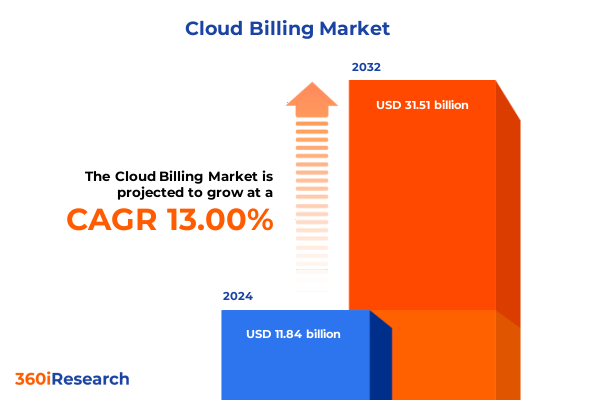

The Cloud Billing Market size was estimated at USD 13.36 billion in 2025 and expected to reach USD 15.07 billion in 2026, at a CAGR of 13.04% to reach USD 31.51 billion by 2032.

Navigating Cloud Billing Dynamics with Strategic Insight to Unlock Operational Efficiency and Financial Control for Modern Enterprises

Cloud billing has emerged as a pivotal discipline for organizations navigating the complexities of digital transformation, where financial agility and operational transparency form the bedrock of IT strategy. As enterprises increasingly migrate workloads to multi-cloud and hybrid environments, understanding the nuances of consumption-based pricing models becomes essential for maintaining cost control and optimizing resource utilization. In this context, an executive summary serves as a strategic compass, distilling intricate research findings into actionable insights that empower decision makers to align cloud investments with broader business goals.

By exploring the foundational principles of cloud billing, this section establishes the conceptual framework necessary to interpret subsequent analyses. It outlines how evolving service models, regulatory changes, and evolving procurement practices intersect to reshape traditional budgeting and forecasting processes. Moreover, an introduction of this nature underscores the significance of building a robust governance structure, where policies, tagging strategies, and visibility tools converge to deliver financial accountability. Consequently, the narrative not only frames the analytical depth of the full report but also sets the stage for an informed discourse on cost optimization, vendor management, and value realization.

Embracing a New Era of Cloud Billing with Service Model Innovations and Dynamic Pricing Architectures Driving Operational Excellence

The cloud billing ecosystem has experienced a transformative shift driven by the proliferation of granular service models and evolving customer expectations. Where previously organizations grappled with coarse cost buckets, emerging paradigms such as containerized offerings and serverless execution have elevated the importance of precision metering. This transition reflects a broader trend toward modular consumption, where businesses only pay for discrete units of compute, storage, or platform capabilities, thus fostering an environment that rewards efficiency and innovation.

In parallel, dynamic pricing architectures have gained traction, empowering providers to introduce tailored rate cards that align more closely with high-volume usage patterns and seasonal demand fluctuations. As a result, enterprises are compelled to adopt real-time visibility tools capable of reconciling detailed billing records with performance and usage metrics. Furthermore, the integration of machine learning-driven cost analytics has unlocked predictive insights, enabling proactive budget alerts and anomaly detection routines that mitigate unforeseen expenses. Collectively, these shifts underscore a maturation of the cloud billing discipline, signaling a departure from static invoicing toward adaptive, data-driven financial management frameworks.

Analyzing the 2025 United States Tariff Cumulative Impacts on Cloud Billing Practices Cost Optimization and Vendor Strategies

Throughout 2025, the United States implemented a series of tariff adjustments that directly influenced the economics of cloud infrastructure and service delivery. These cumulative measures, aimed at balancing trade dynamics, introduced incremental cost pressures on hardware components, network equipment, and software licenses integral to cloud platform operations. Consequently, providers faced a dual challenge: absorbing part of the increased expenses or passing them through to consumers, each option carrying distinct strategic implications.

As tariff-related cost increments rippled across supply chains, cloud service vendors responded by recalibrating their procurement strategies, diversifying manufacturing partnerships, and negotiating alternative sourcing agreements to preserve competitive pricing tiers. In turn, enterprises felt the impact through adjusted rate cards for compute instances, bandwidth usage, and managed service fees. This environment compelled organizations to refine their budget planning cycles and develop more resilient vendor management protocols. Moreover, the tariff landscape underscored the necessity of flexible contract structures that accommodate macroeconomic volatility, thereby shielding both providers and customers from sudden cost escalations.

