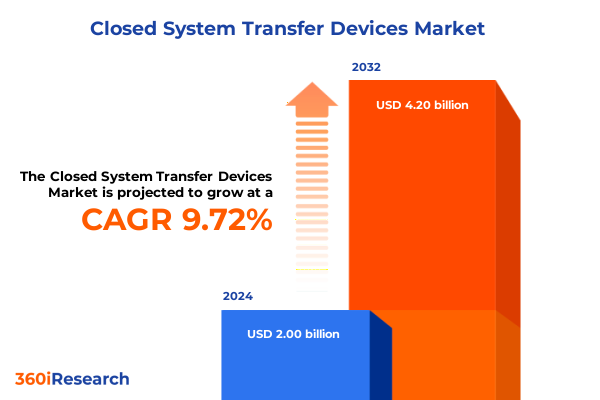

The Closed System Transfer Devices Market size was estimated at USD 2.19 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 9.73% to reach USD 4.20 billion by 2032.

Understanding the Critical Role of Closed System Transfer Devices in Safeguarding Healthcare Personnel and Patients Against Hazardous Drug Exposure

Closed system transfer devices have emerged as an indispensable component in the safe handling and administration of hazardous drugs, fundamentally reshaping occupational safety protocols within healthcare environments. These specialized devices serve as engineered barriers, preventing the escape of noxious aerosols, vapors, and liquids when transferring high-potency medications between containers. As a result, they offer essential protection for clinicians, pharmacy technicians, and support staff against inadvertent exposure, thereby minimizing health risks and fortifying overall workplace safety. Moreover, by shielding drug formulations from environmental contaminants, closed system transfer devices also uphold drug integrity and reduce the likelihood of dosing errors during compounding and administration.

Over the past decade, heightened regulatory scrutiny and evolving standards have driven widespread adoption of these devices across hospitals, clinics, and homecare settings. Regulatory bodies such as the United States Pharmacopeia through USP general chapter <800> and the National Institute for Occupational Safety and Health have codified best practices for hazardous drug handling, underscoring the mandatory use of closed system transfer devices during compounding and administration whenever compatibility allows. These frameworks, coupled with growing industry awareness, have catalyzed substantial investments in device design, manufacturing processes, and user training programs. Consequently, healthcare providers are increasingly prioritizing closed system transfer devices as critical safeguards in their overarching medication safety strategies, reflecting a broader commitment to both patient and staff welfare.

Navigating Regulatory Evolution and Technological Breakthroughs That Are Redefining Closed System Transfer Device Safety Standards and Performance

The closed system transfer device landscape has undergone a profound metamorphosis in recent years, driven by converging regulatory shifts and technological innovations. At the forefront of this transformation is the advancement of rigorous performance standards. In January 2025, the National Institute for Occupational Safety and Health (NIOSH) released a peer review plan for a vapor containment performance protocol specifically tailored for closed system transfer devices, marking a landmark initiative to standardize testing across physical barrier and air-cleaning designs. Complementing this effort, researchers outlined the limitations of the 2015 draft NIOSH protocol and advocated for enhanced challenge agents capable of evaluating all types of devices under realistic use conditions.

Concurrently, the United States Pharmacopeia’s general chapter <800> has crystallized expectations around device utilization, mandating closed system transfer devices for all antineoplastic administration when dosage forms permit. This integration of regulatory guidance has accelerated adoption, prompting manufacturers to refine membrane-to-membrane technologies, optimize pressure-equalizing filter designs, and enhance user interfaces for seamless integration into clinical workflows. Moreover, the growing prevalence of home infusion services and decentralized compounding centers has spurred the development of portable and disposable systems engineered for ease of use outside traditional pharmacy environments. As these devices become increasingly interoperable with automated compounding platforms, stakeholders can anticipate a new generation of closed system transfer devices that combine robust containment with digital monitoring capabilities, ensuring both safety and traceability throughout the medication delivery continuum.

