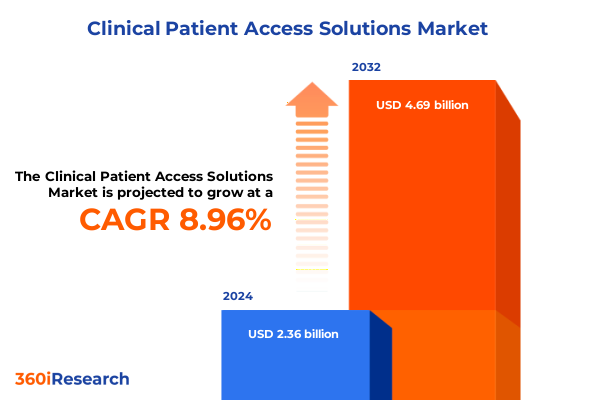

The Clinical Patient Access Solutions Market size was estimated at USD 2.56 billion in 2025 and expected to reach USD 2.78 billion in 2026, at a CAGR of 9.04% to reach USD 4.69 billion by 2032.

Navigating the pivotal intersection of technology and patient engagement to streamline access and optimize clinical pathways in healthcare delivery

The clinical patient access landscape is undergoing profound transformation driven by the convergence of consumer expectations, regulatory pressures, and technological innovation. Historically, patient access processes were often manual, fragmented, and prone to inefficiencies that delayed care and increased administrative burden. Today, healthcare providers recognize that optimizing the front-end of revenue cycles and enhancing patient engagement pathways are fundamental to delivering high-quality, patient-centered care. Advanced digital solutions now empower organizations to automate eligibility checks, streamline scheduling workflows, and personalize communication, thereby reducing friction and improving overall satisfaction.

As the industry pivots toward value-based care, patient access solutions have become a strategic differentiator for providers. By facilitating seamless interactions from appointment booking through financial clearance, these platforms not only bolster operational efficiency but also strengthen patient trust and loyalty. Moreover, integrated analytics capabilities now provide real-time visibility into key performance indicators, enabling data-driven decision making. Against this backdrop, it is essential to understand the drivers, enablers, and challenges shaping market evolution in order to navigate the path to sustainable growth and competitive advantage.

Revolutionary dynamics driving the evolution of clinical patient access through digital front doors, AI automation, and interoperable platforms reshaping care pathways

The healthcare ecosystem is experiencing transformative shifts that are redefining how patient access solutions are conceived, deployed, and leveraged. Digital front doors have emerged as the primary gateway for patients, offering intuitive self-scheduling portals and pre-registration tools that meet consumer demands for convenience and transparency. Concurrently, artificial intelligence and robotic process automation are automating repetitive tasks-such as prior authorization checks and payment estimation-freeing staff to focus on exceptions and complex cases. Interoperability efforts are also gaining momentum, with industry stakeholders collaborating to integrate patient access platforms with electronic health records and complementary health IT systems.

Furthermore, consumerization of healthcare is driving the adoption of omnichannel communication strategies, ensuring that patients receive appointment reminders, eligibility updates, and financial summaries through their preferred channels. As regulatory frameworks continue to evolve, compliance requirements for data security and patient privacy are prompting vendors to embed robust encryption and consent management protocols within their solutions. These converging trends underscore a fundamental paradigm shift: patient access is no longer viewed as an isolated administrative function but as an integral component of holistic care delivery and revenue cycle optimization.

Assessing the compounding effects of evolving United States tariff policies in 2025 on the cost structures and supply chains of clinical patient access solutions

The United States entered 2025 with a series of sweeping tariff actions aimed at addressing national security and trade imbalances, which have had significant downstream effects on healthcare IT and patient access solution providers. On February 4, 2025, the administration imposed a 10 percent ad valorem tariff on all Chinese goods under an executive order citing concerns over precursor chemicals and illicit financing, and this rate was raised to 20 percent on March 4, 2025, under the same authority to spur further cooperation on enforcement actions. Simultaneously, a baseline 10 percent tariff was extended to all trading partners, with an additional 34 percent reciprocal duty announced for China on April 2, 2025, briefly peaking at rates exceeding 125 percent before a 90-day agreement reduced the reciprocal rate to 10 percent on May 14, 2025. In response, China retaliated on February 10, 2025, by imposing targeted duties of up to 15 percent on U.S. coal and liquefied natural gas, followed by additional levies on agricultural machinery, vehicles, and crude oil.

These tariff fluctuations have led to increased hardware procurement costs for patient access kiosks, servers, and network equipment, as many components rely on global supply chains that traverse tariff-sensitive regions. Consequently, implementation budgets for on-premise solutions have been under pressure, driving a pivot toward cloud-based deployments to mitigate capital expenditure risk. Service providers are also absorbing higher service fees or renegotiating vendor contracts to manage margin erosion. In the longer term, organizations are pursuing supply chain diversification strategies, sourcing from alternative geographies and strengthening regional distribution channels to buffer against future trade policy volatility.