Unearthing Critical Segmentation Insights Revealing Varied Cloud Billing Patterns Across Service Types Billing Methods Industry Verticals and Organization Sizes

Key segmentation insights reveal that cloud billing behavior varies significantly when analyzed through the lens of service type. For instance, container usage driven by both Docker and Kubernetes architectures has established a new baseline for consumption spikes and micro-billing events. At the same time, serverless executions under Function as a Service models shift the economic emphasis from persistent resource allocation to event-triggered pricing. Infrastructure services such as compute, networking, and storage continue to command classic usage patterns, yet they too are influenced by the rise of spot and reserved instance strategies. Platform offerings in AI, analytics, and database services bring additional layers of complexity as fluctuating query volumes and model training costs become core considerations. Meanwhile, collaboration suites, customer relationship tools, and ERP applications within Software as a Service frameworks demonstrate converging subscription and usage-based billing hybrids.

When factoring billing method, enterprises show a clear preference for postpaid arrangements, valuing the flexibility of usage reconciliation, while prepaid commitments appeal to organizations seeking capex-like predictability. Industry vertical analysis further distinguishes the unique billing profiles of sectors such as banking, healthcare, telecom, manufacturing, and retail, each with distinct compliance, performance, and consumption drivers. Finally, organization size underscores divergent priorities: large enterprises leverage advanced governance and consolidated billing to optimize sprawling environments, whereas smaller firms emphasize simplicity and cost certainty through streamlined invoicing approaches.

This comprehensive research report categorizes the Cloud Billing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Billing Method

- Industry Vertical

- Organization Size

Delving into Regional Cloud Billing Trends Highlighting Diverse Adoption Drivers and Regulatory Influences Across the Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping cloud billing strategies across global operations, beginning with the Americas, where competitive pressures and mature digital ecosystems drive providers to introduce sophisticated cost management features. Regulatory environments in key markets incentivize transparent billing disclosures and standardized audit trails, compelling vendors and customers alike to prioritize compliance-ready invoicing. Meanwhile, emerging economies in Latin America exhibit growing adoption rates, characterized by demand-driven pricing negotiations and hybrid billing adaptations that align with localized infrastructure developments.

Transitioning to Europe, the Middle East, and Africa, divergent regulatory mandates-from stringent data residency requirements to variable import duties-exert distinct influences on billing structures. Organizations in this expansive region navigate a mosaic of tax regimes and service-level agreements, often opting for multi-tier billing architectures that reconcile cross-border deployments. In addition, geopolitical considerations prompt a rise in sovereign cloud options, introducing specialized rate cards and governance addendums. In the Asia-Pacific arena, rapid digital transformation initiatives and government-led cloud adoption programs spur demand for flexible billing models, particularly among public sector entities and fast-growing enterprises. Moreover, regional partnerships between domestic providers and global hyperscalers have given rise to co-branded offerings that blend global pricing standards with local market incentives.

This comprehensive research report examines key regions that drive the evolution of the Cloud Billing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Billing Innovators Uncovering Competitive Strategies Partnerships and Technological Differentiators Shaping the Market Landscape

Leading cloud billing innovators have demonstrated a commitment to embedding advanced analytics and automation at the core of their commercial offerings. Amazon Web Services, for instance, has invested heavily in native cost optimization tools that synthesize usage telemetry and financial reporting, enabling clients to implement automated rightsizing and budget enforcement across multi-account structures. Google Cloud’s billing platform stands out for its intuitive dashboards and integration with its broader AI services, offering predictive spend forecasting and anomaly detection capabilities woven directly into the pricing interface. Microsoft Azure, with its enterprise scale, continues to refine chargeback and showback features, empowering organizations to allocate costs across departments with unparalleled granularity.

Beyond the hyperscale players, specialized billing vendors are carving niches through cloud-agnostic dashboards and policy-driven automation engines. These providers integrate with multiple hyperscalers to deliver unified invoicing, customizable rate card comparisons, and governance policy enforcement, appealing to organizations juggling complex multi-cloud estates. Collaboration with major platform partners and continuous feature enhancements underscore the competitive dynamics of this space, where rapid innovation cycles and strategic alliances determine market positioning and customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Billing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amdocs Limited

- Comarch S.A.

