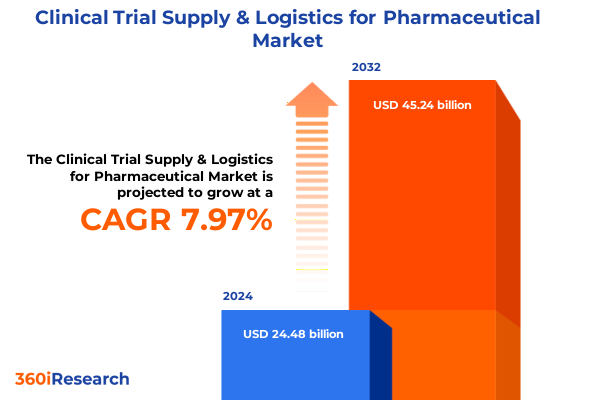

The Clinical Trial Supply & Logistics for Pharmaceutical Market size was estimated at USD 26.35 billion in 2025 and expected to reach USD 28.38 billion in 2026, at a CAGR of 8.02% to reach USD 45.24 billion by 2032.

Understanding the Critical Role of Integrated Supply and Logistics in Modern Clinical Trials Amidst Complex Regulatory Quality and Patient Safety Requirements

Clinical trial supply and logistics represent the lifeblood of pharmaceutical development, ensuring that investigational products reach patients safely, on time, and in compliance with rigorous regulatory standards. In a landscape shaped by stringent quality requirements and complex global networks, sponsors and service providers must orchestrate a seamless flow of materials-from active pharmaceutical ingredients to final dose administration kits. The integration of supply planning, temperature-controlled storage, and meticulous distribution protocols underpins every stage of clinical research, directly influencing patient safety and data integrity.

Moreover, the evolving demands of increasingly decentralized trial designs, coupled with heightened scrutiny from regulatory bodies, have elevated the strategic importance of supply chain agility. The capacity to adapt swiftly to protocol amendments, site expansions, or unexpected disruptions can spell the difference between accelerated study timelines and costly delays. Consequently, organizations are prioritizing investment in robust forecasting models and end-to-end visibility platforms.

As globalization continues to expand the geographic footprint of clinical trials, the logistical matrix grows ever more intricate. Cross-border transportation, cold chain continuity, and multi-jurisdictional compliance converge to create a dynamic environment where risk management and proactive contingency planning are paramount. Against this backdrop, leading stakeholders recognize that a resilient, technology-enabled supply and logistics framework is essential to achieving operational excellence and delivering transformative therapies to patients.

Mapping Transformative Shifts in Clinical Trial Logistics Toward Digitalization Temperature Control and Adaptive Decentralized Trial Designs for Enhanced Efficiency

Over the past decade, the clinical trial supply and logistics sector has undergone a profound transformation driven by digital innovation and evolving trial paradigms. Breakthroughs in temperature monitoring technology, such as real-time IoT-enabled sensors, now provide uninterrupted visibility into shipment integrity, dramatically reducing the risk of thermal excursions. These systems feed seamlessly into cloud-based dashboards, empowering supply chain managers to intervene proactively at the first sign of deviation.

At the same time, decentralized and hybrid trial models are reshaping traditional logistical frameworks. Sponsors are adopting localized depots and home delivery services, enabling direct-to-patient medication distribution that enhances trial accessibility and patient retention. Integration of mobile health units and remote monitoring tools further underscores the shift toward patient-centric delivery strategies.

Simultaneously, advanced analytics and artificial intelligence have become instrumental in demand forecasting and route optimization. By harnessing predictive algorithms that process historical shipment data, geographic variables, and site performance metrics, logistics teams can refine inventory placement and transit planning. This data-driven approach not only improves resource utilization but also accelerates study timelines by minimizing delays.

Furthermore, sustainability has emerged as a critical focus area, with innovative solutions such as reusable thermal packaging and carbon-offset shipping programs gaining traction. These initiatives not only reduce environmental impact but also align with broader corporate social responsibility goals, reflecting a paradigm shift toward greener supply chain practices.

