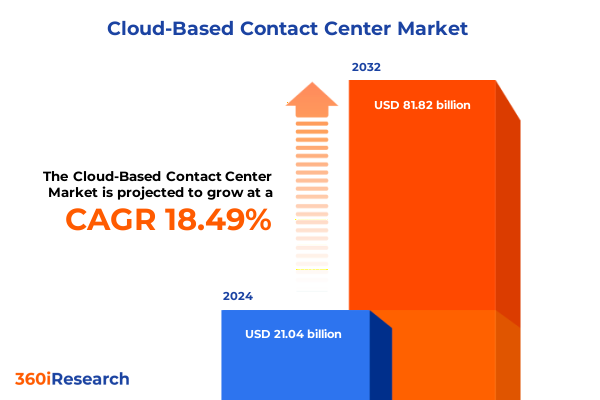

The Cloud-Based Contact Center Market size was estimated at USD 24.87 billion in 2025 and expected to reach USD 29.40 billion in 2026, at a CAGR of 18.54% to reach USD 81.82 billion by 2032.

Outlining the Strategic Imperatives and Emerging Drivers Shaping the Cloud-Based Contact Center Environment in an Era of Pervasive Digital Transformation

As organizations accelerate their digital transformation journeys, cloud-based contact centers have emerged as the strategic cornerstone for delivering seamless, scalable customer engagement. By decoupling infrastructure from physical premises, enterprises can flex capacity dynamically to match fluctuating demand while reducing capital expenditure and maintenance overhead. This agility enables rapid provisioning of new channels and features without the constraints of legacy systems, fostering innovation and time-to-market advantages for service leaders seeking competitive differentiation.

Customer expectations have evolved dramatically, demanding consistent, personalized experiences across voice, chat, email, social networks, and SMS. Cloud contact center platforms address these demands through true omnichannel integration, unifying disparate communication streams into a cohesive interface. Agents gain immediate access to a unified customer history while leaders benefit from live dashboards that monitor sentiment, queue times, and workload distribution in real time, enabling proactive interventions and continuous performance optimization.

Moreover, the infusion of artificial intelligence and advanced analytics into cloud architectures has redefined the boundaries of customer service. Predictive routing harnesses machine learning models to match callers with the best-suited agent based on historical interactions, while AI-driven chatbots and virtual assistants handle routine inquiries around the clock. These capabilities not only drive first-contact resolution rates but also free human agents to focus on complex, high-value engagements, elevating both efficiency and customer satisfaction.

Security and compliance remain paramount as sensitive customer data traverses global networks. Leading cloud contact center providers employ end-to-end encryption, role-based access controls, and real-time fraud detection, aligning with GDPR, CCPA, and HIPAA mandates. By embedding robust governance frameworks within their offerings, these platforms mitigate risk, safeguard brand reputation, and ensure regulatory adherence in an increasingly stringent data landscape.

Analyzing the Convergence of AI Innovation, Omnichannel Integration, and Workforce Evolution Redefining the Cloud-Based Contact Center Landscape

In 2025, the cloud-based contact center landscape is being transformed by an unprecedented convergence of technological and operational trends. Artificial intelligence sits at the forefront, with generative models powering virtual assistants capable of handling complex customer journeys and automating follow-up tasks. Organizations are integrating conversational AI to proactively anticipate needs, personalize interactions, and deliver contextual recommendations within both self-service portals and agent-assisted sessions, thereby redefining service quality benchmarks.

Concurrently, omnichannel communication has shifted from aspirational to essential. Cloud contact center platforms now seamlessly orchestrate interactions across voice, chat, email, social media, and SMS without requiring customers to repeat information. By centralizing data through unified customer profiles, enterprises eliminate silos, streamline agent workflows, and unlock deeper insights from journey analytics dashboards. These capabilities foster consistent brand experiences while optimizing resource allocation and reducing handle times.

Advanced analytics and real-time insights further amplify operational agility, delivering live metrics on agent performance, customer sentiment, and campaign outcomes. Predictive forecasts powered by machine learning help contact center managers anticipate peak volumes, adjust staffing levels dynamically, and implement targeted coaching interventions. As a result, workforce optimization has evolved into a continuous feedback loop where data-driven decision-making enhances both agent satisfaction and service-level adherence.

