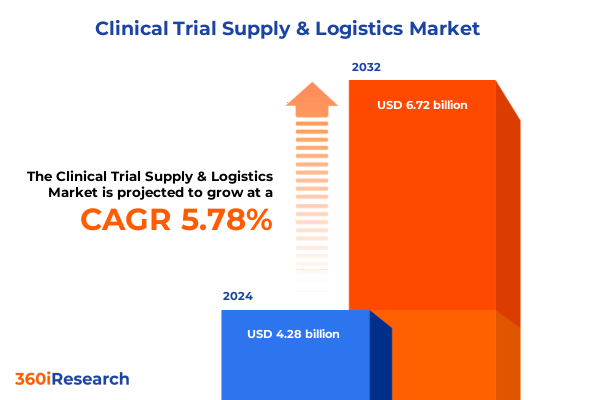

The Clinical Trial Supply & Logistics Market size was estimated at USD 4.47 billion in 2025 and expected to reach USD 4.82 billion in 2026, at a CAGR of 7.87% to reach USD 7.60 billion by 2032.

Setting the Stage for Modern Clinical Trial Supply and Logistics Excellence Amid Rising Complexity and Global Demand Dynamics

The clinical trial landscape has undergone rapid transformation, demanding a more sophisticated approach to supply and logistics that aligns with evolving scientific, regulatory, and commercial imperatives. In this era of heightened complexity, stakeholders must navigate an intricate network of service providers and distribution channels to ensure investigational products reach study sites reliably and in compliance with global regulations. Moreover, patient-centric trials and the proliferation of decentralized models have further elevated the stakes, requiring supply chains to be both flexible and resilient. Consequently, industry leaders are rethinking traditional paradigms, investing in advanced technologies and dynamic partnerships to streamline operations and enhance transparency from comparator sourcing to final disposal.

At the heart of this evolution lies the convergence of cold chain management innovations and digital tracking solutions, which together underpin the shift toward end-to-end visibility and real-time decision-making. These developments are not only critical for safeguarding product integrity, particularly for biologic drug candidates, but also for meeting stringent regulatory requirements across multiple jurisdictions. As trial protocols grow more complex-encompassing small molecules, medical devices, and an expanding range of therapeutic modalities-organizations face the imperative to optimize every element of their supply strategy. In response, they are embracing integrated frameworks that encompass sourcing models, logistics and distribution modalities, packaging, labeling, blinding, plus storage and retention strategies, ensuring the uninterrupted flow of investigational materials.

Navigating Transformative Shifts That Are Redefining Clinical Trial Supply Chains from Regulatory Advances to Technological Innovations

In recent years, transformative shifts have redefined the supply and logistics paradigm, as emerging technologies converge with regulatory advancements to drive efficiency and compliance. Automation and robotics in packaging and labeling processes now accelerate turnaround times while reducing manual errors, enabling agile responses to changing study demands. Complementing these advances, blockchain and IoT-based cold chain monitoring solutions provide immutable, real-time records, ensuring product integrity during transit and storage. This digital evolution extends beyond temperature control, encompassing tamper-evident seals and electronic customs clearance processes that mitigate delays at borders, particularly crucial when trials span multiple continents.

Regulatory landscapes have also adapted, with agencies introducing harmonized guidelines that streamline import and export procedures. Enhanced cooperation between competent authorities has resulted in expedited approvals for critical shipments, while risk-based approaches enable organizations to prioritize high-value biologic and rare disease compounds for accelerated review. Simultaneously, the rise of decentralized trial models has necessitated more localized warehousing and home delivery services, compelling logistics partners to develop micro-fulfillment centers near patient populations. These strategic shifts collectively underscore a new era in which integrated digital infrastructures and adaptive regulatory frameworks coalesce to support robust and resilient clinical trial supply chains.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Clinical Trial Supply Efficiency and Cost Structures

The introduction of adjusted United States tariffs in early 2025 has introduced both challenges and opportunities for clinical trial supply stakeholders operating within or through U.S. gateways. Tariff revisions targeted at certain pharmaceutical excipients and ancillary materials led to increased import costs for comparator sourcing and packaging components sourced from international suppliers. As a result, supply chain managers have reassessed sourcing strategies, balancing centralized import models against the potential benefits of nearshoring and domestic manufacturing to mitigate cost pressures.

Yet, these tariff adjustments have also spurred innovation. To offset increased duties on non-cold chain distribution inputs, organizations have consolidated shipments and adopted more efficient packaging solutions that minimize declared values without compromising product safety. Cold chain segments have experienced less impact due to exemptions for temperature-sensitive clinical materials, but logistics and distribution providers nonetheless accelerated investments in infrastructure improvements to maintain competitive service levels. Furthermore, the evolving tariff environment has motivated cross-functional teams to collaborate more closely, integrating procurement and supply planning to secure favorable supplier agreements and optimize inventory positioning across regional distribution centers. Through these adaptive measures, industry participants are successfully navigating tariff headwinds while preserving trial timelines and ensuring patient access.

