capture, Combustion, and Gasification Innovations

The past few years have seen a paradigm shift in how energy producers, industrial manufacturers, and policymakers conceptualize fossil fuel utilization. What was once a linear approach-combust, emit, and treat-has evolved into a multifaceted integration of emission abatement, heat recovery, and by-product valorization. Leading this transformation, sophisticated carbon capture and storage methodologies now coexist with breakthroughs in combustion optimization, offering a reduction in greenhouse gas output without sacrificing operational continuity.

Simultaneously, the maturation of gasification architectures has opened new pathways for synthesizing hydrogen, producing clean syngas, and generating power with significantly lower carbon footprints. These trends are reinforced by the proliferation of hybrid systems that merge thermal efficiency improvements with carbon capture modules, thus enabling plants to meet stringent regulatory targets while capitalizing on existing infrastructure investments. In addition, digital twin simulations, predictive maintenance algorithms, and advanced materials have converged to enhance reliability and reduce lifecycle costs across clean coal installations.

Collectively, these transformative shifts underscore a broader transition in the global energy matrix, where coal-based assets evolve from emission liabilities into platforms for innovation. By dissecting each of these developments, this section illuminates how stakeholders can harness technological convergence to achieve both environmental compliance and sustained profitability.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Clean Coal Technology Supply Chains and International Partnerships

In 2025, the United States implemented a series of targeted tariffs aimed at recalibrating the competitive balance in strategic energy technologies. These levies, applied predominantly to select imported components for carbon capture systems and advanced pre-combustion modules, have introduced new considerations for supply chain resilience. While domestic manufacturers have experienced a shore-up in demand for locally produced membranes, catalysts, and pressure vessels, purchasers face recalibrated cost structures and extended procurement timelines.

Those adjustments have prompted market participants to reconsider sourcing strategies, including accelerated investment in regional manufacturing partnerships and intensified focus on alternative supply networks in Asia-Pacific and Europe, where tariff impacts are less pronounced. The ripple effects have also manifested in a reassessment of project economics, as the total cost of ownership for turnkey clean coal installations now includes tariff-induced premiums. To adapt, stakeholders are employing hedging mechanisms, renegotiating long-term agreements, and exploring backward integration to mitigate exposure.

Ultimately, the 2025 tariff measures have underscored the criticality of agile supply chain design in the clean coal ecosystem. As export controls and bilateral trade negotiations continue to evolve, this analysis provides a blueprint for navigating the complex interplay between policy levers and market dynamics, ensuring that strategic capital allocations remain both cost-effective and compliant.

Decoding Market Dynamics Through Technology, Coal, Component, and End-User Segmentation to Uncover Niche Growth Opportunities in Clean Coal

A nuanced understanding of the clean coal technology field emerges only when one examines the market through intertwined lenses of technology, coal grade, component specialization, and end-user application. On the technology front, carbon capture and storage solutions represent the vanguard of emission mitigation, whereas fluidized bed and pulverized coal combustion techniques offer incremental efficiency gains within existing thermal infrastructures. Meanwhile, diverse gasification pathways-from hydrogen production via coal gasification to integrated and multipurpose platforms-are enabling a broader spectrum of industrial applications.

Equally consequential is the type of coal underpinning these initiatives. High-energy anthracite reserves are being deployed where maximized thermal output is essential, while more abundant bituminous and subbituminous grades serve as feedstocks for large-scale power generation. In regions with lower-rank lignite deposits, the emphasis has shifted toward pairing gasification and carbon capture to manage the relatively higher moisture content and volatile matter profiles.

In terms of component architecture, boilers remain central to combustion-based systems, yet their efficiency is now enhanced through retrofittable scrubber units capable of both dry and wet pollutant removal. Turbine integration, whether in the form of advanced gas turbines driving syngas turbines or optimized steam turbines in combined cycle setups, rounds out the core hardware landscape. These configurations are then deployed across a spectrum of industrial end-users: cement kilns demanding consistent high-temperature inputs, chemical facilities producing fertilizers and petrochemicals, coal-fired and combined cycle power plants striving for regulatory compliance, and steel manufacturers balancing heat requirements with emission limits. By weaving these segmentation perspectives together, this insight reveals how targeted value propositions can be crafted for each stakeholder cohort.

