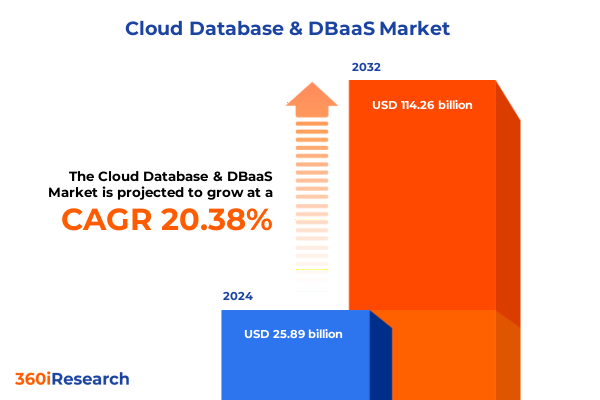

The Cloud Database & DBaaS Market size was estimated at USD 31.13 billion in 2025 and expected to reach USD 37.44 billion in 2026, at a CAGR of 20.41% to reach USD 114.26 billion by 2032.

Unveiling the Critical Drivers Shaping Today’s Cloud Database Landscape Including Performance, Agility, and Cost Efficiency Demands

The enterprise data environment is undergoing a profound transformation driven by the rapid adoption of cloud-native architectures and an ever-expanding demand for real-time insights. Organizations today are balancing the need for robust data governance with the imperative for agility, as the volume and velocity of data continue to grow exponentially. Strategic leaders recognize that legacy on-premises databases no longer suffice to meet modern requirements for scalability, resilience, and cost optimization. Consequently, cloud database solutions have emerged as the linchpin for enterprises seeking to stay competitive in an increasingly data-centric world.

This shift toward data platforms delivered as a service underscores a broader trend toward consumption-based models and modular architectures, where storage, compute, and networking can be scaled independently. As businesses pursue digital transformation initiatives, they confront new questions around multi-cloud portability, vendor lock-in, and performance consistency under fluctuating workloads. The pressure to deliver seamless customer experiences and actionable intelligence is driving IT executives to reassess their data management strategies in favor of platforms that can evolve rapidly without imposing prohibitive costs or complexity.

Examining the Revolutionary Shifts in Cloud Database Architectures Fueled by Emerging Technologies and Evolving Enterprise Requirements

Over the past several years, the cloud database domain has witnessed a convergence of technologies that are reshaping the architectural and operational paradigms of data management. First and foremost, the maturation of container orchestration frameworks and serverless compute engines is enabling truly elastic provisioning of database instances. This elasticity allows workloads to scale on demand, delivering cost efficiencies for intermittent or highly variable transaction volumes. At the same time, developments in in-memory processing and distributed SQL engines are closing the performance gap between traditional on-premises systems and their cloud counterparts.

In parallel, the rise of intelligent automation-leveraging machine learning for index tuning, query optimization, and predictive scaling-has begun to reduce the burden of manual database administration. These autonomous capabilities are complemented by advancements in hybrid connectivity and secure access frameworks, which facilitate seamless data mobility across corporate data centers and public cloud environments. As enterprises migrate mission-critical applications to the cloud, considerations around latency, data sovereignty, and unified security models have become integral to platform selection. Taken together, these transformative shifts have set the stage for a new era of data platform innovation, empowering organizations to harness advanced analytics and mission-critical services with unprecedented agility.

Understanding the Far-Reaching Consequences of Recent United States Tariff Policies on Cloud Database Services and Global Supply Chains

Throughout 2025, a series of tariff adjustments enacted by the United States government have had a cascading effect on the cloud database ecosystem, particularly impacting infrastructure costs, component sourcing, and hardware procurement cycles. Tariffs on critical server and storage hardware have increased capital expenses for service providers, prompting some to pass costs downstream in the form of higher subscription fees. This dynamic has spurred enterprises to re-evaluate workload placement strategies, weighing the total cost of ownership against performance and data residency constraints.

Moreover, the broader trade measures have introduced unpredictability into global supply chains, affecting lead times for specialized components such as NVMe drives and advanced networking gear. As a result, several vendors have intensified efforts to diversify their manufacturing partnerships and localize production to mitigate exposure to tariff volatility. In addition, some organizations have accelerated investments in software-defined storage and hyperconverged infrastructures to reduce reliance on expensive imported hardware. The net effect is a more nuanced cost calculus for end users, who must navigate a complex interplay of regulatory changes, vendor pricing adjustments, and the imperative to maintain uninterrupted service availability.

