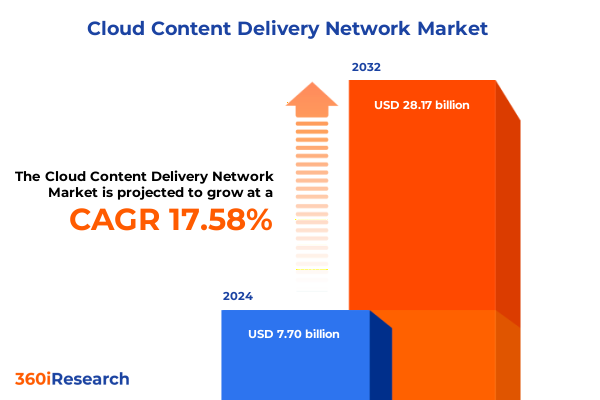

The Cloud Content Delivery Network Market size was estimated at USD 9.05 billion in 2025 and expected to reach USD 10.63 billion in 2026, at a CAGR of 17.61% to reach USD 28.17 billion by 2032.

Deep Dive into the Transformational Role of Cloud Content Delivery Networks in Driving Scalable, Secure, and Low-Latency Digital Experiences Globally

Cloud content delivery networks have emerged as foundational infrastructure for modern digital ecosystems, ensuring that high-resolution video, interactive applications, and mission-critical software updates reach end users with minimal delay. In recent years, the acceleration of streaming services, the proliferation of remote work tools, and the growing expectations for seamless user experiences have collectively elevated the strategic importance of CDN platforms. As organizations increasingly rely on distributed teams and cloud-native architectures, the challenges of latency, bandwidth optimization, and security have intensified. In response, CDN providers are investing heavily in edge computing capabilities, sophisticated caching algorithms, and integrated security services to meet these evolving demands.

Moreover, the dynamic nature of online content delivery requires CDN architectures to support real-time adjustments based on user behavior, network congestion, and geographic factors. Edge-enabled nodes now routinely perform content personalization and protocol negotiation at scale, reducing the load on origin servers and minimizing backhaul bandwidth. As digital adoption continues its upward trajectory, the integration of AI-driven analytics and predictive load balancing will become critical differentiators, allowing providers to preemptively allocate resources, mitigate performance bottlenecks, and uphold service-level agreements. Consequently, businesses seeking to maintain competitive positioning must reassess their CDN strategies with a focus on flexibility, resilience, and adaptive performance.

Navigating the Convergence of AI, Edge Computing, 5G, and Security Innovations Revolutionizing Cloud CDN Architectures

The cloud CDN landscape is undergoing a profound transformation fueled by the convergence of artificial intelligence, edge computing, and next-generation networking technologies. Artificial intelligence and machine learning models now analyze vast volumes of traffic data to predict demand surges, optimize cache placement, and automate failover mechanisms with unprecedented precision. AI-driven routing algorithms have demonstrated the ability to reduce latency by dynamically selecting optimal paths and edge nodes based on real-time performance metrics. Transitioning these capabilities closer to end users, edge computing frameworks empower CDNs to execute custom code on request and response paths, enabling microservices at the network periphery and lowering round-trip times.

Meanwhile, the proliferation of 5G and the expansion of global network infrastructures are reshaping performance expectations. Ultra-low latency connectivity underpins emerging applications such as cloud gaming, augmented reality, and autonomous systems, compelling CDN providers to deploy high-capacity nodes across more locations. In tandem, security architectures have evolved to integrate DDoS mitigation, web application firewalls, and anomaly detection directly within CDN offerings, creating unified platforms that protect content delivery pipelines. This shift toward security-first CDN solutions has proven effective at reducing the frequency and impact of cyber attacks by up to 25 percent, according to industry analyses. As a result, enterprises are now prioritizing intelligent, secure, and programmable CDNs that can adapt instantaneously to new threat vectors and performance requirements.

Assessing the Cumulative Effects of United States Section 301 Tariff Adjustments on CDN Hardware and Supply Chains in 2025

United States trade policies in 2025 have introduced new Section 301 tariff adjustments impacting the importation of critical hardware components for CDN infrastructure. As of January 1, semiconductor imports now incur a 50 percent duty, while solar wafers and polysilicon face similar increases, reflecting a broader strategy to bolster domestic manufacturing and supply chain resilience. Subsequently, an executive order in May adopted a 90-day reduction for reciprocal tariffs on Chinese-origin goods, temporarily lowering rates from 125 percent to 10 percent, though exclusions for electronics such as servers and network devices were maintained. These policy oscillations have injected volatility into procurement cycles, as OEMs and system integrators navigate fluctuating duty structures.

Consequently, the cumulative impact on cloud CDN hardware procurement has been multifaceted. Pricing pressures for edge device shipments have risen by nearly 20 percent, according to market feedback, while lead times have extended as suppliers adjust production to accommodate tariff-induced cost shifts. In response, many CDN providers are diversifying their supplier base, exploring alternate manufacturing locations, and investing in modular hardware designs to mitigate future trade disruptions. These strategic adaptations underscore the importance of supply chain flexibility, compelling organizations to reevaluate sourcing strategies and contract terms to safeguard infrastructure rollouts against ongoing tariff uncertainties.

