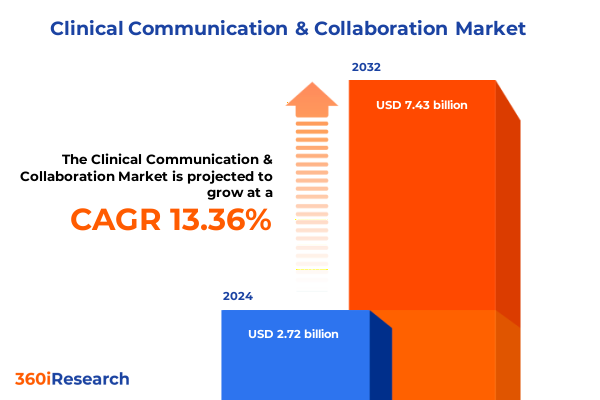

The Clinical Communication & Collaboration Market size was estimated at USD 3.08 billion in 2025 and expected to reach USD 3.45 billion in 2026, at a CAGR of 13.38% to reach USD 7.43 billion by 2032.

Pioneering Seamless Clinical Communication and Collaboration to Enhance Patient Outcomes and Drive Healthcare Operational Efficiency in Modern Care Settings

Clinical communication and collaboration represent the lifeblood of modern healthcare delivery, weaving together the efforts of physicians, nurses, laboratory technicians, and administrative teams into a cohesive care tapestry. As healthcare organizations grapple with increasing complexity, the ability to seamlessly share patient data, coordinate care pathways, and quickly respond to emergent situations has become indispensable. Real-time exchange of critical information not only accelerates decision-making but also mitigates the risk of errors that can compromise patient safety. Moreover, the shift toward integrated care models places added emphasis on interoperable platforms that transcend departmental silos, enabling a continuum of care that extends from ambulatory settings to acute hospital environments.

Over the past decade, digital transformation has propelled clinical communication from pagers and fax machines to secure messaging, mobile applications, and telehealth interfaces. In parallel, regulatory imperatives have strengthened the mandate for data portability and standardization, underscoring the need for robust clinical collaboration frameworks. Consequently, healthcare leaders are pivoting toward solutions that foster teamwork, streamline workflows, and deliver actionable insights at the point of care. This executive summary sets the stage for a deep dive into the forces reshaping this landscape, the fiscal dynamics introduced by recent tariff policies, and strategic pathways for organizations to maintain clinical excellence in an era defined by rapid technological change and shifting patient expectations.

Emerging Technological and Operational Paradigms Reshaping Clinical Communication and Collaboration in Response to Evolving Patient Needs and Industry Regulations

The clinical communication and collaboration landscape is undergoing unprecedented transformation as emerging technologies, regulatory shifts, and new care paradigms converge. Cloud-native architectures are replacing legacy on-premise servers, enabling instantaneous messaging, secure video conferencing, and centralized documentation across distributed care teams. Mobile-first designs ensure that clinicians have access to real-time patient data and collaboration tools at the bedside, in operating theatres, or during field visits to ambulatory care centers. Simultaneously, artificial intelligence and machine learning algorithms are being embedded within communication platforms to prioritize critical alerts, streamline care coordination, and reduce cognitive load.

Furthermore, the proliferation of telehealth and remote patient monitoring has extended the boundaries of clinical collaboration beyond physical facilities, fostering virtual care ecosystems that require seamless integration between home devices, mobile applications, and hospital information systems. Regulatory standards-such as the 21st Century Cures Act interoperability rules-have accelerated the adoption of APIs and data-exchange protocols, driving vendors to embrace open standards and ensuring that patient information flows unimpeded. As a result, the industry is witnessing a shift from isolated point solutions toward unified platforms that deliver end-to-end visibility, strengthen care pathways, and support comparative analytics for continuous improvement in patient outcomes.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on Clinical Communication Hardware Supply Chains and Service Cost Structures

In March 2025, the United States implemented new tariff measures targeting electronic components and medical-grade communication hardware imported from key global suppliers. These duties, averaging an additional 10 percent on secure mobile devices, nurse-call systems, and video conferencing endpoints, have introduced notable cost pressures for hospitals and clinics that relied on streamlined procurement channels. As organizational budgets remained fixed, care providers faced difficult trade-offs, reallocating funds from expansion initiatives and software enhancements to cover increased hardware expenses. This budgetary realignment has extended procurement cycles and prompted greater scrutiny of total cost of ownership, particularly among smaller ambulatory care groups.

