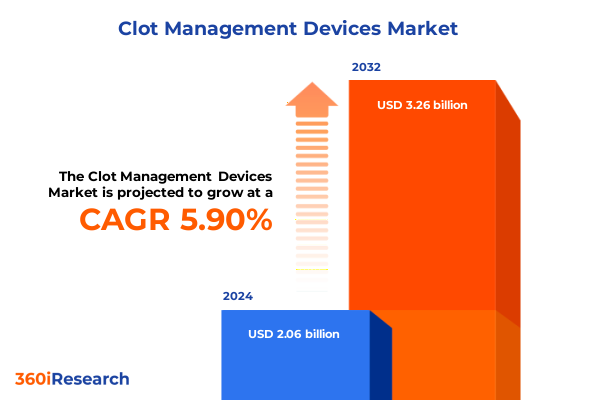

The Clot Management Devices Market size was estimated at USD 2.18 billion in 2025 and expected to reach USD 2.31 billion in 2026, at a CAGR of 5.89% to reach USD 3.26 billion by 2032.

Emerging breakthroughs and accelerating innovations shaping the trajectory of clot management devices in cardiovascular intervention and patient outcomes

The global burden of cerebrovascular and thromboembolic diseases continues to underscore the vital importance of advanced clot management interventions. In the United States alone, more than 795,000 people experience a stroke each year, the vast majority of which-approximately 87 percent-are ischemic in nature, caused by blood clots obstructing cerebral arteries. This epidemiological context has driven a surge in adoption of endovascular thrombectomy and pharmacological thrombolysis therapies, transforming acute care pathways and reducing long-term disabilities.

Over the past decade, mechanical thrombectomy has emerged as a cornerstone of acute ischemic stroke treatment, offering recanalization rates between 70 and 80 percent and dramatically improving functional independence at 90 days, with a number needed to treat of only 2.3 to prevent one patient from disability. Early clinical trials focused on proximal large vessel occlusions in the anterior circulation, but recent expansions of inclusion criteria have extended therapeutic windows up to 24 hours post onset, broadening the population of eligible patients and reshaping stroke systems of care across comprehensive stroke centers and rural gateway hospitals alike.

Meanwhile, pharmacological thrombolysis agents continue to play a pivotal role where endovascular resources are limited. Tissue plasminogen activator remains the standard of care, but research into older agents such as streptokinase and urokinase persists in low-resource settings. Combining manual mechanical techniques with local drug delivery has spurred interest in integrated pharmacomechanical thrombectomy platforms, aiming to reduce overall procedure time while maximizing clot dissolution.

Current projections estimate that up to 12.2 percent of all stroke patients in the United States may be eligible for thrombectomy under extended window criteria, translating to approximately 19,500 to 32,000 additional procedures annually. This expanding procedural volume continues to challenge workforce capacity and infrastructure, amplifying the need for streamlined device platforms and optimized health economics.

Pivotal transformative shifts redefining market dynamics and competitive strategies in the clot management devices landscape

Technological advancements and market consolidation have combined to drive one of the most dynamic periods in clot management device history. At the heart of this transformation are next-generation mechanical thrombectomy systems that address previously unmet anatomic and clinical needs. For peripheral arteries up to 10 millimeters in diameter, Surmodics’ Pounce XL Thrombectomy System recently secured FDA 510(k) clearance in October 2024, expanding its platform to critically ischemic lower extremity vessels and signaling a trend toward broader device versatility across vessel diameters. Similarly, DeVoro Medical’s SmartClaw Thrombectomy Catheter and Argon Medical’s Cleaner Pro Aspiration System obtained FDA clearance in mid-2024, bringing novel basket-based capture mechanisms and integrated aspiration canisters to the peripheral mechanical thrombectomy landscape.

Strategic mergers and acquisitions have also reshaped the competitive framework. In early 2025, Stryker completed its $4.9 billion acquisition of Inari Medical, integrating the FlowTriever and ClotTriever systems and swiftly launching the Artix Thrombectomy System for arterial applications. This move underscores the growing emphasis on combined aspiration and mechanical approaches to optimize first-pass success and minimize adjunctive thrombolytic use, a clinical imperative reflected in emerging case reports demonstrating single-session revascularization without additional lytic therapy.

