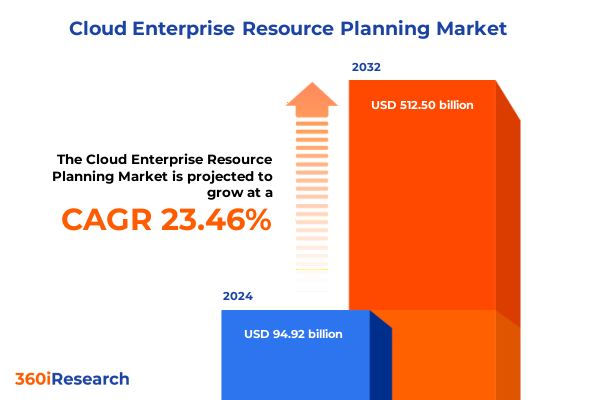

The Cloud Enterprise Resource Planning Market size was estimated at USD 117.03 billion in 2025 and expected to reach USD 144.29 billion in 2026, at a CAGR of 23.48% to reach USD 512.50 billion by 2032.

Defining the Cloud ERP Revolution with Unmatched Scalability, Agility, and Strategic Integration to Propel Enterprise Digital Transformation Efforts Worldwide

In today’s rapidly evolving digital ecosystem, cloud enterprise resource planning stands out as a cornerstone for enabling holistic business transformation. Organizations are increasingly confronted with the imperative to unify disparate systems, automate end-to-end processes, and gain real-time visibility into operations. Against this backdrop, cloud ERP has emerged as a powerful enabler, offering scalable infrastructure, continuous innovation, and seamless integration capabilities that traditional on-premises solutions struggle to match.

Early adopters are reporting meaningful improvements in decision cycle times and operational productivity, attributing gains to the cloud’s ability to deliver instant access to critical data and advanced analytics. Moreover, the subscription-based cost model inherent to cloud deployments helps organizations align technology spend with actual usage patterns, shielding them from unpredictable capital expenditures. As a result, finance teams can redirect resources from routine maintenance toward strategic growth initiatives, while IT departments shift their focus from system upkeep to innovation and user experience enhancement.

Looking ahead, the breadth of functionalities now available via cloud ERP-ranging from embedded artificial intelligence to built-in compliance management-indicates that this technology will continue to be a pivotal driver of competitive differentiation. As enterprises grapple with increasingly complex supply chains, dynamic regulatory landscapes, and evolving customer expectations, the cloud ERP narrative will only intensify in relevance and urgency.

Identifying the Major Disruptive Forces, Technological Innovations, and Operational Paradigm Shifts Shaping the Future of Cloud ERP Solutions

Over the last several years, a confluence of disruptive forces has reshaped the cloud ERP landscape, driving unprecedented shifts in how organizations plan and operate. Notably, the rise of artificial intelligence and machine learning has infused core ERP modules with predictive insights, enabling finance and procurement teams to anticipate demand fluctuations and optimize resource allocation. Alongside this, advancements in robotic process automation have automated repetitive tasks such as invoice matching and payroll reconciliation, freeing human capital to focus on higher-impact responsibilities.

Simultaneously, the evolution of cloud architectures-from monolithic platforms to modular, microservices-based designs-has empowered organizations to customize ERP deployments to their unique requirements. This architectural flexibility, coupled with robust application programming interfaces, fosters an ecosystem of third-party extensions and industry-specific solutions that accelerate time to value. At the same time, the emergence of low-code and no-code development environments has democratized application customization, allowing business users to tailor workflows and dashboards without heavy reliance on IT resources.

Moreover, the ongoing shift toward outcome-based contracting models is recalibrating vendor-customer relationships. By aligning pricing to key performance indicators such as system uptime or process efficiency gains, vendors and clients share a vested interest in continuous improvement. Collectively, these transformative shifts underscore the imperative for businesses to adopt a forward-looking strategy when evaluating cloud ERP, one that not only addresses current operational pain points but also anticipates future innovation trajectories.

