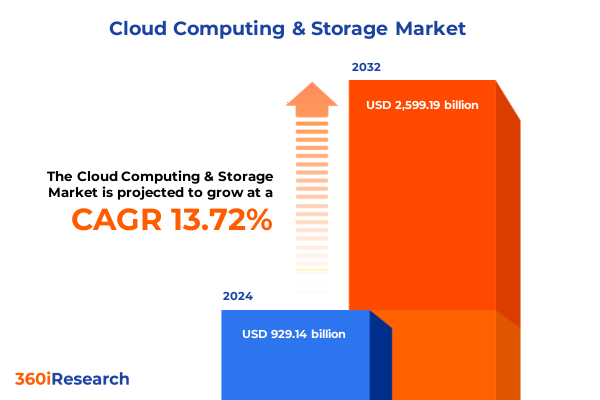

The Cloud Computing & Storage Market size was estimated at USD 1.05 trillion in 2025 and expected to reach USD 1.19 trillion in 2026, at a CAGR of 13.69% to reach USD 2.59 trillion by 2032.

Outlining the Strategic Context of Cloud Computing and Storage with Emphasis on Technological Advances, Market Dynamics, and Critical Growth Drivers

This executive summary presents a high-level overview of a transformative era in cloud computing and storage, laying out the strategic context that frames current market developments and future trajectories. It underscores the critical role that cloud architecture and scalable storage solutions play in driving digital transformation across enterprises. As organizations grapple with accelerating data volumes, tightening regulatory requirements, and intensifying security challenges, this document highlights the imperative for stakeholders to align technological investments with evolving operational demands.

From an economic perspective, the accelerating pace of digital adoption has elevated cloud computing and storage from supplementary IT functions to core business enablers. Moreover, the confluence of emerging technologies such as artificial intelligence, edge computing, and advanced networking protocols has catalyzed new service models and consumption patterns. Through this summary, readers will gain clarity on how these factors converge to create compelling opportunities for innovation and growth. Transitional insights guide decision-makers through complex considerations, from cost containment strategies to optimizing resource allocation in hybrid environments, ensuring that organizational priorities remain aligned with architectural best practices and regulatory compliance landscapes

Examining the Transformative Shifts in Cloud and Storage Architectures Driven by Edge Computing, AI Integration, Hybrid Solutions, and Sustainability Priorities

The landscape of cloud infrastructure and storage is undergoing seismic transformations driven by the integration of edge computing, AI workloads, hybrid deployment models, and rising sustainability commitments. Edge computing has shifted critical processing to the network’s periphery, reducing latency and enabling real-time analytics for industries ranging from manufacturing to healthcare. Concurrently, the infusion of artificial intelligence into cloud-native architectures is reshaping how workloads are orchestrated, with machine learning optimizations driving more efficient resource utilization and predictive maintenance capacities.

Hybrid and multi-cloud strategies have ascended from niche approaches to mainstream architectures, offering greater flexibility and risk mitigation by distributing workloads across public, private, and edge environments. This trend is underpinned by advanced orchestration tools and standardized APIs that bridge previously siloed infrastructures. At the same time, environmental concerns and corporate social responsibility initiatives are embedding sustainability priorities into technology roadmaps. Providers and enterprises alike are committing to cleaner energy sources, carbon-neutral data center operations, and hardware lifecycle management policies to minimize environmental impact. These converging shifts underscore the necessity for stakeholders to reevaluate legacy systems, invest in adaptive platforms, and foster collaborative ecosystems that support continual evolution and compliance with emergent standards

Analyzing the Comprehensive Impact of Newly Implemented United States Tariffs on Cloud Computing and Storage Market Dynamics in 2025

In 2025, newly enacted United States tariffs on imported cloud infrastructure hardware and storage components have significantly affected cost structures and supply chain configurations within the sector. By imposing additional duties on servers, networking equipment, and storage arrays sourced from key international suppliers, these measures have prompted both providers and end users to reassess procurement strategies. The immediate impact has been a rise in total cost of ownership for on-premise deployments and a corresponding ripple through managed service offerings that rely on imported hardware platforms.

As a result, strategic sourcing has shifted toward domestic manufacturing and nearshoring solutions, giving rise to partnerships with regional vendors capable of meeting rigorous performance and compliance requirements. Companies have accelerated the diversification of their supplier ecosystems to mitigate concentration risk and reduce exposure to future tariff escalations. Transitional pricing clauses negotiated in service agreements now often include indexation mechanisms tied to duty fluctuations, ensuring more predictable budgeting for enterprise IT departments. Moreover, the tariff environment has galvanized interest in software-defined technologies and virtualized storage architectures that decouple functionality from hardware form factors, allowing organizations to extract maximum value under evolving regulatory constraints

Unveiling Multi-Dimensional Segmentation Spanning Service Types, Cloud Components, Deployment Models, Organization Sizes, and End-User Industries

Unveiling multi-dimensional segmentation insights reveals distinct adoption patterns and investment priorities across various market segments. Within the realm of service offerings, demand is calibrated by the unique value propositions of Backup as a Service, Disaster Recovery as a Service, Infrastructure as a Service, Platform as a Service, Software as a Service, and Storage as a Service. Each of these delivery models addresses specific pain points, from simplifying data protection workflows to enabling rapid application deployment and streamlining operational management.