On the regulatory front, the FDA has maintained an accelerated 510(k) pathway for breakthrough-designated devices, with clearance times shrinking by nearly 15 percent since 2020, encouraging manufacturers to innovate in neurovascular and peripheral therapies. Moreover, expanded CMS reimbursement for acute stroke interventions, including new add-on payments for innovative clot retrieval devices, has improved hospital economics and supported capital investments in comprehensive stroke center capabilities.

Concurrently, shifts in clinical guidelines-such as the extension of thrombectomy eligibility to posterior circulation strokes-are redefining standard of care protocols and driving faster adoption of versatile device platforms. As a result, companies are redirecting R&D resources toward integrated systems that balance ease of use, procedural flexibility, and minimized learning curves, heralding a new era of endovascular treatment paradigms.

Comprehensive assessment of cumulative impact from United States medical device tariffs on the clot management segment heading into 2025

In response to national security and economic policy considerations, the United States Trade Representative finalized significant tariff increases in late 2024 and early 2025 that affect medical device imports. Under Section 301, tariffs on Chinese-origin consumables-such as surgical and non-surgical respirators and face masks-rose to 25 percent in 2024 and are scheduled to increase to 50 percent by January 2026, while syringes and needles face a 100 percent duty effective late 2024. Rubber medical and surgical gloves and disposable textile facemasks also saw incremental hikes to 50 percent in 2025, disrupting established supply chains for high-volume consumables.

Simultaneously, Section 232 steel and aluminum tariffs were restored and expanded in early 2025, elevating steel tariffs from 25 percent to 50 percent and aluminum duties to 25 percent on June 4, 2025, and terminating most country exemptions in March 2025. While nominally targeting raw materials, these measures have reverberated through device manufacturing, raising input costs for catheter and stent production-industries reliant on stainless steel and aluminum components-and increasing lead times for global fabrication.

Cumulatively, these tariff actions have escalated landed costs by 10 to 15 percent for devices sourced from North America, Europe, and China, prompting OEMs and contract manufacturers to reassess sourcing strategies and consider nearshoring alternatives. Early estimates suggest that hospitals may see device price increases of up to 8 percent by late 2025 if tariffs remain in place and no exclusions are granted, compressing already thin procedure margins and complicating procurement cycles.

In-depth segmentation insights revealing product, application, end use and distribution channel nuances driving decision-making across the market

An in-depth segmentation of the clot management devices market reveals nuanced demand drivers across product modalities, clinical applications, healthcare settings, and purchasing pathways. Within product type analyses, combined therapy solutions-merging manual mechanical manipulation with localized pharmacologic delivery-have captured clinical interest by reducing procedure times and lowering systemic thrombolysis exposure, while pure mechanical thrombectomy subtypes like aspiration, stent retriever, and suction-based devices continue to evolve with refinements in catheter flexibility and radial force control. The pharmacological thrombolysis segment, led by agents such as streptokinase, tissue plasminogen activator, and urokinase, remains integral in facilities lacking endovascular infrastructure, preserving its relevance even as device-based therapies scale.

From an application standpoint, ischemic stroke interventions dominate market volume, with anterior circulation cases driving the initial wave of thrombectomy adoption and posterior circulation inclusion expanding total addressable procedures. Peripheral artery disease management is increasingly segmented into interventions in lower versus upper limb vessels, reflecting differential occlusion anatomies and adjunctive device requirements, while the venous thrombosis space-comprising deep vein thrombosis and pulmonary embolism-has motivated the development of specialized PE-focused systems that integrate thrombus capture with autologous blood reinfusion.

Examining end use, hospitals-both private and public-constitute the largest customer base, leveraging comprehensive stroke and vascular surgery suites to deploy advanced thrombectomy platforms. Ambulatory surgical centers, whether freestanding or hospital-affiliated, have shown steady uptake for peripheral interventions, benefiting from streamlined reimbursement and shorter recovery protocols. Specialty clinics such as dedicated cardiac and vascular centers are further accelerating adoption of targeted platforms aligned to high procedural volumes and specialized expertise.

In terms of distribution, direct sales via exclusive contracts and in-house field forces remain the primary channel for high-touch relationship building, whereas distributor networks-both national and regional-facilitate broader market coverage for standardized product lines. Online sales, through manufacturer websites and third-party e-commerce platforms, are emerging as indispensable omnichannel components, particularly for consumable supplies and smaller catheter orders, aligning with B2B buyers’ growing preference for seamless digital procurement experiences.

