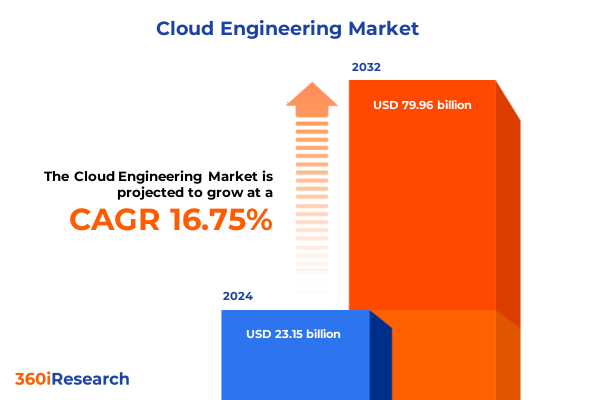

The Cloud Engineering Market size was estimated at USD 27.00 billion in 2025 and expected to reach USD 31.50 billion in 2026, at a CAGR of 16.77% to reach USD 79.96 billion by 2032.

Embracing the Era of Cloud Engineering Excellence to Propel Organizational Agility and Digital Innovation at Scale and Resilience

Cloud engineering has emerged as the cornerstone of digital transformation, enabling organizations to harness the full potential of scalable infrastructure, automated processes, and resilient architectures. As businesses navigate an ever-evolving technological landscape, the importance of adopting a cloud engineering mindset extends far beyond simple cost reduction; it becomes the catalyst for innovation and competitive differentiation. Leaders who prioritize cloud-native designs and continuous integration pipelines position themselves to roll out new services with unprecedented speed, all while maintaining rigorous security standards and operational efficiency.

Moreover, the convergence of cloud engineering with container orchestration, infrastructure as code, and serverless computing has redefined how teams collaborate across distributed environments. This multifaceted approach fosters a culture of DevSecOps, where development, security, and operations unite under shared objectives and automated workflows. Consequently, organizations that invest in modern cloud engineering capabilities can respond to market shifts and customer demands with agility, ultimately strengthening their resilience in the face of disruption.

Transitioning to a robust cloud engineering strategy calls for a clear framework that aligns technical excellence with business goals. By leveraging advanced monitoring, policy-as-code, and self-healing architectures, enterprises can strike the optimal balance between innovation speed and risk mitigation. This executive summary unpacks the pivotal trends, regulatory influences, segmentation deep dives, regional nuances, and actionable recommendations that will guide decision-makers toward a transformative cloud engineering future.

Analyzing the Disruptive Transformative Shifts Redefining Cloud Engineering Practices across Modern Technology Ecosystems and Next-Generation Applications

Over the past several years, the cloud engineering discipline has experienced a wave of transformative shifts that have recalibrated the boundaries of what is possible in software delivery and infrastructure management. The rise of serverless architectures, for instance, has liberated developers from the intricacies of server provisioning, allowing them to focus squarely on business logic and user experience. Simultaneously, the proliferation of containerization and microservices has ushered in a paradigm where modularity and portability become the norm, accelerating release cadences and reducing the blast radius of potential failures.

Furthermore, the integration of artificial intelligence and machine learning into cloud platforms has introduced new layers of operational intelligence. Predictive autoscaling, anomaly detection, and intelligent resource allocation now drive efficiencies that were inconceivable just a few years ago. As these capabilities mature, cloud engineering teams are increasingly tasked with embedding AI-driven insights into continuous delivery pipelines, thus elevating both performance optimization and security posture.

In parallel, sustainability considerations and carbon footprint tracking have become integral to platform design, compelling organizations to adopt greener computing practices. Edge computing has also surged in relevance, distributing processing closer to data sources and enabling low-latency applications such as real-time analytics, IoT telemetry, and immersive experiences. Taken together, these disruptive trends are reshaping how enterprises architect, deploy, and govern their cloud environments, setting a new benchmark for speed, reliability, and environmental responsibility.

Exploring the Complex Cumulative Impact of 2025 United States Tariffs on Cloud Engineering Supply Chains and Service Delivery Models

The imposition of new United States tariffs in 2025 has introduced a complex layer of cost and supply dynamics for cloud engineering stakeholders. Hardware components such as semiconductor chips, high-performance memory modules, and advanced networking equipment are now subject to increased duties, which in turn elevates the landed cost of on-premises infrastructure purchases. Even organizations that lean heavily on public cloud services feel the reverberations, as cloud providers pass through component cost increases or adjust contract structures to account for higher procurement expenses.

In response, many enterprises are reevaluating their hardware procurement strategies and exploring alternative sourcing options, including distributed supply networks and regional manufacturing partnerships. Consequently, software-defined infrastructure gains additional strategic weight, as it mitigates dependence on specific hardware models and allows for more flexible, agnostic deployments. Cloud engineering teams are also accelerating the shift toward fully managed services-ranging from hyperscale compute clusters to edge orchestration platforms-to insulate themselves from hardware market fluctuations.

