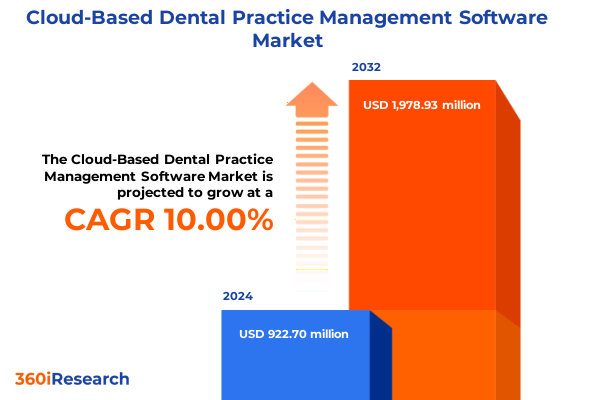

The Cloud-Based Dental Practice Management Software Market size was estimated at USD 1.01 billion in 2025 and expected to reach USD 1.10 billion in 2026, at a CAGR of 10.06% to reach USD 1.97 billion by 2032.

Setting the Stage with an In-Depth Exploration of Cloud-Based Dental Practice Management Software and Its Strategic Role in Modern Healthcare Delivery

Cloud-based dental practice management software represents a paradigm shift in the way dental professionals operate and deliver patient care. By harnessing the scalability of cloud infrastructure, this software eliminates the constraints of on-premise systems and provides real-time access to critical data from any connected device. This agile approach to practice management empowers practitioners to streamline appointment scheduling, oversee inventory, manage billing processes, and analyze patient records with unprecedented efficiency. Moreover, the integration of advanced reporting capabilities facilitates data-driven decision-making, helping practices optimize workflows and enhance patient satisfaction. Over the past few years, the convergence of healthcare regulations and digital transformation initiatives has accelerated the adoption of cloud solutions in dentistry. The ability to maintain compliance with stringent privacy standards while minimizing IT overhead has become a key driver for both emerging and established practices. As the digital imperative intensifies, dental offices are seeking solutions that offer flexibility, cost savings, and seamless interoperability with other health information systems.

This executive summary delves into the transformative currents reshaping the cloud dental software landscape, examining the impact of recent shifts in technology and economic policy. It outlines how evolving consumer expectations and regulatory frameworks create new opportunities and challenges for software vendors and end users alike. The analysis also highlights critical segmentation and regional dynamics that reveal pockets of growth potential and areas requiring strategic focus. By synthesizing the most relevant insights, this summary aims to equip decision-makers with an actionable understanding of market forces, guiding their strategies for product development, partnership formation, and go-to-market execution.

Examining Revolutionary Technological and Organizational Transformations Reshaping the Cloud Dental Software Arena in Today’s Innovative Healthcare Environment

Over the last two years, the dental sector has witnessed a wave of transformative shifts driven by advances in artificial intelligence, telehealth integration, and enhanced cybersecurity measures. AI-powered diagnostic tools integrated into practice management platforms now offer predictive analytics for patient outcomes, enabling practitioners to create proactive treatment plans. The seamless incorporation of virtual consultation features has expanded patient reach beyond traditional geographic boundaries, fostering greater continuity of care. Concurrently, stricter regulatory requirements around patient data privacy have prompted software providers to adopt robust encryption standards and multi-factor authentication protocols. These developments have elevated the baseline expectations for security and compliance, motivating vendors to embed governance features that simplify audit trails and streamline reporting obligations.

In parallel, the rise of mobile-first interfaces has revolutionized daily operations, granting dental teams real-time access to scheduling calendars, patient histories, and inventory levels through smartphone and tablet applications. This shift toward on-the-go management enhances responsiveness and reduces administrative bottlenecks. Moreover, recent strategic alliances between practice management vendors and laboratory service providers illustrate a growing trend toward ecosystem partnerships. By integrating lab ordering and results delivery directly into the practice management workflow, these collaborations reduce turnaround times and improve treatment precision.

Collectively, these transformative developments have set the stage for next-generation innovation in cloud dental software. Vendors are exploring blockchain architectures to enhance data integrity and traceability, particularly for secure sharing of patient records across disparate systems. Voice recognition and natural language processing technologies are being piloted to automate clinical note-taking and streamline charting workflows. As these advancements mature, they will redefine the parameters of practice management by embedding intelligence more deeply into routine operations and patient engagement channels.