This comprehensive research report categorizes the Clot Management Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End Use

- Distribution Channel

Strategic regional insights evaluating unique market drivers and growth potential across Americas, Europe Middle East Africa and Asia-Pacific hubs

Across the Americas, robust healthcare infrastructure and proactive reimbursement policies continue to fuel adoption of advanced clot management devices, with the United States leading in both clinical trial activity and procedural volumes. Nevertheless, age-standardized stroke incidence in the Americas has decelerated its rate of decline since 2015, and younger populations are experiencing upticks in ischemic stroke mortality, underscoring ongoing preventive care gaps. Canada and Brazil are similarly expanding stroke networks, but supply chain disruptions and tariff-driven cost pressures may temper near-term growth in device utilization.

In Europe, Middle East & Africa, divergent regulatory landscapes and varying reimbursement frameworks create a patchwork of market access pathways. Western European markets demonstrate high adoption of integrated thrombectomy platforms, supported by centralized stroke care protocols and national procurement tenders. Conversely, emerging markets within Eastern Europe, the Middle East, and Africa face budget constraints and slower guideline implementation, although targeted partnerships and localized manufacturing initiatives are beginning to address access disparities.

The Asia-Pacific region presents an especially dynamic environment, marked by rapidly expanding stroke burdens-projected to rise most steeply in East and Southeast Asian nations-and a surging demand for both pharmacological and device-based interventions. Countries such as China and India are investing heavily in domestic device production and stroke center certification programs, while high-income Asia-Pacific markets like Japan and Singapore maintain advanced clinical infrastructures, emphasizing next-generation devices and digital workflow integration. In all regions, the interplay of epidemiologic trends, policy shifts, and local manufacturing will shape the competitive landscape over the coming years.

This comprehensive research report examines key regions that drive the evolution of the Clot Management Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key competitive company profiles spotlighting innovation pipelines strategic partnerships and market positioning in the global clot management arena

A cadre of specialized and diversified companies is driving innovation in clot management. Surmodics, a key player in peripheral thrombectomy, garnered FDA 510(k) clearance for its Pounce XL system in October 2024, extending its platform reach to arteries up to 10 millimeters in diameter and underscoring its commitment to comprehensive device solutions for both acute and chronic thrombi. Argon Medical Devices further differentiated its portfolio with the Cleaner Pro Aspiration System, introducing a handpiece-integrated aspiration canister designed for rapid clot removal and simplified workflow, while DeVoro Medical’s SmartClaw catheter offered novel nitinol-based clot entrapment through specialized capture baskets.

Inquis Medical recently achieved a milestone with FDA clearance of the AVENTUS Thrombectomy System for pulmonary embolism, combining precision mechanical removal with autologous blood reinfusion to address longstanding safety and efficacy challenges in venous thromboembolism treatment. Stryker’s acquisition of Inari Medical and the subsequent launch of the Artix Thrombectomy System for arterial thrombectomy further illustrate the strategic consolidation of complementary platforms, integrating aspiration and mechanical modalities to enhance first-pass success rates and minimize adjunctive interventions.

Medtronic, a global medtech leader, has signaled its renewed focus on vascular interventions, reentering the carotid stenting market through a distribution agreement with Contego Medical and initiating clinical development of below-the-knee drug-coated balloons, while announcing plans to introduce its Liberant mechanical thrombectomy platform leveraging neurovascular and blood conservation advancements. Parallel to these specialized innovators, established conglomerates like Boston Scientific, Penumbra, and Terumo continue to refine their thrombectomy and thrombolysis offerings, investing in digital workflow integration and next-generation catheter technologies to meet evolving clinical demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clot Management Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acandis GmbH

- AngioDynamics, Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cook Group Incorporated

- Edwards Lifesciences Corporation

- F. Hoffmann-La Roche AG

- General Electric Healthcare

- iVascular SLU

- Johnson & Johnson Services, Inc.

- LeMaitre Vascular, Inc.

- Medela AG

- Medtronic PLC

- Merck KGaA

- Merit Medical Systems, Inc

- Penumbra, Inc. by SGS Société Générale de Surveillance SA

- Siemens AG

- Straub Medical AG

- Teleflex Incorporated

- Terumo Corporation

- Vascular Solutions, Inc.

