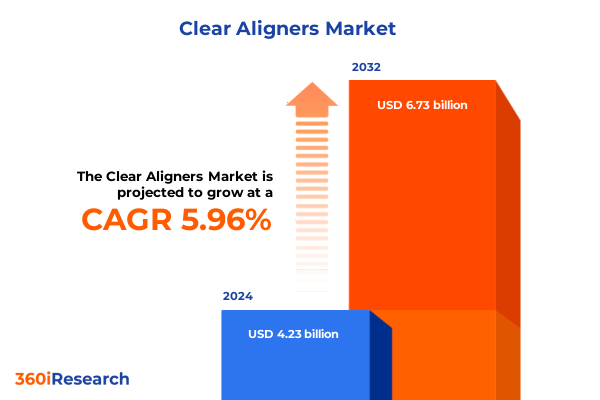

The Clear Aligners Market size was estimated at USD 4.47 billion in 2025 and expected to reach USD 4.73 billion in 2026, at a CAGR of 5.99% to reach USD 6.73 billion by 2032.

Unveiling the Driving Forces Behind the Rapid Evolution of the Global Clear Aligners Market Landscape and Critical Implications for Industry Stakeholders

Over the past decade, the clear aligners industry has evolved from a niche orthodontic offering into a mainstream solution that reshapes patient expectations and clinical workflows. Emerging digital scanning technologies, coupled with advances in thermoplastic materials, have lowered barriers to entry and accelerated adoption across general dentistry and orthodontic practices. At the same time, a growing consumer emphasis on aesthetics, convenience, and minimally invasive treatments has driven demand among adults and teenagers alike. These dynamics set the stage for a market environment characterized by rapid innovation, shifting competitive structures, and new value propositions focused on speed, customization, and end-to-end digital integration.

As alignment therapies become increasingly democratized, stakeholders across the value chain are recalibrating strategies to stay ahead of consumer and regulatory shifts. Direct-to-Consumer platforms are challenging the status quo by offering remote treatment monitoring, while professional service providers are exploring hybrid models that blend in-office expertise with digital follow-up. Meanwhile, leading manufacturers and distributors continue to invest heavily in research and development, seeking to optimize material properties and streamline fabrication processes. This introduction provides a panoramic view of the forces reshaping the clear aligners market landscape, highlighting the critical levers that stakeholders must understand to navigate emerging opportunities and risks.

Examining the Transformative Shifts Reshaping Consumer Preferences Technological Innovations and Competitive Strategies Across the Clear Aligners Sector

Today’s clear aligners ecosystem is defined by transformative shifts across multiple dimensions, from technological breakthroughs to consumer engagement models. Teleorthodontics, made possible by artificial intelligence–powered treatment planning and remote monitoring, is redefining the patient experience and creating new channels for market penetration. At the same time, material science advances have introduced next-generation polymers that combine superior transparency, durability, and printability, enabling faster turnaround times and lower per-unit costs. These developments are converging with data analytics platforms that harness treatment outcome feedback to refine algorithmic aligner stage sequencing, ultimately driving improved clinical precision and shorter overall therapy durations.

Concurrently, regulatory agencies in key markets are updating guidance on medical device classification, patient safety protocols, and digital health integration. These policy adaptations have encouraged greater standardization in lab processes and fostered trust among dental professionals and end users. On the competitive front, the rise of subscription-based offerings and bundled service models underscores a shift toward recurring revenue strategies, while strategic partnerships between aligner innovators and established dental equipment manufacturers are accelerating product diversification. Together, these dynamics illustrate a market in transition, ushering in a new era of personalized, technology-driven orthodontic care.

Assessing the Cumulative Impact of United States Tariff Adjustments Implemented in 2025 on Supply Chains Pricing Structures and Industry Dynamics

In 2025, a new suite of United States tariff measures targeting imported polymers and dental device components came into effect, compelling clear aligners manufacturers to reassess their sourcing strategies and cost structures. These duties, applied to a range of thermoplastic materials integral to aligner fabrication, elevated landed costs and created pricing pressure along the supply chain. Suppliers in Asia-Pacific and other low-cost regions have responded by optimizing production footprints and forging strategic alliances to secure tariff exemptions or qualify for preferential trade arrangements. At the same time, certain material innovators accelerated the commercialization of domestically produced alternatives to mitigate exposure to cross-border duties.

The cumulative impact of these tariff adjustments extends beyond raw material procurement. As import costs have risen, contract manufacturers and distribution partners have renegotiated terms, prompting some aligner providers to absorb margin compression in the short term to preserve competitive price points. Others have pursued nearshoring initiatives, establishing regional fabrication centers within the United States to bypass tariff regimes and enhance supply chain resilience. These shifts have, in turn, influenced inventory management practices, lead time expectations, and capital allocation plans. Ultimately, the 2025 tariff landscape has catalyzed greater agility among market players and underscored the importance of diversified sourcing strategies.

