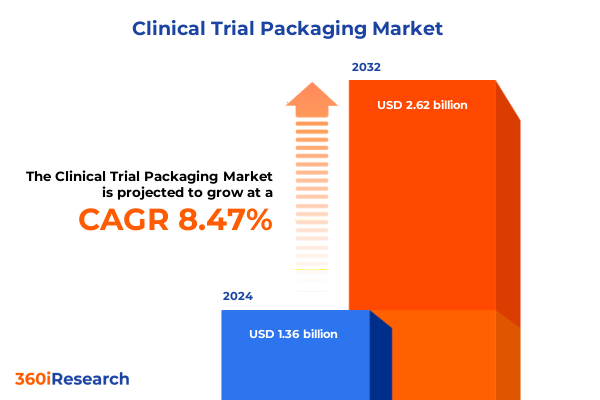

The Clinical Trial Packaging Market size was estimated at USD 1.46 billion in 2025 and expected to reach USD 1.57 billion in 2026, at a CAGR of 8.66% to reach USD 2.62 billion by 2032.

Setting the Stage for Innovation in Clinical Trial Packaging with an Overview of Emerging Trends and Challenges Shaping the Industry Future

Clinical trial packaging stands at the forefront of delivering safe, effective, and compliant therapies to patients around the globe. As pharmaceutical and biotechnology companies accelerate study timelines and complexity, the role of packaging has expanded beyond mere containment to an essential component of trial integrity. The selection of appropriate materials, formats, and delivery devices directly influences product stability, patient adherence, and regulatory acceptance.

In today’s environment, packaging teams must navigate multifaceted challenges ranging from evolving global regulations to the logistical demands of decentralized and adaptive trial models. Moreover, the rise of advanced therapies, such as cell and gene treatments, has driven a need for bespoke solutions that address stringent cold chain requirements. With mounting pressure to reduce time to market while ensuring participant safety, stakeholders must partner with innovative packaging providers and develop agile strategies capable of responding to rapidly shifting conditions.

Navigating the Transformative Shifts in Clinical Trial Packaging through Digital Advancements, Sustainability Imperatives, and Regulatory Evolution Impacting Stakeholders

The clinical trial packaging landscape has been transformed by the rapid adoption of digital printing technologies, enabling faster label customization and real-time serialization tracking. These advances not only bolster anti-counterfeiting measures but also accelerate batch release processes, thereby reducing time-to-clinic. Simultaneously, sustainability considerations have taken center stage, prompting a shift toward recyclable materials and minimized packaging footprints to align with corporate environmental commitments.

Additionally, regulatory authorities are harmonizing serialization and traceability requirements, creating both opportunities and challenges for global supply chain consistency. This regulatory momentum drives investment in integrated packaging lines equipped with automated inspection systems to ensure compliance and reduce human error. Furthermore, the convergence of data analytics and Internet of Things sensors within smart packaging solutions offers unprecedented visibility into environmental conditions, enabling proactive risk management across long-distance distribution networks.

Evaluating the Cumulative Impact of United States Tariffs Implemented in 2025 on Clinical Trial Packaging Costs, Supply Chains, and Strategic Sourcing Decisions

In 2025, the implementation of enhanced U.S. tariffs on select packaging materials, including polymer resins and specialty glass, has introduced new cost pressures across the clinical trial ecosystem. These duties have elevated the landed cost of components sourced from key international suppliers, compelling packaging teams to reassess their vendor portfolios. As a consequence, many organizations have begun to explore onshore manufacturing partnerships to mitigate tariff exposure and reduce supply chain volatility.

Moreover, the tariffs have accelerated discussions around strategic buffer inventory and long-term sourcing agreements. By proactively stockpiling critical packaging elements and negotiating fixed-price contracts, sponsors are striving to shield trial budgets from future levies. However, these approaches require careful balancing, as excess inventory can lead to obsolescence risks, particularly in adaptive trials where protocol revisions may alter packaging specifications. Consequently, packaging professionals are tasked with developing dynamic sourcing models that accommodate rapidly changing trial designs while preserving cost efficiency.