Analyzing the Comprehensive Effects of 2025 United States Tariff Policies on Cloud Delivery Models and the Economics of Dental Practice Management Solutions

Starting in early 2025, the implementation of new United States tariffs on imported hardware components and related software licenses has introduced notable cost considerations for cloud-based dental practice management providers and their clients. Tariffs on microprocessors, networking equipment, and storage arrays have inflated the capital expenditure associated with deploying cloud services, indirectly affecting subscription pricing models. Although most cloud infrastructures are hosted in domestic data centers, the reliance on international hardware suppliers has transmitted cost pressures down the value chain. Smaller vendors, in particular, have encountered margin compression as they seek to absorb or pass on these increased import duties to end users. At the same time, the heightened tariff environment has spurred discussions around reshoring production and exploring alternative sourcing regions to alleviate price escalations.

Despite these headwinds, innovative pricing strategies and the scalability of cloud architectures have mitigated the overall impact on practitioners. Subscription-based models enable practices to spread additional costs over contract periods, preserving budget predictability. In response to the evolving tariff landscape, leading software companies have renegotiated vendor agreements and optimized their hardware footprints to reduce exposure to high-duty categories. Some firms have accelerated a shift toward pure software-as-a-service (SaaS) delivery modes, decoupling expensive on-premise hardware requirements from their offerings. Consequently, while the cumulative impact of tariffs in 2025 has introduced new challenges, the inherent flexibility of cloud-based solutions has allowed the dental software market to adapt and maintain upward growth trajectories.

From the perspective of dental professionals, the incremental cost impacts can be managed through optimized resource allocation and phased upgrade strategies. Practices are increasingly evaluating hybrid cloud deployments that leverage domestic data center partners for sensitive workloads while using public cloud services for non-critical functions. This blended model reduces tariff exposure and ensures compliance with local data residency requirements. Additionally, software providers are offering hardware leasing options and bundled service agreements that amortize equipment costs over multi-year contracts, further insulating end users from tariff-driven price volatility.

Unveiling Critical Insights from the Multi-Dimensional Segmentation Landscape Driving Adoption of Cloud Dental Practice Software Across Diverse Professional Needs

An in-depth examination of the market structure reveals that practice management software offerings differentiate themselves across functional modules, with appointment scheduling emerging as a critical entry point for new adopters and established users alike. Solutions for inventory management and invoice and billing follow closely, reflecting the operational emphasis on resource control and revenue cycle efficiency. Patient management modules, which centralize clinical records and treatment histories, drive deeper platform engagement, while advanced reporting and analytics tools support strategic decision-making and performance optimization. Within these functional dimensions, vendors have organized their products along administrative and clinical categories, ensuring that each platform variant aligns with either front-office workflow automation or chairside support activities that directly influence treatment quality.

Further segmentation uncovers diverse monetization approaches, where subscription-based models offer predictable recurring revenue streams for providers and scalable entry costs for practices of all sizes. Complementing this are tiered pricing structures that grant practices the flexibility to select feature bundles tailored to specific needs, such as premium analytics or multi-location administration. On the clinical front, applications serving cosmetic dentistry and orthodontics have exhibited particularly strong uptake, given the high value associated with elective and corrective treatments. Endodontics and oral surgery modules are gaining traction as practices seek specialized scheduling and clinical documentation features. Ultimately, the end-user landscape bifurcates between standalone dental clinics that prioritize cost-effective, flexible platforms and larger hospital systems that require enterprise-grade integration, security, and compliance capabilities.

This comprehensive research report categorizes the Cloud-Based Dental Practice Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Category

- Pricing Model

- Application

- End-User

Understanding Regional Market Dynamics and Strategic Growth Patterns Shaping Adoption of Cloud-Based Dental Practice Management Solutions Across Global Territories

Across the Americas region, the adoption of cloud-based dental practice management solutions has been driven by strong demand in the United States and Canada, where regulatory incentives for electronic health records and reimbursement efficiencies underpin cloud migration. Mature healthcare infrastructures in metropolitan centers have accelerated uptake among multi-location group practices, which value unified scheduling and billing across geographies. Latin America is emerging as a high-growth submarket, fueled by improving broadband penetration and the modernization of dental clinics in urban hubs. As pricing sensitivity remains a factor, vendors have introduced local data residency options to comply with national privacy laws while delivering global service reliability.

