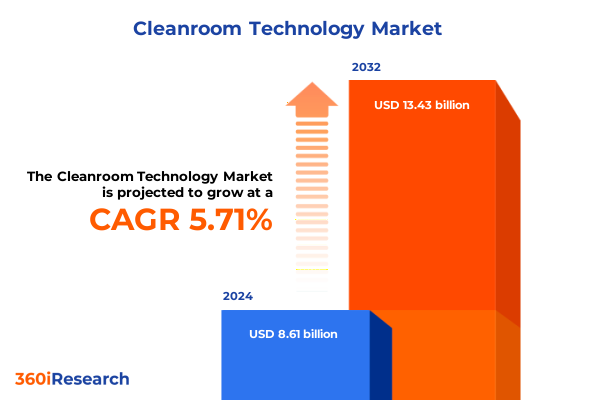

The Cleanroom Technology Market size was estimated at USD 9.08 billion in 2025 and expected to reach USD 9.58 billion in 2026, at a CAGR of 5.75% to reach USD 13.43 billion by 2032.

Overview of Cleanroom Technology Landscape Featuring Definitions, Critical Importance, Industry Applications, and Emerging Quality Standards Shaping the Future

Cleanrooms represent the cornerstone of modern manufacturing and research environments where contamination control is paramount. These specialized facilities maintain precisely controlled levels of airborne particulates, temperature, humidity, and pressure, safeguarding the integrity of critical processes in industries as varied as microelectronics, biotechnology, and pharmaceuticals. An effective cleanroom environment mitigates the risks of product defects, regulatory noncompliance, and safety hazards while underpinning advancements in sectors reliant on ultra-high purity conditions.

Tracing its origins to mid-20th century semiconductor production, cleanroom technology has evolved in parallel with industry demands for greater precision and reliability. Today’s cleanroom environments integrate advanced filtration systems, real-time monitoring, and rigorous operational protocols designed to adapt to emerging contaminants and materials. This convergence of mechanical engineering, materials science, and data analytics ensures that modern cleanrooms not only address present-day requirements but are also poised to accommodate future innovations and regulatory enhancements.

As industries continue to innovate, cleanroom facilities have become strategic assets that differentiate leading organizations from their competitors. Through continuous improvements in design, maintenance, and performance validation, cleanrooms enable companies to achieve higher throughput, reduced waste, and unmatched product quality-thus serving as critical drivers for operational excellence and technological breakthroughs in an increasingly demanding global marketplace.

Emergence of Innovative Solutions, Regulatory Revisions, and Digital Integration Transforming Cleanroom Technology Operations and Compliance Across Sectors

Cleanroom technology is undergoing a period of profound transformation driven by the convergence of regulatory revisions, sustainability imperatives, and digital integration. On the regulatory front, agencies worldwide are tightening contamination control standards, compelling operators to adopt advanced monitoring systems and automated compliance reporting. This shift ensures more transparent traceability of environmental conditions while reducing the risk of nonconformities and costly production interruptions.

In parallel, a growing emphasis on environmental responsibility is reshaping cleanroom operations. Manufacturers are embracing energy-efficient HVAC systems, sustainable consumables, and recyclable filtration media to minimize carbon footprints and waste disposal challenges. These sustainable practices not only support corporate social responsibility goals but also deliver long-term cost savings and enhanced public perception.

Digital technologies such as the Internet of Things, machine learning, and predictive analytics are now integral to cleanroom management. Real-time data from sensors embedded in fan filter units, HVAC systems, and HEPA filters feeds advanced algorithms that anticipate filter replacements, detect anomalies, and optimize airflow patterns. Consequently, organizations achieve higher uptime, lower maintenance costs, and improved operational resilience in the face of unplanned disruptions.

Assessing the Cumulative Effects of 2025 United States Tariffs on Supply Chains, Material Costs, and Competitive Dynamics in Cleanroom Technology

The implementation of United States tariffs in 2025 has fundamentally altered the economics of cleanroom technology supply chains. Increased duties on imported high-efficiency filters, specialized airflow components, and proprietary consumables have translated into higher raw material costs for manufacturers and end users alike. As a result, organizations are reassessing supplier arrangements and exploring alternative sourcing strategies to mitigate long-term cost pressures.