Exploring the Cumulative Impact of Newly Enforced United States Tariffs on Cloud ERP Deployment Costs, Vendor Strategies, and Customer Adoption Dynamics

In 2025, newly enacted tariff measures by the United States government have introduced nuanced complexities for cloud ERP providers and their customers. While software delivered as a service remains largely exempt from traditional customs duties, hardware components integral to edge computing and on-premises integration hubs have been subject to increased import fees. This has led to a reevaluation of infrastructure strategies, particularly for organizations operating hybrid environments that marry cloud-native applications with localized processing units.

As a direct consequence, certain vendors have responded by diversifying their supply chains, relocating manufacturing and assembly operations to regions outside high-tariff zones. Such strategic shifts not only mitigate cost pressures but also enhance supply resilience. At the same time, service providers have begun to incorporate incremental tariff impacts into managed service agreements, offering bundled packages that include both hardware provisioning and ongoing maintenance under a single, transparent fee structure.

For customers, the most salient real-world impact has been on the total cost of ownership of integrated ERP landscapes. In response, leading enterprises are placing greater emphasis on public cloud adoption, where no physical import is required, as well as negotiating longer-term support commitments to amortize the elevated hardware expenses. These adaptations exemplify how policy changes can accelerate broader macroeconomic trends, prompting a renewed focus on cloud-native approaches and distributed architectures.

Uncovering Granular Insights into Component, Deployment, Application, Vertical, and Organization Size Trends Driving Market Differentiation

When examining the cloud ERP ecosystem through the lens of component segmentation, two primary areas emerge: software offerings and professional services. Software solutions themselves are branching into specialized modules, while the services sphere encapsulates consulting engagements that define implementation roadmaps, the technical workflows that drive go-live activities, and ongoing support and maintenance to ensure system stability. Clients often engage consulting practices to align their digital transformation goals before transitioning to implementation teams that configure environments. Post-deployment, support and maintenance specialists provide continuous updates and performance tuning to sustain operational excellence.

Transitioning to deployment modalities, the market unfolds across hybrid cloud configurations that blend on-premises infrastructure with public cloud services, private cloud setups that deliver dedicated resources, and fully public cloud deployments that prioritize rapid scalability. Hybrid environments have gained traction among enterprises seeking to maintain sensitive data on-premises while still leveraging cloud elasticity for burstable workloads. Private cloud configurations appeal to entities with stringent security mandates, offering a balance of control and managed services, whereas public clouds continue to attract organizations prioritizing cost efficiency and global reach.

Applications for cloud ERP have diversified significantly, spanning customer relationship management functions that drive sales and service excellence to finance and accounting modules that automate core ledger and reporting processes. In parallel, human capital management suites enable talent acquisition, workforce planning, and performance management, while procurement applications streamline sourcing, contract management, and spend analytics. Underpinning this value chain, supply chain management solutions orchestrate demand planning, inventory control, and logistics, ensuring end-to-end visibility and operational responsiveness.

Industry vertical segmentation further highlights nuanced demands across government agencies, healthcare and life sciences organizations, manufacturing plants, retail chains, and telecom and IT service providers. Within healthcare and life sciences, subsegments such as hospitals and pharmaceutical firms exhibit unique compliance and traceability requirements, driving specialized feature sets. Retail players prioritize omnichannel inventory synchronization and personalized marketing capabilities, whereas manufacturers emphasize production scheduling and quality management. Across all verticals, digital resilience and regulatory adherence remain common priorities.

Finally, organization size segmentation reveals distinct adoption patterns. Large enterprises, with complex global operations and legacy landscapes, often pursue phased rollouts with extensive customization, while small and medium enterprises tend to favor rapid, out-of-the-box deployments to minimize time to benefit. Each cohort brings its own blend of agility requirements and resource constraints, shaping vendor engagement models and the selection of partner ecosystems.

This comprehensive research report categorizes the Cloud Enterprise Resource Planning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Application

- Industry Vertical

Highlighting Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets to Illuminate Growth Opportunities and Challenges

Across the Americas, cloud ERP adoption is driven by a relentless focus on digital innovation and regulatory compliance. North American organizations are harnessing advanced analytics and embedded AI to optimize supply chains and finance operations, while Latin American markets are increasingly embracing cloud to leapfrog legacy ERP headwinds. The underlying theme is a collective push toward unified data models that break down silos between lines of business, enabling holistic performance management across geographies.

