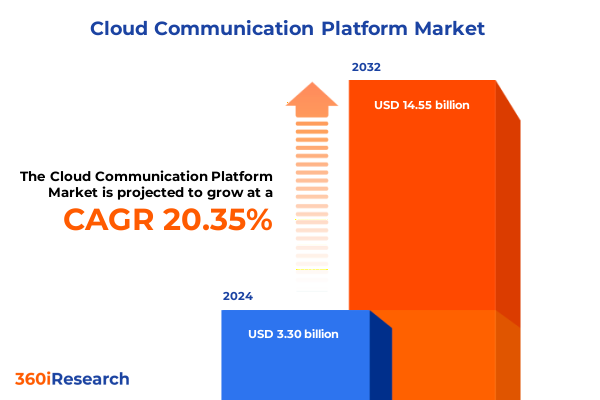

The Cloud Communication Platform Market size was estimated at USD 3.94 billion in 2025 and expected to reach USD 4.71 billion in 2026, at a CAGR of 20.50% to reach USD 14.55 billion by 2032.

Introduction to cloud communications strategic value for enterprises navigating digital transformation, customer experience, and operational continuity

Cloud communication platforms have moved from a tactical cost-saving alternative to a strategic backbone for customer engagement and operational resiliency. Organizations increasingly treat messaging, voice, video, and contact-center APIs as programmable infrastructure that enable faster product launches, richer customer experiences, and tighter integration with CRM and analytics systems. Consequently, teams charged with digital transformation view platform selection not merely as a procurement exercise but as a competitive architecture decision that affects time-to-market, service continuity, and the ability to monetize new channels.

Today’s environment requires leaders to balance agility with risk management. As enterprises weave cloud communications into core workflows, they also face new imperatives around data residency, interoperability, and vendor lock-in. This duality - opportunity on one hand and governance pressure on the other - means that the introduction of new features such as AI-driven routing or programmable video must be accompanied by clear operational playbooks and security controls. The result is that communications strategy is now inseparable from broader enterprise strategy, demanding collaboration across product, security, procurement, and legal teams.

Transformative market shifts driving cloud communications where AI orchestration, API-first design, and supply chain resilience are redefining market dynamics

The landscape for cloud communications is being reshaped by three transformative forces that operate in parallel: rapid adoption of AI and automation, an API-first product evolution, and increased supply-chain scrutiny tied to trade policy and sourcing resilience. AI has already shifted contact-center workflows from scripted responses to intent-driven orchestration, enabling more efficient self-service and the emergence of “super agents” who handle complex cases while AI handles routine interactions. At the same time, API-first architectures accelerate integration across sales, marketing, and operations, turning discrete communication capabilities into composable building blocks.

Concurrently, macroeconomic and geopolitical pressures are forcing buyers to reassess total cost of ownership and procurement risk. Tariff uncertainty and hardware supply volatility are encouraging firms to extend device lifecycles, rebalance between cloud and on-premises investments, and prioritize vendors with flexible sourcing footprints. Taken together, these shifts are changing buying criteria: agility, security, and supplier transparency now carry as much weight as feature parity and price. Organizations that adopt a systems view - treating communications as part of a larger customer-operations fabric - will extract disproportionate value from new capabilities while containing risk. The drive to marry innovation with resilience is now a defining theme of the market, and it is prompting investment in platform modularity, observable pipelines, and cross-functional governance.

Assessing cumulative impact of 2025 United States tariffs on cloud communications supply chains, procurement costs and innovation incentives

The suite of tariffs and trade measures introduced across 2024–2025 has created cumulative pressures that ripple into cloud communications through hardware, semiconductors, and component availability. Tariff actions that target chips and critical electronic components increase procurement cost risk for data centers and edge hardware, and they also shift the calculus for where vendors assemble and source equipment. These policy moves have amplified conversations about reshoring, supplier diversification, and the lifecycle extension of existing infrastructure; procurement teams now routinely model tariff exposure as a material line-item in contract negotiations and capital planning.

Beyond procurement, the tariffs carry an innovation dimension: higher input costs for semiconductors and related components can slow experimental deployments that rely on on-premises or edge compute, nudging some workloads further toward hyperscale cloud providers while incentivizing investment in domestic fabrication where possible. The policy environment therefore has both near-term operational consequences and longer-term strategic implications for where compute and communications innovation happens. Organizations are responding with a mix of forward purchasing, phased hardware refresh schedules, and partnerships that emphasize manufacturing transparency and dual-sourcing strategies. These dynamics are increasing the premium placed on vendors who can demonstrably manage multi-region supply chains and alternative sourcing to mitigate tariff-driven disruptions.

