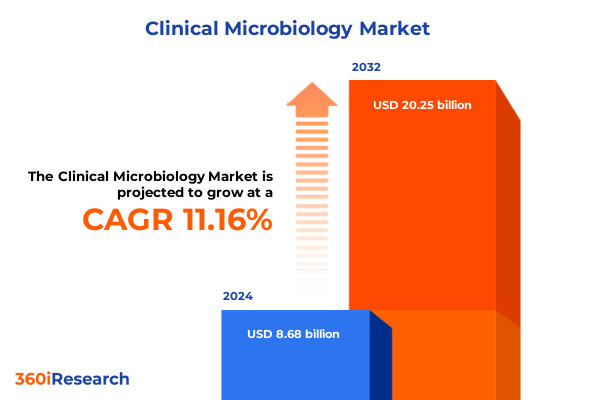

The Clinical Microbiology Market size was estimated at USD 9.63 billion in 2025 and expected to reach USD 10.70 billion in 2026, at a CAGR of 11.19% to reach USD 20.25 billion by 2032.

Discovering the Vital Role of Clinical Microbiology in Driving Diagnostic Innovation, Strengthening Laboratory Resilience, and Elevating Patient Outcomes Worldwide

Clinical microbiology stands at a critical intersection where cutting-edge diagnostics and patient care converge to address complex infectious disease challenges. Over recent years, the field has evolved far beyond routine pathogen identification. Laboratories now embrace advanced molecular techniques, automated workflows, and integrated data platforms, fundamentally transforming diagnostic accuracy, throughput, and turnaround times. In this dynamic environment, stakeholders must understand how these developments coalesce to drive innovation and improve clinical outcomes.

As healthcare systems face mounting pressures from emerging pathogens, antimicrobial resistance, and heightened regulatory expectations, clinical microbiology serves as a cornerstone of disease surveillance and therapy optimization. By rapidly detecting pathogens and characterizing their resistance profiles, laboratories inform treatment decisions with unprecedented precision. Furthermore, as healthcare moves toward value-based care models, the emphasis on cost-effective, rapid diagnostics elevates the strategic importance of robust microbiology operations.

Consequently, laboratories and their partners are investing in next-generation platforms and data-driven solutions that seamlessly integrate results into electronic health records and bioinformatics pipelines. This shift not only enhances diagnostic workflows but also fosters deeper collaboration between clinicians, microbiologists, and data scientists. Ultimately, understanding these foundational trends is essential for navigating the clinical microbiology landscape and unlocking new opportunities for innovation and improved patient care.

Exploring the Transformative Shifts in Clinical Microbiology Shaped by Automation, Artificial Intelligence, and Integrated Diagnostics

The clinical microbiology arena is undergoing a transformative wave driven by the integration of automation, artificial intelligence, and high-throughput sequencing. Laboratory automation platforms now handle sample preparation, microbial identification, and susceptibility testing with minimal human intervention, boosting consistency and reducing error rates. Simultaneously, machine learning algorithms analyze complex data patterns in real time, enabling early detection of outbreak clusters and offering predictive insights into antimicrobial resistance trends.

In parallel, the proliferation of next-generation sequencing has democratized access to genomic data, allowing laboratories to characterize pathogens at the strain level and monitor evolutionary shifts. This technological synergy is reshaping traditional workflows, as molecular diagnostics and bioinformatics converge to provide comprehensive insights from a single patient sample. Moreover, the advent of cloud-based data management solutions facilitates secure, scalable storage of genomic and clinical data, further strengthening collaborative research and public health surveillance.

Together, these innovations are dismantling historical bottlenecks in clinical microbiology. Turnaround times that once required days are now measured in hours, enabling clinicians to prescribe targeted therapies more swiftly. As a result, laboratories that adopt these disruptive technologies are better positioned to respond to emerging health threats, optimize resource utilization, and deliver higher-value diagnostic services.

Assessing the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Reagent Costs, and Laboratory Operations in Clinical Microbiology

In 2025, the implementation of new U.S. tariffs has exerted significant pressure on clinical microbiology supply chains, particularly affecting imported reagents, instruments, and critical consumables. Laboratory managers have reported acute cost increases for molecular testing kits and automated culture devices, necessitating a reevaluation of procurement strategies. Furthermore, disruptions at key manufacturing hubs abroad have led to sporadic shortages, compelling facilities to diversify their supplier base and explore domestic alternatives.

Consequently, diagnostic laboratories are implementing just-in-time inventory models and forging strategic partnerships with regional distributors to mitigate the impact of tariff-induced price volatility. Some institutions have accelerated validation of in-house reagent formulations and open-access testing protocols to maintain continuity of care, while others have renegotiated long-term contracts to ensure more predictable pricing. These adaptive strategies underscore the industry’s resilience in the face of regulatory and economic headwinds.