Amid these tariff-driven pressures, organizations must adopt a multifaceted mitigation approach. This begins with enhanced cost modeling, extends through ongoing vendor due diligence, and culminates in proactive architecture designs that privilege portability and interoperability. By embedding these practices into cloud engineering road maps, enterprises can sustain innovation velocities while buffering the financial impacts of trade policy changes.

Deriving Actionable Segmentation Insights That Illuminate Service, Deployment, Organization Size, and Industry Variations within Cloud Engineering Markets

Cloud engineering markets reveal nuanced variations when viewed through the lens of service type, deployment model, organization size, and industry vertical. Within the service domain, infrastructure as a service offerings-covering compute, networking, and storage-continue to underpin foundational resource provisioning, whereas platform as a service options such as container as a service, database as a service, function as a service, and integration platform as a service enable accelerated development lifecycles. Software as a service solutions tailored to collaboration and communication, customer relationship management, enterprise resource planning, and human capital management empower business teams to adopt cloud capabilities without deep technical overhead.

Deployment preferences further diversify the landscape, as organizations blend hybrid cloud strategies that leverage on-premises investments alongside public cloud bursts, or opt for strictly private or strictly public cloud footprints based on regulatory and performance requirements. Similarly, large enterprises pursue bespoke, complex integration architectures to support global operations, while small and medium enterprises often prioritize turnkey cloud solutions that reduce management complexity.

Overlaying these considerations, industry verticals exhibit distinct cloud engineering patterns. Banking, financial services, and insurance stakeholders emphasize ultra-secure architectures and stringent compliance guardrails. Government and defense agencies require sovereign cloud environments with tight data residency controls. Healthcare and life sciences firms focus on interoperability and sensitive data protection, while IT and telecommunications providers seek scalable network functions virtualization and edge compute synergy. Manufacturing entities adopt digital twins and IoT data pipelines, and retail and eCommerce firms rely on elastic commerce platforms to dynamically handle traffic peaks.

This comprehensive research report categorizes the Cloud Engineering market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Organization Size

- Industry Vertical

Unveiling Critical Regional Dynamics Impacting Cloud Engineering Adoption Patterns across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping cloud engineering adoption and investment patterns, with each geography charting its own trajectory. In the Americas, robust digital infrastructure investments and favorable regulatory initiatives have fueled rapid uptake of multi-cloud strategies; this environment rewards providers that can demonstrate strong service level agreements and end-to-end encryption practices. Cross-border data transfer agreements between the United States, Canada, and select Latin American nations add further complexity, compelling regional cloud engineering teams to design architectures that respect evolving privacy frameworks.

Across Europe, the Middle East, and Africa, cloud engineering efforts hinge on navigating a tapestry of data protection regulations, from GDPR in the European Union to emerging personal data laws in Gulf Cooperation Council countries. Organizations in this region often adopt private or hybrid cloud models to comply with data sovereignty mandates, while simultaneously exploring pan-regional interconnectivity solutions to optimize latency and resilience. Additionally, strategic partnerships between local data center operators and global hyperscalers have become instrumental in expanding digital ecosystem coverage.

In the Asia-Pacific sphere, government-led digital initiatives and national cloud programs have catalyzed widespread infrastructure modernization. Markets such as China, India, Japan, and Australia emphasize sovereign cloud offerings, incentivizing domestic innovation and localized service portfolios. Furthermore, the APAC region’s diversity in network maturity and economic development drives a dual focus on edge-enabled services in advanced markets alongside cost-effective public cloud adoption in emerging economies.

This comprehensive research report examines key regions that drive the evolution of the Cloud Engineering market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Engineering Innovators and Emerging Players Driving Competitive Differentiation through Strategic Partnerships, Acquisitions, and Ecosystem Investments

Leading adopters and providers in the cloud engineering arena continue to differentiate through strategic investments and ecosystem collaborations. Major hyperscale players have deepened their AI-driven automation portfolios, integrating predictive maintenance and policy-as-code frameworks to streamline operations. Meanwhile, global software vendors have bolstered their platform as a service offerings by acquiring container orchestration specialists and expanding database management services, thereby providing unified development and runtime environments.

Concurrently, telecommunications incumbents are forging alliances with cloud-native infrastructure providers to deploy edge compute networks, catering to low-latency use cases such as autonomous systems and real-time analytics. Furthermore, specialized firms focusing on cloud security posture management, cloud cost optimization, and compliance automation have attracted significant venture funding, underscoring the critical demand for granular governance across distributed cloud estates.

In addition, several regional champions are emerging, leveraging localized data center footprints and tailored service-level guarantees to capture market share in their home territories. These players often partner with global platforms to deliver hybrid cloud orchestration solutions, reinforcing the notion that a robust, collaborative ecosystem is essential for sustaining innovation and meeting diverse enterprise requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Engineering market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Alphabet Inc.

- Amazon.com, Inc.

- Cisco Systems

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Tencent Cloud

- Tencent Holdings Limited

- VMware, Inc.

