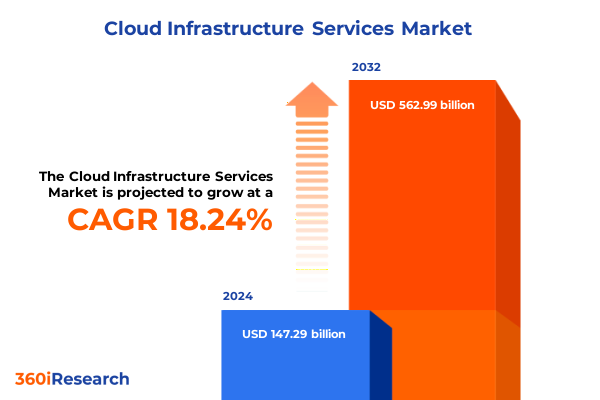

The Cloud Infrastructure Services Market size was estimated at USD 172.54 billion in 2025 and expected to reach USD 202.12 billion in 2026, at a CAGR of 18.40% to reach USD 562.99 billion by 2032.

Navigating the Dynamic Frontier of Cloud Infrastructure Services: Unveiling Unprecedented Opportunities and Strategic Imperatives for Modern Enterprises

The cloud infrastructure services landscape stands at a pivotal junction where technological breakthroughs intersect with evolving enterprise demands. Modern organizations are no longer content with mere scalability; they seek agile, resilient, and cost-effective foundations capable of powering complex digital ecosystems. Over the past decade, cloud adoption has progressed from a niche solution to a strategic imperative, reshaping how businesses conceive, build, and deploy mission-critical applications.

As data volumes swell and the need for instant insights intensifies, infrastructure services have emerged as the backbone of digital transformation. Enterprises now prioritize environments that seamlessly integrate compute, storage, and networking capabilities while enabling rapid provisioning and dynamic resource allocation. Alongside this, a growing emphasis on hybrid cloud models highlights the importance of balancing flexibility with control, allowing organizations to optimize workloads across on-premises and public cloud environments.

In this context, the expanded role of platform services is equally notable. By abstracting the underlying infrastructure, analytics, application development, and database services empower development teams to innovate without heavy operational overhead. The synergy between these service layers underpins a new era of cloud maturity-one characterized by self-service agility, deeper automation, and a relentless focus on delivering business outcomes. This executive summary distills the essential drivers, challenges, and opportunities shaping the cloud infrastructure services arena today.

Harnessing Breakthrough Innovations and Market Dynamics That Are Redefining the Global Cloud Infrastructure Ecosystem and Driving Next-Gen Value Creation

Over recent years, the cloud infrastructure sector has undergone transformative shifts fueled by advancements in containerization, serverless computing, and artificial intelligence integration. These innovations have redefined operational paradigms, enabling organizations to deploy and manage applications with unprecedented speed and granularity. For instance, serverless architectures eliminate the need for server provisioning, allowing developers to focus solely on code while automatically scaling in response to demand.

Concurrently, container orchestration platforms have matured into robust ecosystems that streamline microservices deployment and lifecycle management at scale. By facilitating consistent, portable workloads across heterogeneous environments, containers have become the de facto standard for cloud-native application design. This shift towards modularity not only enhances resource utilization but also accelerates release cycles through continuous integration and continuous delivery pipelines.

Meanwhile, artificial intelligence and machine learning workloads have placed new demands on infrastructure, driving the proliferation of specialized hardware accelerators and high-performance networking solutions. Organizations are increasingly investing in technologies that can support real-time analytics and data-intensive processing, thereby unlocking deeper customer insights and operational efficiencies. As these trends converge, the cloud infrastructure landscape continues to evolve at breakneck speed, compelling industry stakeholders to adapt their strategies to maintain competitive relevance.

Assessing the Multifaceted Consequences of 2025 United States Tariff Adjustments on Cloud Infrastructure Service Supply Chains Cost Structures and Competitive Positioning

In 2025, the United States enacted a series of tariff adjustments that substantially affected the supply chains underpinning cloud infrastructure services. Hardware components, in particular, faced increased duties, driving up costs for servers, networking equipment, and storage arrays sourced from overseas manufacturers. These import levies necessitated that providers reevaluate procurement strategies and reinforce relationships with domestic suppliers.

As a result, many organizations saw capital expenditures rise in the short term, prompting a shift in consumption patterns. Some providers offset these cost pressures by optimizing resource utilization and accelerating the adoption of consumption-based billing models. Others increased investment in edge computing, where regional micro-data centers could mitigate tariff impacts and reduce dependency on international hardware shipments.

