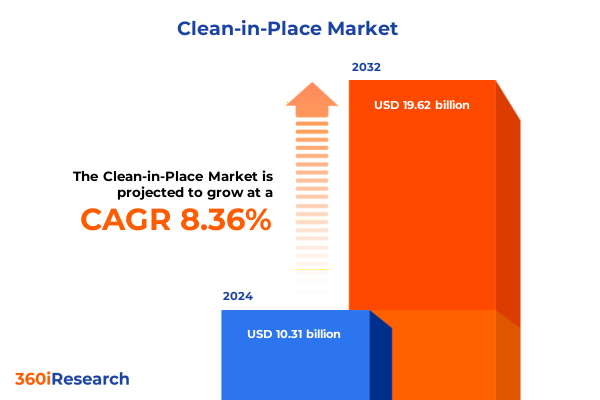

The Clean-in-Place Market size was estimated at USD 11.19 billion in 2025 and expected to reach USD 12.03 billion in 2026, at a CAGR of 8.34% to reach USD 19.62 billion by 2032.

Pioneering Comprehensive Insights into the Clean-in-Place Landscape and Emerging Opportunities for Process Optimization

As industries seek to maintain stringent hygiene standards while optimizing operational efficiency, Clean-in-Place (CIP) systems have emerged as a critical cornerstone for process cleanliness across food and beverage, pharmaceutical, and cosmetics manufacturing. CIP processes enable the internal cleaning of vessels, piping, and process equipment without disassembly, thereby reducing downtime and labor costs while ensuring consistent sanitation. In recent years, rising regulatory scrutiny, consumer demand for product safety, and the imperative to minimize water and chemical usage have converged to elevate the strategic importance of CIP investments. This introduction lays the groundwork for understanding how technological advancements and operational imperatives are reshaping CIP applications.

Building on this context, the following sections deliver an integrated perspective on pivotal market drivers, evolving tariff environments, and nuanced segmentation insights. Furthermore, insights into regional dynamics and competitive positioning underscore how market leaders are navigating challenges and seizing growth opportunities. The summary then articulates actionable recommendations designed for industry stakeholders eager to enhance operational resilience and achieve best-in-class sanitation outcomes. Finally, readers will find a transparent overview of the research methodology to appreciate the rigor and credibility of the findings presented.

Exploring How Automation, Sustainability Initiatives, and Digital Transformation Are Redefining Clean-in-Place Practices Across Industries

Major shifts in the clean-in-place landscape are underway as manufacturers embrace automation, sustainability, and digitalization. Automation is transforming manual or semi-automatic CIP cycles into fully automatic processes capable of self-regulating flow rates, temperatures, and chemical concentrations to optimize cleaning efficacy. Meanwhile, sustainability initiatives are driving the adoption of eco-friendly chemistries that reduce water consumption and minimize hazardous effluents. As a result, organizations are integrating real-time monitoring and control systems to track resource use and environmental impact, thereby aligning CIP operations with corporate responsibility goals.

Moreover, digital transformation is fundamentally reshaping CIP practices through the deployment of IoT sensors, cloud-based analytics, and predictive maintenance algorithms. These technologies enable remote supervision of cleaning cycles, data-driven adjustments to parameters, and early identification of maintenance requirements. Consequently, downtime is reduced and lifecycle costs are optimized. In addition, a growing shift toward service-based models has seen technology providers offering CIP as a managed service, bundling equipment, chemicals, and data insights under subscription contracts. This evolution underscores the transition from product-centric offerings to outcome-oriented partnerships that deliver measurable improvements in sanitation reliability and cost efficiency.

Analyzing the Far-Reaching Effects of 2025 United States Tariffs on Clean-in-Place Supply Chains and Operational Costs

The introduction of revised United States tariffs in early 2025 has exerted significant pressure on clean-in-place supply chains and operational budgets. With import duties increased on key chemical inputs such as specialty cleaning agents and surfactants, upstream costs have risen sharply for suppliers dependent on overseas production. As a result, manufacturers have experienced margin compression, prompting many to reassess supplier relationships and accelerate sourcing diversification strategies. Consequently, the tariff environment has compelled both equipment OEMs and chemical formulators to explore domestic production or alternative chemistries that mitigate exposure to duty fluctuations.

Simultaneously, the heightened cost structure has triggered innovation in CIP system design and maintenance practices. For instance, several end users have invested in modular equipment capable of using broader ranges of cleaning agents, including newer enzymatic and acidic formulations, to minimize reliance on tariff-impacted substances. Furthermore, collaboration between chemical suppliers and equipment manufacturers has intensified to develop more concentrated cleaning solutions that reduce transportation weight and lower duty liabilities. This interplay between regulation and innovation illustrates how tariff policy serves as both a disruptive force and a catalyst for enhanced efficiency across the CIP ecosystem.