In Europe, Middle East, and Africa (EMEA), the market exhibits significant heterogeneity. Western European countries demonstrate robust engagement due to advanced digital health policies, whereas Central and Eastern Europe reflect nascent demand, driven by slower on-premise legacy replacement cycles. Within the Gulf states and African markets, public-private partnerships and government-sponsored telehealth initiatives are creating fresh opportunities for cloud software implementation. Turning to Asia-Pacific, the region represents a dynamic front for innovation adoption. Established markets such as Australia and Japan show strong uptake of integrated platforms with mandatory compliance features, while India and Southeast Asia present rapid expansion of the dental sector driven by rising disposable incomes and growing emphasis on preventive care. Across each region, language localization, regulatory compatibility, and data sovereignty frameworks define the competitive battleground for vendors seeking to capture cross-border growth potential.

This comprehensive research report examines key regions that drive the evolution of the Cloud-Based Dental Practice Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Propelling Innovation and Competitive Differentiation in Cloud Dental Practice Management Software

The competitive landscape of cloud-based dental practice management software is characterized by a mix of established incumbents and agile challengers. Industry stalwarts have leveraged extensive domain expertise to enrich their platforms with deep clinical functionality and comprehensive administrative tools. At the forefront, several leading providers have accelerated product roadmaps to integrate artificial intelligence capabilities, enhance patient engagement modules, and reinforce cybersecurity defenses. Strategic partnerships with digital imaging and laboratory service firms have also become a hallmark of market leaders, delivering seamless end-to-end workflows for prosthodontics and orthodontic treatment planning. Moreover, established vendors are capitalizing on brand trust and extensive customer support networks to scale their cloud footprint across diverse practice sizes and specialties.

Concurrently, emerging players are differentiating through focused niche offerings and pricing innovations. These companies typically emphasize rapid deployment, user-friendly interfaces, and flexible subscription tiers tailored to small clinics and solo practitioners. A number of these challengers have secured venture capital backing to fund expansions into underserved regions and to bolster R&D investments in machine learning and predictive analytics. Notably, several firms have pursued acquisitions of complementary software suites, thereby broadening their service portfolios to include teledentistry, patient communication, and marketing automation tools. This blend of organic innovation and inorganic growth has intensified competition, compelling all participants to refine their value propositions and reinforce client retention through ongoing product enhancements and customer success initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud-Based Dental Practice Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABELDent Inc

- ACE Dental Software

- Benco Dental Supply Co.

- CareStack by Good Methods Global Inc.

- Carestream Dental, LLC by Envista Holdings Corporation

- Curve Dental, Inc.

- DentaCloud Systems, Inc.

- Dentally Ltd.

- Dentiflow.

- DentiMax Dental Solutions, Inc.

- eClinicalWorks, LLC

- Henry Schein, Inc.

- iCoreConnect Inc.

- iDentalSoft, Inc.

- Integrated Charts, Inc.

- MOGO, Inc.

- Nextgen Healthcare, Inc.

- Open Dental Software Inc.

- Ortho2

- Oryx Dental Software

- Patterson Dental Supply, Inc.

- PDDS Buyer, LLC

- Pearl Dental Software by Baker Heath Associates Limited

- Praktika by Lizard Software Pty. Ltd.

- Ultimo Software Solutions Inc.

- vcita Inc.

Developing Actionable Strategic Recommendations for Industry Leaders to Capitalize on Cloud-Based Dental Practice Software Opportunities and Future-Proof Operations

Given the current market dynamics, industry leaders should prioritize the development of modular product architectures that allow seamless scalability and rapid feature customization. By adopting a microservices-based approach, software providers can accelerate time to market for new capabilities while minimizing disruption to existing client workflows. It is imperative to expand API ecosystems, enabling integration with emerging telehealth platforms, digital radiography systems, and electronic health record networks. This will not only improve interoperability but also create avenues for strategic alliances with vendors in adjacent healthcare technology segments. Furthermore, investing in user experience optimization, with an emphasis on mobile-responsive design and intuitive dashboards, will drive higher adoption rates among time-constrained dental professionals.

