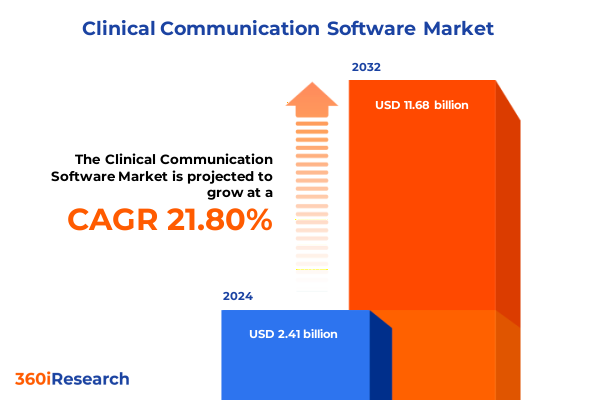

The Clinical Communication Software Market size was estimated at USD 2.94 billion in 2025 and expected to reach USD 3.53 billion in 2026, at a CAGR of 21.74% to reach USD 11.68 billion by 2032.

Charting the Future of Patient Engagement and Clinical Coordination Through Advanced Communication Technology Across Modern Healthcare Ecosystems

Clinical communication software has revolutionized the way healthcare providers coordinate care deliver timely notifications and foster meaningful engagement with patients. By seamlessly integrating alert notification workflows secure messaging channels and telemedicine capabilities into existing clinical processes organizations are experiencing enhanced operational efficiency and a more patient centered approach. Rapid digitization of health records and the proliferation of mobile devices have accelerated adoption of centralized platforms that support communication across interdisciplinary teams while ensuring compliance with stringent privacy regulations. As healthcare delivery continues to shift towards value based models providers and technology vendors alike are prioritizing solutions that facilitate real time collaboration between caregivers and empower patients to participate in their care journeys.

In this executive summary we explore the transformational role of clinical communication software within modern healthcare ecosystems and outline key insights from segmentation analysis regional perspectives and competitive dynamics. We further distill the cumulative impact of evolving tariff policies on technology procurement and present actionable recommendations that industry leaders can leverage to optimize software investments. With a clear understanding of market drivers adoption barriers and emerging technological trends this summary equips decision makers with a strategic overview to guide long term planning and maximize the impact of communication tools on patient outcomes and operational performance

Exploring the Fundamental Technological and Operational Shifts Shaping Clinical Communication Platforms in Response to Evolving Healthcare Delivery Models

Healthcare communication platforms are evolving rapidly in response to both technological innovation and shifts in care delivery paradigms. The integration of artificial intelligence driven analytics is augmenting alert notification by predicting clinical deterioration and prioritizing messages for care teams. At the same time, the rise of patient engagement portals and real time feedback modules is transforming traditional outreach efforts into interactive dialogues that drive satisfaction and adherence. Moreover, secure messaging solutions are expanding beyond simple text based interactions to support complex group workflows and peer to peer consultations across virtual care networks. Telemedicine services have matured into robust on demand and scheduled consultation frameworks that align with hybrid care models, accommodating both in person visits and virtual follow ups.

These transformative shifts are underpinned by the convergence of cloud hosted architectures with on premises systems to deliver scalable reliable and secure communication environments. Vendors increasingly leverage integration services to connect clinical communication software with electronic health records and interoperability engines, while consulting and support & maintenance offerings ensure seamless deployment and ongoing optimization. As innovation accelerates healthcare organizations must adapt to these fundamental changes by adopting flexible modular platforms that can evolve with emerging use cases and regulatory requirements

Assessing the Cumulative Consequences of Recent United States Tariff Policies on Technology Adoption and Cost Structures Within Healthcare Communication Networks

Recent tariff measures implemented by the United States government have introduced new cost considerations for healthcare providers procuring imported communication hardware and software components. These policies have led vendors and integrators to reevaluate supply chains, seeking local hardware alternatives and negotiating revised contracts to mitigate increased import duties. Although software licensing is often exempt from traditional goods tariffs, associated infrastructure components such as servers mobile devices and network equipment have experienced elevated costs, prompting a shift towards cloud hosted deployment models that reduce reliance on on premises hardware.

