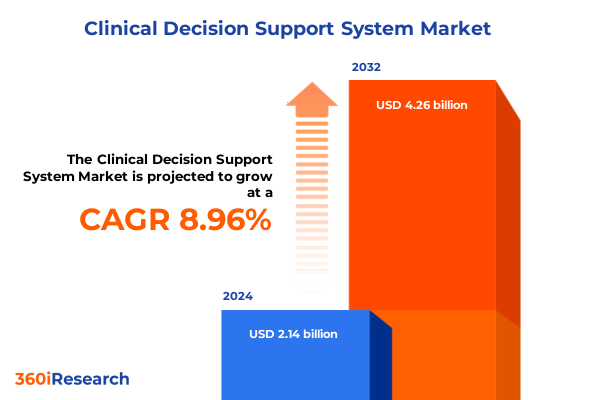

The Clinical Decision Support System Market size was estimated at USD 2.32 billion in 2025 and expected to reach USD 2.52 billion in 2026, at a CAGR of 9.05% to reach USD 4.26 billion by 2032.

Understanding the Imperative of Clinical Decision Support Systems in Modern Healthcare to Drive Better Patient Outcomes and Operational Efficiency

The rapid evolution of healthcare technology has brought clinical decision support systems into the spotlight as critical enablers of high-quality, evidence-based patient care. As providers navigate increasing complexity in diagnostics and treatment protocols, the integration of advanced decision support tools offers a path toward greater diagnostic accuracy and risk mitigation. Consequently, stakeholders across the healthcare ecosystem are seeking a deeper understanding of how to best deploy these systems to unlock clinical value.

This executive summary frames the context of clinical decision support by examining the convergence of data science, regulatory drivers, and clinician workflows that underpin system adoption. It highlights the importance of interoperability with electronic health records and the role of artificial intelligence in augmenting rule-based frameworks. Moreover, it underscores the transition from pilot projects to enterprise-wide implementations, reflecting a growing emphasis on scalable solutions that respond to both acute care and population health management needs.

In outlining market dynamics, this section sets the stage for subsequent analysis by connecting technological innovation with practical challenges faced by hospitals, clinics, and research institutes. By foregrounding the strategic imperative of clinical decision support, the introduction establishes a cohesive narrative for exploring segmentation, regional nuances, and actionable recommendations that will guide informed decision-making.

Identifying Key Technological and Regulatory Transformations Reshaping Clinical Decision Support Systems to Enhance Workflow and Care Delivery Standards

Healthcare delivery is in the midst of a transformative era characterized by the intersection of artificial intelligence, machine learning, and cloud computing. Clinical decision support systems have shifted from basic alert mechanisms to sophisticated platforms that leverage predictive analytics. This progression has been propelled by regulatory frameworks that incentivize outcomes-based care, compelling providers to adopt tools that substantiate clinical decisions with real-time data insights.

Concurrently, the rise of value-based reimbursement models has intensified the demand for solutions that demonstrate measurable improvements in quality and cost containment. As a result, vendors have expanded their offerings to include not only rule-based alerts but also adaptive algorithms capable of identifying subtle patterns in patient data. Integration with telehealth platforms and mobile applications has further broadened access, enabling clinicians to engage decision support tools across care settings.

Moreover, partnerships between technology firms and academic medical centers have accelerated research into natural language processing and image recognition, resulting in more nuanced decision pathways. This confluence of technological advancement and collaborative research is redefining how care teams approach diagnosis and treatment planning, ushering in an era where personalized medicine and predictive analytics converge to enhance clinical workflows across the continuum of care.

Evaluating the Combined Effects of Recent United States Trade Tariffs on the Clinical Decision Support Systems Sector and Stakeholder Dynamics

In 2025, the cumulative effect of US trade policies has exerted a palpable influence on the availability and cost of clinical decision support technologies. Tariffs imposed on imported software components and medical device hardware have necessitated strategic recalibrations for both vendors and healthcare providers. Increased input costs have, in some instances, led to extended deployment timelines as procurement budgets seek equilibrium.

Nevertheless, these trade measures have also catalyzed domestic innovation, prompting a surge in investment for in-country development of core software modules and integration services. The drive to localize supply chains has spurred collaborations among technology startups, implementation specialists, and established IT service enterprises. As providers reassess long-term procurement strategies, the emphasis has shifted toward platforms that offer modular architectures, thereby mitigating exposure to tariff-related disruptions.

Furthermore, the recalibrated cost structures have reinforced the importance of scalable support and maintenance services. Organizations now place greater emphasis on subscription-based models and cloud-native deployments that can absorb incremental tariff pressures without compromising system upgrades. This balancing act underscores the resilience of the clinical decision support ecosystem in adapting to external economic headwinds while maintaining a focus on clinical efficacy and user adoption.