- CSG International, Inc.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Netcracker Technology Corporation

- Oracle Corporation

- Recurly, Inc.

- SAP SE

- Stripe, Inc.

- Telefonaktiebolaget LM Ericsson

- Zuora, Inc.

Empowering Industry Leaders with Actionable Recommendations to Optimize Cloud Billing Frameworks Enhance Cost Transparency and Drive Scalable Growth Trajectories

To optimize cloud billing frameworks, industry leaders should adopt granular metering and tagging strategies that align resource usage with organizational cost centers. By standardizing metadata conventions across cloud environments, finance and IT teams can collaborate more effectively on usage reconciliation, budget forecasting, and anomaly investigations. In addition, integrating artificial intelligence and machine learning algorithms into cost management platforms empowers proactive identification of inefficiencies, ensuring that scaling decisions are informed by both performance metrics and financial thresholds.

Furthermore, organizations must cultivate a governance culture that embraces continuous policy refinement and cross-functional accountability. Establishing clear chargeback mechanisms and showback principles not only enhances transparency but also fosters a sense of ownership among business units. Vendor relationships should be approached as strategic partnerships, with regular rate card reviews and term renegotiations to capture volume discounts and emerging service credits. Lastly, embedding cost management into the DevOps lifecycle ensures that teams build cost-efficient architectures from inception, driving sustainable growth while maintaining financial discipline.

Detailing a Rigorous Research Methodology Combining Primary Stakeholder Interviews Secondary Data Analysis and Expert Validation for Unbiased Insights

The research underpinning this executive summary combines rigorous primary and secondary methodologies to ensure comprehensive validity and reliability. Initially, interviews with C-level executives, cloud architects, and procurement specialists provided firsthand perspectives on emerging billing challenges and strategic priorities. These qualitative insights were then triangulated with vendor documentation, public policy announcements, and regulatory filings to construct a robust analytical foundation.

In parallel, secondary data analysis leveraged industry reports, technology whitepapers, and peer-reviewed research to contextualize tariff impacts and regional regulatory influences. The integration of expert panels further validated key findings, offering peer review from practitioners and academicians specializing in cloud economics. This multi-pronged approach, encompassing stakeholder dialogues, documentary review, and expert consensus, ensures that the insights presented are not only data-driven but also reflective of real-world complexities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Billing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Billing Market, by Service Type

- Cloud Billing Market, by Billing Method

- Cloud Billing Market, by Industry Vertical

- Cloud Billing Market, by Organization Size

- Cloud Billing Market, by Region

- Cloud Billing Market, by Group

- Cloud Billing Market, by Country

- United States Cloud Billing Market

- China Cloud Billing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings into a Cohesive Framework Guiding Decision Makers Through Cloud Billing Complexities and Strategic Opportunity Identification

This executive summary captures the essence of a rapidly evolving cloud billing environment, where transformative service models and external economic factors converge to redefine traditional cost management paradigms. The cumulative impact of United States tariff adjustments has underscored the importance of agility in procurement and contract structures, while segmentation and regional analyses reveal the diverse consumption patterns that organizations must navigate.

Key takeaways include the necessity of granular analytics, the strategic value of governance frameworks, and the competitive differentiators offered by leading billing platforms. By synthesizing these findings, decision makers gain a coherent roadmap for optimizing both technology and financial operations. Ultimately, the interplay of innovation, regulatory shifts, and vendor strategies emphasizes that effective cloud billing management is not merely a back‐office function but a strategic enabler of sustainable digital transformation.

Seize the Opportunity to Gain In-Depth Cloud Billing Intelligence by Connecting with Ketan Rohom for Comprehensive Research Access and Tailored Insights

For tailored insights and to fully leverage the comprehensive cloud billing intelligence outlined in this report, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His deep understanding of cloud cost management and strategic market dynamics enables him to guide your team toward the precise solutions that align with your organization’s unique objectives. By reaching out, you’ll gain exclusive access to our full suite of research methodologies, proprietary data sets, and expert analyses designed to fuel your decision-making process and secure a competitive advantage in the rapidly evolving cloud billing landscape

- How big is the Cloud Billing Market?

- What is the Cloud Billing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?