Illuminating Key Segmentation Insights That Reveal Critical Service, Sourcing, Type, Delivery, End-User, Therapeutic, and Trial Phase Dynamics in the Market

Deep analysis of market segmentation reveals nuanced dynamics across multiple dimensions of clinical trial supply services. Within the services domain, comparator sourcing, logistics and distribution, manufacturing, packaging, labeling, blinding, and storage and retention each play distinct roles, with cold chain distribution emerging as a critical sub-segment due to stringent temperature requirements. Logistics and distribution partners that excel in both cold chain and non-cold chain offerings are increasingly differentiated by their ability to provide seamless transitions across modalities, reducing handoff risks and ensuring compliance with temperature protocols.

Examining sourcing models exposes the strategic trade-offs between centralized and decentralized approaches, where centralized sourcing can leverage bulk purchasing power but may suffer from extended lead times, while decentralized sourcing offers local responsiveness at the expense of reduced volume discounts. Type-based segmentation underscores varying needs across biologic drugs, medical devices, and small molecules, driving tailored manufacturing and packaging processes. Mode of delivery distinctions-offsite supply management versus onsite supply management-highlight how sponsors balance control with convenience, particularly in hybrid trial designs. End-user segmentation points to the unique requirements of contract research organizations, medical device companies, and pharmaceutical and biotechnology firms, each prioritizing different service combinations to align with their operational models. Therapeutic area and phase of trial divisions further demonstrate that supply strategies must be customized for indications ranging from oncologic treatments to respiratory disorders and for phases spanning BA/BE through Phase 4 studies.

This comprehensive research report categorizes the Clinical Trial Supply & Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- By Service Type

- Type

- Mode of Delivery

- By Clinical Trial Phase

- End-user

Uncovering Regional Variances Across the Americas, Europe Middle East & Africa, and Asia-Pacific That Shape Strategic Approaches to Clinical Trial Supply and Logistics

Regional analysis highlights distinct patterns and strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a mature ecosystem of contract research organizations and logistics providers supports highly sophisticated cold chain networks, with multinational sponsors leveraging established infrastructure to accelerate trials in North America and Latin America. Meanwhile, EMEA markets display a dichotomy between Western Europe’s advanced regulatory harmonization and the Middle East and Africa’s emerging opportunities, where sponsors must navigate diverse import requirements and invest in capacity building to ensure reliable distribution.

Across Asia-Pacific, rapid growth in clinical research activity has been driven by large patient populations and cost-effective operations, prompting supply chains to expand regional warehousing and hub-and-spoke models. This region’s focus on thermal mapping standards and quality management systems elevates service expectations, particularly for biologic drug candidates. Whether in the Americas, EMEA, or Asia-Pacific, companies must calibrate their strategies to align with regional regulatory frameworks, infrastructure maturity, and local service provider capabilities. This tailored approach ensures that supply chain investments yield maximum value, enabling swift trial execution and safeguarding product integrity through every logistical pathway.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trial Supply & Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Companies Driving Innovations in Clinical Trial Supply Chain Management Through Advanced Technologies and Strategic Partnerships

Leading companies in the clinical trial supply and logistics arena are distinguished by their strategic investments in end-to-end digital platforms, specialized infrastructure, and collaborative partnerships. Top-tier logistics providers have rolled out integrated control towers that centralize inventory visibility, exception management, and regulatory documentation, empowering sponsors to monitor site shipments in real time and address deviations before they impact patient dosing schedules. Meanwhile, companies focusing on manufacturing and packaging have introduced modular clean rooms and mobile packaging units, which streamline changeovers and localize production closer to trial sites.

On the technology front, innovators are harnessing artificial intelligence and machine learning to predict supply chain disruptions, optimize route planning, and forecast temperature excursion risks. These capabilities are complemented by advanced analytics dashboards that unify data across sourcing, distribution, and storage functions, facilitating proactive decision-making. Strategic alliances between pharmaceutical sponsors, device makers, and specialized logistics firms have further consolidated expertise, yielding tailored solutions for complex trials in rare diseases and oncology. Collectively, these leading organizations set new benchmarks for operational excellence, setting the stage for broader adoption of digitalized, resilient supply frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trial Supply & Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Thermo Fisher Scientific Inc.

- Catalent, Inc

- United Parcel Service, Inc.

- Parexel International Corporation

- Movianto International B.V. by Yusen Logistics Group

- DHL Group

- Almac Group

- Kuehne und Nagel International AG

- FedEx Corporation

- Eurofins Scientific SE

- Lonza Group AG

- Biocair International Limited

- Acnos Pharma GmbH

- ADAllen Pharma Ltd

- Ancillare, LP

- CLINICAL SERVICES INTERNATIONAL LTD

- Clinigen Group PLC by Triley Bidco Limited

- COREX LOGISTICS LIMITED

- Experic, LLC

- ICON PLC

- Inceptua S.A.

- Infosys Limited

- IPS Pharma

- KLIFO A/S

- Myonex, Inc.

