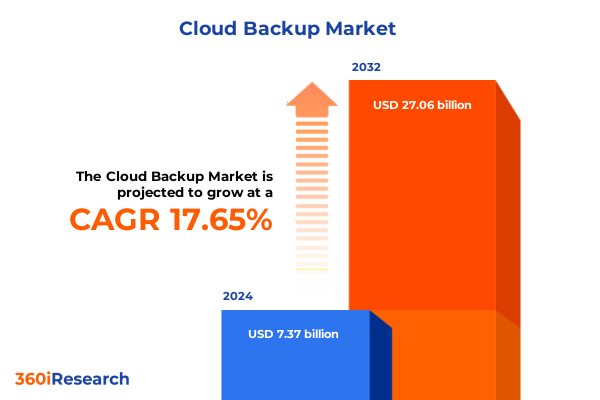

The Cloud Backup Market size was estimated at USD 8.59 billion in 2025 and expected to reach USD 10.02 billion in 2026, at a CAGR of 17.80% to reach USD 27.06 billion by 2032.

Understanding the Critical Importance of Robust Cloud Backup Strategies for Business Continuity Amid Unprecedented Data Growth and Evolving Cybersecurity Threats

The explosive proliferation of digital data has ushered in unprecedented challenges for organizations striving to maintain business continuity and data integrity in complex environments. IDC projects that global data generation will reach approximately 175 zettabytes per year by 2025, underscoring an era defined by massive information flows across public, private, and hybrid cloud infrastructures. Concurrently, enterprises worldwide are allocating ever-larger portions of their IT budgets to cloud computing services, with spending expected to approach $1.3 trillion by 2025. This convergence of unrelenting data growth and rising cloud adoption places robust cloud backup strategies at the heart of organizational resilience initiatives.

Amid this backdrop, enterprises face a proliferating threat landscape where ransomware attacks surged by 126% in the first quarter of 2025 alone, marking more than double the number of public extortion cases compared to the previous year. Simultaneously, AI-driven threat vectors and automated scanning activities have increased by 16.7% year-on-year, reaching 36,000 scans per second, intensifying the urgency for proactive data protection mechanisms. Against these evolving risks, cloud backup solutions have emerged as a critical pillar of a comprehensive cyber resilience framework, enabling rapid recovery, immutable snapshots, and enhanced visibility to mitigate the financial and operational fallout of data loss incidents.

Embracing Revolutionary Technological and Operational Shifts Driving Next Generation Cloud Backup Solutions with Automation, AI, and Flexible Multi-Cloud Architectures

Modern cloud backup solutions are being transformed by the integration of advanced automation, orchestration, and artificial intelligence capabilities. Managed Service Providers report that AI is now their top concern, with 44% of MSPs citing it as their greatest security challenge in 2025, overtaking ransomware and other conventional threats. These technologies are being leveraged to automate backup scheduling, detect anomalies in backup integrity, and predict resource requirements dynamically, fundamentally reshaping how organizations approach data protection.

In parallel, hybrid cloud and multi-cloud deployment models are redefining infrastructure architectures, enabling seamless failover between on-premises systems and cloud platforms. IDC forecasts that cloud infrastructure spending will grow at a 17.8% CAGR through 2029, driven by surges in shared cloud deployments that captured 64% of total infrastructure expenditures in the fourth quarter of 2024. Moreover, the rise of edge computing has extended backup and recovery capabilities closer to data sources, meeting the low-latency requirements of enterprise applications and supporting distributed workforces in remote locations.

Analyzing the Cumulative Impact of Newly Imposed 2025 United States Tariffs on Cloud Backup Infrastructure Costs, Supply Chains, and Service Delivery Models

Newly imposed U.S. tariffs in 2025 have introduced significant cost pressures on cloud backup operations by targeting imported hardware from China, Taiwan, and South Korea with duties ranging from 25% to 34%. The baseline 10% tariff on all imports has raised expenses for servers, storage arrays, and networking equipment-core components of cloud backup infrastructure-forcing providers to reassess pricing models and capital expenditure budgets.