Revealing Comprehensive In-Depth Segmentation Insights Across Deployment, Database Type, Enterprise Size, and Industry Vertical Dynamics

A comprehensive examination of the market reveals that deployment models each present distinct trade-offs. Hybrid Cloud environments blend on-premises control with public cloud elasticity, enabling workloads to shift seamlessly according to business priorities and cost considerations. Private Cloud implementations, by contrast, offer enhanced security and customization, appealing to industries with stringent compliance requirements. Pure Public Cloud usage, meanwhile, maximizes uplift capabilities and rapid resource provisioning, catering to organizations that prioritize speed of innovation and minimal infrastructure management.

When exploring the landscape by database category, Newsql platforms are gaining traction for their ability to deliver transactional consistency alongside distributed scalability. NoSQL databases, which include column-oriented stores, document databases, graph engines, and key–value pairs, continue to excel in high-throughput, schema-flexible scenarios such as IoT, web applications, and content management. Traditional relational systems-spanning MySQL, Oracle, PostgreSQL, and SQL Server-remain the backbone for established transaction processing and reporting workloads, with increasing native integration into cloud services.

Segmenting by organizational size highlights that large enterprises often drive requirements for advanced performance tuning, multi-region replication, and extensive support SLAs. Meanwhile, small and medium-sized enterprises, which encompass medium businesses, micro organizations, and smaller startups, prioritize ease of use, predictable pricing, and minimal administrative overhead. Across industry verticals-from financial services and insurance, government agencies, and healthcare providers to IT and telecom, and retail and e-commerce-each sector’s unique data gravity and regulatory environment inform platform selection and integration strategies.

This comprehensive research report categorizes the Cloud Database & DBaaS market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Database Type

- Deployment

- Enterprise Size

- Industry Vertical

Uncovering Critical Regional Variations Shaping the Cloud Database Market Across Americas, EMEA, and Asia-Pacific Growth Patterns

Regional dynamics play a pivotal role in shaping how cloud database services evolve and are consumed. In the Americas, a mature ecosystem of hyperscale providers, robust network infrastructure, and a large base of enterprise customers has fostered rapid adoption of advanced data platforms and autonomous database features. Many organizations in this region are pushing the boundaries of real-time analytics, artificial intelligence integration, and microservices architectures, driving providers to enhance global availability and service-level guarantees.

Conversely, the Europe, Middle East & Africa region presents a more fragmented yet strategically expanding market, where data sovereignty regulations and local hosting requirements shape deployment choices. Public sector initiatives and digital transformation funding have accelerated uptake in government and regulated industries, prompting providers to establish region-specific cloud zones and compliance certifications. Notably, several countries across this region are investing heavily in next-generation datacenter infrastructure to attract technology partnerships.

In Asia-Pacific, explosive growth in digital services across e-commerce, telecommunications, and fintech verticals is fueling demand for multi-cloud and hybrid database solutions that can address diverse language, currency, and regulatory considerations. Rapidly developing local cloud providers are emerging as competitive alternatives to global hyperscalers by tailoring offerings to regional performance needs and cost sensitivities. This trifurcated regional landscape underscores the importance of localized strategies, with providers and consumers alike adapting to regulatory, cultural, and technological nuances.

This comprehensive research report examines key regions that drive the evolution of the Cloud Database & DBaaS market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Database Vendors and Innovative Players Shaping the Competitive Landscape Through Strategic Partnerships and Technological Advances

Within this evolving market, a constellation of established hyperscale operators and specialized database vendors are vying for leadership. Major public cloud platforms continue to expand their suite of managed database services, integrating high-performance storage tiers and advanced automation to differentiate on total cost of ownership and operational simplicity. Concurrently, independent software vendors and open source projects are carving out niches with purpose-built engines optimized for niche workloads, such as graph analytics, time-series processing, and real-time event ingestion.

Strategic alliances between cloud providers and database technology pioneers are reshaping the competitive dynamics. Co-development efforts around edge computing, distributed caching, and AI-driven optimization are deepening vendor ecosystems and accelerating roadmap execution. Established incumbents are also leveraging their enterprise customer bases to introduce industry-specific solutions, bundling database capabilities with middleware, integration services, and verticalized analytics. At the same time, upstarts are capitalizing on lean, API-first architectures and transparent pricing models to attract digitally native companies seeking agility without legacy constraints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Database & DBaaS market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Cockroach Labs, Inc.

- Cyfuture India Pvt. Ltd.

- DataStax, Inc.

- EnterpriseDB Corporation

- FairCom Corporation

- Google LLC by Alphabet Inc.

- International Business Machines Corporation

- Lumen Technologies, Inc.

- Microsoft Corporation

- MongoDB, Inc.

- Neo4j, Inc.