Uncovering Crucial Segmentation Insights Spanning Product Types, Automation Levels, Agent Variants, Applications, End Users, and Sales Channels

Insight into product type segmentation reveals that cleaning solutions remain the core revenue generator, encompassing acid cleaners, alkaline cleaners, enzymatic cleaners, and sanitizers designed to meet diverse hygiene requirements. Complementing these solutions, equipment offerings such as batch CIP and inline CIP systems provide flexible platforms for both discrete and continuous processing environments. Equally critical, service segments encompassing consulting, installation & commissioning, and maintenance & repair ensure that users maximize system uptime and maintain compliance with stringent sanitation regulations. Together, these elements form a holistic value chain that addresses the complete lifecycle of CIP deployment, from initial planning through ongoing support.

Further analysis across automation levels underscores that fully automatic systems are rapidly gaining traction among high-throughput facilities seeking repeatable, validated cleaning outcomes, while semi-automatic and manual configurations continue to serve lower-volume or cost-sensitive operations. When considering cleaning agent type specifically, parity between acid cleaners, alkaline cleaners, enzymatic cleaners, and sanitizers highlights the need for system compatibility and parameter flexibility to leverage each chemistry’s strengths. Application segmentation illustrates robust demand in cosmetics and pharmaceuticals, with particularly nuanced requirements in food & beverage subsegments such as beverage, brewing, dairy, and food processing. In parallel, end users spanning chemical manufacturers, food & beverage manufacturers, and pharmaceutical manufacturers seek tailored CIP solutions that meet product-specific challenges. Finally, the choice of sales channel-whether direct sales, distributor networks, or online sales-shapes customer engagement models and after-sales service expectations.

This comprehensive research report categorizes the Clean-in-Place market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Automation Level

- Cleaning Agent Type

- Application

- End User

- Sales Channel

Highlighting Regional Dynamics Shaping the CIP Market in the Americas, Europe Middle East and Africa, and the Asia-Pacific Regions

Regional analysis begins with the Americas, where established manufacturing hubs prioritize strict compliance with environmental and safety regulations. In North America, high adoption rates of advanced analytics and automated CIP systems reflect a mature ecosystem that values operational transparency and resource conservation. Shifting southward, emerging markets in Latin America are investing in CIP infrastructure to support growth in dairy, beverage, and biofuels, albeit with continued emphasis on cost optimization and modular deployment to match variable production scales.

Across Europe, the Middle East, and Africa, the landscape is characterized by wide regulatory diversity and pioneering sustainability mandates. Western Europe leads in the implementation of circular-economy principles, integrating water recovery and chemical reuse into CIP strategies. Meanwhile, Middle Eastern food & beverage producers focus on rapid deployment of standardized systems to meet surging local demand, and African markets exhibit increasing interest in turnkey CIP packages adapted to energy-constrained environments. In the Asia-Pacific region, rapid industrial expansion in countries such as China, India, and ASEAN is driving substantial investment in both green chemistries and digital control platforms. Cost sensitivity coexists with a readiness to embrace smart CIP solutions, presenting unique opportunities for collaborative innovation and localized manufacturing partnerships.

This comprehensive research report examines key regions that drive the evolution of the Clean-in-Place market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Perspectives from Leading Clean-in-Place System Providers and Innovative Technology Developers Advancing Industry Standards

Leading clean-in-place system providers are differentiating through integrated technology roadmaps that blend equipment innovation with advanced chemical formulations. Many established OEMs are forging alliances with chemical specialists to co-develop proprietary cleaning solutions optimized for specific system architectures. Simultaneously, technology developers are embedding IoT sensors and machine-learning algorithms directly into pumps, valves, and control panels to deliver real-time performance metrics and predictive maintenance alerts. This convergence of hardware and software is elevating the role of CIP providers to strategic partners in manufacturing excellence.

Moreover, a wave of mergers and acquisitions has reshaped the competitive landscape, enabling companies to expand geographic footprints and broaden their product portfolios. Players with strong service networks are capitalizing on recurring revenue streams by offering outcome-based contracts that guarantee cleaning efficacy and resource savings. In parallel, nimble start-ups are gaining traction with modular, skid-mounted CIP units that reduce installation complexity and enable plug-and-play scalability. Collectively, these dynamics underscore a shift toward more collaborative, ecosystem-based business models that prioritize customer-centric solutions over one-off equipment sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clean-in-Place market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adam Equipment Pty Ltd

- Admix Inc.

- Alfa Laval Corporate AB

- Bran+Luebbe GmbH

- Chester-Jensen Company, Inc.