In parallel, firms must refine their go-to-market strategies by leveraging targeted educational programs and community-driven support initiatives. Hosting virtual and in-person training sessions that showcase best practices for clinical documentation and appointment management can enhance product stickiness. Equally important is the implementation of flexible pricing frameworks that align with the financial realities of different practice sizes and specializations. Offering tiered subscription models with optional add-on services-for example, advanced analytics or teledentistry modules-allows practices to tailor their investment to immediate priorities while preserving room for future expansion. Leadership teams should also explore selective acquisitions or partnerships to fill gaps in service offerings, particularly in regions where local regulatory compliance and language support are critical

Detailing the Robust Research Methodology Combining Primary Interviews and Secondary Data to Ensure Comprehensive Analysis and High-Fidelity Market Insights

To ensure a comprehensive and robust analysis, this report employs a mixed-method research methodology that synthesizes qualitative insights from primary interviews with quantitative data from reliable secondary sources. Over thirty in-depth interviews were conducted with dental practice owners, clinical directors, IT administrators, and software vendors to capture first-hand perspectives on purchasing criteria, integration challenges, and emerging feature requirements. These conversations were supplemented by surveys targeting end users across diverse geographic regions, enabling a granular understanding of adoption drivers and pain points. The integration of primary stakeholder feedback provides critical context for interpreting market trends and aligning strategic recommendations with real-world practice needs.

Secondary research was conducted through systematic reviews of publicly available industry reports, regulatory filings, vendor publications, and technology white papers. Special attention was paid to tracking changes in health data privacy regulations, tariff legislation, and telehealth reimbursement policies to evaluate their implications on cloud software adoption. Vendor benchmarking tables were created by analyzing product feature sets, support offerings, and customer satisfaction ratings. Regional market sizing and competitive intensity assessments were derived from a combination of government healthcare statistics, industry association data, and expert analyst commentary. This dual-layered approach ensures that the findings and conclusions presented in this report are underpinned by rigorous data validation and multidimensional insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud-Based Dental Practice Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud-Based Dental Practice Management Software Market, by Type

- Cloud-Based Dental Practice Management Software Market, by Category

- Cloud-Based Dental Practice Management Software Market, by Pricing Model

- Cloud-Based Dental Practice Management Software Market, by Application

- Cloud-Based Dental Practice Management Software Market, by End-User

- Cloud-Based Dental Practice Management Software Market, by Region

- Cloud-Based Dental Practice Management Software Market, by Group

- Cloud-Based Dental Practice Management Software Market, by Country

- United States Cloud-Based Dental Practice Management Software Market

- China Cloud-Based Dental Practice Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Findings and Strategic Takeaways to Illustrate the Transformative Potential of Cloud-Based Dental Practice Management Software for Stakeholders

In conclusion, cloud-based dental practice management software stands at the intersection of technological innovation and evolving healthcare delivery models. The convergence of artificial intelligence, mobile-enabled workflows, and strategic ecosystem partnerships has set a new standard for operational efficiency and patient engagement. While the introduction of tariff policies in 2025 has momentarily altered the cost structure for hardware-dependent solutions, the flexibility of cloud-based architectures and creative pricing models have effectively mitigated these challenges. Market participants that embrace modular design principles, prioritize interoperability, and cultivate collaborative alliances will be best positioned to capture the next wave of growth.

Looking ahead, the dental industry is poised for continued digital transformation as regulatory frameworks mature and practitioner expectations evolve. Success will hinge on the ability of software providers to balance innovation with compliance, delivering platforms that anticipate future clinical needs while ensuring data security and ease of use. Decision-makers should view this landscape as an opportunity to redefine patient care paradigms, harnessing data-driven insights to optimize treatment outcomes and practice profitability. By leveraging the strategic guidance outlined in this report, stakeholders can confidently navigate the shifting currents of the cloud dental software market and secure enduring competitive advantage.

Engage with Ketan Rohom Associate Director Sales & Marketing to Unlock Premium Access and Strategic Advantages Through the Comprehensive Market Research Report

To gain full access to the in-depth market analysis, strategic insights, and tailored growth recommendations outlined in this executive summary, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to purchase the comprehensive market research report and secure a competitive edge

- How big is the Cloud-Based Dental Practice Management Software Market?

- What is the Cloud-Based Dental Practice Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?