The shift toward remote and hybrid work models has underlined the importance of cloud scalability and flexibility. Distributed teams leverage web-based consoles to log in from any location, collaborating through integrated video, messaging, and knowledge bases. While this model expands access to global talent pools and supports business continuity, it also elevates the imperative for secure, resilient connectivity and rigorous end-point protection measures across virtualized environments.

Assessing the Cumulative Effects of 2025 U.S. Import Tariffs on Technology Infrastructure Costs and Cloud Contact Center Deployment Strategies

The imposition of broad U.S. import tariffs in 2025 has introduced significant headwinds to cloud contact center deployments by inflating costs for critical technology infrastructure. Advanced telecom equipment such as 5G base stations, fiber-optic transceivers, network switches, and enterprise antennas face tariffs ranging from 34% to 145%. In parallel, data center infrastructure components-including server racks, cooling systems, and power conversion units-carry additional levies of 20% to 25%, creating immediate capital expenditure pressures for cloud service providers and systems integrators.

Hardware suppliers have responded by adjusting pricing to offset the tariff burden. Enterprise networking solutions manufacturers report router price increases between 10% and 15%, while high-performance servers are up by 12% to 20%. Leading vendors have already passed through portions of these costs, with some noting average server price uplifts of approximately 8% in direct response to escalating duties. These adjustments not only impact new deployments but also raise the total cost of ownership for existing contact center environments seeking upgrades or capacity expansions.

In turn, business investment in communication equipment has experienced a notable slowdown. U.S. orders for core capital goods contracted by 0.7% in June 2025, defying economists’ expectations and signaling broad reluctance to advance major technology procurements amid tariff-driven uncertainty. While shipments crept up modestly, the prevailing sentiment indicates that many enterprises are postponing or scaling back modernization initiatives until policy clarity returns and input costs stabilize.

Moreover, global equipment vendors are recalibrating profitability forecasts due to these levies. One major telecom manufacturer recently lowered its 2025 profit outlook by up to €80 million, citing the combined impact of tariffs and currency headwinds. Such guidance revisions underscore the cascading effect of tariff policy on supply chain economics, compelling stakeholders across the cloud contact center ecosystem to explore alternative sourcing, nearshoring strategies, and cost mitigation tactics to preserve margins and sustain innovation roadmaps.

Distilling Key Insights from Deployment Models, Component Structures, Organizational Profiles, Application Suites, Communication Channels, and Industry Verticals

Insightful segmentation reveals that deployment preferences, solution architectures, and organizational requirements vary significantly across market participants. Enterprises typically evaluate cloud contact center offerings by deployment type, choosing between hybrid architectures that blend on-premises control with cloud scalability, private clouds for enhanced data governance, and fully public cloud models that prioritize rapid provisioning and cost efficiency. This spectrum of options allows organizations to align technology stacks with unique compliance constraints and growth objectives.

From a component standpoint, solutions are differentiated by services and software layers. Comprehensive platforms integrate integration and deployment services that accelerate time-to-value, coupled with support and maintenance offerings designed to ensure continuous platform availability. Meanwhile, organizations tailor their solution mix based on the relative importance of managed services, professional services engagement, and long-term operational support.

Organizational size also plays a pivotal role in shaping requirements. Large enterprises demand robust, enterprise-grade feature sets and global support, whereas small and medium enterprises often seek modular solutions that scale across distinct segments-enterprise entities employing 100 to 999 users and smaller operations with fewer than 100 agents. This segmentation enables vendors to offer tiered pricing and feature bundles that match the scale and complexity of diverse businesses.

Application-focused adoption highlights varying use cases. Inbound contact center solutions prioritize high-volume call routing and interactive voice response, while omnichannel suites unify digital channels to facilitate seamless cross-channel transitions. Outbound systems, by contrast, emphasize campaign management and predictive dialing to drive proactive outreach and lead generation.

Communication channels further differentiate platform capabilities, with modern architectures accommodating chat, email, SMS, social media engagements, and traditional voice simultaneously. Service leaders leverage these integrated modalities to construct personalized customer journeys and optimize agent productivity.

Finally, end-user industries exhibit unique adoption dynamics. Financial services institutions derive value from advanced fraud detection and compliance reporting, whereas government entities focus on citizen engagement and case management. Healthcare providers prioritize secure patient interactions across hospitals, payers, and pharmaceutical networks, while telecom operators and IT services firms emphasize high-availability infrastructure. Retailers, spanning e-commerce and brick-and-mortar, leverage contact center analytics to deliver targeted promotions and omnichannel loyalty experiences.