In response to these pressures, leading cloud service providers have issued guidance on maintaining existing pricing agreements while exploring supply chain diversification. Amazon Web Services, for example, has prepared staff to address customer concerns regarding tariffs and data sovereignty, reinforcing commitments to local price stability and regulatory compliance. Simultaneously, procurement teams are shifting sourcing strategies toward alternative manufacturing hubs in Vietnam, Mexico, and Taiwan to mitigate tariff impacts, although such transitions require rigorous vendor qualification processes and carry their own timelines and complexities.

Uncovering Key Segmentation Insights by Component, Deployment Type, Industry Vertical, and Organization Size to Illuminate Cloud Backup Adoption Patterns

Component and deployment type segmentation reveal nuanced adoption patterns that directly influence solution design and service offerings. Enterprises increasingly subscribe to comprehensive managed services that extend beyond mere backup storage to encompass disaster recovery orchestration, continuous data protection, and professional services for implementation and support. At the same time, organizations balance the cost-efficiency of public cloud platforms with the control and customization afforded by private cloud infrastructures, often electing hybrid configurations that blend on-premises resiliency with cloud elasticity.

Industry verticals and organizational scale also shape backup requirements and solution portfolios. Banking, financial services, and insurance firms demand stringent encryption, compliance reporting, and near-instantaneous recovery to meet regulatory mandates; healthcare organizations prioritize secure patient data retention under HIPAA standards; government bodies focus on data sovereignty and retention policies; telecom and IT firms emphasize scalability to accommodate rapid data growth; and retail and consumer goods enterprises integrate backup capabilities with e-commerce platforms to maintain uptime. Large enterprises deploy sophisticated, multi-tiered backup strategies at global scale, while small and midsize businesses adopt streamlined, cost-effective services geared toward ease of use and rapid deployment.

This comprehensive research report categorizes the Cloud Backup market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- End-User Industry

Deriving Key Regional Insights across the Americas, EMEA (Europe Middle East & Africa), and Asia-Pacific to Illustrate Distinct Cloud Backup Market Dynamics

The Americas continue to lead global cloud backup adoption, fueled by mature digital infrastructure, extensive multi-cloud deployments, and a strong focus on cybersecurity. North America accounted for over 65% of businesses operating in multi-cloud environments in 2024, driving robust demand for enterprise-grade backup solutions with advanced threat detection and immutable storage capabilities. Meanwhile, market maturity in Canada and Latin America is characterized by a growing shift from legacy tape and on-premises systems toward fully automated cloud backup services that support regulatory compliance and disaster recovery objectives.

In the EMEA region, revenue in the public cloud market is projected to reach $259.15 billion in 2025, reflecting a 21.95% year-on-year increase driven by strong SaaS adoption and ongoing digital transformation initiatives in Germany, the UK, and Gulf Cooperation Council countries. However, growth rates in Central and Eastern Europe remain comparatively modest, constrained by regulatory complexities and slower infrastructure investment, underscoring the need for sovereign cloud strategies and localized data center expansions. Asia-Pacific markets, led by rapid AI-driven cloud investments in Australia, Japan, and Southeast Asia, are experiencing the fastest growth, as evidenced by AWS’s recent multibillion-dollar expansions and culturally attuned service offerings tailored to regional data residency requirements.

This comprehensive research report examines key regions that drive the evolution of the Cloud Backup market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Backup Providers and Innovative Challengers Shaping the Competitive Landscape through Differentiated Solutions and Strategic Partnerships

Dominant players continue to innovate with differentiated feature sets and strategic alliances. Veeam has extended its leadership in enterprise backup by integrating AI-powered analytics and advanced ransomware recovery workflows across AWS, Azure, Google Cloud, and VMware environments. Rubrik leverages a software-defined platform to deliver unified data management, cyber recovery, and compliance reporting, while Commvault and Acronis distinguish themselves through comprehensive API ecosystems that enable deep integration with DevOps toolchains and cloud-native architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Backup market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Commvault Systems, Inc.