Assessing How Recent United States Tariff Policies and International Trade Actions in 2025 Are Transforming the Cost Dynamics of Closed System Transfer Devices

In 2025, the cumulative impact of evolving United States tariff policies and international trade negotiations is exerting significant pressure on the cost structure of closed system transfer devices. In April 2025, new tariffs established a baseline 10% import duty on most medical device components, escalating costs for manufacturers reliant on global supply chains, particularly those importing raw materials and intermediate components from key markets. Simultaneously, 25% tariffs on steel and aluminum derivatives-effective March 12, 2025-have further inflated production expenses for device enclosures, locking mechanisms, and sealing assemblies manufactured with metal alloys.

Adding complexity to the landscape, a pending U.S.-EU trade agreement threatens to introduce reciprocal 15% tariffs on European medical device imports, a deal modeled after the U.S.-Japan pact, though exemptions for critical medical equipment remain under negotiation. Should negotiations falter, the European Union has readied a retaliatory package with tariffs up to 30%, potentially disrupting the transatlantic supply of high-performance polymeric components and specialized filter membranes. Industry associations are actively engaging policymakers to secure carve-outs for closed system transfer devices, emphasizing their classification as essential medical safety equipment. As a result, device makers are increasingly exploring nearshoring strategies and supplier diversification to mitigate tariff exposure and preserve budgetary predictability for healthcare providers.

Deciphering Market Segmentation Insights to Illuminate the Diverse Applications and Distribution Models Shaping the Closed System Transfer Device Landscape

A nuanced understanding of the closed system transfer device market emerges when examining its segmentation from multiple vantage points. When considering product portfolios, the market spans bag and line access devices, syringe safety devices, and vial access devices each engineered to address distinct stages of the medication handling process. These platforms are further differentiated by design type, with luer-based systems offering universal connectivity through standardized luer fittings, while membrane-to-membrane systems leverage physical barriers to eliminate vapor and aerosol escape. In parallel, the divide between disposable and reusable categories underscores trade-offs between cost efficiency and environmental sustainability, prompting healthcare systems to weigh waste management concerns against procurement budgets.

Delving deeper into device functionality, closed system transfer devices employ a spectrum of locking mechanisms. Click-to-lock designs prioritize tactile feedback and ease of use, whereas luer-lock designs enhance secure connectivity in high-flow settings and push-to-turn designs offer intuitive engagement with minimal risk of accidental disconnection. Distribution channel analysis reveals a bifurcation between offline and online pathways; many providers still depend on direct sales or distributor and wholesaler networks to source inventory, while an increasing number of smaller facilities and homecare programs leverage digital storefronts for rapid replenishment. Finally, end-user segmentation-ranging from homecare settings and hospitals to long-term care facilities and research centers-reflects the growing ubiquity of closed system transfer devices across clinical environments, each segment presenting unique operational requirements and adoption barriers.

This comprehensive research report categorizes the Closed System Transfer Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Design Type

- Category

- Locking Mechanism

- Distribution Channel

- End-User

Unveiling Regional Differentiators That Drive Closed System Transfer Device Innovation and Adoption Across the Americas Europe Middle East & Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping the trajectory of closed system transfer device adoption and innovation. In the Americas, the United States remains a hotbed for device development, buoyed by stringent occupational safety regulations and robust reimbursement frameworks that prioritize hazardous drug containment. Driven by an entrenched network of domestic manufacturers, North American providers benefit from localized production capabilities, yet remain sensitive to tariff-induced cost fluctuations and supply chain bottlenecks.

Across Europe Middle East & Africa, regulatory harmonization under the European Union’s medical device regulations has elevated device certification requirements, compelling manufacturers to invest heavily in clinical validation and post-market surveillance. Simultaneously, disparities in healthcare infrastructure between Western Europe and emerging African markets create a dichotomy in adoption rates: while EU member states rapidly integrate advanced membrane-to-membrane systems, resource-constrained facilities in parts of the Middle East and Africa often rely on cost-effective disposable solutions.

