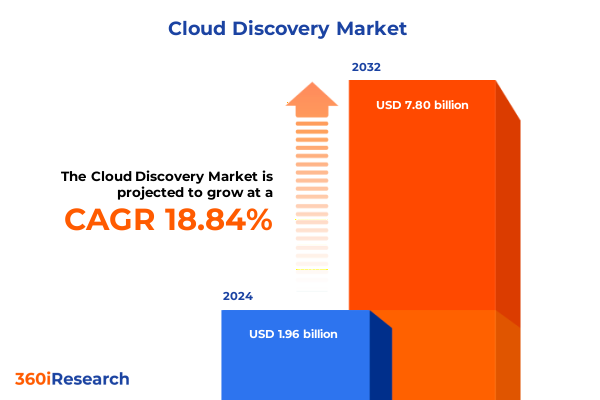

The Cloud Discovery Market size was estimated at USD 2.32 billion in 2025 and expected to reach USD 2.76 billion in 2026, at a CAGR of 18.89% to reach USD 7.80 billion by 2032.

Setting the Stage for Strategic Cloud Adoption With an In-Depth Overview of Key Drivers, Opportunities, and Challenges in Cloud Discovery

Cloud computing has become a foundational pillar for digital transformation across sectors, enabling organizations to accelerate innovation, enhance operational agility, and optimize resource utilization. As enterprises increasingly migrate workloads from on-premises environments to virtualized infrastructures, the conversation has shifted from basic adoption concerns to strategic value creation. This executive summary offers a concise yet comprehensive introduction to the essential drivers, emerging opportunities, and persistent challenges shaping the modern cloud landscape. Through this lens, decision-makers will gain clarity on how to harness cloud services effectively, mitigating risk while maximizing business impact.

In the following sections, our analysis highlights seismic shifts in technology paradigms, examines the influence of regulatory and fiscal policies such as recent United States tariffs, and distills key segmentation, regional, and competitive insights. By integrating rich qualitative inputs from industry veterans with rigorous data validation, this overview positions readers to navigate complex choices, prioritize investments, and craft scalable cloud roadmaps. Ultimately, this executive summary sets the stage for deeper exploration into transformative cloud strategies and actionable guidance for realizing sustained growth.

Understanding the Transformative Shifts Redefining the Cloud Landscape Through Innovation, Scalability, and Intelligent Automation Trends

The cloud ecosystem is undergoing transformative shifts driven by a confluence of technological breakthroughs and evolving business priorities. First, the convergence of advanced artificial intelligence capabilities with cloud platforms has redefined the value proposition of managed services, enabling predictive analytics, autonomous operations, and AI-powered application development. As a result, enterprises are no longer merely migrating legacy workloads but architecting intelligent systems that learn, adapt, and optimize continuously.

Concurrently, edge computing is reshaping the traditional centralized model by pushing data processing closer to end users and devices. This trend responds to demands for ultra-low latency and localized data sovereignty requirements, particularly in industries such as manufacturing, healthcare, and autonomous vehicles. Consequently, hybrid and distributed architectures have risen to prominence, blending public cloud scalability with private or on-premises control to meet diverse performance, security, and compliance needs.

Moreover, sustainability concerns and carbon footprint targets are prompting cloud providers to innovate in renewable energy sourcing, green data center design, and circular hardware practices. Together with enhanced cybersecurity frameworks-incorporating zero-trust principles and confidential computing-these shifts underscore a new era in which agility, intelligence, and responsibility converge to redefine cloud value propositions.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Cloud Infrastructure, Services, and Global Supply Chains in a Rapidly Evolving Market

In 2025, newly implemented United States tariffs on imported server hardware, networking components, and storage media have introduced notable cost pressures for cloud infrastructure deployments. These levies, aimed primarily at certain offshore manufacturing hubs, have elevated procurement expenses for commodity servers and high-performance storage arrays. As a result, cloud providers and enterprise users are reassessing supplier relationships, accelerating diversification strategies, and exploring regional manufacturing partnerships to insulate supply chains from further tariff volatility.

Beyond hardware, service-level agreements and managed offerings have seen upward price adjustments as providers integrate increased import duties into operating budgets. This dynamic has catalyzed the adoption of software-defined infrastructure models, where functionality once tied to specific hardware configurations can now be delivered through virtualized, decoupled services. These software overlays not only buffer tariff-induced cost spikes but also enable organizations to migrate workloads more seamlessly across heterogeneous environments.

Furthermore, the tariff landscape has reinforced the strategic significance of localized data centers and edge facilities. By partnering with domestic colocation providers and investing in on-shore manufacturing initiatives, market participants can mitigate exposure to international trade tensions. In this evolving environment, agility in supply chain management and a nimble mix of global and regional sourcing have become critical to sustaining competitive pricing and service reliability.