Uncovering Key Segmentation Insights Revealing How Aligners Deliver Personalized Solutions Across Types Materials Age Groups Distribution Channels and End Users

Insight into how different product types perform is fundamental to understanding consumer adoption patterns. Aligners designed for fixed applications-where attachments remain in place for the entire treatment duration-tend to attract more complex cases managed by orthodontic specialists, whereas removable systems appeal to patients seeking greater autonomy and ease of use. Material choice further differentiates offerings; polycarbonate-based aligners are prized for their rigidity in achieving precise tooth movements, while PETG-based options deliver a balance of flexibility and clarity. Polymethyl methacrylate alternatives are recognized for medical-grade biocompatibility, polypropylene variants for their resilience, and polyurethane aligners for their superior elasticity.

Demographic segmentation reveals that adult patients, driven by aesthetic considerations and discretionary spending power, account for a significant share of demand growth, whereas teenage users-who benefit from guided monitoring by guardians and practitioners-represent a strategic entry point for long-term brand loyalty. Distribution channels also exhibit distinct trends: direct-to-consumer models leverage digital marketing and remote consultations to deliver aligners at scale, while professional dental service providers-comprising allied health partners and retail dental clinics-capitalize on in-office expertise to command premium treatment packages. Finally, end-user segmentation highlights that orthodontic clinics remain core drivers of alignment therapies, with group practices and stand-alone operators expanding service lines, and hospitals integrating aligner offerings to complement broader oral health programs.

This comprehensive research report categorizes the Clear Aligners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Age Group

- Distribution Channel

- End User

Examining Regional Dynamics Highlighting Growth Drivers and Market Maturity Trends Across the Americas Europe Middle East Africa and Asia Pacific

Regional performance in the clear aligners sector reveals a tapestry of maturity levels and growth catalysts. In the Americas, entrenched consumer awareness and a robust private dental infrastructure underpin widespread adoption, with the United States leading on demand for premium, digitally integrated solutions. Brazil and Canada are notable for localized innovations and tailored financing models that broaden market access. Across Europe, Middle East & Africa, regulatory harmonization efforts within the European Union and patient financing initiatives have accelerated uptake, while Gulf Cooperation Council nations are witnessing early growth driven by rising health care expenditures and expanding dental service networks. Conversely, parts of Africa still contend with limited infrastructure and awareness, presenting long-term opportunity zones for awareness campaigns and practitioner training.

The Asia-Pacific region represents the most dynamic frontier, combining high population density, ascending disposable incomes, and rapid modernization of oral care services. Markets such as China, Japan, and Australia have seen surging interest in consumer-centric models, propelled by domestic startup ecosystems and government investments in health care digitization. Southeast Asian economies are progressively adopting teleorthodontic frameworks, while India’s expansive private dental sector is emerging as a competitive battleground for both global incumbents and regional challengers. Taken together, these regional narratives underscore the necessity for tailored go-to-market strategies that reflect local regulatory climates, consumer preferences, and distribution structures.

This comprehensive research report examines key regions that drive the evolution of the Clear Aligners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Enterprises Driving Innovation Strategic Partnerships and Market Expansion Initiatives within the Competitive Clear Aligners Ecosystem

Leading enterprises in the clear aligners ecosystem are distinguished by their integrated digital platforms, expansive treatment networks, and strategic partnerships. Innovators in proprietary treatment planning software have enabled clinically validated workflows that reduce manual intervention and enhance predictability. At the same time, vertically integrated providers leverage in-house manufacturing to optimize capacity utilization and maintain tighter quality control, while pure-play platform companies focus on scaling remote treatment services through alliances with local clinicians. Collaborations between material science specialists and 3D printing pioneers have yielded custom resin formulations that enhance step-by-step tooth movements, underscoring the critical role of cross-industry synergies.

Competitive intensity is further amplified by mergers and acquisitions aimed at consolidating digital scanning, artificial intelligence-driven analysis tools, and telehealth capabilities. Joint ventures between medical device firms and orthodontic networks are expanding access in untapped regions, while targeted investments by private equity groups are fueling rapid expansion of direct-to-consumer operations. Moreover, research partnerships with academic institutions are advancing bioactive polymer coatings designed to reduce microbial adhesion and improve patient comfort. Collectively, these strategic moves illustrate how top players are shaping a future defined by end-to-end digitalization, material innovation, and scalable network effects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clear Aligners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- 3Shape A/S

- Align Technology, Inc.

- AMPA Orthodontics Pvt. Ltd.

- Argen Corporation

- Candid Care Co.

- Clarus Company by Carnegie

- Clear Aligners III Sdn Bhd

- Danaher Corporation

- DENTSPLY SIRONA Inc.

- DynaFlex

- Envista Holding Corporation

- EZ SMILE Pty Ltd.

- Great Lakes Dental Technologies

- K Line Europe GmbH

- Patterson Companies Inc.

- Scheu Dental GmbH

- Shandong Huge Dental Material Corporation

- Shanghai Smartee Dental Technology Co., Ltd.