Moreover, healthcare technology vendors have responded by diversifying their manufacturing bases, reshoring critical production lines, and absorbing a portion of the tariffs to preserve competitive service pricing. While these supply chain adjustments offer medium-term resilience, they have also created temporary bottlenecks in component availability and extended lead times. The net effect has been a recalibration of deployment timelines for new unified communication platforms and an increased emphasis on modular, software-driven upgrades that can circumvent hardware-dependent constraints. As organizations look ahead, scenario planning around tariff trajectories and multi-sourcing strategies will be essential to mitigate future supply disruptions and maintain momentum on digital transformation roadmaps.

Uncovering Critical Market Dynamics through Product Type End-User and Organizational Size Segmentation to Inform Clinical Collaboration Strategies

When analyzing the clinical communication and collaboration market through a product lens, it becomes evident that hardware devices, professional services, and software platforms each follow distinct adoption and investment cycles. Hardware offers tangible endpoints-ranging from secure tablets to integrated nurse-call stations-whereas service engagements encompass consulting, integration, and training to ensure seamless platform onboarding. Meanwhile, software delivers continuous innovation through feature updates, analytics modules, and user experience enhancements, driving sustained engagement across clinical teams.

Diving deeper into tool types reveals a bifurcation between collaboration and communication solutions. The collaboration suite envelops clinical workflow platforms designed to orchestrate patient rounds and care coordination, documentation management systems that automate charting processes, event management tools that streamline educational and emergency response exercises, and project management interfaces that oversee multidisciplinary initiatives. In contrast, communication tools concentrate on direct interactions via calling and messaging environments that offer secure text, voice, and paging functionalities, as well as high-definition video conferencing for virtual consultations, multidisciplinary team huddles, and remote patient monitoring check-ins.

The end-user spectrum underscores divergent priorities across ambulatory care centers, clinical laboratories, and hospital networks. Ambulatory settings demand mobile-optimized platforms that reduce administrative overhead and support rapid patient throughput. Clinical labs emphasize seamless integration with laboratory information management systems to minimize manual errors and expedite test result dissemination. Hospitals and clinics, by virtue of their scale and complexity, require unified command-and-control dashboards that amalgamate data streams from diverse sources and facilitate enterprise-wide communication strategies.

Lastly, organizational size drives procurement models and deployment approaches. Large enterprises tend to invest in comprehensive, tightly integrated suites with extensive customization options, leveraging economies of scale to negotiate enterprise licensing agreements. Conversely, small and medium enterprises gravitate toward modular SaaS offerings that enable phased rollouts and predictable subscription pricing, aligning with budgetary constraints and resource capabilities while still accessing essential features.

This comprehensive research report categorizes the Clinical Communication & Collaboration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- End-User

- Enterprise Size

Analyzing Regional Variations across the Americas EMEA and Asia-Pacific Markets to Illuminate Divergent Clinical Communication Priorities and Opportunities

The Americas region, led by the United States and Canada, continues to pioneer clinical communication and collaboration advancements, bolstered by a mature regulatory framework and robust healthcare infrastructure. Incentives for value-based care have driven the adoption of interoperable platforms that connect electronic health records with real-time messaging and telehealth services. North American providers frequently pilot advanced analytics and artificial intelligence integrations to streamline clinical workflows and predict patient deterioration. In addition, cross-state licensure compacts and evolving reimbursement policies for virtual care have further catalyzed regional innovation.

In Europe the Middle East and Africa, compliance with stringent data privacy regulations such as GDPR shapes solution architectures, compelling vendors to incorporate granular consent management and robust encryption standards. National health systems in Western Europe are integrating communication platforms with centralized patient records, whereas emerging markets in the Gulf Cooperation Council emphasize rapid deployment of telemedicine solutions to overcome workforce shortages. Africa presents unique challenges and opportunities, as mobile network penetration facilitates mHealth initiatives, enabling remote consultations and health education in under-served communities.

