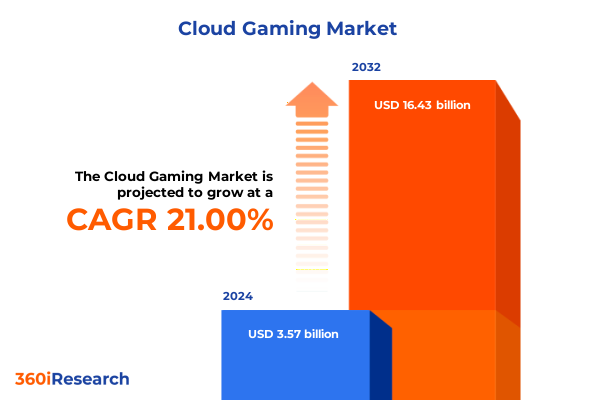

The Cloud Gaming Market size was estimated at USD 4.32 billion in 2025 and expected to reach USD 5.18 billion in 2026, at a CAGR of 21.02% to reach USD 16.43 billion by 2032.

Exploring the Convergence of Low-Latency Streaming and On-Demand Interactive Content to Redefine Global Gaming Experiences

The meteoric rise of cloud gaming represents not merely a technological evolution but a fundamental shift in how interactive entertainment is conceived, distributed, and consumed. As remote rendering, high-speed data transfer, and ultra-low-latency streaming converge, gamers gain unprecedented freedom to play AAA titles on a diverse array of connected devices without reliance on high-end local hardware. This paradigm shift is catalyzing new business models and redefining competitive dynamics across the gaming ecosystem.

Today’s audiences expect instant access to gaming experiences delivered seamlessly across smartphones, tablets, smart TVs, PCs, and dedicated consoles. This demand for cross-device compatibility is driving platform providers and network operators to invest heavily in edge computing infrastructure, optimized codecs, and robust internet connectivity. Meanwhile, developers are reimagining game design to leverage real-time scalability and integrated social features that amplify engagement in ways never possible with traditional, hardware-bound distribution methods.

With venture capital and strategic partnerships fueling expansion, cloud gaming now stands at the forefront of digital transformation in entertainment. From subscription-based “all-you-can-play” libraries to transactional and freemium models that incentivize ongoing engagement, this landscape is primed for exponential growth. In light of these developments, industry stakeholders must navigate the convergence of technology, content, and connectivity to craft compelling offerings that resonate with both hardcore enthusiasts and casual players alike.

Analyzing the Impact of 5G, Edge Computing, and Strategic Telecom Alliances in Propelling the Cloud Gaming Evolution

The cloud gaming arena has undergone transformative shifts as service providers leverage breakthroughs in 5G connectivity, edge computing, and adaptive streaming protocols to elevate performance to console-grade levels. These technological advancements have reduced lag, enhanced visual fidelity, and expanded geographic reach, effectively democratizing high-end gaming.

At the same time, strategic alliances between telecom operators and gaming platform developers are enabling integrated bundled offerings that combine data plans, content libraries, and cloud GPU resources. Such collaborations not only diversify revenue streams but also create richer user experiences through tighter integration of network management and gaming application layers. Operators are embracing network slicing and quality-of-service prioritization to guarantee consistent frames-per-second rates and minimize jitter.

Concurrently, the emergence of hybrid cloud architectures is affording publishers greater control over content delivery, enabling seamless transitions between private and public cloud environments. This flexibility enhances scalability, optimizes infrastructure costs, and supports regional compliance requirements. As a result, stakeholders are reengineering their platforms to support dynamic resource allocation, while prioritizing security frameworks that protect intellectual property and user data across multi-cloud deployments.

Uncovering How 2025 United States Import Tariff Adjustments on Hardware Components Reshaped Cloud Gaming Infrastructure Strategies

In 2025, the United States imposed a series of import tariffs on key hardware components and networking equipment, introducing new complexities into cloud gaming infrastructure deployment. Hardware manufacturers faced increased costs for specialized GPUs, memory modules, and dedicated servers. These higher input expenses have reverberated across the value chain, influencing pricing strategies and capital expenditure plans for platform operators.

Service providers subsequently reassessed their deployment roadmaps, shifting some capacity expansions to alternate regions with more favorable trade conditions. This reallocation has underscored the importance of diversified data center locations to mitigate geopolitical risks and maintain service continuity. Moreover, certain companies are negotiating with local assembly partners to produce hardware domestically, thereby qualifying for tariff exemptions under specific trade agreements.

Despite these headwinds, organizations are leveraging long-term procurement contracts and strategic vendor partnerships to lock in favorable component pricing. Some are also embracing modular, containerized data center designs that streamline equipment upgrades and reduce lead times. By blending proactive supply chain management with agile infrastructure planning, cloud gaming platforms are insulating themselves against tariff-driven margin pressures while ensuring uninterrupted service delivery to end users.