Examining the cloud service component dimension, compute resources continue to underpin mission-critical workloads, while database services evolve through specialized offerings such as Data Warehousing as a Service, NoSQL Database as a Service, and Relational Database as a Service. Networking services are being enhanced by modular Content Delivery Network architectures, programmable load balancing solutions, and secure Virtual Private Networks that support distributed workforces. Security and compliance tools have matured to include robust data encryption mechanisms, sophisticated identity and access management frameworks, and advanced threat and intrusion management systems. Alongside these, storage capabilities range from high-performance block volumes to cost-effective object storage tiers, catering to a diverse array of use cases.

Deployment preferences bifurcate between on-cloud environments that maximize elasticity and on-premise configurations that satisfy latency, residency, or sovereign data requirements. Within organizational profiles, large enterprises leverage their scale to integrate full-stack hybrid infrastructures, whereas small and medium enterprises favor managed services that deliver turnkey simplicity. Sector-specific adoption spans industries such as banking, financial services and insurance; education; government and public sector; healthcare and life sciences; IT and telecommunications; manufacturing; media and entertainment; and retail and e-commerce, each demonstrating unique performance, security, and compliance imperatives

This comprehensive research report categorizes the Cloud Computing & Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Availability Configuration

- Deployment Model

- Industry Vertical

- Organization Size

Highlighting Regional Dynamics and Growth Drivers across the Americas, Europe Middle East and Africa, and Asia-Pacific Cloud Computing and Storage Markets

Regional dynamics in the Americas are characterized by robust enterprise modernization initiatives, with a strong emphasis on hybrid cloud architectures that bridge legacy systems and public cloud investments. North American organizations are leading in the adoption of AI-optimized storage solutions and edge frameworks to support use cases ranging from autonomous driving simulations to digital healthcare platforms. Latin American markets are steadily increasing cloud investments, with local data centers expanding to address data localization requirements and improve application performance.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by stringent data protection regulations, such as GDPR, and emerging digital sovereignty frameworks. Western European nations prioritize sustainability targets within data center operations, while Middle Eastern governments drive national cloud policies to foster digital economies and smart city deployments. Africa’s cloud adoption journey is supported by public-private partnerships that fund broadband expansion and capacity-building initiatives, unlocking new opportunities for fintech and e-learning platforms.

In Asia-Pacific, leading economies are at the forefront of integrating AI-driven analytics and 5G-enabled edge solutions into their cloud strategies. Strong government support for digital transformation, coupled with an abundance of technology talent, fuels rapid growth in cloud-native application development and next-generation storage architectures. Emerging markets in Southeast Asia and Oceania are investing in scalable infrastructure projects that reduce latency across archipelagos and support the burgeoning gaming, e-commerce, and telehealth sectors

This comprehensive research report examines key regions that drive the evolution of the Cloud Computing & Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud and Storage Providers to Illuminate Strategic Initiatives, Partnerships, and Technological Innovations in the Competitive Landscape

Leading cloud and storage providers have adopted differentiated strategies to capture distinct market segments and foster customer loyalty. Hyperscale platforms are intensifying their focus on vertical-specific solutions, embedding compliance libraries and workload optimizations tailored for segments such as financial services and healthcare. Strategic partnerships with hardware OEMs and software integrators have yielded purpose-built appliances that accelerate time-to-value for enterprises seeking turnkey deployment models.

Mid-tier and niche vendors are capitalizing on gaps left by hyperscalers, offering specialized offerings in areas like data sovereignty, low-latency edge processing, and advanced encryption frameworks. These providers emphasize consultative services, guiding clients through complex migrations or bespoke architecture designs. Furthermore, ecosystem expansions through alliances with independent software vendors and systems integrators strengthen go-to-market channels, enabling more cohesive end-to-end solutions.

Innovation roadmaps across the competitive landscape reveal significant investment in next-gen storage technologies such as NVMe over Fabrics, software-defined storage clusters, and immutable backup vaults. Continuous advancements in network virtualization, orchestration tooling, and unified management consoles are reducing operational burdens and fostering developer productivity. Through these strategic initiatives, market participants aim to deliver differentiated value propositions that resonate with both enterprise architects and line-of-business stakeholders

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Computing & Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Adobe Inc.

- Akamai Technologies, Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Box, Inc.

- Capgemini Services SAS

- Cisco Systems, Inc.

- Cloud Software Group, Inc.

- Cloudera, Inc.