Within Asia-Pacific, government-driven digital health strategies are accelerating investments in secure communication networks and clinical collaboration tools. In China, large hospital groups implement integrated communication platforms as part of broader smart hospital initiatives, while in India, scalable video conferencing and remote patient monitoring solutions bridge gaps in rural care delivery. Japan and Australia are leveraging public–private partnerships to standardize health information exchanges, fostering collaboration across hospital conglomerates, research centers, and insurance providers. This heterogeneous landscape underscores the importance of region-specific tailoring, as cultural, regulatory, and infrastructure variables directly influence adoption velocities and feature priorities.

This comprehensive research report examines key regions that drive the evolution of the Clinical Communication & Collaboration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Solutions Providers and Strategic Innovators Driving Clinical Communication and Collaboration Excellence Across the Healthcare Continuum

A diverse set of solutions providers shapes the competitive terrain of clinical communication and collaboration, each bringing distinct competencies to the table. One vendor has distinguished itself through an AI-driven voice recognition engine embedded in wearable badges, enabling hands-free alerts and real-time location tracking within intensive care units. Another market player offers a unified messaging platform architected on open APIs, facilitating seamless integration with leading electronic health record systems and third-party applications. A third contender focuses on clinical workflow orchestration, delivering end-to-end automation for patient rounding, care team huddles, and discharge planning through a combination of mobile and desktop interfaces.

In parallel, global technology giants are expanding their foothold in healthcare by adapting enterprise collaboration suites with healthcare-specific security and compliance enhancements. These platforms extend messaging and video capabilities into integrated clinical settings, leveraging existing enterprise accounts to accelerate adoption and reduce training overhead. Traditional networking equipment providers have introduced clinical-grade video conferencing endpoints with advanced noise cancellation and data encryption, targeting operating room and tele-ICU environments. Simultaneously, strategic partnerships between device manufacturers and software vendors are coalescing around standards-based interoperability, enabling a plug-and-play ecosystem where hardware endpoints, cloud platforms, and mobile applications converge to deliver a unified user experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Communication & Collaboration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- American Tel-A-Systems Incorporated

- Andor Health

- AppleButter LLC

- Ascom Holding AG

- Avaya Inc.

- Axero Holdings LLC

- BlueNote Software

- Celo Platform

- Cisco Systems, Inc.

- Deltapath Inc.

- Everbridge, Inc.

- Foothold Technology

- Forcura, LLC

- Google LLc by Alphabet Inc.

- HCA Healthcare

- Hewlett Packard Enterprise Company

- Hill-Rom Holdings, Inc.

- HUB Technologies, Inc.

- Hucu.ai

- Imprivata, Inc.

- Medigram

- Medsender, Inc.

- MEFTii LLC

- Microsoft Corporation

- NEC Corporation

- Netsmart Technologies, Inc.

- Olio Health

- OnPage Corporation

- Oracle Corporation

- PerfectServe, Inc.

- Petal Solutions Inc.

- QliqSOFT, Inc.

- Salesforce, Inc.

- SAP SE

- Siemens Healthineers AG

- Siilo Holding B.V.

- Skyscape

- SpectraLink

- Spok Inc.

- Stryker Corporation

- Symplr Software Intermediate Holdings, Inc.

- TigerConnect, Inc.

- Trillian by Cerulean Studios LLC

- Vaporstream, Inc.

- Verizon

- Wipro Limited

- Xealth Platform

- Zebra Technologies

- Zoho Corporation Pvt. Ltd.

Strategic Action Roadmap for Industry Leaders to Capitalize on Evolving Clinical Communication Technologies and Navigate Regulatory and Market Complexities

To navigate the evolving clinical communication and collaboration landscape, healthcare organizations should prioritize the adoption of open standards such as HL7 FHIR and implement vendor-neutral APIs to enable seamless data exchange across disparate systems. By establishing an interoperability-first mindset, leaders can reduce integration complexity and foster agile environments where new tools can be incorporated without disrupting core workflows. Clinical IT teams should collaborate closely with frontline staff to map communication pain points and design pilot programs that validate technology fit before full-scale rollouts.