This comprehensive research report categorizes the Cloud-Based Contact Center market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Type

- Component Type

- Channel Type

- Application

- End User Industry

Unpacking Regional Dynamics: Disparate Adoption Patterns, Regulatory Challenges, and Growth Drivers Across Americas, EMEA, and Asia-Pacific Markets

Regional nuances profoundly influence market trajectories and adoption strategies. In the Americas, rapid digital transformation initiatives in the United States and Canada are propelled by robust cloud infrastructure investments and a regulatory environment that balances data privacy with innovation. Financial services, healthcare, and retail sectors lead the charge, integrating generative AI for customer personalization and deploying omnichannel platforms to support hybrid workforces.

Across Europe, the Middle East, and Africa, market growth is tempered by data sovereignty regulations and varying levels of cloud maturity. While Western European nations adopt advanced contact center capabilities, many emerging economies focus on foundational deployments. Public-sector modernization programs in the United Kingdom, Germany, and the Nordics emphasize secure citizen services, whereas the Middle East invests heavily in digital transformation as part of broader economic diversification strategies.

In Asia-Pacific, investment patterns reflect stark contrasts between developed and developing markets. Japan and Australia demonstrate high uptake of AI-driven automation and predictive analytics, supported by stable regulatory regimes. In Southeast Asia and India, organizations prioritize affordable cloud models that accommodate multilingual support and complex regional compliance requirements. Telecom operators in the region often serve as key solution integrators, combining network services with cloud contact center platforms to address rapid urbanization and expanding digital economies.

This comprehensive research report examines key regions that drive the evolution of the Cloud-Based Contact Center market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Cloud Contact Center Providers’ Strategic Innovations, Partnerships, and AI Advancements Driving Market Leadership

Leading providers continue to push the envelope through targeted innovation, strategic partnerships, and extension of AI-driven capabilities. Genesys has solidified its position with a suite of agentic AI orchestration tools. Its AI Studio and Cloud AI Guides empower businesses to build, govern, and scale autonomous virtual agents without extensive coding, while real-world deployments have driven annual recurring revenue above two billion dollars, underpinned by robust multi-year contracts and high net revenue retention rates.

AWS has doubled down on Amazon Connect by embedding advanced AI features across self-service, agent assistance, and post-contact evaluation. The platform’s next-generation release offers unlimited use of AI capabilities with consumption-based pricing, enabling companies to activate powerful conversational agents and real-time transcription services with minimal configuration-all accessible via a single-click enablement process in core AWS regions.

Cisco’s Webex Contact Center has introduced an AI Assistant that delivers real-time guidance, context summaries, and wellbeing monitoring for agents. With upcoming support for multi-language AI Agents and deep integrations with healthcare workflows, Cisco is leveraging its Unified Communications heritage to offer a differentiated proposition that spans self-service automation and human-assisted engagement.

Meanwhile, Microsoft continues to enhance its Dynamics 365 Customer Service suite with cloud-native contact center components, focusing on AI-infused routing and seamless integration with Teams. NICE and Verint drive value through advanced workforce engagement management and enterprise analytics, while emerging players like Twilio and Five9 differentiate via programmable APIs and vertical-specific solutions that emphasize rapid deployment and developer-friendly toolsets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud-Based Contact Center market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 8x8, Inc.

- Alvaria

- Amazon Web Services, Inc.

- Avaya Holdings Corp.

- Cisco Systems, Inc.

- Content Guru

- Dialpad

- Five9, Inc.

- Genesys Telecommunications Laboratories, Inc.

- Google LLC

- NICE Ltd.

- RingCentral, Inc.

- Talkdesk, Inc.

Providing Actionable Strategic and Operational Recommendations to Accelerate Customer Experience Excellence and Operational Agility in Cloud-Based Contact Centers

To unlock the full potential of cloud-based contact centers, organizations should prioritize seamless omnichannel orchestration. Investing in platforms that unify voice, messaging, social and digital channels via a single interface reduces complexity and elevates customer satisfaction through consistent, context-rich interactions. Integrating customer data from CRM, e-commerce, and back-office systems ensures agents can swiftly access comprehensive histories, driving first-contact resolutions and personalized service.

Adoption of AI and analytics must extend beyond pilot programs. Enterprises should architect AI-driven assistants and predictive models into core workflows, leveraging generative AI tools to automate responses, route inquiries, and analyze sentiment. Establishing a central data repository-with real-time dashboards and machine learning pipelines-enables continuous performance optimization and rapid adaptation to emerging customer needs.