- Cognizant Technology Solutions Corporation

- Dell Inc.

- DigitalOcean Holdings, Inc.

- Dropbox, Inc.

- Epicor Software Corporation

- Fujitsu Limited

- Google Inc. by Alphabet Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Lumen Technologies

- Microsoft Corporation

- NetApp, Inc.

- Nutanix Group

- OpenText Corporation

- Oracle Corporation

- Rackspace Technology’s

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- Snowflake Inc.

- Tencent Cloud

- VMware by Broadcom Inc.

- Zoho Corporation

Delivering Actionable Strategic Recommendations to Enable Industry Leaders to Capitalize on Cloud Computing and Storage Opportunities

Industry leaders can seize emerging opportunities by prioritizing hybrid and multi-cloud readiness. Establishing integrated management platforms that provide unified visibility and governance across disparate environments ensures consistent policy enforcement and proactive performance optimization. Simultaneously, embedding robust data governance frameworks that encompass encryption best practices, identity controls, and audit readiness will mitigate regulatory and security risks while supporting strategic compliance objectives.

Investments in edge-enabled storage and compute infrastructures can yield competitive differentiation by enabling real-time analytics and low-latency services in distributed locations. Collaborating with regional partners and leveraging programmable networking services accelerates deployment timelines and optimizes total cost of ownership. Embracing sustainability targets through renewable energy procurement, energy-efficient hardware selection, and circular hardware lifecycle strategies not only aligns with corporate responsibility mandates but also reduces operational expenses over time.

To harness the full potential of cloud-native innovations, organizations should cultivate internal expertise via targeted upskilling programs. Engaging cross-functional teams in proof-of-concept initiatives and building internal centers of excellence fosters a culture of continuous improvement. Finally, diversifying supplier ecosystems and integrating tariff contingency clauses in procurement contracts will ensure resilience against future trade policy shifts and supply chain disruptions

Detailing the Rigorous Research Methodology Incorporating Comprehensive Secondary Analysis, Primary Interviews, and Robust Data Validation for In-Depth Insights

The research methodology underpinning this report integrates both comprehensive secondary analysis and targeted primary insights. Secondary sources include an extensive review of industry publications, government regulations, vendor whitepapers, patent filings, and case study repositories. These materials were systematically evaluated to identify macroeconomic drivers, regulatory frameworks, and emerging technology trends shaping cloud computing and storage.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Computing & Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Computing & Storage Market, by Service Model

- Cloud Computing & Storage Market, by Availability Configuration

- Cloud Computing & Storage Market, by Deployment Model

- Cloud Computing & Storage Market, by Industry Vertical

- Cloud Computing & Storage Market, by Organization Size

- Cloud Computing & Storage Market, by Region

- Cloud Computing & Storage Market, by Group

- Cloud Computing & Storage Market, by Country

- United States Cloud Computing & Storage Market

- China Cloud Computing & Storage Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Strategic Reflections on Cloud Computing and Storage Evolution to Reinforce Key Takeaways and Guide Future Decision-Making Processes

Concluding reflections underscore the rapid evolution and strategic importance of cloud computing and storage in contemporary enterprise architectures. The convergence of edge computing, AI integration, and hybrid deployment models has redefined how organizations approach data management and application delivery. Navigating this complexity demands a balanced strategy that addresses cost efficiency, security imperatives, and sustainability commitments, all while maintaining agility to adapt to future disruptions.

By leveraging the segmentation, regional, and competitive insights presented herein, decision-makers are equipped with a holistic understanding necessary to craft tailored roadmaps. Whether refining cloud migration plans, optimizing multi-cloud governance, or exploring tariff mitigation strategies, the collective findings guide actionable decision-making and foster long-term resilience. Continuous monitoring of policy changes, vendor innovations, and emerging use cases will further refine priorities and support ongoing value creation across the cloud computing and storage ecosystem

Engage Directly with Ketan Rohom to Secure Your Comprehensive Cloud Computing and Storage Market Research Report and Drive Strategic Business Growth

Engaging with an experienced advisor can transform the way organizations harness cloud computing and storage capabilities to achieve strategic objectives and drive sustained value. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to facilitate an in-depth dialogue that uncovers how this comprehensive market research report aligns with your unique business requirements. By leveraging his nuanced understanding of industry trends, technological breakthroughs, and pricing models, you gain personalized guidance that ensures every insight in the report is applied with maximum impact.

To initiate a conversation, simply reach out to schedule a consultation with Ketan Rohom. He will walk you through the report’s structure, highlight sections of particular relevance to your role, and outline tailored purchase options that fit both your budget and timeline. Whether you are evaluating strategic partnerships, optimizing cost structures, or planning for next-generation infrastructure, this report will serve as a foundational resource. Begin your journey toward informed decision-making and competitive differentiation by connecting with Ketan Rohom today.

- How big is the Cloud Computing & Storage Market?

- What is the Cloud Computing & Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?