Given the potential for future tariff fluctuations and geopolitical uncertainties, organizations are advised to diversify their supplier base and explore nearshore manufacturing partnerships for critical hardware components. Concurrently, shifting capital expenditures toward software subscriptions and managed services can buffer the impact of import duties while ensuring access to continuous updates and support. Investing in change management and comprehensive training initiatives will maximize user adoption, particularly when integrating advanced features such as AI-powered alert triage and context-sensitive decision support.

Finally, industry leaders must embrace a platform-centric approach that unifies collaboration and communication capabilities under a single interface. By consolidating project management, documentation workflows, secure messaging, and video conferencing within a cohesive environment, organizations can streamline care coordination, reduce cognitive load for clinicians, and accelerate time to insight. Building cross-functional governance structures that oversee technology selection, privacy compliance, and performance measurement will ensure that strategic investments align with broader organizational objectives and deliver sustainable improvements in patient care.

Rigorous Mixed-Method Research Approach Combining Primary Expert Interviews Secondary Data Analysis and Triangulation to Ensure Robust Insights

This study employs a rigorous, mixed-method approach that integrates primary and secondary research to yield holistic and validated insights. In the primary phase, in-depth interviews were conducted with a cross-section of healthcare executives, including chief medical officers, nursing directors, and IT leaders across hospitals, ambulatory care centers, and clinical laboratories. These qualitative discussions illuminated real-world challenges, technology adoption patterns, and budget allocation strategies, providing rich context for quantitative findings.

Complementing these interviews, extensive secondary research encompassed an analysis of public financial filings, industry white papers, regulatory documentation, and peer-reviewed studies. Data synthesis and triangulation were achieved by cross-referencing market intelligence with anonymized usage metrics obtained from leading solution providers. An iterative validation process, including a peer review panel of healthcare informatics experts, ensured accuracy and relevance. Ethical research protocols were observed throughout, with confidentiality agreements safeguarding organizational and individual anonymity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Communication & Collaboration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Communication & Collaboration Market, by Product

- Clinical Communication & Collaboration Market, by Type

- Clinical Communication & Collaboration Market, by End-User

- Clinical Communication & Collaboration Market, by Enterprise Size

- Clinical Communication & Collaboration Market, by Region

- Clinical Communication & Collaboration Market, by Group

- Clinical Communication & Collaboration Market, by Country

- United States Clinical Communication & Collaboration Market

- China Clinical Communication & Collaboration Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Insights Emphasizing the Imperative of Integrated Clinical Communication Strategies for Sustainable Healthcare Transformation and Patient Safety

In conclusion, integrated clinical communication and collaboration systems have emerged as essential enablers of high-quality patient care, operational efficiency, and regulatory compliance. As the industry grapples with evolving care models, tariff-related supply chain complexities, and region-specific adoption drivers, a cohesive technology strategy that prioritizes interoperability, user experience, and scalability is paramount. Healthcare organizations that proactively implement open standards, diversify their supplier ecosystems, and foster cross-disciplinary governance will be best positioned to deliver seamless care journeys, minimize clinical risks, and achieve sustainable performance improvements.

Engage with Our Associate Director Sales and Marketing to Secure Comprehensive Access to the Definitive Clinical Communication and Collaboration Market Intelligence

To explore the full breadth of our clinical communication and collaboration research and to leverage data-driven strategies tailored for your organization’s unique needs, connect directly with Ketan Rohom. As our Associate Director of Sales and Marketing, he will guide you through the detailed methodology, key findings, and value-added services that accompany the comprehensive market intelligence report.

By engaging with Ketan, you will gain priority access to interactive workshops, account-based insights, and custom executive briefings designed to help you translate actionable recommendations into measurable outcomes. Reach out to arrange a personalized consultation, discover exclusive strategic imperatives, and secure the definitive roadmap that will empower your organization to lead in the evolving landscape of clinical communication and collaboration.

- How big is the Clinical Communication & Collaboration Market?

- What is the Clinical Communication & Collaboration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?