In Europe, Middle East & Africa, data sovereignty and compliance requirements shape deployment decisions. European enterprises often opt for private cloud and hybrid cloud models to ensure adherence to Strict GDPR provisions, whereas Middle Eastern governments are rolling out cloud ERP initiatives to support national economic diversification plans. African markets, though nascent, are witnessing a surge in cloud-native implementations driven by mobile-first strategies and infrastructure-as-a-service innovations in regional data centers.

Within Asia-Pacific, rapid digitalization efforts across China, India, Southeast Asia, and Australia underscore a voracious appetite for flexible ERP deployments. Organizations in China are prioritizing local cloud service providers to navigate cybersecurity mandates, while Indian enterprises leverage public cloud platforms to accelerate manufacturing automation and financial inclusion programs. Across Southeast Asia, the convergence of e-commerce, fintech, and logistics ecosystems fuels demand for integrated ERP suites, and in Australia, a mature landscape is directing focus toward native cloud enhancements and platform consolidation.

In each region, the interplay between regulatory frameworks, digital maturity, and infrastructure availability creates a unique trajectory for cloud ERP uptake. As a result, regional strategies must be tailored to local market dynamics, balancing the imperatives of data protection, agility, and cost efficiency.

This comprehensive research report examines key regions that drive the evolution of the Cloud Enterprise Resource Planning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud ERP Providers to Reveal Strategic Partnerships, Innovation Pipelines, and Competitive Differentiators in the Enterprise Ecosystem

A cohort of leading cloud ERP vendors is distinguished by differentiated go-to-market strategies, robust partner networks, and continuous investment in product innovation. Certain incumbents have strengthened their portfolios through strategic alliances with hyperscale cloud providers, enabling optimized performance and global data center footprints. Others have carved out niches by delivering industry-specific suites with deep vertical expertise, customizing workflows to meet stringent compliance and operational requirements.

Newer entrants have disrupted the status quo by embracing composable architectures, where modular microservices can be assembled into bespoke solutions. This approach appeals to organizations seeking agnostic technology stacks and the flexibility to swap out components as strategic needs evolve. In addition, the most dynamic players are integrating low-code design environments directly into their core offerings, empowering citizen developers to extend and personalize applications in real time.

Beyond product roadmaps, ecosystem strategies are proving critical. Leading vendors cultivate extensive marketplaces of third-party extensions and certified system integrators, ensuring seamless implementation and ongoing support. Moreover, commitment to sustainability has surfaced as a competitive differentiator, with cloud providers optimizing data center energy efficiency and incorporating environmental impact metrics into their service level agreements. Collectively, these strategies reflect the multi-dimensional nature of competition in a maturing cloud ERP landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Enterprise Resource Planning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Deltek

- Epicor Software Corporation

- IFS AB

- Infor, Inc.

- Microsoft Corporation

- Odoo SA

- Oracle Corporation

- Plex Systems, Inc.

- QAD Inc.

- Sage Group plc

- SAP SE

- Workday, Inc.

Presenting Actionable Recommendations to Help Industry Leaders Navigate Complexity, Optimize Investments, and Accelerate Value Realization in Cloud ERP Implementations

To harness the full potential of cloud ERP, industry leaders should prioritize alignment between business objectives and technology roadmaps. This begins with cross-functional governance structures that bring finance, operations, IT, and line-of-business stakeholders into ongoing dialogue. By defining clear success metrics tied to operational efficiency, customer experience, and compliance, organizations can drive accountability and measure progress against tangible outcomes.

Next, enterprises should adopt a platform mindset, selecting solutions based on their ability to integrate seamlessly with adjacent systems such as customer data platforms, manufacturing execution systems, and e-commerce storefronts. This interoperability reduces data duplication and establishes a single source of truth. At the same time, leaders must invest in change management programs that equip end users with training, communication, and hands-on support, thereby accelerating adoption and minimizing disruption.