Uncovering Key Segmentation Insights Across Service Models, Industry Verticals, Organization Sizes, and Deployment Models in the Cloud Ecosystem

Dissecting the cloud market through multiple segmentation lenses illuminates nuanced dynamics that inform strategic decision-making. Considering service models first, infrastructure as a service offerings now span compute, networking, and storage portfolios, enabling organizations to choose precisely the resources they need. Platform as a service solutions, encompassing application development frameworks, managed databases, and integration services, have become instrumental for accelerating software delivery lifecycles. Meanwhile, software as a service applications-ranging from customer service management and sales force automation to enterprise resource planning, human resource management, and supply chain management-drive specialized business processes while reducing in-house operational burdens.

Shifting to industry verticals reveals differentiated adoption rates and tailored requirements. In banking, capital markets, and insurance sectors, security certifications and real-time analytics capabilities are paramount. Government entities emphasize compliance with data sovereignty regulations, while healthcare providers-in hospitals and pharmaceuticals-prioritize patient data privacy and interoperability. The retail and ecommerce domain, spanning both brick-and-mortar chains and digital storefronts, demands seamless customer experiences and elastic scaling to accommodate seasonal peaks and promotional campaigns.

Organizational size further modulates cloud strategies. Large enterprises leverage hybrid environments to balance legacy workloads and modern microservices, harnessing centralized governance while empowering distributed business units. Small and medium enterprises, by contrast, often adopt public cloud foundations to minimize capital expenditure and accelerate time to market. Finally, deployment models-hybrid, private, and public-offer distinct trade-offs in control, compliance, and cost. A hybrid approach blends on-premises infrastructure with public cloud bursts, private environments deliver bespoke security controls, and public platforms provide unmatched scalability and global reach.

This comprehensive research report categorizes the Cloud Discovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Industry Vertical

- Organization Size

- Deployment Model

Exploring Critical Regional Insights Across the Americas Europe Middle East Africa and Asia-Pacific to Inform Geographically Driven Cloud Strategies

Regional dynamics play a pivotal role in shaping cloud strategies, as geographic markets diverge in maturity, regulatory frameworks, and technology adoption curves. In the Americas, mature North American markets continue to lead in high-performance cloud utilization, driven by robust digital transformation programs within finance, healthcare, and government sectors. Latin American nations, meanwhile, are accelerating cloud adoption to leapfrog legacy infrastructure constraints, focusing on cost-effective public cloud offerings and cross-border data collaborations.

In Europe, Middle East, and Africa, a complex mosaic of regulatory landscapes and data sovereignty mandates underscores the importance of localized architectures. European Union directives on data protection steer organizations toward sovereign cloud environments, while emerging markets in the Middle East and Africa are leveraging cloud platforms to drive smart city initiatives and digital governance. As a result, multi-cloud strategies backed by regionally compliant service catalogs have become critical to balancing performance, security, and adherence to local statutes.

The Asia-Pacific region stands out as a dynamic frontier of cloud innovation, with leading economies investing heavily in artificial intelligence, 5G-enabled edge deployments, and digital government projects. From advanced manufacturing hubs in East Asia to mobile-first economies across Southeast Asia, enterprises are embracing cloud-native architectures to capture new digital revenue streams. Consequently, partnerships between global cloud providers and regional data center operators are proliferating to meet stringent latency requirements and localize service management.

This comprehensive research report examines key regions that drive the evolution of the Cloud Discovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deriving Strategic Perspectives From Leading Cloud Service Providers to Illuminate Competitive Dynamics and Innovation Pathways in the Market

Leading cloud service providers continue to differentiate through depth of service portfolios, global infrastructure footprints, and ecosystem partnerships. Provider A has established a reputation for expansive compute and networking services, supported by an extensive partner network that delivers specialized vertical solutions. Provider B focuses on hybrid cloud innovations, integrating on-premises software stacks with public cloud capabilities, which resonates strongly with regulated industries seeking gradual migration paths.

Meanwhile, Provider C has invested heavily in artificial intelligence and machine learning platforms, delivering turnkey development environments and pre-trained models that accelerate time to market for intelligent applications. Provider D emphasizes enterprise software integrations, leveraging decades of legacy application expertise to facilitate seamless migrations of critical business workloads. Provider E distinguishes itself through a developer-centric ethos, offering modular services, open source contributions, and community-driven tooling that appeal to a broad spectrum of technical users.

Strategic alliances and emerging entrants further enrich the competitive landscape. Partnerships between global hyperscalers and local system integrators are unlocking new deployment markets, while niche players specializing in secure government clouds, sustainable data centers, or industry-specific compliance frameworks address vertical-market nuances. This dynamic interplay between scale, specialization, and collaboration shapes the trajectories of market leaders and challengers alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Discovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Broadcom

- Google LLC

- Huawei Investment & Holding Co., Ltd.