Analyzing the Cumulative Impact of Comprehensive United States Tariffs in 2025 on Pharmaceutical Clinical Trial Supply Chain Costs Sourcing and Operational Resilience

The imposition of a broad 10 percent global tariff on imports entering the United States from April 5, 2025, has elevated the landed cost of critical pharmaceutical supplies, including active pharmaceutical ingredients and specialized packaging materials, compelling sponsors to reevaluate sourcing strategies and manufacturing footprints. Concurrently, steep reciprocal duties of up to 245 percent on key ingredients procured from China have intensified cost pressures on generic drug supply chains, prompting an urgent pivot toward diversified procurement and regional manufacturing hubs. This layered tariff architecture extends to finished drug imports under a potential 25 percent levy that could drive annual U.S. drug cost increases by as much as $51 billion, reducing market competitiveness for both imported and domestically produced therapies.

These fiscal measures have also introduced operational complexities that ripple across the entire clinical trial continuum. Heightened customs inspections and evolving compliance requirements risk elongating transit timelines and complicating cold chain management for temperature-sensitive biologics. In response, leading biopharma companies are pre-positioning inventories, rerouting shipments through tariff-friendly trade corridors, and exploring reshoring options to circumvent punitive duties. Simultaneously, trial sponsors face increased site setup costs as tariffs on Mexican and Canadian medical devices escalate infrastructure expenses at U.S. research facilities, potentially reducing domestic site participation and shifting study footprints to regions with more stable cost structures. Ultimately, these tariff-driven dynamics underscore the need for resilient supply chain architectures and nimble contingency planning to safeguard trial continuity.

Revealing Key Insights from Multi dimensional Segmentation of Clinical Trial Supply Services Including Packaging Transportation Storage and End User Requirements

Through a prism of service types, clinical trial supply logistics now encapsulate a full spectrum of specialized activities ranging from meticulous packaging and labeling to end-to-end project management, complemented by secure storage and distribution solutions, precise temperature monitoring, and reliable transportation networks. The depth of these offerings aligns closely with trial complexity and therapeutic modality.

Assessments across clinical phases reveal distinct logistical imperatives; early-stage Phase I trials prioritize small-batch production agility and rapid sample turnaround, whereas later-stage Phase III and IV studies demand scalable, multi-modal distribution strategies that can accommodate higher volume demands and broader geographic dispersion. Phase II trials, bridging proof-of-concept and pivotal testing, often require a balanced approach to cost management and logistical flexibility.

Transportation modalities further segment the market landscape. Air freight operations, differentiated by charter and standard services, ensure expedited global reach for time-sensitive consignments, while rail freight options-direct and intermodal-strike a balance between speed and cost for inland transfers. Road networks, spanning full-truckload and less-than-truckload shipments, provide critical last-mile connectivity, and sea freight channels-both full container load and less than container load-offer cost-efficient solutions for bulk or non-urgent inventory movements.

Temperature control requirements carve out additional niche strategies, from ambient storage for small molecule formulations to controlled room conditions for biologics, and frozen or refrigerated handling for cell and gene therapies. Packaging innovations reflect these demands: active systems, including cryogenic shippers and advanced refrigeration units, support extreme cold chain integrity, hybrid configurations such as modular systems and combined solutions deliver adaptable temperature control, and passive alternatives like insulated boxes and thermal wraps serve as cost-effective options.

Finally, end users in this ecosystem encompass biotechnology companies driving early research, clinical trial sites orchestrating hands-on patient interactions, contract research organizations overseeing study execution, pharmaceutical manufacturers scaling production, and specialized third-party logistics providers facilitating seamless coordination across the value chain.

This comprehensive research report categorizes the Clinical Trial Supply & Logistics for Pharmaceutical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Phase

- Transportation Mode

- Temperature Range

- Packaging Type

- End User

Highlighting Regional Dynamics and Strategic Advantages Across Americas Europe Middle East Africa and Asia Pacific Shaping the Global Clinical Trial Logistics Ecosystem

Regional dynamics play a pivotal role in shaping the operational and strategic contours of clinical trial supply logistics. In the Americas, a blend of established hubs such as the United States and emerging markets in Latin America offers sponsors a spectrum of cost and capacity considerations. North American centers benefit from advanced cold chain infrastructure and proximity to regulatory authorities, while Latin American locations deliver expanding patient pools and favorable cost structures for late-stage trial expansions.