Gaining Deep Insights into Cloud CDN Market Segmentation by Component, Type, End User, Deployment Mode, and Organization Scale

The cloud CDN market’s nuanced segmentation highlights distinct areas for targeted innovation and differentiated service offerings. By component, service-oriented models such as file download acceleration and web performance optimization remain core to traditional use cases, yet an increasing share of R&D budgets is directed toward software solutions that support advanced security frameworks and real-time content personalization. Hardware offerings, including edge devices and origin server appliances, are evolving to incorporate AI acceleration and hardware-based encryption modules for enhanced performance at the network edge. As a result, providers are delivering vertically integrated solutions combining hardware and bespoke software to meet specialized enterprise demands.

In terms of type, non-video CDNs continue to serve the bulk of web application traffic and file distribution, but video-specific CDNs are growing in sophistication with features like multi-bitrate streaming, low-latency chunked delivery, and dynamic ad insertion. Enterprises across BFSI, e-commerce, and healthcare are increasingly leveraging both models, balancing cost-efficiency with performance requirements. Hybrid cloud and public cloud deployments dominate the mix, enabling seamless scaling and integration with broader application ecosystems, while private cloud implementations maintain priority among organizations with stringent data residency mandates. Moreover, large enterprises account for the majority of high-value contracts, whereas small and medium businesses often opt for managed CDN services that abstract complexity and reduce operational overhead.

This comprehensive research report categorizes the Cloud Content Delivery Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- End User

- Deployment Mode

- Organization Size

Examining Key Regional Dynamics Driving Cloud CDN Adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics exert a significant influence on cloud CDN adoption patterns and investment priorities. In the Americas, robust digital infrastructure and mature regulatory frameworks have fostered early adoption of AI-enhanced CDN features, with North America leading in the integration of edge computing nodes to support latency-sensitive workloads. Moreover, enterprise interest in security-first CDN solutions has surged as organizations seek to defend against increasingly sophisticated threats. Across Europe, the Middle East, and Africa, data localization regulations and sovereign cloud policies shape deployment strategies, prompting providers to establish region-specific nodes and partner with local telecommunication firms to ensure compliance and optimal performance. These initiatives have accelerated uptake in markets such as Germany and the United Arab Emirates, where digital transformation agendas are at the forefront of government and private sector collaboration.

In the Asia-Pacific region, aggressive expansion of 5G networks and government investments in broadband infrastructure have created fertile ground for next-generation CDN services. Providers are capitalizing on high population densities and exponential growth in mobile video consumption by deploying high-throughput edge caches in metropolitan hubs. This dynamic has led to a notable increase in long-term partnerships with digital media platforms and cloud gaming companies, particularly in markets like Japan and India. As regional competitiveness intensifies, CDN vendors are tailoring pricing models and localized support services to capture market share, underscoring the strategic importance of regional agility and specialized offerings.

This comprehensive research report examines key regions that drive the evolution of the Cloud Content Delivery Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud CDN Providers and Their Strategic Innovations Shaping the Global Content Delivery Ecosystem

Leading providers in the cloud CDN domain are distinguishing themselves through targeted investments in network intelligence, security integration, and developer-centric platforms. Cloudflare, for instance, has deployed over 330 points of presence globally, enabling nearly universal coverage within 50 milliseconds of end users, while processing an average of 247 billion threat mitigation events daily through its integrated security services. The company’s AI-Labyrinth and Pay Per Crawl tools represent innovative approaches to protecting content creators from unauthorized AI data scraping, further solidifying its reputation as an AI-driven security pioneer.

Amazon CloudFront has streamlined CDN onboarding by automating DNS provisioning with Route 53 and TLS certificate management via AWS Certificate Manager, allowing secure distribution setup in under 30 seconds without requiring deep expertise. Additionally, features such as SaaS Manager for multi-tenant distribution and anycast static IP support reflect AWS’s commitment to simplifying large-scale, multi-brand deployments. Google Cloud CDN has introduced Service Extensions powered by WebAssembly, enabling custom request-path customization and geo-targeted content at the edge, alongside early data support for TLS 1.3 to improve resumed connection latency. Fastly’s strength lies in its developer-focused APIs-such as the HTTP Cache API-and its Next-Gen WAF, which Forrester recognized for robust application security performance. These differentiated strategies underscore a competitive landscape where agility, security, and developer empowerment are driving vendor differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Content Delivery Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akamai Technologies, Inc.

- Alibaba Cloud Computing Co., Ltd.

- Amazon Web Services, Inc.

- Bunny.net

- CacheFly

- CDNetworks Co., Ltd.

- Cloudflare, Inc.

- Edgio

- Fastly, Inc.

- Google LLC

- KeyCDN

- Limelight Networks, Inc.