Segmentation insights on how pricing models, deployment choices, communication offerings, organization size, and verticals influence adoption and vendor choices

Segmentation reveals differentiated buyer behavior and implementation patterns across multiple vectors that matter to product, go-to-market, and procurement teams. When viewed through pricing models, organizations evaluate freemium and pay-as-you-go options for rapid experimentation and developer-led projects, while subscription contracts are preferred for predictable enterprise deployments and bundled operational support. Deployment model choices-ranging across hybrid cloud, private cloud, and public cloud-reflect distinct trade-offs between control, latency, and regulatory constraints; hybrid approaches have become especially popular for latency-sensitive or data-residency constrained use cases.

Communication type segmentation provides more granular guidance for architecture and roadmap decisions. Communications Platform as a Service offerings (including chat APIs, messaging APIs, video APIs, and voice APIs) attract engineering-led adopters seeking composability and rapid iteration. Contact Center as a Service implementations vary by inbound contact center, omnichannel contact center, and outbound contact center requirements, with omnichannel orchestration increasingly prioritized to create unified conversation histories across voice, chat, and messaging. Unified Communication as a Service deployments emphasize integrated messaging, video, and voice for internal collaboration and distributed teams. Organization size remains a practical differentiator: large enterprises prioritize scale, security, and vendor SLAs, medium enterprises balance cost and customization, and small enterprises seek low-friction onboarding and predictable pricing. Industry verticals - including banking, financial services and insurance, government, healthcare, IT and telecom, and retail - impose specialized requirements around compliance, latency, and integration with core business systems. The combined segmentation lens informs not only product roadmaps but commercial packaging, enabling companies to align features and contracts to distinct buyer journeys.

This comprehensive research report categorizes the Cloud Communication Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pricing Model

- Communication Type

- Organization Size

- Deployment Model

- Industry Vertical

Regional insights on differentiated demand drivers and regulatory factors across Americas, Europe Middle East & Africa, and Asia-Pacific for cloud communications

Regional forces alter both demand and risk profiles, producing distinct strategies across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, enterprises prioritize rapid innovation, broad omnichannel customer engagement, and tight integration with CRM and analytics stacks; procurement sensitivity to tariff exposure and nearshoring opportunities also drives interest in transparent sourcing and domestic support capabilities. Meanwhile, Europe Middle East & Africa markets often layer additional regulatory and data-residency constraints onto procurement decisions, pushing a higher share of deployments toward private or hybrid models and prioritizing vendors with clear compliance credentials and in-region data handling.

Asia-Pacific presents a different mix of scale and sovereignty dynamics. High-growth digital markets in the region prize low-latency experiences, native messaging integrations, and flexible pricing models that accommodate rapid user growth. At the same time, diverse regulatory regimes and commerce patterns mean that vendors must plan for varied deployment architectures and localized feature sets. Across all regions, the commercialization playbook that succeeds is one that is both globally consistent in security posture and locally adaptable in deployment, commercial terms, and support models. Understanding these regional nuances helps vendors prioritize feature rollouts, set service levels, and design partnership ecosystems that reflect where customers operate and how they consume communication capabilities.

This comprehensive research report examines key regions that drive the evolution of the Cloud Communication Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company insights on vendor strategies, consolidation, partnerships, and innovation priorities reshaping the cloud communications competitive landscape

Company strategies are converging around three visible priorities: platform modularity, partner ecosystems, and differentiated AI capabilities. Vendors that invest in composable APIs and robust developer experiences are better positioned to win engineering-led deals, while those that build turnkey integrations for enterprise stacks capture buyers looking for rapid production readiness. Mergers and strategic partnerships remain active playbooks for filling technical gaps, accelerating time-to-market, and extending geographic reach; consolidation activity, alliances with systems integrators, and reseller programs are all instruments used to accelerate adoption.

Innovation priorities now center on responsible AI for conversational automation, enhanced security controls, and predictable operational economics. Firms that can demonstrate explainable AI behavior, robust privacy controls, and transparent data practices earn higher trust in regulated verticals. Additionally, companies that offer flexible commercial terms-such as mixed pricing models or tariff-aware procurement options-gain an advantage when customers are managing capital budgets under policy and supply risks. Competitive differentiation increasingly depends on being both a reliable infrastructure partner and an innovation-driven vendor that supports rapid experimentation without exposing customers to undue operational or regulatory risk.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Communication Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CLogic, Inc.

- 8x8, Inc.

- Aircall.io, Inc.

- Alvaria, Inc.

- Ameyo Pvt. Ltd.

- Avaya Inc.

- Bandwidth Inc.

- Cisco Systems, Inc.

- Content Guru Limited

- Enghouse Interactive Inc.

- Evolve IP, LLC

- Five9, Inc.

- Genesys Telecommunications Laboratories, Inc.

- Lifesize, Inc.

- Microsoft Corporation

- Mitel Networks Corporation

- NICE Ltd.

- RingCentral, Inc.

