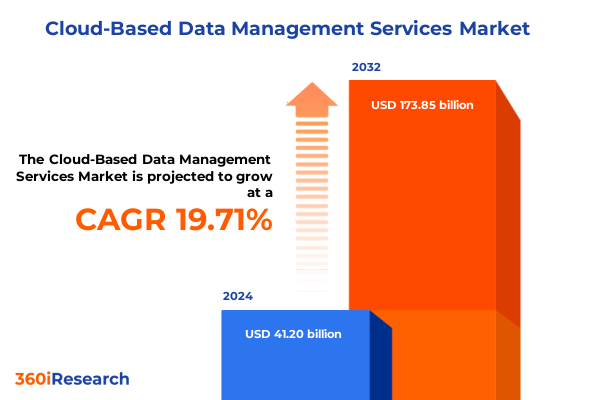

The Cloud-Based Data Management Services Market size was estimated at USD 48.90 billion in 2025 and expected to reach USD 58.19 billion in 2026, at a CAGR of 19.86% to reach USD 173.85 billion by 2032.

Exploring the New Realities of Cloud-Based Data Management as Enterprises Pursue Scalable, Secure, and Agile Digital Transformation

Enterprises worldwide are redefining their competitive edge through the effective management of data assets in cloud environments. The relentless growth of digital touchpoints has generated unprecedented volumes of information, necessitating robust strategies for storage, integration, governance, and real-time analytics. In this landscape, cloud-based data management services have emerged as the cornerstone of digital transformation, enabling organizations to pivot quickly, reduce capital expenditure on infrastructure, and focus on value creation rather than hardware maintenance.

Against this backdrop, leaders in technology and business functions demand an executive-level perspective that synthesizes the complexities of service models, deployment options, end-user requirements, and regional dynamics. This summary distills multifaceted insights into a coherent narrative, illuminating key shifts that shape decision-making. It highlights the interplay of emerging technologies, shifting regulatory frameworks, and the evolving demands of global supply chains.

By offering a concise yet in-depth overview, this section sets the tone for a comprehensive examination of cloud data management. It outlines the critical themes, emerging challenges, and strategic imperatives that will drive enterprise resilience and long-term growth in an increasingly data-driven world.

Mapping the Transformative Shifts in Cloud Ecosystems Driven by AI, Edge Computing, and Data Sovereignty Imperatives

Over the past several years, the landscape of cloud-based data management has undergone profound change. Artificial intelligence and machine learning capabilities have been integrated directly into data pipelines, automating data cleansing, anomaly detection, and predictive analytics. This melding of AI with traditional data management tools accelerates insights, enabling real-time decision-making and uncovering hidden patterns that were previously accessible only through manual analysis.

Moreover, edge computing has shifted data processing closer to the point of generation, reducing latency and alleviating network bandwidth constraints. Organizations deploying IoT devices in manufacturing, healthcare, and smart cities now rely on edge-enabled frameworks to preprocess data locally before transmitting aggregated information to centralized clouds. Consequently, hybrid and distributed architectures have become the norm, compelling vendors to offer seamless orchestration across on-premises, private, and public environments.

In addition, data sovereignty concerns have prompted enterprises to reevaluate governance models. Stricter regulations and localized compliance requirements have driven demand for solutions that embed fine-grained access controls and audit capabilities. As a result, providers are embedding policy-driven automation and encryption technologies to ensure data remains protected throughout its lifecycle. Together, these shifts are redefining the rules of engagement and setting new benchmarks for performance, security, and regulatory adherence.

Assessing the Cumulative Impact of 2025 United States Tariffs on Cloud-Based Data Management Service Supply Chains and Cost Structures

The introduction of significant tariff actions by the United States in 2025 has had far-reaching implications for cloud-based data management providers and their customers. Hardware components such as storage devices, networking switches, and specialized accelerators experienced cost inflation, compelling service operators to absorb additional expenses or pass them through to end users. This dynamic has altered procurement cycles and led to a renewed focus on vendor diversification and contract renegotiation.

Furthermore, the impact of these tariffs rippled through global supply chains, resulting in extended lead times for critical infrastructure deployment. Organizations that had planned on-premises expansions encountered delays, incentivizing a faster transition toward software-defined and multi-tenant environments. In turn, cloud service providers accelerated investments in data center expansions within tariff-exempt zones, shifting resource allocation to regions with favorable trade conditions.

These developments also influenced strategic pricing models. Service-level agreements were reformulated to include clauses addressing supply chain disruptions, while solution architects designed more modular offerings to accommodate fluctuating component costs. Consequently, enterprises are increasingly evaluating total cost of ownership through a lens that balances procurement risks, operational agility, and long-term scalability.