The cumulative effect of these tariff policies extends beyond direct procurement expenses to influence broader technology adoption strategies. Service providers are recalibrating consulting and integration pricing structures to account for higher equipment costs, while healthcare organizations are engaging in more rigorous cost benefit analyses to justify investments in advanced communication solutions. As regulatory landscapes continue to evolve, stakeholders across the ecosystem are collaborating to identify tariff sensitive components and explore domestic manufacturing partnerships. Enhanced focus on support & maintenance agreements and software as a service offerings further insulates organizations against volatility in hardware pricing, ensuring uninterrupted access to critical messaging and telemedicine capabilities despite external economic pressures

Uncovering Critical User and Deployment Dynamics That Define Market Segmentation Trends in Clinical Communication Solutions and Support Services

Analyzing market segmentation reveals distinct patterns in how organizations prioritize solutions based on component and communication type. Software platforms that encompass integrated telemedicine and patient engagement modules are gaining traction among care networks seeking unified experiences, while service oriented consulting offerings support complex implementations that demand tailored workflows. Integration services play a pivotal role in linking secure messaging systems with electronic health record environments, ensuring that alerts and group messaging activities flow seamlessly within clinical routines. Additionally, support and maintenance services have become essential for organizations selecting on premises installations, guaranteeing reliability and compliance.

When evaluating communication types, alert notification remains fundamental to clinical safety protocols, whereas patient engagement capabilities such as feedback surveys and patient portals drive measurable improvements in satisfaction and adherence. Secure messaging solutions facilitate both group coordination and peer to peer collaboration for interdisciplinary teams, streamlining handoffs and minimizing delays. Telemedicine has bifurcated into on demand consultations that cater to urgent needs and scheduled consultations that supplement routine care. Furthermore, organizational scale influences adoption patterns as large enterprises often deploy full feature suites across both cloud and on premises models, while medium and small enterprises may prioritize modular cloud hosted services to optimize capital expenditure. Finally, end user environments from ambulatory care settings and clinics through large medium and small hospitals to long term care facilities exhibit unique deployment preferences that inform solution design and vendor strategies

This comprehensive research report categorizes the Clinical Communication Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Communication Type

- Deployment Mode

- End User

- Organization Size

Analyzing Regional Variations in Healthcare Communication Technology Adoption Driven by Infrastructure Maturity Commercial Frameworks and Regulatory Environments Globally

Regional insights demonstrate that the Americas continue to drive innovation in clinical communication, propelled by robust investment in telehealth infrastructure and favorable reimbursement policies that support virtual care models. North American healthcare systems leverage advanced patient engagement and secure messaging workflows to achieve coordinated care across hospital networks and ambulatory settings. Meanwhile, Europe, Middle East and Africa are experiencing heterogeneous growth as regulatory frameworks and infrastructure maturity differ significantly across national markets. In Western Europe, stringent data protection laws accelerate adoption of secure group messaging and peer to peer solutions, whereas emerging economies in the Middle East and Africa prioritize scalable cloud hosted platforms to bridge connectivity gaps and extend services to rural communities.

Asia Pacific represents the fastest evolving region, driven by governmental initiatives to digitize healthcare ecosystems and integrate telemedicine into mainstream care pathways. Adoption of on demand and scheduled virtual consultations has surged alongside widespread smartphone penetration and government incentives in countries such as India, China and Australia. Furthermore, long term care facilities across the region are investing in telemonitoring and alert notification systems to manage aging populations more effectively. This regional diversity underscores the importance of adaptable deployment strategies and localized support services to navigate varied regulatory and infrastructure landscapes

This comprehensive research report examines key regions that drive the evolution of the Clinical Communication Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Innovators and Strategic Collaborators Driving Competitive Dynamics and Strategic Alliances Within the Clinical Communication Software Market Landscape

Leading participants in the clinical communication software arena continue to pursue innovation through strategic partnerships and targeted acquisitions. Technology firms specializing in AI enabled alert prioritization are collaborating with established telemedicine providers to deliver end to end virtual care solutions. Dedicated secure messaging vendors are integrating medical device data streams to enhance real time situational awareness within critical care units. Meanwhile, major electronic health record system providers are embedding native communication modules to offer cohesive workflows that span scheduling notifications and peer to peer messaging.

Competitive differentiation increasingly hinges on the ability to combine comprehensive service portfolios with modular software architectures. Firms offering consulting services that encompass workflow design, integration engineering and post deployment support enable healthcare organizations to accelerate time to value and adapt rapidly to changing clinical demands. Additionally, deployment flexibility across cloud hosted and on premises models allows vendors to address varied data sovereignty requirements and capital constraints. As market dynamics evolve, companies that invest in expanding patient engagement features and interoperability capabilities will be best positioned to capture opportunities across diverse care environments and organizational scales

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Communication Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ascom Holding AG

- Avaya LLC

- Cisco Systems, Inc.

- Connexall USA, Inc.

- DrFirst.com, Inc.

- Epic Systems Corporation

- Halo Health, Inc.

- Imprivata, Inc.

- Luma Health, Inc.

- Mobile Heartbeat, LLC

- OhMD, Inc.

- OnPage Corporation

- Oracle Corporation

- PerfectServe, Inc.

- QliqSOFT, Inc.

- Spok Holdings, Inc.

- Stryker Corporation

- symplr LLC

- Telmediq, Inc.

