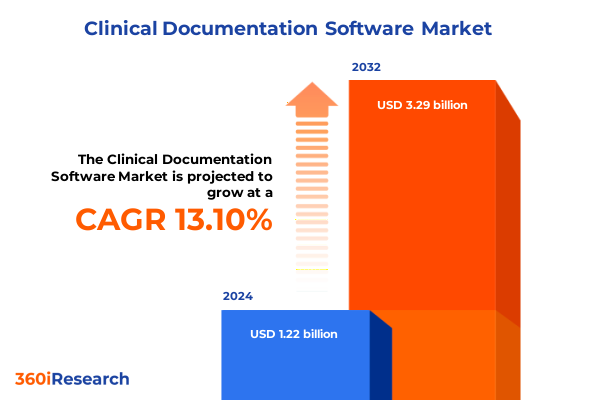

The Clinical Documentation Software Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.56 billion in 2026, at a CAGR of 13.12% to reach USD 3.29 billion by 2032.

Positioning Clinical Documentation Software at the Intersection of Healthcare Innovation, Regulatory Evolution, and Digital Transformation Imperatives

The rapid evolution of healthcare delivery, regulatory mandates, and patient expectations has underscored the pivotal role of clinical documentation software in driving quality, efficiency, and compliance. In this context, understanding the trajectory of technological adoption and market dynamics is essential for healthcare stakeholders seeking to navigate complexity and capitalize on emerging opportunities.

In this executive summary, we synthesize a broad spectrum of insights derived from primary interviews with industry executives, secondary literature spanning regulatory frameworks and vendor announcements, and rigorous analysis of technology trends. Through this lens, readers will gain a holistic view of the factors shaping the clinical documentation software landscape, from disruptive innovations to external pressures, enabling informed strategic planning and investment decisions.

Exploring the Pivotal Technological, Regulatory, and Workflow Disruptions Reshaping Clinical Documentation Software in Today’s Healthcare Ecosystem

Healthcare organizations are experiencing a profound transformation in how clinical documentation is captured, processed, and leveraged. Key among these shifts is the maturation of generative artificial intelligence within EHR platforms, exemplified by Epic’s integration of GPT-4–powered ambient scribing and predictive analytics to automate charting workflows and enhance clinical decision support. At the same time, cloud-based and Software-as-a-Service deployments have gained momentum, offering scalable, cost-efficient, and remotely accessible solutions that reduce IT burdens and accelerate innovation cycles.

Concurrently, interoperability standards and regulations are reshaping vendor and provider strategies. The Centers for Medicare & Medicaid Services’ upcoming FHIR Connectathon and the adoption of USCDI v5 underscore the industry’s commitment to seamless data exchange and burden reduction. These foundational shifts are accelerating the evolution of clinical documentation software from static record-keeping tools to dynamic, intelligence-driven ecosystems that support real-time insights and value-based care.

Assessing How Global and Country-Specific Levies Introduced in April 2025 Have Compounded Cost Pressures for Healthcare Technology and Service Providers

In April 2025, a blanket 10% global tariff on nearly all imported goods, including medical devices and IT hardware, was introduced, with even steeper duties applied to certain countries and components. Specifically, the imposition of a 245% tariff on Chinese active pharmaceutical ingredients and a 25% levy on devices from Canada and Mexico has elevated the cost base for healthcare providers and manufacturers alike. These measures, intended to encourage domestic production, have reverberated across supply chains, raising prices on equipment ranging from diagnostic tools to telehealth infrastructure.

Meanwhile, the escalating tariffs on electronic imports-up to 34% for Chinese goods and 32% for Taiwanese goods-have disrupted semiconductor availability and inflated hardware costs for imaging systems, data-center servers, and networking equipment critical to electronic health records and telemedicine platforms. As a result, many health systems have deferred capital-intensive IT upgrades and are shifting toward cloud-hosted solutions to mitigate tariff exposure, reshaping short-term technology roadmaps and long-term procurement strategies.

Uncovering Critical Segment-Specific Dynamics Within Clinical Documentation Software Across Components, Deployment Modes, Applications, End Users, and Product Suites

The clinical documentation software market encompasses a diverse set of components, with software platforms and professional services playing complementary roles. Software modules integrate core documentation, decision-support, and analytics capabilities, while integration services facilitate seamless connections with peripheral systems, maintenance and support ensure ongoing reliability, and training empowers clinicians to leverage advanced features effectively.