In the Asia-Pacific region, rapid expansion of oncology and home healthcare services is fueling demand for compact and user-friendly systems. Markets such as China, Japan, and Australia are witnessing accelerated uptake of both barrier and air-cleaning technologies, supported by national initiatives aimed at bolstering domestic medical device manufacturing. Conversely, in Southeast Asian and South Asian markets, affordability and supply chain resilience drive preferences for standardized luer-based devices distributed through a mix of direct sales relationships and emerging e-commerce platforms.

This comprehensive research report examines key regions that drive the evolution of the Closed System Transfer Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Approaches of Leading Closed System Transfer Device Manufacturers to Sustain Competitive Advantage and Drive Market Leadership

Leading companies in the closed system transfer device segment distinguish themselves through strategic investments in proprietary technologies, expansive distribution networks, and collaborative partnerships. Becton, Dickinson & Co., for instance, leverages its PhaSeal Optima platform to deliver notable reductions in surface contamination, a strength validated by clinical studies at major healthcare centers. ICU Medical has solidified its market position through vertical integration, offering a comprehensive infusion therapy ecosystem that spans compounding devices to administration sets, thereby fostering cross-selling synergies within hospital pharmacy networks.

Equashield continues to attract attention with its dual-membrane design, appealing to oncology pharmacies seeking high-volume transfer efficiency and rapid throughput in sterile compounding environments. Meanwhile, Baxter and B. Braun pursue complementary strategies: Baxter focuses on compatibility initiatives through partnerships with automated compounding platform providers, whereas B. Braun’s OnGuard series emphasizes streamlined usability and universal connector standards that simplify training and inventory management. Emerging players such as Corvida Medical and Simplivia Healthcare are gaining traction by catering to niche applications, including home infusion and research laboratory settings, and by offering cost-effective alternatives that address both safety compliance and budgetary constraints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Closed System Transfer Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Caragen Limited

- Cardinal Health, Inc.

- Codan Medical GmbH

- CORMED MANAGEMENT SERVICES PRIVATE LIMITED

- Epic Medical

- Equashield LLC

- Fresenius Kabi

- Grifols SA

- ICU Medical, Inc.

- JMS Co., Ltd.

- Medline Industries, LP

- Meissner Corporation

- Paragon Care Limited

- Sartorius AG

- Simplivia Healthcare Ltd.

- Terumo Corporation

- Vygon (UK) Ltd

- Yukon Medical, LLC

- Zephyrus Innovations

Implementing Actionable Strategies for Industry Leaders to Optimize Supply Chains Boost Innovation and Navigate Regulatory Complexities in Closed System Transfer Devices

Industry leaders seeking to thrive in an evolving closed system transfer device market should adopt a multifaceted strategy that balances innovation with operational resilience. First, accelerating the development of next-generation membrane-to-membrane and air-cleaning hybrid technologies can yield differentiated performance advantages, particularly when validated under emerging NIOSH and USP standards. By aligning R&D roadmaps with anticipated regulatory updates, manufacturers will minimize rework cycles and accelerate time to market.

Second, diversifying production footprints through nearshore manufacturing or regional partnerships can mitigate the risks associated with tariff volatility and supply chain disruptions. Establishing strategic alliances with local suppliers in key markets not only enhances supply reliability but also supports compliance with localized content requirements. Third, engaging proactively with policymakers and industry associations to secure tariff carve-outs and regulatory equivalencies for closed system transfer devices will help preserve affordability for healthcare providers.

Finally, embracing digital integration-such as embedding RFID-enabled components and cloud-based traceability platforms-can enhance inventory management, ensure real-time compliance monitoring, and deliver data-driven insights that inform continuous quality improvement. By implementing these actionable recommendations, organizations can optimize product performance, safeguard margins, and reinforce their leadership positions in the closed system transfer device marketplace.