Uncovering Critical Segmentation Insights That Illuminate Diverse Service Models, User Verticals, and Deployment Preferences in Cloud Data Management

Insight into market segments reveals a nuanced ecosystem where service model preferences, end-user adoption, deployment choices, organizational scale, and solution requirements converge to shape strategies. Based on service models, infrastructure as a service, platform as a service, and software as a service each offer distinct value propositions. Infrastructure as a service appeals to enterprises seeking granular control over compute and storage resources, whereas platform as a service attracts development teams aiming for streamlined application deployment. Software as a service resonates with business units that prioritize turnkey solutions and rapid time to value.

Turning to end users, the financial services, government and public sector, healthcare, IT and telecom, manufacturing, and retail verticals display unique patterns. Banking, financial services, and insurance entities demand rigorous security and compliance controls; hospitals, medical device manufacturers, and pharmaceutical companies require data interoperability and quality management; IT services providers and telecom operators prioritize high-throughput, low-latency networks; automotive, chemical, and electronics firms focus on predictive maintenance and quality tracking; and brick-and-mortar and e-commerce retailers emphasize customer analytics and inventory optimization.

When considering deployment, community environments facilitate shared compliance frameworks, hybrid clouds deliver a balance of control and flexibility, private clouds provide dedicated resources for mission-critical workloads, and public clouds offer elasticity for variable demand. Organizational size influences selection, with large enterprises investing in comprehensive, bespoke architectures, while small and medium businesses favor out-of-the-box solutions and managed services. Finally, consulting, implementation, support, and training services round out the ecosystem, enabling enterprises to leverage expertise across advisory, deployment, and ongoing optimization phases of their data management journey.

This comprehensive research report categorizes the Cloud-Based Data Management Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Deployment Model

- Organization Size

- Solution Type

- End User

Highlighting Vital Regional Insights Across Americas, Europe Middle East & Africa, and Asia-Pacific Market Dynamics in Data Management Services

Regional dynamics in cloud-based data management vary considerably across the Americas, Europe Middle East & Africa, and Asia-Pacific, reflecting differences in regulatory regimes, digital maturity, and infrastructure investment. In the Americas, robust investments in hyperscale data centers and an entrepreneurial ecosystem have fueled rapid adoption of data lakes and advanced analytics platforms. Organizations in North America leverage broad service portfolios, integrating native AI capabilities with third-party tools to accelerate innovation.

Meanwhile, in Europe, the Middle East and Africa, regulatory frameworks such as the General Data Protection Regulation and emerging data residency laws have shaped a security-first approach. Public sector initiatives in these regions emphasize digital sovereignty, prompting container-based microservices and confidential computing to gain traction. Data management strategies integrate localized cloud zones to meet compliance requirements while maintaining interoperability across borders.

In the Asia-Pacific region, surging demand for digital commerce and government-led smart city initiatives has catalyzed multi-cloud strategies. Providers collaborate with local partners to tailor offerings to diverse markets, balancing cost sensitivities with performance needs. Edge deployments have proliferated in manufacturing hubs and telecommunications networks to support real-time analytics and low-latency applications. Across all regions, service providers continue to expand footprint and functionality to address evolving enterprise mandates.

This comprehensive research report examines key regions that drive the evolution of the Cloud-Based Data Management Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Providers Driving Innovation and Competitive Differentiation in Cloud-Based Data Management Service Offerings

A select group of technology leaders are driving the evolution of cloud-based data management services through relentless innovation, strategic partnerships, and broad ecosystem integration. Public hyperscale platforms leverage global infrastructure to deliver high-availability data lakes, serverless compute, and intelligent data catalogs. These providers continuously enhance native machine learning suites, offer specialized hardware accelerators, and expand regional availability to reduce latency and meet data residency requirements.

Established enterprise software vendors differentiate through end-to-end portfolios that span on-premises, private, and public environments. They integrate data governance frameworks, metadata management tools, and data fabric architectures to enable seamless data movement. Strategic acquisitions of analytics and integration startups have extended their capabilities into edge analytics and real-time streaming.

Innovative pure-play specialists focus on niche requirements such as high-performance storage protocols, data virtualization, and graph databases. They often collaborate with industry consortia to advance open standards and interoperability. In parallel, emerging players are leveraging serverless paradigms and container orchestration to simplify deployment and reduce operational overhead. This competitive landscape ensures that enterprises benefit from continuous feature rollouts, flexible consumption models, and a growing catalog of partner integrations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud-Based Data Management Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alibaba Group

- Amazon Web Services, Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Cloudian Inc.

- Cloudreach Group by Eviden

- Cloudticity LLC

- Cognizant Technology Solutions Corp.

- DXC Technology Company

- Google LLC by Alphabet Inc.

- HashiCorp, Inc.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co., Ltd.

- Informatica Inc.

- Infosys Ltd.

- International Business Machines Corporation

- Kyndryl Inc.

- Linode LLC by Akamai Technologies, Inc.

- Microsoft Corporation

- NTT Limited

- OVH SAS

- Salesforce, Inc.