- Dell Technologies Inc.

- Druva

- Google LLC

- Hewlett Packard Enterprise Company

- IDrive

- International Business Machines Corporation

- Microsoft Corporation

- NetApp

- Rubrik, Inc.

- Veeam Software Group GmbH

- Veritas Technologies LLC

Delivering Actionable Strategic Recommendations to Boost Resilience, Optimize Costs, and Elevate Data Protection Practices in Cloud Backup Operations

Organizations should prioritize the adoption of AI-driven backup validation and anomaly detection to identify data integrity issues before they impact recovery objectives. Fortinet’s report highlights a 42% surge in credential-based attacks fueled by AI-enabled automation, underscoring the importance of embedding intelligent threat monitoring within backup pipelines. By integrating machine learning models that assess backup health in real time, enterprises can preemptively remediate potential disruptions and fortify cyber resilience.

Leaders must also pursue supply chain diversification and nearshoring to mitigate tariff-related cost pressures and reduce exposure to geopolitical risks. The high import duties introduced in 2025 demonstrate the vulnerability of hardware-dependent services; as such, establishing secondary suppliers in Vietnam, Mexico, or Eastern Europe and maintaining strategic buffer inventories will ensure continuity in infrastructure provisioning and support accelerated deployment timelines.

Detailing the Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Evaluation, and Robust Analytical Frameworks for Market Validation

Our research methodology melds exhaustive secondary research with targeted primary engagements to deliver market insights grounded in both quantitative rigor and qualitative nuance. Secondary sources include international consultancy trackers, leading industry publications, government trade statistics, and reputable financial news outlets to establish baseline trends and benchmark sector benchmarks.

Complementing this desk-based analysis, we conducted structured interviews with CIOs, IT directors, managed service providers, and industry analysts to validate findings, capture emerging priorities, and assess vendor capabilities. Data triangulation techniques were applied at every stage to reconcile discrepancies across sources, yielding robust segmentation frameworks by component, deployment type, end-user industry, and organization size. The synthesis of these methodologies underpins the strategic recommendations and actionable insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Backup market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Backup Market, by Component

- Cloud Backup Market, by Deployment Type

- Cloud Backup Market, by End-User Industry

- Cloud Backup Market, by Region

- Cloud Backup Market, by Group

- Cloud Backup Market, by Country

- United States Cloud Backup Market

- China Cloud Backup Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing the Comprehensive Findings to Highlight Imperatives, Opportunities, and Future Directions for Effective Cloud Backup Strategies

This executive summary illuminates the converging forces transforming the cloud backup domain-from unprecedented data proliferation and escalating cybersecurity threats to technological innovations in AI and automation, as well as the ramifications of 2025 tariff policies on infrastructure economics. The segmentation and regional analyses offer a granular understanding of diverse market drivers and adoption patterns, while the profiles of leading vendors highlight the competitive strategies shaping solution roadmaps.

By synthesizing these findings, decision-makers can navigate complexity with confidence, aligning cloud backup investments to organizational priorities, regulatory mandates, and evolving threat landscapes. The actionable recommendations provide a blueprint for bolstering resilience, optimizing operational efficiency, and safeguarding critical data assets in an era defined by rapid change and heightened risk.

Prompting Engagement with Ketan Rohom for Expert Guidance and Seamless Acquisition of the Comprehensive Cloud Backup Market Research Report

If you are poised to fortify your organization’s data resilience and gain a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive cloud backup market research report. Engaging directly with Ketan will provide you with personalized insights, tailored support, and an expedited purchasing process designed to align the report’s strategic depth with your business objectives. Don’t miss this opportunity to leverage in-depth analysis and expert recommendations to guide your decision-making and drive sustainable growth.

- How big is the Cloud Backup Market?

- What is the Cloud Backup Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?