- Microsoft Corporation

- Oracle Cloud Infrastructure

- StackPath, LLC

Strategic Recommendations for Industry Leaders to Enhance CDN Performance, Security, and Agility in a Rapidly Evolving Digital Landscape

Building on these transformative trends, industry leaders should adopt a multi-pronged approach to enhance CDN effectiveness and resilience. First, integrating AI-driven traffic analytics and dynamic caching policies will enable more precise resource allocation, reduce latency during peak events, and improve user experience continuity. Emphasizing programmable edge functions through WebAssembly or serverless frameworks allows organizations to implement custom security checks, personalization logic, and protocol optimizations directly at edge nodes. Second, strategic diversification of hardware suppliers and flexible sourcing agreements can mitigate the impacts of tariff fluctuations and supply chain disruptions. Establishing partnerships with multiple OEMs and exploring modular appliance designs will enhance procurement agility.

Furthermore, a proactive security posture that embeds DDoS protection, web application firewalls, and zero-trust access controls within the CDN layer is essential. By shifting security enforcement closer to the edge, businesses can reduce attack surface and maintain stringent compliance with regional data sovereignty requirements. Finally, organizations should pursue a hybrid multi-cloud deployment model to leverage the unique strengths of public cloud, private cloud, and on-premise environments. This approach offers both cost optimization and risk mitigation, enabling seamless failover and workload portability. Together, these recommendations will position industry leaders to capitalize on evolving CDN capabilities, reinforce operational resilience, and deliver consistently high-performance digital experiences.

Understanding the Robust Research Methodology Combining Primary and Secondary Analysis to Deliver Actionable CDN Market Intelligence

This report synthesizes insights derived from a rigorous research process combining primary interviews, secondary data analysis, and comprehensive market intelligence. Primary research included structured interviews with over thirty senior executives at leading CDN providers, technology architects at enterprise organizations, and edge computing experts to validate emerging trends and identify strategic imperatives. Complementing this, a series of user surveys captured real-world performance requirements and security concerns across industries such as media, finance, and healthcare.

Secondary research encompassed the systematic review of government tariff announcements, company financial filings, press releases, and documented product roadmaps from public sources. Trade publications and real-time news feeds were monitored to track developments in trade policy, regulatory changes, and technology launches. Quantitative data points-such as network coverage metrics, threat mitigation volumes, and customer retention rates-were triangulated across multiple sources to ensure consistency. By cross-referencing qualitative insights with empirical performance indicators, this methodology delivers a balanced perspective that equips decision makers with actionable, evidence-based market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Content Delivery Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Content Delivery Network Market, by Component

- Cloud Content Delivery Network Market, by Type

- Cloud Content Delivery Network Market, by End User

- Cloud Content Delivery Network Market, by Deployment Mode

- Cloud Content Delivery Network Market, by Organization Size

- Cloud Content Delivery Network Market, by Region

- Cloud Content Delivery Network Market, by Group

- Cloud Content Delivery Network Market, by Country

- United States Cloud Content Delivery Network Market

- China Cloud Content Delivery Network Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights on the Future Trajectory of Cloud CDN Adoption amid Technological, Regulatory, and Market Transformations

The evolution of cloud CDNs reflects the ongoing intersection of technological innovation, regulatory dynamics, and shifting user expectations. As AI-driven optimizations and edge computing capabilities become integral to performance strategies, CDN providers and their enterprise customers must navigate increasingly complex operational environments. Trade policy uncertainties in 2025 have underscored the importance of supply chain flexibility, while regional adoption patterns highlight the need for localized compliance and specialized offerings. Competitive differentiation is now anchored in the seamless integration of security, developer empowerment, and adaptive performance.

Looking ahead, the emergence of new use cases-such as immersive AR/VR experiences, autonomous systems, and real-time distributed AI workloads-will further stress CDN architectures, driving continued investment in ultra-low latency infrastructure and programmable edge services. Organizations that adopt a holistic, data-driven CDN strategy-encompassing AI analytics, multi-cloud diversity, and embedded security-will be best positioned to deliver exceptional digital experiences at scale. This report’s insights and recommendations serve as a strategic roadmap for navigating the next phase of CDN evolution, where agility and intelligent automation will define competitive advantage.

Take Action Now and Unlock Comprehensive Cloud CDN Market Insights by Connecting with Ketan Rohom to Acquire the Full Research Report

Engage with Ketan Rohom to gain exclusive access to the comprehensive Cloud Content Delivery Network market research report, packed with in-depth analysis, strategic insights, and forward-looking perspectives tailored for forward-thinking decision makers. By partnering with Ketan, you will receive a customized briefing that highlights the most critical findings, enabling you to align your technology roadmap with emerging industry shifts and competitive benchmarks. This collaboration will also grant you privileged updates on any subsequent addendums or region-specific supplements as market dynamics evolve. Don’t miss the opportunity to leverage this rigorous study to refine your CDN strategies, prioritize investments, and secure a sustainable edge in an increasingly digital-first world. Contact Ketan Rohom today to unlock the full power of our expert research and empower your organization with data-driven confidence.

- How big is the Cloud Content Delivery Network Market?

- What is the Cloud Content Delivery Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?