In response, many cleanroom operators have accelerated the development of domestic manufacturing partnerships. This shift toward local production not only reduces exposure to tariff-related price volatility but also shortens lead times and simplifies customs procedures. Furthermore, companies are investing in adaptable modular cleanroom designs that can be retrofitted or expanded with minimal reliance on imported prefabricated units, thereby enhancing capital flexibility.

Despite rising input costs, some stakeholders view the tariff-induced disruption as an opportunity to rebalance supply chains and promote domestic innovation. By fostering closer collaboration between material producers, equipment manufacturers, and research institutions, the industry is laying the groundwork for a more resilient ecosystem capable of withstanding future trade policy shifts.

In-Depth Insights into Cleanroom Market Through Construction, Product, and Application Segmentation Revealing Growth and Investment Opportunities

Insight into cleanroom market segmentation reveals differentiated growth drivers and investment priorities based on construction typology, product categories, and end-use applications. Facilities relying on hard-wall construction continue to serve pharmaceutical and microelectronics sectors, where rigorous barrier integrity and controlled environmental conditions are non-negotiable. By contrast, mobile and portable cleanrooms have gained traction in biotechnology and specialty manufacturing settings that require flexible deployments for pilot studies or on-site testing. Modular cleanrooms strike a balance between scalability and durability by leveraging prefabricated panels for quick assembly, while soft-wall solutions cater to cost-sensitive projects that demand cleanroom functionality with lower capital outlays.

Product segmentation further highlights the critical role of consumables and equipment in maintaining contamination control standards. Within consumables, cleaning agents such as alcohols and quaternary ammonium compounds work in tandem with wipes and disinfectants to sustain sterility, while safety consumables including gloves and specialized apparel safeguard personnel and processes. Key equipment categories encompass laminar airflow systems and biosafety cabinets that deliver unidirectional airflows, HEPA filters that capture submicron particulates, and advanced HVAC configurations that regulate temperature and humidity. Together, these product classes form an integrated ecosystem that ensures reliable cleanroom performance.

Application segmentation underscores the diversity of cleanroom utilization across automotive coatings, microelectronics wafer fabrication, pharmaceutical production, food and beverage inspections, and biotechnology research. Each segment imposes unique contamination thresholds and throughput requirements, prompting tailored cleanroom designs and operational protocols. As a result, stakeholders across industries are investing in specialized cleanroom configurations and process automation to meet stringent quality and safety benchmarks.

This comprehensive research report categorizes the Cleanroom Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Construction Type

- Technology

- Application

- End-User Industry

Exploring Regional Dynamics of Cleanroom Technology Adoption and Growth Patterns Across Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping cleanroom technology adoption, driven by differing regulatory environments, industrial priorities, and investment climates. In the Americas, a robust manufacturing base in pharmaceuticals, microelectronics, and aerospace has spurred demand for both large-scale and modular cleanrooms. North American operators, in particular, are early adopters of digital monitoring platforms and sustainable HVAC solutions, reflecting stringent environmental regulations and heightened customer expectations for transparency in contamination control.

Europe, the Middle East, and Africa present a diverse landscape characterized by mature markets in Western Europe and rapidly developing manufacturing hubs in the Gulf region and sub-Saharan Africa. In Western Europe, tight regulatory frameworks and ambitious sustainability targets drive innovation in energy-efficient consumables and low-carbon filtration media. Meanwhile, the Middle East and Africa are experiencing growing investments in pharmaceutical manufacturing and semiconductor assembly, prompting demand for turnkey cleanroom solutions that can be deployed under accelerated timelines.

Asia-Pacific remains the fastest-evolving region, propelled by large-scale electronics production in East Asia and expanding pharmaceutical research in South Asia. Governments across the region are incentivizing onshore manufacturing through policy support and special economic zones, fueling capital expenditures on both hard-wall and modular cleanrooms. Consequently, competitive pressures in Asia-Pacific have catalyzed cost-effective manufacturing of key consumables and equipment, which is in turn influencing global supply chain realignments.