Uncovering Key Segmentation Insights across Packaging Types, Trial Phases, Dosage Forms, Container Variants, Materials, and End Users for Informed Decision Making

An integrated examination of clinical trial packaging demands reveals that packaging type selection-ranging from barrier bags to blow-fill-seal pouches, cartridges, prefillable syringes, and both glass and plastic vials-directly influences stability, handling, and cold chain compatibility. Early-phase studies often prioritize flexible formats such as barrier bags and pouches to support small-batch chemical and liquid formulations, whereas later-phase trials increasingly rely on prefillable syringes and vials to emulate commercial presentations.

Similarly, trial phase considerations shape packaging complexity. Phase I investigations typically require simple single-use formats optimized for speed, while Phase II and III protocols demand scalable container systems capable of supporting patient-centric dosing across diverse sites. By Phase IV, real-world storage and administration conditions necessitate robust packaging designs that uphold product integrity without compromising user convenience.

Dosage form further refines packaging strategies, as liquid formulations-both aqueous and oily-often mandate precision fill systems and inert container materials, whereas lyophilized and powdered presentations rely on vials engineered for freeze-dry cycles and reconstitution. Within container type, choices between ampoules, flexible and rigid bags, cartridges, manual and prefilled syringes, and vials must account for operational workflows, safety requirements, and patient handling protocols.

Material selection between glass and advanced plastics such as cyclo olefin copolymer and cyclo olefin polymer informs decisions on extractables, durability, and weight reduction. Meanwhile, end-user segmentation highlights the nuanced needs of biopharmaceutical innovators, contract packaging and research organizations, and both large and small pharmaceutical companies. Each stakeholder group demands tailored service offerings, whether through rapid turn-around prototyping, regulatory support, or full-scale commercial readiness.

This comprehensive research report categorizes the Clinical Trial Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Trial Phase

- Dosage Form

- Container Type

- Material

- End User

Analyzing Key Regional Insights across the Americas, Europe Middle East and Africa, and Asia Pacific to Identify Growth Drivers and Market Dynamics Shaping Packaging Strategies

Regional market dynamics are shaped by localized regulatory frameworks, infrastructure maturity, and trial activity concentration. In the Americas, strong investment in biologics and advanced therapies has led to widespread adoption of prefilled syringes, barrier films, and serialized labels, supported by robust logistics networks that ensure cold chain integrity across vast geographies. This region’s emphasis on patient-centric solutions and decentralized trial models has further spurred demand for compact, user-friendly packaging formats.

Across Europe, the Middle East, and Africa, regulatory harmonization under initiatives like EuPRAXIA and EMA guidelines has streamlined cross-border trial deployment, driving interest in adaptable packaging lines capable of accommodating diverse labeling languages and multi-dose configurations. Infrastructure advancements in cold chain and automated inspection facilities have elevated this region’s competitiveness, particularly for trials involving temperature-sensitive biologics.

Meanwhile, Asia-Pacific’s rapid CRO expansion and cost-efficient manufacturing hubs have attracted late-phase trial volumes, creating a surge in demand for scalable vial filling and blow-fill-seal operations. Manufacturers in this region are leveraging low-cost materials and local sourcing partnerships to deliver competitive pricing, while regulators are incrementally tightening serialization and traceability mandates, aligning more closely with global best practices.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trial Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Strategies and Competitive Dynamics Within the Clinical Trial Packaging Ecosystem to Understand Innovation Leadership and Partnership Trends

Leading packaging suppliers have differentiated themselves through strategic investments in digitalization, sustainability, and service integration. Global glass and container manufacturers have expanded capacity for high-throughput vial production while introducing carbon-neutral lines to meet green chemistry goals. Simultaneously, specialty polymer producers are advancing cyclo olefin copolymer and polymer offerings with enhanced barrier properties and improved compatibility for subcutaneous drug delivery.

Contract packaging and research organizations are forging partnerships with technology startups to embed IoT sensors and QR code-driven patient engagement tools directly into labels. These collaborations enable real-time environmental monitoring and remote adherence tracking, offering sponsors deeper insights into trial conduct. Moreover, several firms have integrated modular cleanroom solutions within their network, providing sponsors with flexible regional footprint options to streamline sample management and accelerate distribution timelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trial Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACG Capsules Private Limited

- Almac Group Limited

- Amcor Plc

- Berry Global Inc.