- SAP SE

- ServiceNow

- Tata Consultancy Services

- Tencent Cloud

- UpCloud Ltd.

- Vercel Inc.

- Veritis Group Inc.

- Wipro Ltd.

Actionable Recommendations for Industry Leaders to Navigate Technological Evolution and Enhance Efficiency in Cloud Data Management

To navigate the complex cloud data management ecosystem, industry leaders should start by aligning business outcomes with technology roadmaps. They must prioritize use cases that deliver measurable ROI such as fraud detection, supply chain optimization, and personalized customer experiences. Consequently, cross-functional teams need to collaborate early, ensuring that data architects, security officers, and application owners share a unified vision.

Furthermore, organizations should adopt a multi-phase implementation strategy that begins with pilot projects in low-risk environments. This approach allows teams to validate architecture patterns, performance benchmarks, and governance controls before scaling. In addition, continuous monitoring and feedback loops should be established to track adoption metrics, identify bottlenecks, and inform tooling enhancements.

Moreover, leaders must cultivate a culture of data stewardship and analytics literacy. Training programs, certification paths, and mentorship initiatives will upskill personnel in cloud-native paradigms and advanced analytics techniques. Finally, they should forge strategic partnerships with technology providers and system integrators to access specialized expertise, accelerate deployment timelines, and reduce total cost of ownership. By following these actionable steps, enterprises will position themselves to realize the full potential of their data assets and outpace competitors.

Revealing Rigorous Research Methodology Underpinning In-Depth Analysis of Cloud Data Management Services Across Multiple Dimensions

This analysis integrates both primary and secondary research methodologies to ensure rigor and reliability. Primary insights were gathered through structured interviews with enterprise CIOs, data architects, and service provider executives. These conversations probed challenges in data governance, integration complexity, and cost management, yielding firsthand perspectives on strategic priorities and pain points.

Secondary research involved a comprehensive review of publicly available white papers, regulatory guidelines, technology roadmaps, and credible industry journals. Data points were triangulated across multiple sources to validate trends and minimize bias. Proprietary vendor documentation was also examined to capture the latest feature enhancements and roadmap announcements.

Quantitative analysis focused on deployment footprints, service adoption rates, and infrastructure investment patterns, while qualitative assessment evaluated vendor positioning, customer satisfaction, and innovation trajectories. Throughout the research cycle, cross-validation sessions with subject matter experts ensured that interpretations aligned with real-world experiences. This multilayered approach delivers a holistic view of cloud-based data management and supports the conclusions and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud-Based Data Management Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud-Based Data Management Services Market, by Service Model

- Cloud-Based Data Management Services Market, by Deployment Model

- Cloud-Based Data Management Services Market, by Organization Size

- Cloud-Based Data Management Services Market, by Solution Type

- Cloud-Based Data Management Services Market, by End User

- Cloud-Based Data Management Services Market, by Region

- Cloud-Based Data Management Services Market, by Group

- Cloud-Based Data Management Services Market, by Country

- United States Cloud-Based Data Management Services Market

- China Cloud-Based Data Management Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Future Investments in Cloud-Based Data Management Solutions to Accelerate Digital Maturity

The convergence of advanced analytics, scalable infrastructure, and shifting regulatory landscapes has elevated cloud-based data management from a tactical concern to a strategic imperative. By synthesizing the transformative forces of AI integration, edge computing, and compliance-driven architectures, organizations can chart a clear path toward data-centric operations. Moreover, understanding segmentation nuances, regional variations, and competitive differentiators equips decision-makers to tailor investments that align with business goals.

Enterprises that proactively address the total cost of ownership implications of global tariff changes and supply chain disruptions will gain resilience and agility. Early adoption of hybrid and multi-cloud frameworks, combined with robust data governance, will ensure continuity and compliance. Furthermore, prioritizing talent development and forging strategic alliances will accelerate the realization of value from complex data landscapes.

In conclusion, the cloud data management arena presents abundant opportunities for those willing to embrace innovation and manage risk. By applying the insights and recommendations outlined in this report, organizations can transform raw data into strategic assets, drive operational excellence, and secure a sustainable competitive advantage to Accelerate Digital Maturity

Connect with Ketan Rohom to Secure Strategic Insights and Empower Decision-Making through Comprehensive Cloud Data Management Research

If you are ready to elevate your organization’s data management capabilities and harness the strategic insights outlined in this comprehensive analysis, connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings deep expertise in aligning research findings to organizational priorities, enabling you to translate market intelligence into actionable plans. Engage with him to explore tailored research packages, discuss deployment scenarios, and secure access to detailed data sets that underpin the competitive advantages described throughout this report. Reach out today and take the next decisive step toward optimizing your cloud data management strategy with confidence and clarity

- How big is the Cloud-Based Data Management Services Market?

- What is the Cloud-Based Data Management Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?