Looking ahead, ongoing dialogue between laboratory networks, supplier consortiums, and regulatory bodies will be instrumental in stabilizing supply chains and safeguarding diagnostic capacity. Enhanced transparency around cost structures and collaborative forecasting initiatives can further alleviate disruptions, ensuring that critical clinical microbiology services remain accessible and reliable.

Unraveling Key Segmentation Insights Across Product Types, Technologies, Applications, End Users, Specimen Types, and Test Modalities

A nuanced understanding of market segments is essential for tailoring product development and service offerings. When examining instruments, reagents and kits, and software and services, industry leaders observe that advanced data management platforms and consulting services are increasingly sought after to optimize laboratory workflows and regulatory compliance. At the same time, immunoassays such as CLIA-based formats and ELISA continue to deliver robust pathogen detection, while fluorescence immunoassays offer enhanced sensitivity for low-abundance targets. Next-generation sequencing has cemented its role alongside traditional Sanger methods for comprehensive genomic profiling, enabling precise identification of novel or resistant strains.

Moreover, laboratories are diversifying applications to include antimicrobial resistance testing, blood donor screening protocols, and genotyping for epidemiological studies. Within infectious disease testing, bacterial diagnostics remain foundational, yet fungal, parasitic, and viral assays are experiencing accelerated uptake, driven by global health concerns and emerging zoonotic outbreaks. On the end-user front, academic research institutes and reference laboratories pioneer new methodologies, whereas hospitals, clinics, and pharmaceutical companies leverage these advances to streamline clinical trials and patient management.

Finally, specimen diversity-from plasma, serum, and whole blood to respiratory swabs, tissue biopsies, and urine-demands versatile testing platforms. Laboratories balance qualitative assays for rapid detection with quantitative technologies crucial for viral load monitoring and antimicrobial stewardship. By aligning portfolios to these intersecting dimensions, organizations can meet evolving clinical requirements and unlock new revenue streams in the clinical microbiology ecosystem.

This comprehensive research report categorizes the Clinical Microbiology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Specimen Type

- Test Type

Illuminating Regional Dynamics in Clinical Microbiology Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics in clinical microbiology reflect variation in healthcare infrastructure, regulatory frameworks, and disease prevalence. In the Americas, investment in laboratory automation and molecular platforms remains robust, fueled by strong reimbursement policies and private-public partnerships focused on pandemic preparedness. Coastal and urban centers in North America spearhead the adoption of high-throughput sequencing and digital pathology integration, while Latin American markets prioritize cost-effective reagents and mobile diagnostics solutions to expand testing access in remote communities.

Across Europe, the Middle East, and Africa, diverse regulatory landscapes shape diagnostic adoption. Western European nations lead in implementing comprehensive antimicrobial resistance surveillance networks, leveraging centralized data repositories and harmonized standards. Meanwhile, emerging markets in the Middle East invest heavily in state-of-the-art laboratory facilities, often through government-led initiatives. In sub-Saharan Africa, where infectious disease burdens remain high, point-of-care immunoassays and portable PCR platforms are scaling rapidly to address resource constraints and improve field diagnostics.

In Asia-Pacific, a blend of mature and emerging markets characterizes the region. East Asian countries, driven by advanced biopharmaceutical sectors, prioritize real-time analytics and automation. South and Southeast Asian nations are scaling up capacity for disease screening and surveillance, tapping into locally developed molecular assays and cost-efficient reagents. Collaborative networks spanning public health agencies and academic institutes further accelerate the deployment of innovative diagnostics across the entire Asia-Pacific spectrum.

This comprehensive research report examines key regions that drive the evolution of the Clinical Microbiology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Market Leaders and Emerging Players Driving Innovation and Competitive Strategies in the Clinical Microbiology Sector

A cadre of multinational and regional specialty firms is shaping the competitive landscape in clinical microbiology. Global leaders known for their comprehensive portfolios have intensified investments in molecular diagnostics, automation, and data analytics, striving to deliver end-to-end solutions that span from sample preparation to actionable insights. Concurrently, agile niche players are carving out positions by focusing on high-growth segments such as rapid immunoassays, portable PCR platforms, and bioinformatics software tailored for microbial genomics.

Collaborations and strategic alliances underscore the industry’s drive toward integrated offerings. Partnerships between instrument manufacturers and laboratory information system providers accelerate the adoption of seamless workflows, while co-development agreements between reagent suppliers and academic centers foster innovation in assay design. Additionally, mergers and acquisitions remain an active strategy for expanding geographic reach and augmenting technology portfolios, especially as established firms seek to enter emerging markets or bolster capabilities in next-generation sequencing and artificial intelligence.

These competitive dynamics compel stakeholders to continuously evaluate their R&D priorities, supply chain resilience, and customer support models. By benchmarking against peers and embracing open innovation, organizations can anticipate unmet needs and secure a leadership position in the evolving clinical microbiology market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Microbiology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux

- Bruker Corporation

- Danaher Corporation

- DiaSorin S.p.A.

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- Hologic, Inc.

- Illumina, Inc.