- Diversey Holdings, Ltd.

- Evoguard GmbH

- Flowserve Corporation

- GEA Group Aktiengesellschaft

- Grundfos Holding A/S

- KHS GmbH

- Krones AG

- Melegari Manghi S.p.A.

- Nijhuis Saur Industries

- Sani-Matic, Inc.

- Sentinel Process Systems, Inc.

- Sistemas Técnicos de Lavado, S.L.

- Soler & Palau Research, S.L.

- SPX FLOW, Inc.

- Tetra Pak International SA

Formulating Strategic and Actionable Recommendations to Drive Efficiency, Sustainability, and Compliance in Clean-in-Place Operations

Industry leaders are encouraged to prioritize investment in smart CIP systems that integrate real-time monitoring and advanced analytics to drive continuous performance improvements. By establishing cross-functional teams that include operations, maintenance, and sustainability experts, organizations can identify efficiency gaps and deploy targeted process optimizations. In addition, adopting a portfolio of eco-friendly cleaning chemistries can significantly reduce environmental impact while buffering against supply chain volatility driven by raw material tariffs.

Furthermore, forging strategic alliances with technology providers and chemical specialists will enable companies to co-create tailored CIP solutions that meet unique production requirements. Pursuing outcome-based service models can generate predictable revenue streams and enhance customer loyalty, while rigorous training programs for operations personnel ensure competency in managing automated cleaning cycles. Ultimately, these measures will position industry stakeholders to achieve superior sanitation outcomes, regulatory compliance, and cost control in an increasingly complex operational environment.

Detailing Rigorous Research Methodologies, Data Sources, and Analytical Frameworks Ensuring Credibility of Clean-in-Place Market Insights

The research methodology underpinning this analysis combines comprehensive secondary research with targeted primary data collection to ensure robust and credible findings. Secondary sources include regulatory filings, industry white papers, technology patent databases, and thought-leadership publications that provide historical context and benchmark performance metrics. These insights were augmented by primary interviews with senior executives, process engineers, and procurement leaders across key end-user segments to capture real-world perspectives on evolving CIP requirements.

To validate and triangulate data, the study applied structured analytical frameworks, including SWOT analysis to assess competitive positioning and Porter’s Five Forces to evaluate market dynamics. Segmentation was rigorously defined by product type, automation level, cleaning agent chemistry, application, end user, and sales channel, ensuring that insights are precisely aligned with stakeholder needs. Quality control measures included peer review of draft findings and cross-verification of quantitative inputs against multiple independent sources, providing assurance that the conclusions drawn reflect the current state and future trajectory of the clean-in-place market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clean-in-Place market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clean-in-Place Market, by Product Type

- Clean-in-Place Market, by Automation Level

- Clean-in-Place Market, by Cleaning Agent Type

- Clean-in-Place Market, by Application

- Clean-in-Place Market, by End User

- Clean-in-Place Market, by Sales Channel

- Clean-in-Place Market, by Region

- Clean-in-Place Market, by Group

- Clean-in-Place Market, by Country

- United States Clean-in-Place Market

- China Clean-in-Place Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Takeaways and Future Outlook to Guide Decision Makers Through the Evolving Clean-in-Place Ecosystem and Strategic Imperatives

This executive summary has distilled the pivotal trends transforming clean-in-place operations-from the acceleration of automation and digital integration to the influence of tariff policies and the imperative for sustainable chemistries. By synthesizing segmentation and regional insights alongside competitive benchmarks, decision-makers are equipped with a multidimensional view of the market landscape. The interplay between cost pressures, regulatory mandates, and technological innovation underscores the need for agile strategies that balance efficiency, compliance, and environmental stewardship.

Looking forward, organizations that embrace data-driven CIP management, foster partnerships across the value chain, and invest in adaptable system architectures will be best positioned to capitalize on emerging opportunities. As the market continues to evolve, continuous monitoring of policy changes and technology advancements will be essential for maintaining competitive advantage. This conclusion underscores the importance of a proactive approach to clean-in-place, where insight-led decision-making drives both operational excellence and sustainable growth.

Engage with Ketan Rohom to Unlock Comprehensive Clean-in-Place Market Research Report Tailored to Your Strategic Goals Immediately

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to access a deeply granular analysis of clean-in-place systems that aligns precisely with your strategic objectives. Engaging with Ketan will provide you with a tailored briefing on emerging technologies, regulatory shifts, and competitive best practices that can be translated into immediate operational improvements. By partnering with this expert, you will secure bespoke recommendations and priority access to ongoing updates, enhancing your ability to capitalize on new opportunities within the CIP landscape.

- How big is the Clean-in-Place Market?

- What is the Clean-in-Place Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?