Revealing Insights from Device Preferences Genres Monetization Dynamics and End User Behaviors to Shape Competitive Strategy

The device dimension reveals distinct usage patterns and technical requirements across game console, PC, smart TV, smartphone, and tablet environments. Console-style interfaces continue to attract premium subscribers seeking controller-based gameplay experiences, whereas smartphones and tablets serve as pivotal on-the-go engagement channels, particularly for casual and mid-core genres. Smart TVs are emerging as living-room hubs for family-friendly and social gaming, and high-end PCs remain the domain of competitive and visually intensive titles.

When examining game genres, action and role-playing experiences command broad appeal, while strategy and racing titles benefit from deterministic input requirements and streamlined streaming optimizations. Sports simulations leverage cloud-powered physics engines to deliver hyper-realistic gameplay, and all five genres coalesce to form complementary portfolios for subscription-based platforms aiming to satisfy diverse player preferences.

Monetization strategies vary widely: advertising models drive revenue through in-game sponsorship and dynamically inserted video spots; freemium tiers entice users with free access supplemented by microtransaction-driven content; subscription models deliver curated libraries for a flat monthly fee; and transactional approaches empower players to purchase individual titles or expansions. Collectively, these models offer flexible paths to revenue generation depending on user acquisition and engagement objectives.

Finally, end-user segmentation distinguishes between business-focused users-such as enterprise training, simulation, and promotional activations-and consumer audiences who prioritize social connectivity, competitive play, and content variety. While enterprise customers demand guaranteed service-level agreements and dedicated support, consumer segments emphasize seamless experiences, community features, and value-driven pricing.

This comprehensive research report categorizes the Cloud Gaming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Game Genre

- Monetization Model

- End User

Mapping Regional Trends from North American Broadband Maturity to Asia-Pacific Mobile-First Innovators Shaping Cloud Gaming Success

In the Americas, cloud gaming uptake is propelled by robust broadband penetration, a mature console market, and growing investment in digital entertainment. Key operators leverage localized content and sports licensing to differentiate their offerings. Meanwhile, regulatory frameworks around net neutrality and data privacy influence partnership models between telecom and gaming providers, underscoring the need for compliance-driven architectures.

Europe, Middle East & Africa exhibit a heterogeneous landscape shaped by varying network infrastructures and cultural gaming preferences. Western Europe benefits from advanced fiber deployments and consumer-ready smart TV ecosystems, whereas emerging markets in the Middle East and Africa represent greenfield opportunities driven by increasing smartphone access and digital literacy programs. Regional content partnerships and language localization are critical to capturing these diverse audiences.

Asia-Pacific remains the world’s most dynamic cloud gaming frontier, with China, Japan, and South Korea leading in service adoption and technological innovation. Governments and industry consortia invest heavily in 5G rollouts and edge data centers, while local publishers integrate cloud platforms into mobile-first gaming ecosystems. Australia and Southeast Asian markets also display accelerated growth, supported by rising disposable incomes and strategic international content collaborations.

This comprehensive research report examines key regions that drive the evolution of the Cloud Gaming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Technology Giants Telecom Operators Console Manufacturers and Niche Innovators Are Competing for Cloud Gaming Dominance

Major cloud gaming providers are leveraging strategic partnerships, proprietary streaming technologies, and comprehensive content libraries to advance their market positioning. Leading technology firms integrate custom GPU instances and adaptive bit-rate streaming across their global data center fleets to ensure minimal latency and consistent frame rates.

Meanwhile, telecom incumbents are harnessing existing network infrastructure to deliver bundled gaming-as-a-service packages, bundling data plans with exclusive gaming tiers to augment subscriber retention. Traditional console manufacturers are diversifying through cloud-based subsystems that complement hardware sales and extend their ecosystem reach.

Additionally, emerging players are carving niche positions by specializing in esports-focused cloud streams, interactive live events, and regional content curation. They differentiate through white-label solutions, developer-friendly APIs, and in-platform analytics that drive user insights and personalized experiences. Collectively, these competitive maneuvers have intensified the race to optimize performance, expand content libraries, and cultivate engaged communities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Gaming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 37 Interactive Entertainment Co., Ltd

- Amazon.com, Inc.

- Antstream Arcade Ltd

- Blacknut SAS

- Blade SAS

- Boosteroid Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Loudplay Ltd

- Microsoft Corporation

- NetEase, Inc.

- Numecent Holdings Ltd.

- NVIDIA Corporation

- Perfect World Co., Ltd.

- Playkey LLC

- Sony Interactive Entertainment LLC

- Tencent Holdings Ltd

- Ubitus K.K.