- Luminex Corporation

- Merck KGaA

- Ortho Clinical Diagnostics Holdings plc

- PerkinElmer, Inc.

- QIAGEN N.V.

- Rapid Micro Biosystems, Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc

Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption, Optimize Operations, and Capitalize on Clinical Microbiology Trends

To capitalize on emergent opportunities and mitigate sector-specific challenges, industry leaders should prioritize a multifaceted strategy. Initially, investing in modular automation solutions that integrate seamlessly with existing laboratory information systems will optimize throughput while safeguarding legacy workflows. In addition, establishing data governance frameworks and leveraging artificial intelligence for predictive analytics can enhance diagnostic accuracy and facilitate real-time surveillance of antimicrobial resistance patterns.

Moreover, diversifying supplier portfolios by qualifying domestic reagent manufacturers and validating open-access protocols can reduce dependence on international imports and buffer against tariff-induced cost variability. Concurrently, expanding service offerings to include remote technical support, virtual training modules, and consulting on regulatory compliance will deepen customer relationships and create recurring revenue streams. Collaboration with public health agencies and academic consortia can further amplify impact by jointly developing standardized proficiency testing and shared data repositories.

Finally, fostering a culture of continuous learning within laboratory teams is paramount. Implementing structured professional development programs that cover emerging technologies-ranging from next-generation sequencing to CRISPR-based diagnostics-will equip personnel to adapt swiftly. By executing these recommendations, organizations can enhance operational resilience, accelerate innovation cycles, and maintain a competitive edge in the dynamic clinical microbiology landscape.

Outlining Robust Research Methodology Emphasizing Data Collection, Validation Techniques, and Analytical Framework for Clinical Microbiology Insights

This report’s findings derive from a rigorous, multi-phased research framework combining primary interviews, secondary data review, and expert validation. Initially, a comprehensive literature review encompassed peer-reviewed journals, industry white papers, regulatory documentation, and public health agency reports. This secondary research established a foundational understanding of technological advancements, market drivers, and regulatory environments across key regions.

Subsequently, primary insights were garnered through structured interviews with laboratory directors, microbiologists, procurement managers, and technology providers. These engagements provided qualitative perspectives on adoption barriers, operational challenges, and strategic priorities. In parallel, data from regional and national healthcare databases were extracted and cleansed to ensure consistency, followed by cross-validation against financial disclosures and company press releases to confirm product launches and strategic initiatives.

Finally, an iterative expert review phase involved external stakeholders, including academic researchers and public health officials, to vet analytical assumptions and refine narrative conclusions. Throughout the process, stringent data validation protocols were applied, addressing potential biases and ensuring that the synthesized insights accurately reflect the current state of the clinical microbiology domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Microbiology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Microbiology Market, by Product Type

- Clinical Microbiology Market, by Technology

- Clinical Microbiology Market, by Application

- Clinical Microbiology Market, by End User

- Clinical Microbiology Market, by Specimen Type

- Clinical Microbiology Market, by Test Type

- Clinical Microbiology Market, by Region

- Clinical Microbiology Market, by Group

- Clinical Microbiology Market, by Country

- United States Clinical Microbiology Market

- China Clinical Microbiology Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Synthesis of Clinical Microbiology Trends, Challenges, and Opportunities to Guide Stakeholders Toward Informed Decision Making

In summary, the clinical microbiology landscape is being reshaped by converging forces of technological innovation, supply chain recalibration, and evolving regional priorities. Advancements in automation, artificial intelligence, and sequencing technologies have unlocked unprecedented diagnostic capabilities, while recent tariff changes underscore the importance of resilient procurement strategies. At the same time, key segmentation dimensions-from product types and technology modalities to application areas and end-user profiles-highlight where tailored solutions deliver the greatest impact.

Regional analyses reveal distinct growth trajectories across the Americas, EMEA, and Asia-Pacific, each offering unique opportunities and challenges. Competitive dynamics further emphasize the need for agility, as global incumbents and specialized players vie for market share through strategic partnerships, M&A activity, and open innovation models. By integrating these insights with robust research methodologies and actionable recommendations, stakeholders can navigate complexity, capitalize on emerging trends, and drive sustainable growth.

Ultimately, the confluence of data-driven strategies, collaborative ecosystems, and continuous learning will shape the next era of clinical microbiology. Organizations that embrace these imperatives will be best positioned to address global health needs, innovate diagnostic pathways, and deliver superior patient outcomes.

Secure Exclusive Access to the Comprehensive Clinical Microbiology Market Research Report Through Collaboration with Associate Director Ketan Rohom

To take advantage of the unparalleled insights detailed in this report and align your organization’s strategy with emerging clinical microbiology trends, reach out for personalized guidance. Ketan Rohom, Associate Director of Sales & Marketing, is ready to facilitate a tailored consultation and ensure you harness the report’s full value. Engage now to empower your team with actionable intelligence and a competitive edge in the rapidly evolving clinical microbiology landscape.

- How big is the Clinical Microbiology Market?

- What is the Clinical Microbiology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?