Detailing Rigorous Research Methodology Framework Employed to Ensure Comprehensive Analysis and Reliable Insights for the Closed System Transfer Device Market

This market research report was developed through a rigorous methodology that integrated both primary and secondary data sources to achieve comprehensive market coverage and reliability. Initially, extensive secondary research was conducted, including a review of regulatory guidelines from NIOSH, USP, and the U.S. Food and Drug Administration, as well as analysis of trade publications, peer-reviewed literature, and reputable industry blogs. These sources informed the foundational understanding of device classifications, performance standards, and tariff implications.

Subsequently, primary research was undertaken, involving structured interviews with key stakeholders across the closed system transfer device ecosystem. Participants included senior executives at leading device manufactures, regulatory affairs specialists, hospital pharmacy directors, and independent consultants with expertise in hazardous drug handling. These interviews provided qualitative insights into emerging trends, adoption barriers, and strategic imperatives. Quantitative validation was achieved through data triangulation, correlating manufacturer-reported shipment figures with macroeconomic indicators such as healthcare expenditure forecasts and trade tariff schedules.

Finally, insights were synthesized and subjected to multiple rounds of internal review to ensure consistency, accuracy, and alignment with market realities. This iterative approach enabled the development of robust segmentation analyses, competitive benchmarking, and actionable recommendations tailored to diverse stakeholder needs within the closed system transfer device sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Closed System Transfer Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Closed System Transfer Devices Market, by Product

- Closed System Transfer Devices Market, by Design Type

- Closed System Transfer Devices Market, by Category

- Closed System Transfer Devices Market, by Locking Mechanism

- Closed System Transfer Devices Market, by Distribution Channel

- Closed System Transfer Devices Market, by End-User

- Closed System Transfer Devices Market, by Region

- Closed System Transfer Devices Market, by Group

- Closed System Transfer Devices Market, by Country

- United States Closed System Transfer Devices Market

- China Closed System Transfer Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways on Innovation Challenges and Opportunities Defining the Future Trajectory of Closed System Transfer Devices

In summary, the closed system transfer device sector stands at an inflection point, propelled by stringent regulatory mandates and technological advancements that enhance containment performance and user experience. Regulatory bodies, from NIOSH to USP, are driving harmonization around testing protocols and usage guidelines, prompting manufacturers to refine both barrier and air-cleaning designs. Concurrently, tariff pressures and international trade negotiations in 2025 underscore the necessity for supply chain diversification and proactive policy engagement to maintain cost competitiveness.

Segment-level analysis reveals a diverse landscape of device types, locking mechanisms, and end-user requirements, highlighting opportunities for tailored solutions in hospitals, homecare programs, and research centers. Regional insights illustrate varying adoption dynamics: North America’s robust regulatory environment fuels innovation, EMEA’s harmonized certifications raise performance thresholds, and Asia-Pacific’s growth in oncology and home infusion services sustains demand for versatile systems. Competitive profiling indicates that market leaders are leveraging proprietary technologies, strategic acquisitions, and integrated platforms to reinforce leadership, while agile challengers capitalize on niche applications and cost efficiencies.

Looking ahead, stakeholders who align product development with evolving regulatory frameworks, optimize manufacturing footprints against tariff volatility, and harness digital integration will be best positioned to capture emerging opportunities. By synthesizing these insights, decision-makers can navigate market complexities, mitigate risks, and unlock sustainable growth pathways in the dynamic closed system transfer device landscape.

Engage with Ketan Rohom to Secure Exclusive Market Intelligence and Propel Strategic Decisions with the Latest Closed System Transfer Device Report

To obtain the definitive guide on the evolving closed system transfer device landscape and empower your organization with actionable market intelligence, connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise and personalized support will ensure swift access to the comprehensive market research report that delivers strategic insights, in-depth analysis, and tailored recommendations for decision-makers. Elevate your competitive positioning and drive sustainable growth by securing the most current data and expert analysis available today

- How big is the Closed System Transfer Devices Market?

- What is the Closed System Transfer Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?