Deployment models range from fully cloud-hosted to on-premises installations. Private and public cloud configurations deliver rapid scalability and continuous updates, whereas on-premises systems offer greater data sovereignty and customization. Meanwhile, applications span inpatient settings-covering both acute care and long-term care facilities-and outpatient environments, including ambulatory centers and home healthcare programs. End users vary from high-volume hospitals, both government and private, to clinics in group or solo practice formats, diagnostic laboratories, and ambulatory care centers. Lastly, product portfolios extend across clinical decision support solutions, computerized physician order entry modules, electronic health record platforms, mobile documentation tools, and template libraries, each incorporating subsegments such as AI-driven and rule-based decision engines, nurse-managed and physician-managed order workflows, and integrated versus standalone record systems.

This comprehensive research report categorizes the Clinical Documentation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Application

- End User

Mapping Regional Adoption Trends, Growth Drivers, and Regulatory Barriers for Clinical Documentation Software Across the Americas, EMEA, and Asia-Pacific

In the Americas, the clinical documentation software market is characterized by high maturity, widespread EHR adoption, and a trend toward consolidation among large health systems seeking economies of scale. Advances in ambient AI scribing and cloud migrations are driving next-generation deployments, even as organizations grapple with lingering tariff-induced cost headwinds and evolving reimbursement models.

Europe, the Middle East, and Africa are navigating a complex regulatory landscape, highlighted by the European Health Data Space regulation that came into force in March 2025 to standardize electronic health data exchange under robust privacy regimes. GDPR nuances and national EHR initiatives continue to shape vendor offerings, prompting a focus on compliance, cross-border interoperability, and secure data access protocols.

The Asia-Pacific region exhibits the fastest growth trajectory, fueled by government-led digital health investments, expanding telehealth services, and rising demand for scalable cloud-based solutions that support diverse care settings. Emerging markets are rapidly adopting mobile-enabled documentation tools to address clinician shortages and drive efficiency, while partnerships with global tech firms accelerate the localization of advanced AI features.

This comprehensive research report examines key regions that drive the evolution of the Clinical Documentation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves, Technological Innovations, and Partnerships of Leading Clinical Documentation Software Providers Redefining the Market

Leading vendors are racing to embed advanced AI capabilities and cloud-native architectures into their clinical documentation offerings. Epic Systems has solidified its market leadership by rolling out generative AI features-ranging from ambient scribing and note summarization to predictive analytics for chronic disease management-powering these innovations through its Microsoft Azure partnership and serving hundreds of health systems.

Oracle Health, having integrated Cerner’s technologies, plans to launch a next-generation, cloud-based EHR in 2025 that embeds AI-driven clinical assistants, voice-activated navigation, and longitudinal data intelligence to streamline documentation and decision support. Veradigm (formerly Allscripts) has fortified its AI ecosystem by integrating Onpoint Healthcare Partners’ Iris platform into its marketplace, delivering agentic AI agents for automated charting, coding, and care coordination within Allscripts systems.

Meanwhile, MEDITECH’s Expanse platform is advancing voice-assisted charting and ambient AI documentation to enhance workflow efficiency, and NextGen Healthcare is leveraging machine learning to optimize revenue cycle management and reduce claim denials, signaling a market-wide pivot toward intelligent automation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Documentation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abridge AI, Inc.

- Ambience Healthcare, Inc.

- athenahealth, Inc.

- CareCloud, Inc.

- CureMD Healthcare, Inc.

- DeepScribe, Inc.

- DrChrono Inc.

- eClinicalWorks, LLC

- Epic Systems Corporation

- Greenway Health, LLC

- Hyland Software, Inc.

- Iodine Software, LLC

- Kareo, Inc.

- Medical Information Technology, Inc.

- Microsoft Corporation

- NextGen Healthcare, Inc.

- Optum, Inc.