- TigerConnect, Inc.

Delivering Strategic Action Plans and Operational Best Practices to Empower Healthcare Providers and Vendors in Maximizing Clinical Communication Software Investments and Outcomes

To capitalize on the momentum of digital transformation in healthcare communication, industry leaders should prioritize the adoption of modular platforms that support an evolving mix of alert notification feedback mechanisms secure messaging workflows and telemedicine services. Executives must foster cross functional governance structures that align IT clinical and administrative stakeholders early in the procurement process, ensuring seamless integration with existing electronic health record infrastructures and interoperability engines. Furthermore, investing in structured change management and comprehensive training programs will mitigate user resistance and accelerate clinical adoption of new communication workflows.

From an operational perspective, organizations should evaluate the cost implications of on premises hardware under current tariff regimes and explore cloud hosted alternatives that bundle support and maintenance within subscription models. Strategic vendor partnerships that offer robust consulting and integration services can streamline implementation timelines while reducing total cost of ownership. Finally, leaders must monitor emerging technologies such as AI driven alert triage and analytics dashboards to identify high value use cases that improve patient safety and provider efficiency. By executing these actionable recommendations, healthcare providers and solution vendors will be well equipped to drive sustained innovation and deliver measurable outcomes

Detailing Methodological Rigor and Structured Research Approaches Underpinning In-Depth Analysis of Clinical Communication Technology Adoption and Market Evolution Insights

This report’s findings are grounded in a structured research methodology that combines qualitative expert interviews quantitative primary surveys and comprehensive secondary data analysis. Industry experts across healthcare providers technology vendors and policy entities were consulted to capture nuanced insights on emerging trends, deployment preferences and adoption barriers. Primary data collection leveraged a stratified sampling approach across various organization sizes and end user environments to ensure representation of hospitals clinics ambulatory care and long term care facilities.

Secondary research encompassed regulatory filings vendor white papers technology case studies and peer reviewed literature to validate market segmentation frameworks and technology use cases. Proprietary databases were analyzed to identify partnership and acquisition activities among leading companies, while tariff policy documents and government announcements were reviewed to assess the impact on procurement strategies. Data triangulation techniques were applied throughout the analysis to maintain accuracy and reliability, ensuring that conclusions are reflective of real time market dynamics and supported by multiple independent sources

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Communication Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Communication Software Market, by Component

- Clinical Communication Software Market, by Communication Type

- Clinical Communication Software Market, by Deployment Mode

- Clinical Communication Software Market, by End User

- Clinical Communication Software Market, by Organization Size

- Clinical Communication Software Market, by Region

- Clinical Communication Software Market, by Group

- Clinical Communication Software Market, by Country

- United States Clinical Communication Software Market

- China Clinical Communication Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Illuminate the Role of Communication Technologies in Enhancing Care Coordination and Patient Outcomes

In summary, clinical communication software has become an integral component of modern healthcare delivery, enabling real time coordination among care teams and fostering active patient participation. The convergence of advanced alert notification, secure messaging and telemedicine capabilities on flexible deployment architectures is reshaping clinical workflows and enhancing system resilience. Although evolving tariff policies have introduced new procurement considerations, the transition towards cloud hosted and subscription models offers a viable path to mitigate hardware cost volatility.

Looking ahead, the continual refinement of AI driven analytics and integration with electronic health records will unlock new opportunities to preempt clinical risks and personalize patient outreach. Providers that adopt comprehensive communication platforms supported by extensive consulting and support services will gain a competitive edge. As regional disparities in infrastructure maturity and regulatory environments persist, tailored deployment and localized partnerships will be critical. Ultimately, organizations that combine strategic investments with robust operational frameworks will be well positioned to drive measurable improvements in care quality and patient outcomes

Engaging with Industry Experts to Access Comprehensive Clinical Communication Market Intelligence to Drive Growth Innovation and Informed Decision Making Across Healthcare

Ready to advance your organization’s communication strategy with comprehensive market insights and expert guidance Contact Associate Director Ketan Rohom to secure access to the full research report and unlock data driven strategies tailored to your specific needs Enhance your decision making process with exclusive analysis on technology adoption trends cost implications regulatory influences and growth drivers Our team stands prepared to provide a customized consultation discussing how emerging capabilities such as AI powered messaging real time monitoring and integrated telehealth modules can be aligned with operational priorities of your healthcare network Whether you seek to evaluate deployment options across cloud hosted environments or optimize secure messaging workflows our exhaustive market intelligence will empower your leadership to confidently navigate competitive landscapes Reach out today to arrange a detailed briefing and obtain the full report to support strategic investments accelerate innovation pathways and ultimately drive superior patient engagement and clinical outcomes

- How big is the Clinical Communication Software Market?

- What is the Clinical Communication Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?