- International Business Machines Corporation

- McAfee, LLC

- Microsoft Corporation

- Oracle Corporation

- Qualys, Inc.

- Salesforce, Inc.

- SAP SE

- Tencent Holdings Limited

Outlining Actionable Recommendations to Empower Industry Leaders in Accelerating Growth, Enhancing Efficiency, and Mitigating Risks in Cloud Adoption

To maintain a competitive advantage and ensure sustainable cloud adoption, industry leaders should prioritize a strategic framework that balances agility, security, and cost optimization. First, aligning cloud investment decisions with business outcomes will help organizations avoid the common pitfall of ungoverned sprawl. By implementing cross-functional governance committees and clear accountability structures, decision-makers can maintain visibility into utilization patterns and enforce policies that curb wasteful spending.

Next, integrating security and compliance considerations into the earliest stages of cloud planning is essential. Adopting a shift-left security posture, wherein vulnerability assessments and threat modeling are embedded within development pipelines, can dramatically reduce risk while accelerating delivery. Organizations should also explore confidential computing offerings and zero-trust network architectures to safeguard sensitive workloads against sophisticated threat vectors.

Finally, accelerating cloud-native skill development through targeted training programs and strategic recruiting will empower teams to harness advanced services effectively. By fostering partnerships with academic institutions and specialized training providers, enterprises can build talent pipelines that support emerging domains such as serverless computing, AI orchestration, and edge-to-cloud data fabric implementations. This comprehensive approach to capability building ensures that cloud investments translate into measurable business value.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity, Analytical Rigor, and Comprehensive Insights in Cloud Discovery

Our research methodology commenced with a thorough review of publicly available technical documentation, vendor whitepapers, and regulatory frameworks to establish a foundational understanding of cloud architectures and policy developments. This secondary research was then augmented by in-depth interviews with senior cloud practitioners, CIOs, and infrastructure managers across diverse industries, ensuring that our insights capture real-world challenges and best practices.

Quantitative validation played a central role, as we analyzed anonymized consumption and cost data from multiple cloud platforms, enabling cross-verification of service usage trends. Triangulating these findings with survey feedback from over one hundred enterprise IT leaders provided clarity on adoption priorities and perceived barriers. Additionally, we conducted a comparative analysis of corporate filings and public statements to map investment flows and strategic partnerships within the competitive landscape.

Throughout the process, rigorous data quality controls and peer reviews were employed to minimize bias and enhance the reliability of our conclusions. This blended approach-integrating secondary sources, primary interviews, quantitative analytics, and iterative expert validation-provides a robust foundation for the strategic recommendations and insights presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Discovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Discovery Market, by Service Model

- Cloud Discovery Market, by Industry Vertical

- Cloud Discovery Market, by Organization Size

- Cloud Discovery Market, by Deployment Model

- Cloud Discovery Market, by Region

- Cloud Discovery Market, by Group

- Cloud Discovery Market, by Country

- United States Cloud Discovery Market

- China Cloud Discovery Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing Key Findings to Provide a Clear Conclusion That Reinforces Strategic Cloud Imperatives and Guides Future Decision-Making

In summary, the cloud computing arena is evolving at an unprecedented pace, driven by technological breakthroughs, policy shifts, and shifting enterprise priorities. Our analysis highlights how service models ranging from infrastructure as a service to software as a service are being tailored to specific industry needs, organizational scales, and deployment preferences. The imposition of United States tariffs in 2025 has underscored the importance of supply chain resilience, driving innovations in software-defined infrastructure and regional sourcing strategies.

Furthermore, regionally nuanced approaches are critical, as mature markets in the Americas, regulatory-intensive environments across Europe, Middle East, and Africa, and high-growth markets in Asia-Pacific each present distinct challenges and opportunities. Competitive dynamics continue to be shaped by established hyperscalers and specialized entrants alike, emphasizing the need for strategic partnerships and continuous innovation. Finally, embedding governance, security, and talent development within cloud roadmaps will ensure that organizations translate technological capabilities into sustainable business value.

This executive summary offers a concise orientation to these complex themes, providing decision-makers with the context and actionable insights needed to navigate the contemporary cloud landscape with confidence and foresight.

Engage With Our Associate Director of Sales and Marketing to Secure Your Comprehensive Cloud Discovery Report and Unlock Critical Market Intelligence

To secure your comprehensive cloud discovery report and gain a competitive edge, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the purchase process, answer any questions you may have, and help tailor the package to your organization’s unique objectives. Engage with Ketan today to unlock strategic insights that can transform your cloud strategy and drive your digital innovation agenda forward

- How big is the Cloud Discovery Market?

- What is the Cloud Discovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?