- Oracle Corporation

- Veradigm LLC

Guiding Industry Leaders to Harness AI, Optimize Tariff Strategies, Prioritize Segmentation, and Expand Regional Footprints in Clinical Documentation Software

Healthcare organizations should prioritize investment in generative AI capabilities to alleviate clinician burden and unlock richer data-driven insights during care delivery. Establishing proof-of-concept deployments with strategic vendor partners can help demonstrate value while managing implementation risk.

Given the ongoing tariff environment, supply chain diversification and the adoption of cloud-based infrastructure will be essential to mitigate cost volatility. Organizations are encouraged to leverage long-term service contracts and explore incentive programs for domestic manufacturing to stabilize procurement budgets.

By aligning product roadmaps with clearly defined segmentation strategies-tailoring offerings to specific care settings, deployment preferences, and end-user profiles-vendors can deepen market penetration and foster stronger client relationships. Likewise, regional expansion efforts should be guided by a thorough understanding of local regulations, interoperability frameworks, and customer readiness, ensuring compliance and accelerating time to value.

Finally, collaborative engagement with regulatory bodies, standards organizations, and technology partners will be critical to navigate evolving policy landscapes and maintain interoperability, positioning stakeholders for sustainable growth in an increasingly interconnected healthcare ecosystem.

Detailing a Rigorous Multi-Source Research Approach Combining Primary Interviews, Secondary Data, and Analytical Frameworks for Clinical Documentation Software Insights

This analysis is grounded in a robust, multi-layered research approach. Primary data was gathered through in-depth interviews with healthcare executives, IT leaders, and vendor representatives, providing firsthand perspectives on operational challenges and strategic priorities.

Secondary research encompassed a systematic review of regulatory documentation, industry white papers, and authoritative market intelligence, including FHIR and USCDI standards, tariff policy briefs, and vendor press releases. Key quantitative and qualitative insights from KLAS Research, Fierce Healthcare, Reuters, and other reputable sources were triangulated to ensure accuracy and relevance.

Data validation processes included iterative cross-referencing of findings, peer reviews by subject-matter experts, and alignment checks against public disclosures and independent industry analyses. This rigorous methodology ensures that the conclusions and recommendations presented herein are supported by empirical evidence and reflect the latest developments in clinical documentation software.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Documentation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Documentation Software Market, by Component

- Clinical Documentation Software Market, by Deployment Mode

- Clinical Documentation Software Market, by Application

- Clinical Documentation Software Market, by End User

- Clinical Documentation Software Market, by Region

- Clinical Documentation Software Market, by Group

- Clinical Documentation Software Market, by Country

- United States Clinical Documentation Software Market

- China Clinical Documentation Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Insights that Synthesize Compliance, Technological Trends, and Strategic Imperatives for the Future of Clinical Documentation Software

The convergence of AI-driven innovation, evolving interoperability mandates, and complex supply chain dynamics has ushered in a new era for clinical documentation software. As vendors accelerate generative AI integration and cloud migrations, healthcare organizations must proactively adapt to capture efficiency gains and enhance patient care.

Simultaneously, the cumulative impact of 2025 tariffs underscores the importance of flexible procurement models and local sourcing strategies. By leveraging deep segmentation insights and tailoring regional approaches, providers and suppliers can mitigate risks and align their technology investments with specific clinical workflows and regulatory requirements.

Looking ahead, the ability to forge strategic alliances, engage with standards-setting bodies, and maintain a forward-looking stance on regulatory evolution will differentiate market leaders. Ultimately, those who integrate intelligent automation, structured data exchange, and adaptive supply strategies will be best positioned to deliver measurable improvements in quality, productivity, and outcomes.

Engage Directly with an Associate Director to Access Tailored Clinical Documentation Software Market Intelligence and Secure Your Strategic Edge

To gain comprehensive, tailored insights and support critical decision-making in the evolving clinical documentation software market, engage with Ketan Rohom, Associate Director, Sales & Marketing. By partnering with him, you will receive a personalized consultation to explore the full breadth of the research findings, discuss customized analysis aligned with your strategic priorities, and secure access to the definitive market research report. Take the next decisive step to equip your organization with actionable intelligence and drive competitive advantage-connect with Ketan Rohom today to begin your journey to informed growth and innovation.

- How big is the Clinical Documentation Software Market?

- What is the Clinical Documentation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?