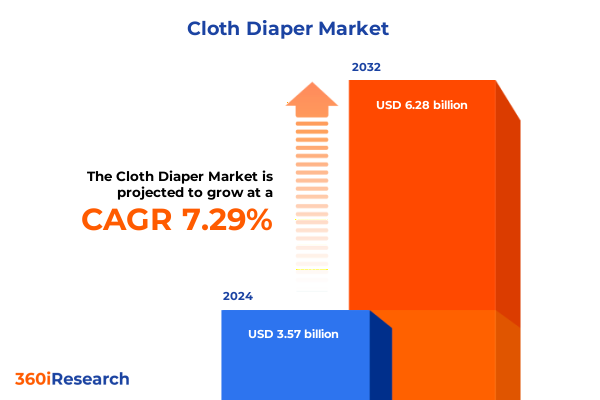

The Cloth Diaper Market size was estimated at USD 3.83 billion in 2025 and expected to reach USD 4.11 billion in 2026, at a CAGR of 7.31% to reach USD 6.28 billion by 2032.

Unveiling the Dynamic Fabric of the Modern Cloth Diaper Industry Through Sustainable Innovations and Consumer-Centric Insights

The cloth diaper industry has entered a pivotal era defined by a convergence of sustainability, consumer empowerment, and design innovation. Once relegated to a niche segment, reusable cloth diapers now command attention as eco-sensitive parents and institutional buyers actively seek environmentally aligned alternatives to single-use products. This shift reflects a broader trend in the infant care landscape, where reducing plastic waste and minimizing chemical exposure rank among top purchase criteria for modern caregivers. Moreover, the balance between initial product investment and long-term cost savings has become a compelling narrative, driving demand for durable, multi-use diapering solutions that resonate with budget-conscious families.

In parallel, technological advancements have elevated perceptions of cloth diapers from traditional fabric wraps to sophisticated, performance-oriented systems. Hybrid models that combine reusable shells with optional disposable inserts have emerged, offering parents both convenience and sustainability. Likewise, the integration of moisture-wicking textiles, advanced leak barriers, and adjustable closure mechanisms has effectively addressed common pain points, fostering broader adoption even among those previously hesitant about maintenance and fit.

As we delve into this report, the evolving roles of digital channels and community-driven education become evident. Social media platforms and specialized forums are shaping purchasing behavior by providing peer-to-peer reviews, practical laundering tips, and style inspiration. Consequently, cloth diaper brands are leveraging direct-to-consumer online sales, subscription models, and interactive content to cultivate loyalty and scale their reach.

Identifying the Transformative Shifts that Have Redefined Cloth Diaper Adoption Through Technological, Social, and Sustainability-Driven Progress

Cloth diapering has transcended its historical roots to become a canvas for transformative shifts fueled by eco-conscious values and technological ingenuity. In recent years, a significant portion of new parents have prioritized products that align with environmental stewardship, reflecting a trend where concerns over landfill waste and chemical exposure drive exploration of reusable solutions. Brands have responded by integrating natural fibers like bamboo and hemp, offering fabrics that not only biodegrade more readily but also provide superior skin sensitivity and breathability, mitigating the risk of irritation among infants. These material innovations align with the broader movement toward plant-based ingredients across the personal care industry.

Simultaneously, the surge in hybrid cloth diaper designs has struck a critical balance between sustainability and convenience. By offering washable outer shells paired with optional compostable inserts, manufacturers have lowered the barrier to entry for time-pressed caregivers, effectively bridging the convenience gap between disposable and reusable options. These hybrids often feature quick-drying fabrics and snap-or-hook closure systems, ensuring a secure fit and simplifying laundry routines without compromising on eco-performance. Consequently, this approach has reshaped consumer expectations regarding functionality and ease of use.

Moreover, the rise of digital engagement has catalyzed a shift in how knowledge circulates within the cloth diaper community. Influencers, parenting bloggers, and user-generated video tutorials now serve as primary education channels, demystifying washing techniques, stain removal strategies, and proper storage methods. This democratization of expertise has accelerated the diffusion of best practices, fostering confidence among new adopters. As such, the industry has witnessed a ripple effect, where credible digital storytelling fuels word-of-mouth referrals, translating into rapid market growth.