- Straumann Group

- TP Orthodontics, Inc.

- V Clear Aligners

Delivering Actionable Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Clear Aligners Marketplace

Industry leaders should prioritize the development of hybrid service models that combine the convenience of remote monitoring with the clinical expertise of in-office consultations. By integrating cloud-based treatment tracking systems with scheduled virtual check-ins, providers can improve patient adherence while optimizing chair time for high-value procedures. Simultaneously, diversifying material sourcing through dual-sourcing agreements and regional fabrication hubs can mitigate tariff-induced cost pressures and bolster supply chain agility. Emphasizing locally produced polymer alternatives will not only reduce lead times but also support sustainability goals by lowering transportation-related carbon footprints.

Marketing strategies must evolve to address the distinct motivations of adult and teenage segments. For adult consumers, messaging that highlights aesthetic discreetness and lifestyle compatibility will resonate most effectively, whereas teenage outreach should focus on parental reassurance, structured check-ins, and gamified compliance incentives. Distribution partnerships with allied health professionals-such as dental hygienists and oral health educators-offer an avenue to broaden patient acquisition beyond traditional orthodontic clinics. Finally, companies should invest in predictive analytics tools that blend patient demographic data with treatment outcomes, enabling proactive identification of drop-off risks and personalized engagement campaigns to maximize long-term retention and satisfaction.

Outlining Comprehensive Research Methodology Detailing Data Collection Analysis Techniques and Validation Procedures Underpinning the Study on Clear Aligners

The findings in this report are grounded in a rigorous, multi-stage research methodology designed to triangulate quantitative and qualitative inputs. Primary data collection included structured interviews with leading orthodontists, dental practitioners, materials engineers, and supply chain executives, ensuring a diverse spectrum of industry perspectives. These insights were complemented by analysis of company disclosures, regulatory filings, and patent databases to capture emerging material technologies and forecast adoption trends.

Quantitative analysis was conducted using a bottom-up approach, mapping aligner consumption patterns by segment and region, and cross-validating with third-party distributor shipment records. Segmentation frameworks were applied to dissect performance across product types, material formulations, age cohorts, distribution channels, and end-user categories. Throughout the research process, data integrity was upheld through validation workshops with an expert advisory panel, and all findings were subjected to consistency checks against publicly available industry reports, market surveys, and peer-reviewed academic studies. This comprehensive methodology ensures that the insights presented herein are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clear Aligners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clear Aligners Market, by Type

- Clear Aligners Market, by Material Type

- Clear Aligners Market, by Age Group

- Clear Aligners Market, by Distribution Channel

- Clear Aligners Market, by End User

- Clear Aligners Market, by Region

- Clear Aligners Market, by Group

- Clear Aligners Market, by Country

- United States Clear Aligners Market

- China Clear Aligners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Executive Summary Emphasizing Strategic Imperatives Strengths and Growth Trajectories Shaping the Future of the Clear Aligners Industry

In summary, the clear aligners market stands at the intersection of technological innovation, regulatory evolution, and shifting consumer expectations. Industry participants who harness advanced materials, deploy digital treatment platforms, and adapt to tariff-induced supply chain realignments will secure competitive advantage. Geographic expansion strategies must be tailored to regional nuances-from the mature ecosystems of North America and Western Europe to the burgeoning opportunities in Asia-Pacific. Segmentation-based approaches that address the unique needs of adults versus teenagers, direct-to-consumer versus professional channels, and varying end-user profiles will further differentiate winning propositions.

The competitive landscape will continue to be shaped by strategic alliances, M&A activity, and the emergence of hybrid care models that blur the lines between traditional dental practices and remote service offerings. Leaders are advised to invest in predictive analytics and agile manufacturing capabilities while maintaining rigorous quality and compliance standards. By synthesizing these strategic imperatives, organizations can navigate the complexities of the clear aligners sector and chart a path toward sustainable growth and innovation.

Engage Directly with Ketan Rohom to Unlock Comprehensive Insights Secure Your Detailed Market Research Report Today and Drive Your Strategic Agenda

Unlock a world of precise data and forward-looking analysis by connecting with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings a wealth of experience guiding executives through complex market landscapes, ensuring that your organization gains tailored insights into the evolving dynamics of the clear aligners space. Whether your priority is understanding the nuanced impact of tariffs, dissecting regional growth patterns, or uncovering material- and age-based preferences among end users, this comprehensive research report delivers the depth and breadth of intelligence you need.

Take the next step toward informed decision-making by engaging directly with Ketan to request a personalized walkthrough of the findings. Secure your copy of the detailed market research report today and equip your strategic agenda with actionable intelligence. With Ketan Rohom’s expertise and our rigorous research framework, you’ll be positioned to identify emerging opportunities, mitigate risks, and optimize your path to competitive advantage in the clear aligners marketplace.

- How big is the Clear Aligners Market?

- What is the Clear Aligners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?