Given ongoing tariff pressures, procurement strategies should diversify sourcing and explore nearshoring options for hardware purchases. Negotiating flexible, consumption-based contracts with cloud providers can mitigate upfront capital exposure while preserving scalability. Concurrently, organizations should engage in regular scenario planning to stress-test budgets against input cost volatility and policy shifts.

Cultivating a resilient workforce remains paramount. Businesses should embed agent well-being tools that monitor stress indicators and support proactive break scheduling, thereby reducing burnout and turnover. Equipping staff with AI-assisted guidance and comprehensive knowledge bases accelerates onboarding and enhances productivity. Finally, fostering a culture of data-driven decision-making-supported by cross-functional centers of excellence-ensures that technology investments translate into tangible experience improvements.

Outlining the Rigorous Research Methodology Employed for Comprehensive Analysis of the Cloud-Based Contact Center Market Dimensions and Trends

Our research methodology integrates a multi-tiered approach to deliver comprehensive market insights. We conducted primary interviews with senior executives, IT architects, and business leaders across key verticals to capture real-time perspectives on adoption drivers, pain points, and future roadmap priorities. These qualitative inputs were supplemented with a robust secondary research framework, encompassing regulatory filings, vendor press releases, financial disclosures, and industry publications.

To quantify adoption trends, we analyzed deployment patterns across region, organization size, and industry verticals, employing data triangulation techniques to reconcile disparate sources and validate key findings. Advanced analytics tools were applied to unstructured data-such as customer reviews and technical forums-to identify emerging feature requirements and sentiment shifts. This hybrid approach ensures both depth and breadth of coverage.

Vendor profiling combined feature benchmarking with strategic initiative mapping. Each provider’s product roadmap was evaluated based on innovation velocity, AI integration depth, and ecosystem partnerships. Financial metrics and customer reference data further informed the competitive landscape analysis.

Finally, scenario planning exercises were employed to assess the impact of macroeconomic variables-such as tariff regimes, regulatory changes, and technology price fluctuations-on total cost of ownership and deployment strategies. This methodology underpins the actionable recommendations and regional insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud-Based Contact Center market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud-Based Contact Center Market, by Deployment Type

- Cloud-Based Contact Center Market, by Component Type

- Cloud-Based Contact Center Market, by Channel Type

- Cloud-Based Contact Center Market, by Application

- Cloud-Based Contact Center Market, by End User Industry

- Cloud-Based Contact Center Market, by Region

- Cloud-Based Contact Center Market, by Group

- Cloud-Based Contact Center Market, by Country

- United States Cloud-Based Contact Center Market

- China Cloud-Based Contact Center Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights on the Future Prospects, Strategic Imperatives, and Market Evolution of Cloud-Based Contact Center Solutions

The cloud-based contact center market stands at a pivotal junction, shaped by the interplay of AI innovation, omnichannel imperatives, and evolving workforce models. As tariff-driven cost pressures challenge hardware-dependent strategies, the shift toward consumption-based, software-centric deployments accelerates. Vendors and end users alike must navigate regulatory complexities, data sovereignty considerations, and competitive landscapes that reward agility and contextual intelligence.

Organizations that embed AI and analytics deeply into customer engagement workflows will unlock new efficiencies and service excellence. Meanwhile, strategic procurement practices and flexible sourcing models will be essential to mitigate macroeconomic uncertainties. Regional dynamics underscore the need for localized compliance frameworks and partner ecosystems that align with specific market requirements.

Looking ahead, the integration of agentic AI, real-time orchestration, and composable microservices architectures promises to reshape how enterprises engage with customers. By prioritizing platform interoperability, data accessibility, and workforce well-being, service leaders can chart a sustainable path to customer loyalty, operational resilience, and long-term growth in an increasingly dynamic business environment.

Connect with Ketan Rohom to Access an Exclusive Cloud-Based Contact Center Research Report Curated for Forward-Thinking Decision-Makers

Elevate your strategic planning with exclusive insights from our comprehensive cloud-based contact center market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored data, in-depth analysis, and competitive intelligence designed to empower your next initiative and guide your organization to customer experience leadership.

- How big is the Cloud-Based Contact Center Market?

- What is the Cloud-Based Contact Center Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?