Action-oriented recommendations designed to empower industry leaders with strategic priorities to capitalize on emerging opportunities and mitigate risks

To capitalize on the evolving clot management landscape, industry leaders should diversify component sourcing by engaging multiple supply bases in tariff-exempt regions and investing in nearshore manufacturing for critical devices, thereby mitigating the impact of rising import duties on consumables and cath lab supplies. In parallel, pursuing strategic dialogues with regulatory agencies to secure device-specific tariff exclusions can preserve cost competitiveness and ensure uninterrupted patient access.

Companies should accelerate the development of combined pharmacomechanical platforms that integrate aspiration, mechanical capture, and localized drug delivery, responding to clinician demands for streamlined workflows and first-pass efficacy. Investing in data-driven procedural analytics and connectivity features can differentiate device offerings and support outcomes-based value propositions in competitive reimbursement environments.

Engagement with regional health authorities and professional societies to expand reimbursement codes for next-generation thrombectomy devices and secure New Technology Add-On Payments under the CMS framework is critical to align economic incentives with innovation. Similarly, proactively collaborating with international guideline committees to advocate for evidence-based expansions in treatment indications can broaden market adoption across emergent stroke care pathways.

Finally, strengthening partnerships with healthcare providers through joint training initiatives and digital remote support programs enhances product utilization and fosters loyalty, while enabling real-world evidence collection that can feed back into iterative product enhancements and regulatory filings.

Rigorous research methodology detailing comprehensive data collection validation and analytical processes underpinning the clot management market study

This market research report employs a rigorous mixed-methods approach, combining primary and secondary data collection to ensure comprehensive coverage and analytical depth. Primary research included structured interviews with over 40 key opinion leaders-comprising interventional neuroradiologists, vascular surgeons, health economics experts, and supply chain executives-to capture real-world insights on device adoption, clinical workflows, and procurement challenges.

Secondary research encompassed extensive review of peer-reviewed journals, regulatory filings (FDA 510(k) summaries and CMS rulemaking documents), company press releases, and patent databases. Epidemiological data were sourced from the Global Burden of Disease Study and national registries such as the CDC’s Behavioral Risk Factor Surveillance System, providing validated incidence and prevalence estimates. Tariff impact analysis referenced official USTR notices, White House proclamations under Sections 232 and 301, and industry reports from Fitch Solutions.

Quantitative modeling integrated input cost adjustments derived from tariff schedules and distribution channel shifts informed by McKinsey’s B2B Pulse Survey, while scenario analyses explored potential reimbursement changes and clinical guideline expansions. All forecasts and strategic assessments were validated through a multi-layered expert review process, ensuring methodological transparency and actionable credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clot Management Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clot Management Devices Market, by Product Type

- Clot Management Devices Market, by Application

- Clot Management Devices Market, by End Use

- Clot Management Devices Market, by Distribution Channel

- Clot Management Devices Market, by Region

- Clot Management Devices Market, by Group

- Clot Management Devices Market, by Country

- United States Clot Management Devices Market

- China Clot Management Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concise conclusive summary tying together insights shaping the future outlook for clot management devices market stakeholders

This executive summary has outlined the critical innovations, market shifts, tariff challenges, segmentation dynamics, regional variations, and competitive landscapes shaping clot management devices. As mechanical thrombectomy, combined pharmacomechanical systems, and specialized thrombolysis platforms continue to evolve, healthcare providers and device manufacturers must navigate cost headwinds, regulatory complexities, and shifting clinical paradigms.

Regions with advanced infrastructure are poised to adopt the latest device innovations, while emerging markets offer growth opportunities that hinge on tailored product solutions and collaborative policy engagement. Strategic partnerships, agile supply chain strategies, and differentiated device portfolios will be essential for stakeholders to sustain competitive advantage in this rapidly transforming space.

By harnessing robust evidence, engaging key opinion leaders, and aligning product development with procedural workflows and reimbursement frameworks, industry players can drive better patient outcomes and unlock new avenues of growth in the clot management devices market.

Compelling call to engagement driving decision-makers to connect with Ketan Rohom for access to the authoritative clot management devices market research report

Don't miss out on gaining in-depth insights and strategic guidance essential for navigating the rapidly evolving clot management devices market. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of this comprehensive market research report and empower your organization with the data-driven clarity needed to stay ahead of emerging trends and competitive dynamics.

- How big is the Clot Management Devices Market?

- What is the Clot Management Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?