Strategic Actionable Recommendations Empowering Industry Leaders to Optimize Cloud Engineering Frameworks for Enhanced Agility, Security, and Innovation

To capitalize on the evolving cloud engineering landscape, industry leaders must adopt a strategic posture that unites technical prowess with business intent. Establishing a cloud-native center of excellence within the enterprise can serve as the command hub for best practice dissemination, architectural governance, and cross-functional training. By embedding security protocols and compliance checks into infancy stages of development pipelines, teams ensure that each code release aligns with organizational risk thresholds.

Furthermore, leaders should accelerate their migration toward modular, microservices-based architectures and leverage service mesh frameworks to standardize communication and observability across distributed workloads. This tactical shift not only enhances fault isolation but also cultivates a culture of rapid experimentation. Additionally, investing in self-service developer platforms fueled by infrastructure as code and policy automation empowers engineering teams to move at pace, enabling the business to release customer-facing features in shorter cycles.

Finally, forging strategic alliances with hyperscale cloud providers, niche technology specialists, and academic institutions can unlock access to cutting-edge innovations, expert talent pipelines, and industry consortiums. Such partnerships, combined with continuous upskilling programs, position organizations to outpace competitors, navigate tariff-induced uncertainties, and meet escalating customer expectations with confidence.

Robust Research Methodology Detailing Comprehensive Data Collection, Rigorous Analysis, and Expert Validation Approaches Underpinning the Study

The research underpinning this executive summary follows a robust methodology designed to ensure comprehensive coverage and analytical rigor. Primary research involved in-depth interviews with senior cloud architects, infrastructure managers, and technology decision-makers across multiple industries, providing firsthand insights into emerging challenges and strategic priorities. Supplementing this, a series of surveys captured quantitative data on adoption patterns, technology preferences, and procurement rationales, offering a balanced perspective on market dynamics.

Secondary research encompassed a thorough review of corporate filings, regulatory documents, white papers published by technology alliances, and peer-reviewed academic journals. This dual-pronged approach facilitated data triangulation, strengthening the validity of our findings and enabling cross-verification between anecdotal and documented evidence. Additionally, the study incorporated analysis of public sector initiatives and international trade policies to map the broader context influencing cloud engineering strategies.

To ensure objectivity and expert validation, the research team convened an advisory board consisting of former CTOs, industry analysts, and cloud engineering consultants. Their feedback loops refined the analytical frameworks and corroborated the key thematic areas. Finally, all data and insights underwent stringent quality assurance checks to guarantee accuracy, consistency, and relevance to strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Engineering market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Engineering Market, by Service Type

- Cloud Engineering Market, by Deployment Model

- Cloud Engineering Market, by Organization Size

- Cloud Engineering Market, by Industry Vertical

- Cloud Engineering Market, by Region

- Cloud Engineering Market, by Group

- Cloud Engineering Market, by Country

- United States Cloud Engineering Market

- China Cloud Engineering Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Strategic Insights Synthesizing Transformative Trends, Tariff Implications, and Segmentation Reveals Guiding the Future of Cloud Engineering

In summary, the trajectory of cloud engineering is defined by a confluence of transformative technologies, regulatory pressures, and evolving business imperatives. From the proliferation of serverless computing and AI-driven operational intelligence to the mitigation strategies born out of tariff disruptions, organizations must remain vigilant and adaptive. Segmentation insights highlight the distinct requirements of service models, deployment architectures, organizational scales, and industry verticals, underscoring the importance of tailored approaches rather than monolithic strategies.

Regional analysis further emphasizes the necessity of designing cloud architectures that respect data sovereignty, regulatory divergence, and varied infrastructure maturity. The profiles of leading cloud engineering providers, along with the emerging cohort of specialized innovators, illustrate that collaboration and ecosystem orchestration are central to unlocking sustained competitive advantage. Meanwhile, actionable recommendations galvanize leaders to build cloud-native centers of excellence, embed security by design, and pursue partnerships that drive continuous improvement.

Ultimately, this executive summary serves as a strategic compass for decision-makers aiming to harness the full potential of cloud engineering. By synthesizing the latest trends, tariff implications, and segmentation and regional insights, it outlines a clear path forward. Organizations that embed these principles into their road maps will be well-equipped to navigate disruption, accelerate innovation, and deliver enduring value to stakeholders.

Empower Your Strategic Decisions with Exclusive Cloud Engineering Insights by Engaging Ketan Rohom to Secure Your Bespoke Market Research Report Today

To delve deeper into the critical insights and connect with the strategic expertise that can drive your organization’s cloud engineering initiatives forward, reach out to Ketan Rohom, Associate Director, Sales & Marketing at the firm. By engaging with Ketan, you gain access to a tailored consultation that aligns with your unique business objectives and operational needs, ensuring that the market research report you acquire delivers maximum impact. Take the next step toward empowering your leadership team with actionable intelligence and secure your comprehensive cloud engineering research report today

- How big is the Cloud Engineering Market?

- What is the Cloud Engineering Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?