- Nutanix, Inc.

- Oracle Corporation

- Rackspace US, Inc.

- Redis Inc.

- SAP SE

- Snowflake Inc.

- Tencent Holdings Limited

- Teradata Operations, Inc.

- TigerGraph, Inc

Delivering Strategic Recommendations to Empower Industry Leaders in Optimizing Cloud Database Investments and Accelerating Innovation

To confidently navigate the shifting cloud database terrain, industry leaders should adopt a multi-pronged strategy. Begin by conducting a comprehensive workload assessment to identify candidates for migration, modernization, or consolidation, paying particular attention to latency sensitivity, transaction volume, and compliance requirements. Next, establish a governance framework that balances central oversight with autonomous team-level database provisioning-this ensures agility while maintaining security and cost controls.

Further, organizations should consider diversifying service providers to mitigate vendor concentration risk, leveraging a combination of public, private, and hybrid environments to optimize cost and performance. Investing in staff capabilities around database DevOps, cloud-native best practices, and automation toolchains will accelerate time to value and reduce administrative overhead. Additionally, engaging closely with vendors on roadmap alignment and pilot programs for new features can secure early access to innovations like AI-driven query acceleration and cross-region disaster recovery. Finally, embedding data observability and continuous benchmarking into daily operations will enable rapid course correction and ensure alignment with evolving business objectives.

Demystifying Our Rigorous Research Methodology Integrating Qualitative and Quantitative Approaches to Deliver Actionable Market Insights

Our research approach integrates a hybrid methodology, combining qualitative insights from executive interviews and expert roundtables with quantitative analysis derived from proprietary usage data and platform telemetry. We began with an extensive literature review of public filings, white papers, and industry reports to establish foundational trends and vendor positioning. This secondary research was complemented by in-depth discussions with CIOs, database architects, and cloud operations leaders to validate emerging priorities and capture first-hand deployment challenges.

On the quantitative side, anonymized usage metrics spanning thousands of database instances provided empirical evidence of adoption patterns, performance benchmarks, and cost drivers across different deployment models. To ensure balanced perspectives, we triangulated findings against third-party surveys, public cloud usage statistics, and software download data. Rigorous data validation protocols, including outlier detection and consistency checks, underpin the credibility of our insights. This multifaceted methodology ensures that the conclusions drawn are both actionable and reflective of real-world practices in cloud database adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Database & DBaaS market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Database & DBaaS Market, by Database Type

- Cloud Database & DBaaS Market, by Deployment

- Cloud Database & DBaaS Market, by Enterprise Size

- Cloud Database & DBaaS Market, by Industry Vertical

- Cloud Database & DBaaS Market, by Region

- Cloud Database & DBaaS Market, by Group

- Cloud Database & DBaaS Market, by Country

- United States Cloud Database & DBaaS Market

- China Cloud Database & DBaaS Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways to Illuminate Future Trajectories in Cloud Database Adoption, Innovation, and Strategic Decision-Making

The convergence of advanced orchestration platforms, autonomous database features, and shifting regulatory landscapes is redefining how organizations manage and extract value from their data assets. As cloud database solutions become ever more sophisticated, enterprises that embrace flexible architectures and invest in operational excellence will differentiate themselves in speed of innovation and cost leadership. The interplay of regional dynamics, tariff headwinds, and segmentation nuances underscores the need for tailored approaches rather than one-size-fits-all solutions.

Looking ahead, the most successful organizations will forge tight partnerships with providers that demonstrate a commitment to open standards, transparent pricing, and continuous R&D investment. By systematically evaluating workloads against performance, security, and compliance criteria, and by embedding data observability into their operations, enterprises can transform databases from cost centers into strategic assets. The future trajectory of cloud database adoption is clear: those who embrace these principles will unlock new opportunities for growth, resiliency, and competitive advantage.

Encouraging Decision-Makers to Connect with Associate Director Ketan Rohom for Tailored Insights and Exclusive Access to the Complete Market Research Report

To explore how tailored data strategies can drive tangible advantages for your organization, we invite you to reach out and discover the full depth of our research. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, you gain prioritized guidance tailored to your unique requirements, along with exclusive access to proprietary insights. Ketan brings extensive expertise in cloud database and DBaaS environments, ensuring your decision-making process is informed by the latest findings and industry best practices. Engage directly with Ketan to discuss how to align your data architecture roadmap with emerging trends, navigate tariff challenges, and optimize deployment strategies across public, private, and hybrid environments. Your journey to data-driven excellence begins here

- How big is the Cloud Database & DBaaS Market?

- What is the Cloud Database & DBaaS Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?