This comprehensive research report examines key regions that drive the evolution of the Cleanroom Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cleanroom Technology Providers Highlighting Strategic Initiatives, Collaborative Partnerships, and Competitive Advantages

Leading providers in the cleanroom technology domain have distinguished themselves through targeted product portfolios, strategic partnerships, and investment in research and development. Some have prioritized the expansion of modular cleanroom offerings, enabling accelerated deployment and cost-effective scaling for biotech and specialty manufacturing clients. Others have deepened collaborations with filtration media innovators to introduce next-generation HEPA and ULPA filters boasting improved capture efficiency and extended service life.

Collaborative ventures between equipment manufacturers and software firms are also redefining the market landscape. Integrated solutions now combine fan filter unit hardware with cloud-based monitoring platforms, offering remote analytics and predictive maintenance alerts. Such partnerships enhance uptime, reduce unplanned downtime, and optimize lifecycle costs, thereby creating compelling value propositions for enterprise customers. Additionally, strategic alliances with universities and research institutes are facilitating rapid prototyping of antimicrobial surface coatings and environmentally friendly disinfectants.

Moreover, several companies are advancing their footprint through acquisitions of niche service providers, broadening their ability to offer on-site validation, certification, and training services. This full-service model not only deepens client relationships but also accelerates time to operational readiness, reinforcing these providers’ positions as trusted end-to-end partners in contamination control.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cleanroom Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABN Cleanroom Technology NV

- Abtech Incorporated

- AIRTECH System Co., Ltd.

- Alpiq Group

- Angstrom Technology, Ltd.

- Ansell group

- Ardmac Group Limited by Purever Industries

- Azbil Corporation

- Bouygues E&S InTec Schweiz AG

- Camfil AB

- Clean Air Products, Inc.

- Clean Rooms International Inc.

- COLANDIS GmbH

- Daikin Industries, Ltd.

- DuPont de Nemours, Inc.

- Ecolab Inc.

- Exyte GmbH

- Filtration Group Corporation

- Freudenberg Filtration Technologies SE & Co. KG

- Getinge AB

- Gilcrest Manufacturing Limited

- Guardtech Cleanrooms Ltd.

- Integrated Cleanroom Technologies Pvt. Ltd. by Takasago Thermal Engineering Group

- ITW Contamination Control BV

- Labconco Corporation

- Lennox Clean Air Technologies

- MANN+HUMMEL GmbH

- Nicos Group, Inc.

- Nortek Air Solutions, LLC

- OCTANORM-Vertriebs-GmbH

- Palas GmbH

- Parker-Hannifin Corporation

- Parteco S.r.l.

- Siemens AG

- STERIS plc

- Subzero Engineering, Inc.

- Taikisha Ltd.

- Terra Universal, Inc.

- Thermo Fisher Scientific Inc.

- Vertex Air Technologies Private Limited

Strategic Recommendations for Industry Leaders to Enhance Cleanroom Performance, Regulatory Compliance, and Sustainable Innovation Practices

Industry leaders should prioritize the integration of predictive analytics and real-time monitoring to transform reactive maintenance into proactive management. By harnessing data from air diffusers, HEPA filters, and HVAC systems, organizations can anticipate performance degradation and schedule maintenance during planned downtime, thereby maximizing throughput and minimizing unplanned interruptions. Simultaneously, aligning cleanroom design with sustainability objectives-through the use of recyclable filter media, energy recovery systems, and non-toxic disinfectants-will enhance both regulatory compliance and corporate social responsibility profiles.

Furthermore, diversifying supplier networks to include both domestic and international partners will buffer against future trade disruptions and tariff fluctuations. Strategic co-development agreements with local manufacturers can accelerate the adoption of proprietary technologies while stabilizing input costs. It is equally critical to foster cross-functional collaboration between quality assurance, facilities management, and R&D teams to ensure that cleanroom configurations are rigorously validated and capable of accommodating evolving processing requirements.

Finally, investing in workforce training programs that emphasize contamination control best practices, equipment operation, and digital tool competency will strengthen organizational resilience. Empowered personnel who understand both the technical and procedural aspects of cleanroom management become frontline guardians of quality and safety, driving continuous improvement and fostering a culture of operational excellence.