Delving into comprehensive segmentation reveals nuanced demand patterns across components, deployment models, functional modules, end-user settings, and integration types

Understanding the clinical patient access market requires a multidimensional lens that dissects demand through component, deployment, function, user, and integration dimensions. Within the component axis, solution portfolios span integrated offerings, standalone software suites, and a range of professional and managed services. The professional services tier, further subdivided into consulting and ongoing support and maintenance, remains critical for driving successful implementations and ensuring system optimization. Transitioning to deployment strategies, many organizations now prefer cloud-hosted environments, with private and public cloud variations allowing for tailored scalability, security, and compliance profiles.

Functionally, the market addresses key workflows including billing and revenue cycle management-encompassing claims submission, denial management, and payment posting-alongside eligibility and enrollment modules. Critical patient-facing elements for financial communication, prior authorization and referral orchestration, and scheduling and registration tie directly to patient satisfaction and collection effectiveness. From an end-user standpoint, ambulatory and outpatient facilities, diagnostic imaging centers, and hospitals each present unique requirements that influence solution selection and customization needs. Finally, integration paradigms vary between fully EHR-embedded modules and standalone platforms, with interoperability success often hinging on open APIs and cross-vendor collaboration. This granular segmentation enables providers to align technology investments with specific operational priorities and clinical environments.

This comprehensive research report categorizes the Clinical Patient Access Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Integration

- Function

- End User

Analyzing distinct regional trajectories across the Americas, Europe Middle East Africa, and Asia-Pacific markets to uncover strategic opportunities and challenges

Regional dynamics significantly shape the trajectory of clinical patient access adoption and innovation. In the Americas, a combination of regulatory reforms and payer-driven incentives accelerates the migration toward digital front-end platforms and patient self-service tools. Leading health systems in North America are pioneering models that integrate eligibility checks with payer portals, while Latin American markets are increasingly embracing cloud-native solutions to address infrastructure constraints and broaden patient outreach.

Meanwhile, Europe, the Middle East, and Africa display a diverse spectrum of maturity levels. Western European nations emphasize data privacy and interoperability, often mandating compliance with stringent GDPR standards. Conversely, emerging markets in the Middle East and Africa are prioritizing rapid digitalization and mobile access, leveraging telehealth bridges to improve coverage in underserved regions. Finally, the Asia-Pacific region stands out for its high rate of technology adoption, with cloud-first strategies and mobile-first patient engagement frameworks gaining traction in markets such as Australia, Japan, and India. Across all regions, partnerships between local system integrators and global vendors foster tailored implementations that respect regulatory contexts and cultural expectations.

This comprehensive research report examines key regions that drive the evolution of the Clinical Patient Access Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling pioneering industry stakeholders and strategic alliances shaping innovation, competitive positioning, and collaborative ecosystems in patient access solutions

Leading organizations in the clinical patient access domain are distinguished by their ability to innovate, scale, and foster strategic partnerships. Key vendors have cultivated comprehensive ecosystems that bundle software functionality with professional services and managed support, thereby delivering end-to-end value propositions. Alliances between technology providers, EHR platforms, and payer networks have become increasingly common, driving enhanced interoperability and streamlined revenue cycle processes.

Moreover, pure-play specialists have carved out niches by focusing exclusively on advanced modules such as artificial intelligence-driven denial prevention, dynamic patient pricing calculators, and omnichannel communication engines. In parallel, larger IT conglomerates differentiate through global delivery capabilities, extensive integration frameworks, and broad product portfolios spanning patient access and downstream clinical systems. This heterogeneous competitive landscape underscores the importance of strategic deals, mergers and acquisitions, and joint development agreements in consolidating market share and accelerating feature roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Patient Access Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Access Healthcare

- athenahealth Inc

- Change Healthcare

- Cognizant Technology Solutions Corporation

- Conifer Health Solutions LLC

- Craneware plc

- eClinicalWorks LLC

- Epic Systems Corporation

- Experian plc

- GE HealthCare

- Kareo Inc

- Kyruus

- McKesson Corporation

- Medical Information Technology Inc

- NextGen Healthcare Inc

- Optum Inc

- Oracle Corporation

- Phreesia (Phreesia)

- Practice Fusion Inc

- Quest Diagnostics Incorporated (Quest Diagnostics Incorporated)

- R1 RCM Inc (R1 RCM Inc)

- Siemens Healthineers AG (Siemens Healthineers AG)

- UnitedHealth Group Inc (UnitedHealth Group, Inc.)