Furthermore, executives should analyze the total cost of ownership implications of hybrid and public cloud deployments, incorporating potential tariff impacts, third-party integration costs, and ongoing maintenance considerations. Partnering with managed services providers can alleviate internal resource constraints and ensure continuous performance tuning. Finally, organizations are advised to embed continuous improvement cycles into their operating models, leveraging real-time analytics and feedback loops to iterate processes and maintain alignment with evolving business priorities.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity, Comprehensive Coverage, and Actionable Market Intelligence for Stakeholders

This research effort was anchored in a multi-tiered methodology designed to ensure both breadth and depth of coverage. Primary data was gathered through consultations with C-level executives, IT architects, and functional leaders across a cross-section of industries, capturing firsthand accounts of deployment experiences and technology priorities. These insights were complemented by expert interviews with system integrators and independent analysts, providing critical context on emerging best practices.

Secondary research encompassed an exhaustive review of vendor documentation, white papers, financial disclosures, and case studies. This was supplemented by analysis of publicly available regulatory filings to map tariff schedules and compliance mandates affecting cloud ERP implementations. Quantitative data points were triangulated against historical adoption trends to validate the directional accuracy of observed patterns.

To refine segmentation insights, we utilized taxonomy frameworks that disentangle overlapping categories-such as hybrid versus private cloud configurations and industry-specific feature requirements. Qualitative filters were applied to ensure that only solutions meeting rigorous security, scalability, and interoperability benchmarks were included. Lastly, rigorous peer review and cross-functional validation sessions were conducted to guarantee the integrity and actionability of all findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Enterprise Resource Planning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Enterprise Resource Planning Market, by Component

- Cloud Enterprise Resource Planning Market, by Deployment

- Cloud Enterprise Resource Planning Market, by Application

- Cloud Enterprise Resource Planning Market, by Industry Vertical

- Cloud Enterprise Resource Planning Market, by Region

- Cloud Enterprise Resource Planning Market, by Group

- Cloud Enterprise Resource Planning Market, by Country

- United States Cloud Enterprise Resource Planning Market

- China Cloud Enterprise Resource Planning Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Findings and Insights to Provide a Cohesive Overview of the Cloud ERP Landscape and Future Implications for Decision-Makers

In synthesizing the findings, several key themes emerge: the accelerating pace of innovation driven by AI and automation; the growing imperative for flexible deployment models in response to regulatory and geopolitical shifts; and the critical need for integrated platforms that break down organizational silos. Uniformly, industry leaders recognize that cloud ERP is no longer a peripheral system but the backbone of digital transformation strategy.

Moreover, the nuanced impact of United States tariffs in 2025 underscores the importance of supply chain diversification and a shift toward cloud-native infrastructures that minimize exposure to hardware import costs. Regional variations in adoption dynamics further emphasize that a one-size-fits-all approach is untenable; instead, organizations must craft localization strategies that address data residency, compliance, and infrastructure availability.

Ultimately, the maturity of the cloud ERP market reflects a balance between technological advancement and pragmatic business imperatives. Decision-makers equipped with a thorough understanding of component modalities, deployment architectures, application scopes, and vertical demands are best positioned to unlock sustainable value. This report serves as a compass for stakeholders navigating an increasingly complex landscape, offering the insights needed to transform ambition into measurable outcomes.

Seize Industry Leadership with Our Comprehensive Cloud ERP Report—Connect Directly with Ketan Rohom to Unlock Strategic Insights and Drive Growth

Embarking on a deeper exploration of cloud enterprise resource planning is the first step toward driving strategic transformation and competitive advantage. To access our comprehensive market analysis and gain peer-reviewed insights, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His guidance will illuminate how organizations across industries are leveraging cloud ERP solutions to optimize operations, enhance agility, and unlock new revenue streams. Reach out now to secure tailored recommendations and an exclusive walk-through of our latest findings to accelerate your digital transformation journey.

- How big is the Cloud Enterprise Resource Planning Market?

- What is the Cloud Enterprise Resource Planning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?