Assessing How 2025 United States Tariff Policies Have Resculpted the Import Economy and Affected the Cloth Diaper Supply Chain and Consumer Pricing Dynamics

The introduction of elevated tariff measures effective August 1, 2025, has significantly recalibrated the economics of importing essential baby care components. Under the new guidelines, baseline tariffs across textile categories escalated, with ranges reportedly extending from 15 percent to 50 percent-substantially above the traditional 10 percent floors-prompting widespread concerns over rising supply chain costs. Goldman Sachs economists cautioned that the burden of these escalated duties would likely be transferred to consumers, with an estimated 65 percent of increased import expenses passed through as retail price hikes. These projections underscore the potential for pronounced upward pressure on end pricing within the cloth diaper segment.

Specific outlays for baby products, including fabrics and closures commonly sourced from major manufacturing hubs, have risen sharply since the tariff implementation. A recent report indicated that prices for essential baby gear saw a 24 percent increase between April and June 2025 in anticipation of the tariffs, signaling preemptive cost adjustments by suppliers and retailers. This has translated into more immediate budgetary considerations for families, especially among lower-income demographics that rely on cost-effective diapering solutions.

Industry stakeholders, from large-scale producers to boutique cloth diaper brands, are strategically adapting their procurement models. Some have diversified sourcing to alternative regions such as Southeast Asia and Central America to mitigate exposure to the highest tariff brackets. Others are renegotiating long-term supply agreements and investing in domestic textile processing partnerships aimed at curbing future volatility. These tactical shifts reflect an imperative to balance cost management with the preservation of product quality and sustainability commitments.

Decoding Key Segmentation Insights Unlocking Growth Drivers Across Type Configurations, Distribution Channels, Material Choices, Pricing Tiers, and End User Profiles in Cloth Diapers

Within the cloth diaper market, the configuration of product offerings spans from comprehensive All-In-One systems to versatile covers and prefolds suited to diverse laundering regimens. All-In-One designs, available with Hook & Loop or Snap closures, provide a seamless, ready-to-use solution that appeals to caregivers seeking simplicity. By contrast, Pocket diapers-featuring either contoured or standard inserts-offer customizable absorbency levels, catering to varied overnight or daytime use cases. Prefolds, composed of either 100 percent cotton or cotton blends, remain valued for their affordability and ease of layering beneath waterproof covers.

Distribution channels reflect an ecosystem designed to meet both brick-and-mortar shoppers and digital-first consumers. Hypermarket and supermarket venues, including warehouse clubs, serve as touchpoints for mass-market penetration, while online platforms-accessible via brand websites or major marketplaces-enable subscription-based delivery models that foster brand loyalty. Pharmacies, both physical and online, have emerged as trusted sources for eco-friendly cloth diaper bundles, whereas specialty stores, encompassing baby boutiques and maternity shops, curate premium collections that emphasize design and organic materials.

Material innovation further segments offerings into options such as bamboo-processed or organically certified-and cotton, whether conventionally farmed or organically grown. Hemp and microfiber variants extend functional performance, with each substrate contributing distinct attributes in terms of absorbency, drying speed, and softness. Pricing structures range from economy alternatives that prioritize cost efficiency to premium tiers that integrate advanced textiles and bespoke prints.

End users span direct consumers-whether through one-time purchases or ongoing subscription services-and institutional buyers, including child care centers and hospitals, which require scalable, high-capacity diapering solutions aligned with strict hygiene standards. This layered segmentation underscores the nuanced demand landscape that brands must navigate.

This comprehensive research report categorizes the Cloth Diaper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Distribution Channel

- End User

Exploring Regional Cloth Diaper Market Nuances Across the Americas, Europe Middle East & Africa, and Asia-Pacific Revealing Distinctive Adoption Patterns

Geographic dynamics shape both consumer behaviors and strategic imperatives across the global cloth diaper arena. In the Americas, mature markets such as the United States and Canada are characterized by high levels of environmental advocacy, with established retail networks and digitally native direct-to-consumer brands driving mainstream adoption. Latin American nations are progressively embracing reusable options, supported by localized manufacturing initiatives and government efforts to reduce landfill burdens.