- Veradigm LLC

- Waystar (Waystar)

- Zocdoc Inc

Translating insights into targeted strategies for healthcare executives to enhance patient access, optimize operational efficiencies, and future-proof technology investments

To capitalize on emerging opportunities and navigate ongoing challenges, healthcare leaders should prioritize a series of targeted strategic initiatives. First, they must adopt a patient-centric design philosophy, ensuring that access portals, communication workflows, and financial estimators align with end-user expectations for simplicity and transparency. Second, investing in data and analytics capabilities will be essential for monitoring performance metrics and identifying bottlenecks across the access journey. Third, forming cross-functional governance teams that include IT, finance, clinical operations, and patient advocacy representatives will foster accountability and drive adoption.

In addition, mitigating geopolitical and supply chain risks requires a proactive procurement strategy that balances on-premise investments with cloud-based alternatives. Organizations should also engage in vendor ecosystem management, evaluating partners not only on feature sets but also on service quality, security posture, and roadmap alignment. Finally, continuous training and change management programs are necessary to embed process improvements, optimize staff utilization, and ensure that technology investments translate into measurable operational and financial benefits.

Employing a rigorous blend of primary interviews, secondary research, data triangulation, and validation protocols to ensure robust and comprehensive market insights

This research integrates a rigorous multi-stage methodology designed to ensure authoritative and actionable insights. Primary research involved interviews with key stakeholders across healthcare provider organizations, health systems, software vendors, service providers, and industry experts to validate market drivers, challenges, and adoption patterns. Secondary research encompassed an extensive review of regulatory guidelines, industry publications, vendor whitepapers, and peer-reviewed articles to contextualize emerging trends and technological innovations.

Data triangulation techniques were applied to reconcile divergent perspectives and quantify qualitative insights. Key performance indicators were benchmarked against industry frameworks, while vendor capabilities were assessed through comparative matrices. Validation workshops with domain specialists served to refine findings and identify any potential blind spots. This approach underpins the report’s reliability, ensuring that conclusions and recommendations accurately reflect the current state and future trajectory of the clinical patient access solutions market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Patient Access Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Patient Access Solutions Market, by Component

- Clinical Patient Access Solutions Market, by Deployment

- Clinical Patient Access Solutions Market, by Integration

- Clinical Patient Access Solutions Market, by Function

- Clinical Patient Access Solutions Market, by End User

- Clinical Patient Access Solutions Market, by Region

- Clinical Patient Access Solutions Market, by Group

- Clinical Patient Access Solutions Market, by Country

- United States Clinical Patient Access Solutions Market

- China Clinical Patient Access Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing critical findings to underscore the transformative potential and strategic imperatives driving the next phase of clinical patient access solution adoption

The analysis presented in this report illuminates the transformative potential of patient access solutions to redefine how care is delivered and experienced. By leveraging digital front doors, automation technologies, and interoperable platforms, healthcare organizations can enhance operational resilience, improve financial performance, and foster deeper patient engagement. The cumulative effect of policy shifts, geopolitical events, and technological advancements underscores the imperative for agile strategy development and adaptive technology investment.

Moving forward, the ability to integrate patient access solutions seamlessly within broader care delivery frameworks will differentiate industry leaders from laggards. Strategic alignment across stakeholders, from executive leadership to frontline staff, will be critical for translating technology capabilities into real-world impact. In an environment where patient expectations, regulatory requirements, and competitive pressures are evolving rapidly, this report’s insights and recommendations provide a clear blueprint for success in the next phase of clinical patient access adoption.

Engage with Ketan Rohom to secure exclusive access to the full market research report and unlock actionable insights for your organization’s growth trajectory

As healthcare organizations strive to stay ahead in an increasingly competitive and technology-driven environment, acquiring comprehensive, actionable insights is critical. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide executive teams through the purchasing process. Engaging with Ketan ensures that key stakeholders receive personalized support tailored to their strategic objectives. Whether you seek to benchmark against industry standards, explore emerging opportunities, or validate partnership strategies, Ketan’s expertise will help align your organization’s growth agenda with the transformative trends identified in this report.

Take the next step toward securing your organization’s market leadership by accessing the full clinical patient access solutions research report. Partnering with Ketan Rohom grants you exclusive advantages including early access to in-depth analyses, customized briefings, and direct consultation channels. Reach out today to unlock a tailored roadmap that will elevate patient access performance, optimize operational workflows, and fortify your competitive positioning in the evolving healthcare landscape.

Discover how this report’s strategic recommendations can drive tangible improvements in patient satisfaction, revenue cycle efficiencies, and care coordination. Connect with Ketan Rohom to convert insights into impact and accelerate your organization’s journey toward next-generation patient access excellence

- How big is the Clinical Patient Access Solutions Market?

- What is the Clinical Patient Access Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?