- Utomik B.V.

Strategic Imperatives for Building Resilient Network Partnerships Exclusive Content and Developer Ecosystems to Drive Sustainable Growth

Industry leaders should prioritize deepening partnerships with telecom operators and edge infrastructure providers to secure network-level quality assurances. Investment in multi-cloud orchestration platforms can facilitate dynamic workload distribution and resilience, minimizing performance degradation during peak usage periods.

On the content front, cultivating exclusive titles and early-access deals can serve as powerful differentiators in a crowded subscription landscape. Furthermore, adopting real-time telemetry and behavioral analytics will enable personalized recommendations and targeted content promotions, thereby increasing user engagement and reducing churn.

From an operational perspective, securing long-term supply agreements for specialized hardware components can mitigate tariff-related cost volatility. Simultaneously, exploring energy-efficient data center designs and carbon-offset programs can align with sustainability commitments and resonate with environmentally conscious consumers.

Finally, establishing developer incubators and SDK toolkits can cultivate an ecosystem of third-party content creators, expanding platform capabilities and fostering innovation. By weaving together network partnerships, content exclusivity, analytics-driven personalization, cost-optimization, and developer engagement, market participants can build defensible competitive advantages and secure long-term growth.

Detailing a Multimodal Research Framework That Blends Interviews Patent Analysis and RealTime Monitoring to Illuminate Cloud Gaming Dynamics

This research synthesizes qualitative and quantitative data through a multifaceted approach combining extensive secondary literature reviews, expert interviews, and high-frequency tracking of industry developments. Primary insights were gathered via in-depth discussions with cloud architects, platform operators, and network engineers to validate observed trends and emerging challenges.

Complementing these inputs, desktop-based analysis of patent filings, regulatory filings, and technical whitepapers provided a granular understanding of infrastructural innovations and compliance landscapes. Real-time monitoring of partnership announcements, infrastructure rollouts, and beta program launches ensured that findings reflect the current state of cloud gaming architectures and service models.

All data points were cross-validated to address potential biases, and thematic coding was applied to distill insights across device usage, monetization structures, and regional dynamics. End-user perspective surveys and developer feedback loops enriched the narrative by capturing the nuanced requirements of both consumer and enterprise segments.

Together, this rigorous methodology underpins a holistic view of the cloud gaming market, illuminating actionable intelligence for decision-makers seeking to navigate technological complexities, tariff implications, and shifting competitive pressures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Gaming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Gaming Market, by Device Type

- Cloud Gaming Market, by Game Genre

- Cloud Gaming Market, by Monetization Model

- Cloud Gaming Market, by End User

- Cloud Gaming Market, by Region

- Cloud Gaming Market, by Group

- Cloud Gaming Market, by Country

- United States Cloud Gaming Market

- China Cloud Gaming Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Technological, Regulatory, and Market Forces to Envision the Future Trajectory of Cloud Gaming

As cloud gaming cements its role as a cornerstone of modern interactive entertainment, stakeholders must remain agile in responding to technological, regulatory, and geopolitical shifts. The integration of next-generation networks, adaptive streaming protocols, and strategic alliances will determine which platforms capture the zeitgeist of on-demand, device-agnostic gaming.

Balancing the intricate web of content acquisition, infrastructure investment, and monetization strategies is essential for sustainable success. Tariff fluctuations and supply chain disruptions present ongoing challenges, highlighting the need for diversified sourcing and flexible deployment models. At the same time, the proliferation of unique content and community-driven features will shape user loyalty and platform differentiation.

Ultimately, cloud gaming’s promise of boundless access and frictionless experiences will redefine player expectations and industry benchmarks. By interpreting emerging trends through the lenses of segmentation, regional diversification, and competitive dynamics, organizations can craft strategies that harness the full potential of cloud-based delivery and secure leadership positions in the digital gaming frontier.

Unlock Exclusive Cloud Gaming Market Insights and Connect with Our Associate Director of Sales & Marketing to Purchase the Definitive Industry Report

Ready to elevate your strategic positioning in the fast-evolving cloud gaming market? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure exclusive access to the comprehensive market research report. Gain unparalleled insights into emerging trends, tariff impacts, segmentation nuances, regional dynamics, competitive landscapes, and expert recommendations tailored for actionable decision making. Engage with an in-depth analysis that empowers you to navigate complexities, optimize investments, and capture growth opportunities in cloud gaming.

Contact Ketan Rohom today to discuss pricing, delivery options, and how the report can be customized to your organization’s unique needs. Don’t miss the chance to transform insights into strategic advantage-connect now to purchase the definitive cloud gaming market research report and stay ahead of the competition.

- How big is the Cloud Gaming Market?

- What is the Cloud Gaming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?