Comprehensive Research Methodology Detailing Data Collection, Analytical Frameworks, and Validation Techniques Underpinning Cleanroom Technology Insights

This research relies on a multifaceted methodology that combines primary interviews with cleanroom engineers, facility managers, and regulatory experts, alongside secondary sources such as industry whitepapers, peer-reviewed journals, and professional association guidelines. Interview insights were carefully triangulated with published standards to validate the practical applicability of emerging technologies and operational practices under real-world conditions. In addition, anonymized survey data from end users in pharmaceutical, microelectronics, biotechnology, and food and beverage sectors helped identify prevailing challenges and investment priorities.

Quantitative assessments of equipment categories and consumable usage patterns were derived from detailed product specifications and procurement records. To ensure robustness, data points were cross-checked against multiple independent vendor reports and adherence requirements specified by regulatory bodies such as the U.S. FDA, European Medicines Agency, and ISO 14644 standards. Qualitative analysis benefited from a comparative review of case studies documenting successful cleanroom upgrades, retrofits, and greenfield implementations.

Finally, all findings were peer-reviewed by an interdisciplinary panel of industry practitioners and academic researchers. This iterative validation process confirmed that the presented insights accurately reflect current market dynamics, technological advancements, and regulatory frameworks, thereby providing a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cleanroom Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cleanroom Technology Market, by Offering

- Cleanroom Technology Market, by Construction Type

- Cleanroom Technology Market, by Technology

- Cleanroom Technology Market, by Application

- Cleanroom Technology Market, by End-User Industry

- Cleanroom Technology Market, by Region

- Cleanroom Technology Market, by Group

- Cleanroom Technology Market, by Country

- United States Cleanroom Technology Market

- China Cleanroom Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings to Illuminate Future Directions, Emerging Trends, and Strategic Priorities in the Evolving Cleanroom Technology Landscape

The collective insights from this analysis illuminate a cleanroom industry in flux, where regulatory tightening, sustainability mandates, and digital innovation converge to reshape contamination control paradigms. From the growing appeal of modular and mobile cleanroom solutions to the acceleration of domestic sourcing in response to tariff impacts, the landscape is becoming increasingly dynamic and competitive. Stakeholders who embrace predictive maintenance, energy-efficient designs, and collaborative supplier ecosystems will be best positioned to capitalize on these transformative trends.

Moreover, the critical role of segmentation-across construction typologies, consumables and equipment portfolios, and diverse end-use applications-underscores the need for tailored strategies that align with specific operational and compliance requirements. Regional variations further complicate the picture, with each geographic market exhibiting distinct regulatory pressures, investment climates, and technological preferences. Leading companies are already distinguishing themselves through strategic partnerships, holistic service offerings, and targeted research and development efforts that anticipate evolving customer demands.

Looking ahead, the integration of advanced materials, antimicrobial technologies, and machine-learning-driven analytics promises to elevate cleanroom performance to unprecedented levels. By synthesizing the key findings of this report, organizations can chart a clear path toward operational excellence, robust compliance, and sustainable growth in an era defined by rapid technological progress and shifting global trade dynamics.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Cleanroom Technology Research and Drive Informed Strategic Decisions

Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the intricacies of cleanroom technology and tailor a research solution that meets your organization’s unique requirements. By partnering directly with Ketan, you’ll gain access to in-depth analyses, data-driven insights, and strategic frameworks that empower informed decision-making and competitive advantage. Whether you require a bespoke deep dive into specialty cleanroom applications, support with regulatory compliance, or strategic guidance on emerging materials and technologies, Ketan’s expertise will ensure you receive a comprehensive report aligned to your business objectives.

Engaging with Ketan also provides the opportunity to explore custom deliverables such as executive briefings, interactive workshops, and ongoing advisory services. This personalized collaboration will enable you to translate research findings into actionable roadmaps, optimize your cleanroom investments, and accelerate time-to-value. Act now to secure exclusive early-access pricing and priority scheduling, ensuring your organization stays at the forefront of cleanroom innovation. Connect with Associate Director Ketan Rohom today to purchase the full cleanroom technology market research report and catalyze your strategic growth initiatives

- How big is the Cleanroom Technology Market?

- What is the Cleanroom Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?