Across Europe, the Middle East and Africa, regulatory harmonization within the EU facilitates streamlined cross-border shipments and consolidated depot networks, supporting large-scale Phase III deployments. In contrast, markets in the Middle East and Africa present a mosaic of regulatory environments and nascent logistics capabilities, prompting many sponsors to establish centralized distribution hubs in gateway countries to serve diverse subregions.

The Asia-Pacific region has emerged as a dynamic frontier, driven by rapid biotech innovation in East Asia and scaling clinical trial capacities in Southeast Asia and Australia. Robust investments in cold chain firmware, integrated tracking technologies, and local manufacturing partnerships underpin Asia-Pacific’s growing appeal. Moreover, the strategic interconnectivity of major ports and inland rail corridors accelerates multi-modal transport, enabling sponsors to optimize lead times and cost efficiencies across a geographically vast territory.

Collectively, these regional insights underscore the necessity for nuanced, geography-specific strategies. Sponsors and logistics partners must calibrate their footprint to leverage regional strengths-be it infrastructure maturity, regulatory expediency or cost competitiveness-while maintaining a harmonized global supply framework that ensures consistent quality and reliability.

This comprehensive research report examines key regions that drive the evolution of the Clinical Trial Supply & Logistics for Pharmaceutical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Landscapes and Strategic Company Profiles Driving Innovation Collaboration and Market Leadership in Clinical Trial Supply and Logistics Services

The competitive landscape of clinical trial supply and logistics is defined by a diverse set of industry-leading organizations that continually innovate to meet evolving sponsor demands. Established global carriers are fortifying their specialized cold chain divisions to support complex biologic and cell therapy trials, integrating advanced temperature monitoring and compliance documentation into their core offerings. Meanwhile, niche service providers are carving out differentiated positions by developing full-service solutions that span from custom labeling and serialization to patient-centric home delivery models.

Strategic alliances and acquisitions have become central to growth strategies, as large logistics firms partner with clinical trial technology specialists to enhance end-to-end visibility and traceability. Joint ventures with packaging engineering experts are also on the rise, delivering next-generation solutions such as active thermal shippers and modular cold chain units tailored to high-value molecules.

In parallel, contract research organizations are expanding their in-house supply chain capabilities to provide integrated trial management services, while third-party logistics firms are leveraging their distribution networks to offer seamless cross-dock and direct-to-site deliveries. These collaborations underscore a broader trend of ecosystem convergence, where service providers seek to neutralize handoff risks and deliver frictionless operational continuity.

Leading companies are also placing a premium on sustainability, implementing reusable packaging programs and carbon footprint reporting to align with sponsor ESG goals. As competition intensifies, differentiation is increasingly rooted in the ability to offer bespoke, scalable solutions, underpinned by digital platforms that grant sponsors unprecedented transparency and control over their global supply operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clinical Trial Supply & Logistics for Pharmaceutical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Almac Group

- AmerisourceBergen Corporation

- Bilcare Limited

- Biocair International Limited

- Catalent, Inc.

- Clinigen Group PLC

- DHL International GmbH by Deutsche Post AG

- Eurofins Scientific SE

- FedEx Corporation

- ICON PLC

- Infosys Limited

- KLIFO A/S

- Lonza Group

- Metrics Contract Services by Mayne Pharma group

- Movianto

- Parexel International Corporation

- PCI Pharma Services

- Seveillar Clinical Trial Supplies Pvt. Ltd.

- SIRO Clinpharm Private Limited

- Thermo Fisher Scientific, Inc.

- UDG Healthcare PLC

Presenting Actionable Recommendations for Industry Leaders to Optimize Supply Chain Resilience Enhance Agility Embrace Innovation and Mitigate Regulatory Risks

Industry leaders must adopt a proactive stance to fortify their supply chain resilience and stay ahead of emerging market disruptions. Investing in integrated digital platforms that combine predictive analytics, real-time temperature monitoring, and automated compliance workflows will be critical to minimizing delays and ensuring regulatory adherence. By leveraging machine learning algorithms, organizations can anticipate potential bottlenecks and dynamically adjust inventory placements and transport routes.

Diversification of sourcing strategies is equally paramount. Establishing multi-regional manufacturing and distribution hubs reduces tariff- and weather-related vulnerabilities, while strategic partnerships with local providers can accelerate market entry and enhance flexibility. Sponsors are advised to conduct regular supply chain risk assessments and scenario simulations to validate contingency plans, including alternative port selections and backup cold storage capabilities.