- N-SIDE SA

- NUVISAN GmbH

- OCT Clinical GmbH

- Octalsoft Solutions Private Limited

- PCI Pharma Services

- PHOENIX Pharmahandel GmbH & Co KG

- SAP SE

- Sharp Services, LLC

- Signant Health

- SIRO Clinpharm Private Limited

- Uniphar PLC

Providing Actionable Recommendations That Enable Industry Leaders to Enhance Resilience and Agility in Clinical Trial Supply and Logistics Operations

To fortify your clinical trial supply and logistics operations against evolving risks, industry leaders should adopt a series of targeted actions that balance innovation with operational discipline. First, integrate digital control tower architectures to achieve unified visibility across every shipment and inventory node, enabling rapid response to temperature deviations and regulatory inquiries. Next, reassess sourcing models by blending centralized purchasing with localized nearshore capabilities, thereby optimizing cost structures without compromising speed to site. Transitioning packaging and labeling workflows to modular or mobile units can reduce changeover times, while implementing risk-based quality management systems will streamline compliance across multiple geographies.

Further, develop strategic partnerships with logistics and distribution providers that offer both cold chain and non-cold chain expertise, ensuring seamless mode transitions. Enhance data analytics capabilities to forecast demand fluctuations by leveraging AI-driven insights into patient enrollment trends and protocol amendments, and integrate these forecasts into dynamic inventory management platforms. Finally, prioritize continuous process optimization through regular cross-functional reviews, aligning procurement, clinical operations, and quality assurance teams. These recommendations, when executed cohesively, will drive resilient, agile supply chains, reduce trial timelines, and safeguard patient welfare across diverse therapeutic and geographic settings.

Explaining the Comprehensive Multi-Stage Research Methodology Employed to Derive Accurate and Actionable Insights for Clinical Trial Supply Analysis

This analysis is founded on a robust, multi-stage research methodology designed to deliver precise, actionable insights into the clinical trial supply and logistics market. The process commenced with an extensive review of primary sources, including structured interviews with senior supply chain executives, trial operations leaders, and regulatory specialists across multiple regions. Secondary research encompassed analysis of industry reports, peer-reviewed publications, regulatory guidance documents, and publicly disclosed product pipelines. These qualitative inputs were triangulated with proprietary datasets detailing shipment volumes, temperature excursion incidents, and service level metrics.

Quantitative modeling was then applied to historical and current data, identifying key drivers, cost components, and risk factors influencing supply chain performance. Segmentation frameworks were developed to reflect differentiated service offerings, sourcing strategies, product types, delivery modes, end-user profiles, therapeutic indications, and trial phases. Regional mapping incorporated infrastructure capacity, regulatory timelines, and market maturity assessments, while company profiles were evaluated based on service breadth, technological capabilities, and strategic alliances. Rigorous validation checks, including peer benchmarking and expert advisory reviews, ensured the integrity of findings, culminating in a comprehensive market intelligence report that supports strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trial Supply & Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trial Supply & Logistics Market, by By Service Type

- Clinical Trial Supply & Logistics Market, by Type

- Clinical Trial Supply & Logistics Market, by Mode of Delivery

- Clinical Trial Supply & Logistics Market, by By Clinical Trial Phase

- Clinical Trial Supply & Logistics Market, by End-user

- Clinical Trial Supply & Logistics Market, by Region

- Clinical Trial Supply & Logistics Market, by Group

- Clinical Trial Supply & Logistics Market, by Country

- United States Clinical Trial Supply & Logistics Market

- China Clinical Trial Supply & Logistics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Conclusive Insights That Integrate Tariff Impacts, Segmentation Findings, Regional Variances, and Industry Trends for Strategic Prioritization

In summary, the clinical trial supply and logistics landscape is being reshaped by digital innovations, evolving regulatory frameworks, and targeted tariff policies that together demand more agile, data-driven approaches. Segmentation insights clarify that tailored service combinations-spanning everything from comparator sourcing through cold chain distribution and onsite supply management-are essential to meet the unique needs of pharmaceutical, biotechnology, and medical device organizations. Regional analysis underscores the importance of aligning strategies with the operational realities of the Americas, EMEA, and Asia-Pacific markets, while leading companies demonstrate that integrated digital platforms and strategic alliances can unlock new levels of efficiency and compliance.

As industry leaders confront the cumulative impact of shifts in tariff structures, technology adoption, and decentralized trial models, the path forward lies in embracing end-to-end visibility, risk-based quality systems, and collaborative partnerships. By translating these conclusions into targeted investments-such as modular packaging units, AI-driven predictive analytics, and flexible sourcing frameworks-organizations can fortify their supply chains against disruptions, accelerate trial timelines, and ultimately deliver safer, more effective therapies to patients worldwide.

Encouraging Direct Engagement to Secure the Clinical Trial Supply Market Report through Consultation with Associate Director, Sales & Marketing, Ketan Rohom

Elevate your strategic planning by obtaining the definitive resource on clinical trial supply and logistics. Engage directly with Associate Director, Sales & Marketing, Ketan Rohom to discuss how this market research report can empower your organization with actionable intelligence and industry-leading analysis. Connect with Ketan Rohom to unlock comprehensive insights that drive innovation, mitigate risk, and ensure robust supply chain performance throughout every phase of your clinical development program.

- How big is the Clinical Trial Supply & Logistics Market?

- What is the Clinical Trial Supply & Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?