This comprehensive research report categorizes the Clean Coal Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Coal Type

- Component

- End-User

Mapping Regional Momentum in Clean Coal Innovation Across Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Global variations in resource endowments, policy frameworks, and industrial infrastructure have given rise to distinct regional trajectories in the adoption of clean coal technologies. In the Americas, legacy coal fleet operators have prioritized retrofitting initiatives, spurred by both federal incentives and state-level carbon pricing schemes. This environment has fostered collaboration between equipment suppliers and vertically integrated utilities seeking to extend asset lifespans while meeting progressively tighter emission standards.

Across Europe, the Middle East & Africa corridor, the emphasis has skewed toward pilot projects and demonstration facilities. The drive to secure energy security, especially in regions with nascent renewable capacities, has catalyzed government-sponsored trials of integrated gasification combined cycle plants. Simultaneously, multinational partnerships have emerged to adapt technology transfers to local coal qualities and regulatory landscapes, thus creating a mosaic of site-specific solutions.

In Asia-Pacific, rapid industrialization and persistent energy demand have amplified interest in both large-scale carbon capture deployments and modular gasification units. National development plans in China, India, and Southeast Asia increasingly feature cross-sectoral decarbonization roadmaps that incorporate clean coal systems as transitional mechanisms. Within this dynamic context, consortiums of technology vendors, research institutions, and utilities are forming to pilot next-generation materials and digital control systems tailored to high-throughput environments.

This comprehensive research report examines key regions that drive the evolution of the Clean Coal Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Pioneers and Strategic Players Driving Innovation and Competitive Differentiation in the Clean Coal Technology Landscape

The competitive arena for clean coal solutions is characterized by a spectrum of specialized technology providers, large engineering conglomerates, and nimble startups. Leading equipment manufacturers have leveraged decades of power plant expertise to introduce retrofit-ready carbon capture modules, while global energy firms have diversified portfolios to include hydrogen-from-coal ventures and bespoke gasification process engineering. This has generated a dynamic landscape where cross-sector M&A activity and strategic alliances are commonplace.

Concurrently, a wave of entrepreneurial ventures has emerged, focusing on advanced sorbents, low-footprint compressors, and AI-driven process optimizers. These innovators are often anchored by research partnerships with academic institutions, enabling accelerated scale-up of lab-validated technologies into pilot and commercial phases. Meanwhile, services firms offering consulting, project management, and financing solutions are carving out a niche by bundling technical prowess with market access, thus facilitating smoother project execution.

Amid these competitive pressures, differentiation hinges on the ability to demonstrate not only technological performance but also lifecycle value, regulatory expertise, and end-to-end project delivery capabilities. As a result, strategic profiles range from vertically integrated suppliers providing turnkey installations to specialized component vendors and engineering consultancies, each vying to establish footholds in burgeoning regional and application-specific segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clean Coal Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Air Products and Chemicals, Inc.

- Aker Solutions ASA

- ALSTOM Holdings

- Babcock & Wilcox Enterprises, Inc.

- Bechtel Corporation

- Bharat Heavy Electricals Limited

- Carbon Clean Solutions Limited

- Doosan Corporation

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Harbin Electric Company Limited

- Hitachi, Ltd.

- JGC Corporation

- KBR, Inc.

- Linde Engineering Division

- Mitsubishi Heavy Industries, Ltd.

- NextFuel AB

- Shell PLC

- Shenhua Group Corporation Limited

- Siemens AG

Actionable Strategies for Industry Leaders to Accelerate Clean Coal Adoption, Enhance Sustainability, and Strengthen Competitive Advantage

Industry leaders must prioritize agile innovation pipelines that align emergent clean coal solutions with evolving regulatory imperatives. To that end, fostering collaborative R&D partnerships with technology startups and research centers can accelerate proof-of-concept demonstrations and de-risk commercialization efforts. Moreover, forming consortiums that aggregate demand for standardized components can unlock economies of scale and mitigate supply chain bottlenecks.

Equally important is the strategic integration of digital twins, advanced sensors, and predictive analytics within plant operations. These tools enable continuous performance optimization, preemptive maintenance, and rapid adaptation to shifting fuel properties or regulatory thresholds. By deploying modular architectures, companies can phase capital investments, reduce downtime risks, and maintain operational continuity during upgrade cycles.