The Europe, Middle East & Africa region presents a tapestry of regulatory environments and consumer sensibilities. Western European countries, buoyed by stringent waste reduction policies and organic fabric mandates, lead on premium, certified-organic cloth diaper choices. Meanwhile, emerging economies within Eastern Europe and select Middle Eastern markets are witnessing nascent growth as disposable alternatives face increasing taxation and consumer costs rise.

In the Asia-Pacific, demographic scale and rising disposable incomes underpin robust demand trajectories. Australia and New Zealand blend high consumer awareness with strong e-commerce penetration, enabling international and regional brands to excel. In East and South Asia, accelerated urbanization has spurred interest in sustainable infant care solutions, though the balance between cost and convenience continues to influence regional product development strategies.

This comprehensive research report examines key regions that drive the evolution of the Cloth Diaper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloth Diaper Innovators Unveiling Strategic Moves, Collaborative Ventures, and Sustainable Product Roadmaps of Key Industry Players

Leading cloth diaper manufacturers have carved distinct positions by advancing specialty materials, design patents, and strategic collaborations. US-based innovators like BumGenius and Thirsties amplify their sustainability credentials through the use of certified organic cotton and plant-based PUL fabrics. European brands, including Charlie Banana and GroVia, differentiate via hybrid systems that appeal to parents seeking an intermediary step between disposable and fully reusable models.

Subscription-driven companies have disrupted traditional retail by offering curated cloth diaper boxes delivered at regular intervals, harnessing data analytics to predict consumption cycles. This approach reduces friction from repetitive purchasing decisions and fosters a continuum of engagement through loyalty rewards and educational content. Separately, niche players have introduced smart textiles with integrated wetness indicators and temperature sensors, enabling real-time monitoring of a child’s comfort while providing data-driven care insights.

Supply chain resilience has also become a focal point for industry leaders. In response to rising import levies, some manufacturers have invested in facility expansions within tariff-exempt zones, while others have forged joint ventures to localize critical production phases. Strategic partnerships with textile mills and chemical-free dye suppliers underscore a commitment to both cost optimization and product integrity. Collectively, these moves signal a concerted effort to secure competitive advantage through vertical integration and innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloth Diaper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alvababy, Inc.

- Babyhug (FirstCry Pvt. Ltd.)

- Bambino Mio Ltd.

- Blueberry, Inc.

- Cotton Babies, Inc.

- FuzziBunz, Inc.

- GroVia, Inc.

- ImseVimse AB

- Just Bumm Pvt. Ltd.

- Kanga Care, Inc.

- Kinder Cloth Diaper Co., Inc.

- LittleLamb Ltd.

- Modern Cloth Nappies Ltd.

- OsoCozy Pvt. Ltd.

- Procter & Gamble Co.

- Smart Bottoms, Inc.

- Snugkins Pvt. Ltd.

- SuperBottoms Pvt. Ltd.

- Thirsties, Inc.

- TotsBots Ltd.

Actionable Industry Recommendations Enabling Brands to Navigate Tariff Challenges, Elevate Sustainability, and Capitalize on Emerging Consumer Behaviors in Cloth Diapers

To navigate emerging trade complexities and shifting consumer preferences, cloth diaper brands should intensify investment in sustainable raw materials, prioritizing organic certifications and transparent supply chains. By forging direct partnerships with regenerative fiber growers, companies can both stabilize costs and reinforce environmental credibility. Concurrently, expanding hybrid product lines offers a pragmatic bridge for new adopters, lowering perceived effort while maintaining an eco-friendly positioning.

Enhancing digital engagement through immersive content remains imperative. Brands can develop interactive care portals featuring video tutorials, real-time chat support, and peer-to-peer forums to reinforce brand authority and reduce abandonment rates. Subscription models should leverage predictive analytics to optimize delivery cadences, ensuring households consistently receive appropriate inventory without surplus or shortage.

Given the elevated tariff landscape, diversifying production geographies and exploring tariff-exempt manufacturing hubs can mitigate import duty exposure. Simultaneously, value-based pricing strategies that clearly communicate total cost of ownership advantages will resonate with cost-conscious segments. Collaborative advocacy with industry associations to seek duty exemptions for essential baby care products can further alleviate financial pressures on families.