Embracing decentralized trial models and patient-centric delivery mechanisms can further optimize trial efficiency and patient engagement. Collaborations with specialized home delivery services and deployment of smart packaging solutions will support this transition, enabling safer, direct patient interactions and reducing site dependency.

Finally, embedding sustainability across the logistics framework not only aligns with corporate social responsibility imperatives but also fosters long-term cost efficiencies. Implementing reusable packaging systems, offsetting carbon emissions, and integrating ESG metrics into key performance indicators will differentiate organizations in a market increasingly focused on ethical and environmental stewardship.

Outlining a Rigorous Research Methodology Combining Primary Expert Interviews Secondary Data and Robust Analytical Frameworks Supporting Unbiased Conclusions

This study employs a systematic research methodology, commencing with comprehensive secondary research that reviews industry publications, regulatory guidelines and technology whitepapers to establish foundational knowledge. This phase informed the development of a structured segmentation framework and highlighted key market drivers, challenges and evolving trends.

Primary research followed, involving in-depth interviews with senior executives from biopharma sponsors, contract research organizations, logistics providers and regulatory experts. These dialogues provided nuanced perspectives on operational complexities, regional specificities and emerging best practices, ensuring the analysis reflects real-world experiences.

Quantitative validation was achieved through data triangulation, cross-referencing proprietary shipment and service usage statistics with publicly available trade data and company disclosures. Advanced analytical techniques, including comparative benchmarking and trend analysis, were applied to distill actionable insights and identify performance gaps.

Finally, expert panel reviews were conducted to vet findings, refine conclusions and ensure the robustness of recommendations. This multi-phase approach guarantees an unbiased, comprehensive evaluation of the clinical trial supply and logistics ecosystem, equipping decision-makers with credible, data-driven intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clinical Trial Supply & Logistics for Pharmaceutical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Service Type

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Phase

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Transportation Mode

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Temperature Range

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Packaging Type

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by End User

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Region

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Group

- Clinical Trial Supply & Logistics for Pharmaceutical Market, by Country

- United States Clinical Trial Supply & Logistics for Pharmaceutical Market

- China Clinical Trial Supply & Logistics for Pharmaceutical Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Drawing Conclusive Perspectives on Evolving Clinical Trial Supply Logistics Landscape Emphasizing Sustainability Adaptability and Future readiness Strategies

In conclusion, the clinical trial supply and logistics landscape is undergoing a pivotal evolution driven by technological innovation, shifting trial designs and complex regulatory environments. The confluence of advanced digital platforms, real-time monitoring solutions and decentralized delivery models has redefined how investigational products are managed from factory to patient.

At the same time, geopolitical factors such as new U.S. tariffs underscore the importance of resilient, multi-regional supply strategies that can absorb cost fluctuations and regulatory changes. By harnessing segmentation insights-from service offerings and trial phases to transportation modes and temperature requirements-stakeholders can tailor their operational models to meet specific study demands.

Regional dynamics across the Americas, Europe, the Middle East, Africa and Asia-Pacific further illustrate the need for geographically nuanced approaches that leverage local infrastructure strengths and regulatory efficiencies. Meanwhile, collaboration among leading logistics providers, CROs and packaging innovators continues to accelerate solution development, driving greater transparency and reliability.

Looking forward, agility, sustainability and strategic partnerships will remain the cornerstones of a future-ready clinical trial logistics framework. Organizations that proactively embrace these imperatives will be best positioned to deliver life-changing therapies to patients globally while maintaining competitive advantage in a rapidly shifting marketplace.

Driving Strategic Engagement to Empower Stakeholders to Acquire In Depth Market Intelligence by Connecting with Ketan Rohom Associate Director Sales Marketing

To explore the full depth of this comprehensive market research report and equip your organization with the insights needed to navigate the complexities of clinical trial supply and logistics, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a customized consultation to address your unique strategic objectives, gain immediate access to proprietary data, and unlock a tailored action plan that aligns with your operational goals and risk profile

Take the first step toward transforming your supply chain resilience, accelerating time-to-trial execution, and securing a competitive edge in the evolving pharmaceutical landscape by initiating a conversation with Ketan Rohom today.

- How big is the Clinical Trial Supply & Logistics for Pharmaceutical Market?

- What is the Clinical Trial Supply & Logistics for Pharmaceutical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?