Unveiling Critical Component Delivery and Deployment Segmentation Insights Driving Diverse Clinical Decision Support System Adoption Across Healthcare

Within the clinical decision support landscape, differentiation emerges across a spectrum of offerings that span core services and software solutions. Service capabilities extend beyond initial deployment to include ongoing training, consulting, and dedicated maintenance, ensuring that users derive maximum value from their investments. Meanwhile, delivery modes diverge between integrated suites compatible with broader health IT infrastructures and standalone applications optimized for specific use cases.

The technological underpinnings of these systems bifurcate into knowledge-based frameworks, which codify clinical guidelines and expert consensus into rule sets, and non-knowledge-based engines that utilize pattern recognition and machine learning to generate insights. Deployment strategies further diversify into cloud-based platforms offering rapid scalability, on-premise installations providing greater data sovereignty, and web-based interfaces that facilitate remote access and collaboration.

Application breadth stretches from diagnostic decision support and clinical reminders to focused modules for drug dosing assistance, allergy alerts, and therapeutic planning. Population health management tools add a strategic dimension by enabling risk stratification and chronic disease monitoring at scale. Distinct end-user segments, including hospital networks, clinics, diagnostic laboratories, and research institutes, tailor their utilization patterns based on organizational priorities, workflow complexity, and resource constraints. Consequently, vendors must architect flexible solutions that address the nuanced requirements of each cohort.

This comprehensive research report categorizes the Clinical Decision Support System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Delivery Mode

- Model

- Deployment Mode

- Application

- End User

Exploring In-Depth Regional Variations and Adoption Patterns for Clinical Decision Support Systems Across the Americas EMEA and Asia-Pacific Markets

Adoption patterns for clinical decision support systems vary significantly across global regions, shaped by regulatory environments, healthcare infrastructure maturity, and investment appetites. In the Americas, robust reimbursement frameworks and widespread electronic health record penetration have accelerated uptake, particularly within hospital networks that pursue integrated solutions to optimize clinical pathways and reduce readmission rates.

In contrast, the Europe, Middle East & Africa region presents a multifaceted picture where regional blocs navigate data protection regulations and budgetary constraints. Leading markets prioritize interoperability standards and governmental initiatives that fund digital health transformation, while emerging markets in the region grapple with infrastructure gaps that favor cloud-native deployments due to lower upfront capital requirements.

Meanwhile, the Asia-Pacific sphere is witnessing exponential growth driven by rising healthcare expenditures, expanding telehealth services, and public-private partnerships. Nations with high population densities are leveraging web-based decision support tools to extend specialized expertise into remote areas, whereas advanced economies within the region focus on integrating AI-driven predictive analytics into conventional clinical workflows. These regional dynamics underscore the necessity for vendors and providers to tailor their strategies to local market conditions and stakeholder expectations.

This comprehensive research report examines key regions that drive the evolution of the Clinical Decision Support System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Strategies and Innovations Shaping the Competitive Dynamics Within the Clinical Decision Support System Landscape

In the competitive arena of clinical decision support, a cohort of innovative enterprises is distinguishing itself through strategic investments in research and development, partnerships, and customer-centric service offerings. Market leaders anchor their portfolios on modular architectures that allow rapid customization, while emerging challengers focus on niche applications such as precision dosing algorithms or specialized chronic disease modules.

Strategic alliances between major healthcare IT vendors and academic research institutions have yielded advanced cognitive computing capabilities, positioning these players to deliver sophisticated non-knowledge-based solutions. Concurrently, specialist firms with a legacy of clinical guideline expertise continue to refine knowledge-based platforms, integrating real-time data feeds and expanding multilingual support for global deployments.

Service-oriented vendors differentiate by packaging comprehensive support and maintenance agreements that extend beyond technical troubleshooting to include analytics-driven performance optimization workshops. As competitive intensity escalates, successful companies demonstrate agility by offering hybrid licensing models, enabling enterprises to transition between on-premise and cloud configurations seamlessly. This multifaceted competitive landscape compels all stakeholders to assess vendor roadmaps and partner ecosystems meticulously to ensure alignment with long-term clinical and operational objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Decision Support System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CareCloud, Inc.

- Cedar Gate Technologies

- CureMD.com, Inc.

- EBSCO Information Services

- eClinicalWorks, LLC

- Elsevier B.V.

- Epic Systems Corporation

- EvidenceCare, LLC

- First Databank, Inc.

- GE HealthCare Technologies Inc.

- Hearst Corporation

- Henisaja GmbH

- Hera-MI, SAS

- International Business Machines Corporation

- Koninklijke Philips N.V.

- LeewayHertz

- Logical Images, Inc. d/b/a VisualDx

- McKesson Corporation

- Medical Information Technology, Inc.

- Merative L.P.

- Mocero Health Solutions Private Limited

- OneAdvanced

- Optum, Inc.

- Oracle Corporation

- Premier, Inc.

- Raapid Inc.