Lastly, integrating smart diapering innovations, such as embedded wetness sensors or temperature-responsive fabrics, can serve as a competitive differentiator. These advanced features not only elevate user convenience but also position brands at the forefront of the next wave of infant care technology.

Outlining a Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Sources, and Rigorous Analysis to Ensure Market Intelligence Accuracy

This report employs a robust, multi-faceted research design to assemble accurate and actionable market insights. Initial scoping involved secondary data collection from authoritative sources, including government trade publications, regulatory filings, and peer-reviewed journals. These materials provided baseline perspectives on tariff regimes, textile material innovations, and sustainability standards across target regions.

Complementing the secondary research, primary qualitative inquiries were conducted through structured interviews with key stakeholders, spanning brand executives, supply chain managers, and infant care experts. These dialogues yielded nuanced understandings of strategic pivots, operational challenges, and emerging trends. Additionally, consumer sentiment was gauged via focus groups and online surveys, targeting both direct purchasers and institutional procurement professionals to validate adoption drivers and purchasing criteria.

Data synthesis involved triangulation across sources, ensuring coherence between industry forecasts, stakeholder feedback, and observed market behaviors. Segmentation frameworks were refined iteratively, cross-referenced against transactional data from e-commerce platforms and retailer audits. All quantitative inputs underwent consistency checks and outlier analyses, while qualitative insights were coded and thematically grouped to highlight recurring patterns and anomalies.

Finally, findings were peer-reviewed by an independent panel of infant care and sustainable textile experts, confirming methodological integrity and minimizing bias. This rigorous approach ensures that the resulting intelligence equips decision-makers with reliable guidance for strategic planning and investment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloth Diaper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloth Diaper Market, by Type

- Cloth Diaper Market, by Material

- Cloth Diaper Market, by Distribution Channel

- Cloth Diaper Market, by End User

- Cloth Diaper Market, by Region

- Cloth Diaper Market, by Group

- Cloth Diaper Market, by Country

- United States Cloth Diaper Market

- China Cloth Diaper Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Rounding Out Executive Reflections on Sustainability, Segmentation, and Strategic Imperatives Shaping the Future Trajectory of the Cloth Diaper Industry

The cloth diaper landscape is unmistakably shaped by a confluence of environmental, economic, and technological forces. From pioneering material science breakthroughs in bamboo and hemp blends to the emergence of hybrid diapering systems, the sector has evolved far beyond its traditional roots. At the same time, tariff escalations have introduced new cost considerations that necessitate agile supply chain strategies and transparent consumer communications.

Segment-specific insights underscore the importance of differentiated offerings: whether through premium hook-and-loop All-In-One solutions, customizable pocket diapers, or cost-efficient prefolds. Similarly, the diversity of distribution channels-from hypermarkets to digital marketplaces and specialized boutiques-calls for tailored go-to-market approaches that resonate with distinct buyer segments.

Regional contrasts further accentuate growth opportunities and challenges in equal measure. While mature markets benefit from well-established sustainability mandates, emerging economies present untapped potential for both local manufacturing and consumer education initiatives. Meanwhile, leading companies are setting benchmarks by integrating subscription models, smart textile features, and vertical integration tactics to secure resilient market positions.

Ultimately, navigating this dynamic terrain requires a holistic strategy that aligns product innovation, channel optimization, and supply chain flexibility. Stakeholders who embrace these imperatives will be best positioned to unlock value, foster brand loyalty, and contribute to a more sustainable future in infant care.

Empowering Decision-Makers to Engage with Ketan Rohom for Exclusive Insights and Securing the Definitive Cloth Diaper Market Research Report Purchase

To access unparalleled expertise and unlock the full spectrum of insights covered in this comprehensive cloth diaper market analysis, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage with his deep understanding of the infant care landscape to tailor the report to your organization’s strategic requirements. Whether you need customized data breakdowns, executive briefings, or in-depth segment analysis, he can guide you through the purchase process and ensure you receive the most relevant, actionable intelligence. Elevate your decision-making with this definitive resource and connect with Ketan today to secure the definitive market research report.

- How big is the Cloth Diaper Market?

- What is the Cloth Diaper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?