- Bilcare Limited

- Catalent Pharma Solutions, Inc.

- CCL Industries Inc.

- Fisher Clinical Services

- Gerresheimer AG

- Lonza Group

- Marken Ltd.

- PCI Services

- Sharp Packaging Services, Inc.

- Stora Enso Oyj

- Thermo Fisher Scientific Inc.

- Tjoapack Group Holding B.V.

- UDG Healthcare plc

- Westrock Company

- Wuxi AppTec

- Xerimis Inc.

Formulating Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency, Ensure Regulatory Compliance, and Foster Sustainable Packaging Practices

Industry leaders should prioritize investments in serialization and smart packaging platforms that align with evolving traceability regulations and enhance end-to-end visibility. By adopting modular, automated lines, organizations can rapidly adjust to protocol amendments while minimizing manual interventions that introduce risk. In parallel, diversifying supplier networks across geographies will mitigate tariff exposure and reduce lead-time uncertainties, ensuring uninterrupted trial supply.

Furthermore, integrating sustainability into packaging strategies-through lighter materials, reduced secondary packaging, and return-able container programs-will support corporate ESG objectives and resonate with increasingly eco-conscious stakeholders. Collaboration with regulatory bodies to pilot innovative packaging technologies, such as on-site fill-and-administer systems, can streamline approvals and establish first-mover advantages in new therapy areas. Finally, fostering cross-functional partnerships among sourcing, clinical operations, and quality teams will accelerate decision-making and drive cohesive packaging solutions that align with broader trial imperatives.

Detailing a Robust Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Industry Validation to Ensure Comprehensive Market Intelligence

This analysis is grounded in a multi-layered research approach that commenced with comprehensive secondary data collection from regulatory filings, scientific literature, and publicly available corporate disclosures. These insights were supplemented by in-depth interviews with packaging engineers, supply chain managers, and clinical operations executives across biopharmaceutical, contract, and research organizations.

Quantitative data points were validated through triangulation across industry databases, patent repositories, and technology provider whitepapers. Regional perspectives were gained via consultations with logistics specialists and regulatory affairs consultants to capture localized challenges and best practices. Throughout the process, data integrity was maintained by cross-referencing findings against quality benchmarks and seeking direct clarification from subject matter experts where discrepancies arose.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trial Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trial Packaging Market, by Packaging Type

- Clinical Trial Packaging Market, by Trial Phase

- Clinical Trial Packaging Market, by Dosage Form

- Clinical Trial Packaging Market, by Container Type

- Clinical Trial Packaging Market, by Material

- Clinical Trial Packaging Market, by End User

- Clinical Trial Packaging Market, by Region

- Clinical Trial Packaging Market, by Group

- Clinical Trial Packaging Market, by Country

- United States Clinical Trial Packaging Market

- China Clinical Trial Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Executive Perspectives on the Clinical Trial Packaging Landscape Emphasizing Strategic Priorities, Emerging Opportunities, and Future Industry Trajectories

The clinical trial packaging landscape is evolving rapidly under the influence of digital innovation, regulatory modernization, and heightened sustainability expectations. Success in this environment hinges on the ability to blend agile sourcing strategies with advanced packaging technologies that safeguard product integrity from manufacturing to patient administration.

As organizations navigate the complexities of tariff fluctuations, regional regulatory variances, and diverse trial demands, a cohesive, data-driven approach emerges as essential. By leveraging segmentation insights, understanding regional nuances, and partnering with forward-looking suppliers, stakeholders can optimize packaging processes, reduce operational friction, and ultimately support the delivery of safe, effective therapies to patients worldwide.

Engage with Ketan Rohom to Unlock Strategic Value from the Comprehensive Clinical Trial Packaging Market Research Report

To explore the full depth of clinical trial packaging innovations, regulatory frameworks, and strategic insights, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive report. Ketan will guide you through the methodologies, key findings, and actionable strategies tailored to your organizational priorities, ensuring you leverage the latest market intelligence for competitive advantage.

- How big is the Clinical Trial Packaging Market?

- What is the Clinical Trial Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?