- Sinch AB

- Twilio Inc.

- Vonage Holdings Corp.

- Zoom Video Communications, Inc.

Actionable recommendations for leaders to optimize procurement, adopt secure AI, diversify supply chains, and realign commercial models with client needs

For industry leaders, the immediate priorities are pragmatic and tactical while also requiring strategic commitment. First, procurement models should be updated to include tariff scenario analysis, forward-buying options for critical hardware, and contractual protections that allocate sourcing risk appropriately. Second, accelerate secure AI adoption in customer-facing channels by piloting narrowly scoped use cases that deliver measurable efficiency gains, while simultaneously implementing guardrails for data privacy, model monitoring, and human escalation pathways. Third, diversify supply chains and demand clearer manufacturing provenance from vendors; dual-sourcing and regional inventory strategies reduce exposure to localized trade disruptions.

Leaders should also realign commercial models to reflect evolving buyer preferences: offer developer-friendly, pay-as-you-go options for innovation teams while retaining enterprise-grade subscription packages for production operations. Invest in interoperability and open APIs to lower migration friction and strengthen negotiating leverage. Finally, operationalize resilience by extending hardware refresh cycles where feasible, establishing contingency plans with cloud providers and integrators, and requiring vendors to disclose their supply-chain resilience strategies. These combined moves lower risk while preserving the ability to capture the value unlocked by AI, omnichannel orchestration, and programmable communications.

Methodology overview of data sources, primary and secondary research, mixed-method synthesis, and validation protocols underpinning the study's findings

This analysis synthesizes primary interviews with practitioners, supplier briefings, and secondary research drawn from industry reporting, policy analyses, and vendor disclosures. Primary research included structured interviews with procurement leads, platform architects, and contact-center operations executives to validate vendor claims and to surface practical mitigation strategies for tariff and supply risks. Secondary sources supplemented primary inputs by providing contemporaneous reporting on policy developments, supply-chain disruptions, and industry adoption patterns.

The study applied a mixed-method approach: qualitative coding of interview transcripts to identify recurring themes, paired with comparative analysis of vendor feature sets and commercial terms. Findings were validated through triangulation across sources and through a review of documented procurement actions taken by enterprises in response to tariff announcements. Where possible, vendor capabilities were assessed against technical criteria such as API breadth, security certifications, and multi-region deployment options. The methodology aims to provide robust directional insight and practical recommendations for decision-makers while acknowledging that ongoing policy shifts and vendor updates require continual re-evaluation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Communication Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Communication Platform Market, by Pricing Model

- Cloud Communication Platform Market, by Communication Type

- Cloud Communication Platform Market, by Organization Size

- Cloud Communication Platform Market, by Deployment Model

- Cloud Communication Platform Market, by Industry Vertical

- Cloud Communication Platform Market, by Region

- Cloud Communication Platform Market, by Group

- Cloud Communication Platform Market, by Country

- United States Cloud Communication Platform Market

- China Cloud Communication Platform Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusion synthesizing strategic implications for executives, the need for resilient architectures, and practical pathways to sustain competitive advantage

In conclusion, cloud communications are now a strategic enabler rather than a point solution; the interplay between AI, API composability, and supply-chain realism determines which organizations capture the upside of richer customer engagement and improved operational efficiency. Executives should view platform decisions through a lens that balances innovation velocity with governance and procurement resilience. The combination of tariff-driven uncertainty and accelerating AI capabilities means that organizations that plan for flexibility-both in sourcing and in architecture-will sustain competitive advantage.

Leaders should therefore prioritize modular, API-first platforms with clear compliance postures, insist on vendor transparency regarding sourcing and manufacturing, and adopt phased AI deployments that demonstrate ROI while preserving customer trust. By doing so, organizations can harness emerging capabilities without exposing themselves to disproportionate operational or regulatory risk, positioning communications as a durable foundation for differentiated customer experiences and long-term growth.

Contact Ketan Rohom Associate Director Sales & Marketing to purchase the market research report and access tailored licensing, briefings, and strategic support

For purchase inquiries and to arrange an executive briefing, please contact Ketan Rohom, Associate Director Sales & Marketing. Ketan can coordinate customized licensing, tailored briefings, and strategic support that align the report’s insights with your organization’s priorities. Engage Ketan to request a corporate license, ask about bespoke addenda that focus on procurement or technical integration, or schedule a confidential consult to translate findings into an actionable roadmap for your teams. The engagement can include guided walkthroughs of segmentation implications, prioritized risk-mitigation measures, and a focused review of tariff-driven procurement scenarios to support board-level and operational decision making. Reach out to arrange a short exploratory conversation so your leadership can rapidly apply the research findings to vendor negotiations, platform selection, and multi-year modernization plans.

- How big is the Cloud Communication Platform Market?

- What is the Cloud Communication Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?