- RELX PLC

- Siemens Healthineers AG

- The Medical Algorithms Company Limited

- Veradigm LLC

- VisualDx

- Wolters Kluwer N.V.

- Zynx Health, Inc.

Highlighting Strategic Actionable Recommendations for Healthcare Stakeholders to Optimize Clinical Decision Support System Implementation and Maximize Value

Healthcare organizations and technology providers must adopt a proactive posture to extract maximum value from decision support capabilities. First, aligning executive sponsorship with clinical leadership fosters a governance structure that drives user engagement and service-level accountability. Investing in comprehensive training and consulting services lays the foundation for sustained adoption and system optimization.

Second, stakeholders should prioritize interoperability by selecting platforms that support open standards and application programming interfaces, thereby reducing integration complexity and fostering an ecosystem of third-party innovations. Transitioning to cloud-based models can offer enhanced scalability and predictable cost structures, but organizations must conduct rigorous data security assessments and compliance audits to safeguard patient information.

Third, continuous performance monitoring through embedded analytics establishes feedback loops that inform iterative improvements. By tracking key clinical metrics such as alert response rates and diagnostic accuracy trends, decision makers can refine rule sets and algorithms to align with evolving care protocols. Finally, fostering strategic partnerships with vendors that demonstrate a clear roadmap for artificial intelligence capabilities and population health functionalities will position decision support investments to deliver long-term clinical and financial returns.

Detailing Rigorous Research Methodologies and Analytical Frameworks Employed to Assess Clinical Decision Support Systems Market Trends and Insights

This research synthesized primary qualitative interviews with healthcare executives, IT directors, and clinical informaticists, complemented by secondary analysis of regulatory filings, peer-reviewed literature, and industry whitepapers. A rigorous vendor mapping exercise identified key participants across the spectrum of software, services, and delivery modes. Data triangulation techniques ensured consistency between reported adoption trends and observed deployment case studies.

A structured segmentation framework guided our examination of component, delivery mode, model, deployment mode, application, and end-user categories. Quantitative insights were validated through consensus workshops with domain experts to ensure that our categorizations reflect real-world clinical workflows. Regional analyses incorporated macroeconomic indicators and digital health maturity scores to contextualize adoption patterns across major geographies.

Competitive benchmarking leveraged a multi-criteria scoring matrix to evaluate vendor capabilities in areas such as innovation, customer support, and scalability. Finally, scenario planning exercises assessed the potential impact of external factors-most notably trade policies and regulatory shifts-on future system upgrades and service offerings. This methodology underpins the comprehensive insights presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Decision Support System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Decision Support System Market, by Component

- Clinical Decision Support System Market, by Delivery Mode

- Clinical Decision Support System Market, by Model

- Clinical Decision Support System Market, by Deployment Mode

- Clinical Decision Support System Market, by Application

- Clinical Decision Support System Market, by End User

- Clinical Decision Support System Market, by Region

- Clinical Decision Support System Market, by Group

- Clinical Decision Support System Market, by Country

- United States Clinical Decision Support System Market

- China Clinical Decision Support System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Major Findings and Strategic Implications of Clinical Decision Support System Trends to Inform Future Decision-Making in Healthcare Settings

The landscape of clinical decision support has reached a critical juncture where technological sophistication and practical workflow integration converge. Our findings reveal that successful deployments hinge on the confluence of robust service offerings, interoperable architectures, and adaptive clinical models that accommodate both rule-based and machine-learning approaches.

Regional dynamics emphasize the importance of contextual strategies: mature markets demand enterprise-grade solutions with full feature sets, whereas emerging regions benefit from cloud-native and web-based platforms that lower barriers to entry. Tariff-driven cost pressures have accelerated domestic innovation, leading to resilient supply chains and flexible, subscription-based service models.

Segmentation insights highlight that end-user requirements vary dramatically-from diagnostic laboratories seeking rapid alert mechanisms to research institutes prioritizing data analytics capabilities. Competitive analysis shows that market participants who invest in strategic partnerships and prioritization of artificial intelligence roadmaps are poised to capture expanding use cases. Ultimately, this summary distills practical guidance for executives and technology leaders to make informed decisions that align with both immediate operational goals and long-term strategic imperatives.

Take the Next Step to Empower Clinical Decisions by Engaging with Associate Director Ketan Rohom to Secure Your Comprehensive Market Research Insights Now

To explore how cutting-edge clinical decision support systems can transform patient care and operational performance, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings extensive expertise in translating data-driven insights into strategic roadmaps tailored for healthcare executives and technology adopters. By engaging directly with him, stakeholders will gain privileged access to comprehensive analyses, detailed competitive landscapes, and proven guidance designed to accelerate implementation and optimize ROI. Secure your copy of the full market research report today and empower your organization to lead in clinical decision excellence.

- How big is the Clinical Decision Support System Market?

- What is the Clinical Decision Support System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?