Finally, pursuing policy advocacy and actively engaging with regulatory bodies will ensure that incentives, credits, and compliance frameworks evolve to recognize the full environmental and economic benefits of clean coal systems. Aligning corporate sustainability commitments with transparent reporting mechanisms and third-party certifications will further strengthen stakeholder trust, enhance access to green finance, and solidify long-term competitive positioning.

Outlining Robust Qualitative and Quantitative Research Frameworks to Ensure Comprehensive and Reliable Insights into Clean Coal Technology

This research draws on a blended methodology encompassing rigorous primary and secondary investigation. In the primary phase, in-depth interviews were conducted with senior executives, technical directors, and policy advisors across the energy, industrial, and regulatory spectrum. These dialogues provided firsthand insights into technology selection criteria, capital allocation drivers, and emerging regional regulatory trends.

Secondary research included comprehensive analysis of peer-reviewed journals, patent filings, industry consortium publications, and governmental white papers. Historical tariff schedules, trade agreement texts, and public financial disclosures were examined to map policy impacts and identify strategic responses. Market intelligence databases and competitive benchmarking tools were employed to catalog product pipelines, partnership networks, and M&A activities among leading clean coal technology providers.

Quantitative triangulation techniques synthesized this data into relational frameworks that correlate technology maturity, regional adoption rates, and supply chain dynamics. Through this multilayered approach, the report ensures both breadth and depth of coverage, delivering insights that are both robust and actionable for stakeholders navigating the clean coal landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clean Coal Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clean Coal Technology Market, by Technology Type

- Clean Coal Technology Market, by Coal Type

- Clean Coal Technology Market, by Component

- Clean Coal Technology Market, by End-User

- Clean Coal Technology Market, by Region

- Clean Coal Technology Market, by Group

- Clean Coal Technology Market, by Country

- United States Clean Coal Technology Market

- China Clean Coal Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Insights on the Evolution, Challenges, and Strategic Pathways Shaping the Future of Clean Coal Technology Adoption

The trajectory of clean coal technology is defined by a convergence of stringent emission mandates, evolving fuel portfolios, and a broader decarbonization ethos. As carbon capture, advanced combustion, and gasification techniques continue to mature, the industry stands at a crossroads: one path leads to incremental upgrades within existing coal fleets, while the other charts a course toward integrated, hybridized energy systems that align with ambitious net zero targets.

Challenges persist, notably in balancing capital intensity with project returns and in harmonizing policy frameworks across jurisdictions. Nevertheless, compelling value propositions emerge when lifecycle benefits, such as by-product valorization, reduced carbon levies, and extended asset longevity, are accounted for. Further, strategic synergies between clean coal and renewable assets promise to elevate grid reliability and economic resilience in transitional markets.

Ultimately, the adoption of clean coal solutions will depend on the ability of industry stakeholders to orchestrate collaborations, align policy incentives with technological capabilities, and communicate transparently with investors and communities. By leveraging the insights detailed in this report, organizations can chart a strategic course that balances operational pragmatism with environmental stewardship, thereby securing both short-term gains and long-term sustainability.

Discover How Personalized Advisory from Our Associate Director Can Empower Your Strategic Decisions in Clean Coal Technology

Engaging with an experienced strategist can be pivotal in refining your market approach and accelerating clean coal initiatives. Ketan Rohom, Associate Director of Sales & Marketing, offers bespoke guidance tailored to your organizational goals and market challenges. By partnering with him, you gain access to specialized insights that translate complex industry dynamics into clear, actionable pathways, enabling you to navigate regulatory frameworks, cultivate strategic alliances, and unlock emerging opportunities.

To empower your decision-making and secure a competitive edge, we invite you to reach out to Ketan Rohom directly. Discover how a collaborative dialogue can clarify your priorities, align your resource allocation with high-impact initiatives, and drive sustainable growth within the clean coal technology arena. Take the next step today and leverage personalized expertise designed to transform your strategic vision into measurable outcomes.

- How big is the Clean Coal Technology Market?

- What is the Clean Coal Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?