Moreover, the tariff environment catalyzed consolidation among smaller equipment vendors, as scale became a decisive factor in absorbing additional costs. Larger providers leveraged their bargaining power to negotiate volume discounts and pass through minimal price increases to end customers. While this dynamic temporarily strained profit margins, it also reinforced the resilience of supply chains and sparked innovation in modular, software-defined infrastructure components that are less dependent on proprietary hardware.

Decoding Market Patterns Through Deployment Models Components Organizational Scales and Industry Verticals to Uncover Actionable Cloud Infrastructure Segmentation

Through the lens of deployment models, the market reveals distinct value propositions across hybrid, private, and public cloud environments. Hybrid architectures have gained traction among enterprises seeking to balance data sovereignty and scalability, while private clouds remain the choice for highly regulated industries requiring stringent compliance controls. Public cloud platforms, in turn, continue to expand their service catalogs, targeting developers with on-demand resources that scale to virtually any workload.

Component segmentation further highlights divergent growth trajectories. The infrastructure as a service layer, comprising compute, network, and storage elements, serves as the foundational tier. Within compute, organizations evaluate the trade-offs between bare metal performance and the flexibility of virtual machines. Networking offerings range from programmable load balancers that optimize traffic distribution to virtual networks that segment data flows securely. Storage capabilities span block, file, and object paradigms, each tailored to specific application profiles-from transactional databases to unstructured data lakes.

Above this layer, platform as a service brings together analytics, application development, and database services. Analytics as a service encompasses big data processing frameworks as well as real-time streaming analytics, equipping enterprises to derive insights from both historical and live data feeds. Application development services include container platform offerings alongside serverless computing, enabling teams to focus on business logic rather than infrastructure management. Database as a service segments into NoSQL solutions for flexible schema requirements and relational options for structured, transaction-oriented workloads.

When viewed by organization size, large enterprises dominate consumption volumes, leveraging scale to negotiate favorable terms and deploy complex multi-region architectures. Medium enterprises, however, prioritize turnkey solutions that reduce operational overhead, often gravitating toward managed service offerings. Small businesses, in contrast, are drawn to entry-level cloud packages that lower the barrier to experimentation and innovation.

End-user industries also shape demand patterns significantly. Financial services organizations demand ultra-low latency and high security, pressing providers to offer dedicated environments. Government and public sector entities emphasize compliance and data residency, driving the expansion of sovereign cloud initiatives. Healthcare firms seek robust data analytics for patient insights while safeguarding sensitive medical information. IT and telecom sectors leverage cloud platforms to deliver scalable communication and content distribution services. Manufacturing enterprises adopt digital twins and industrial IoT integrations, necessitating high-performance compute at the network edge. Finally, retail and eCommerce players pivot toward personalized customer experiences powered by real-time data processing.

This comprehensive research report categorizes the Cloud Infrastructure Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Deployment Model

- End-User Industry

Uncovering Regional Growth Trajectories and Strategic Imperatives Across the Americas Europe Middle East & Africa and Asia-Pacific Cloud Infrastructure Markets

Regional analysis underscores divergent growth vectors and strategic considerations across the Americas, Europe Middle East & Africa, and Asia-Pacific domains. In the Americas, a mature ecosystem of cloud providers competes fiercely on service breadth and global reach. Organizations here emphasize advanced analytics and cross-border collaboration, benefiting from robust regional connectivity and a culture of rapid digital adoption.

Conversely, the Europe Middle East & Africa region presents a tapestry of regulatory regimes and digital maturity levels. Data localization mandates in key markets have accelerated the establishment of localized cloud zones, while cross-border initiatives continue to foster interoperability. Providers in this region prioritize sovereign infrastructure offerings that address privacy concerns and meet stringent compliance requirements, particularly in the public sector.

The Asia-Pacific landscape is characterized by high growth, fueled by digital transformation initiatives across both developed and emerging economies. Nations with advanced technology infrastructures focus on next-generation services such as AI-driven analytics and autonomous operations, while developing markets leverage cloud platforms to leapfrog traditional IT investments. Strategic partnerships between global providers and regional system integrators have become a hallmark of this region, accelerating deployment timelines and tailoring solutions to local market idiosyncrasies. These regional dynamics illustrate the importance of nuanced strategies and localized engagement for providers seeking to maximize their footprint globally.

This comprehensive research report examines key regions that drive the evolution of the Cloud Infrastructure Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Infrastructure Service Providers and Innovators Showcasing Strategic Initiatives Collaborations and Differentiators Driving Competitive Advantage

The competitive landscape features a mix of hyperscale providers, niche specialists, and emerging challengers. Industry titans continue to expand their service portfolios, integrating machine learning toolsets, security frameworks, and developer-centric features. These providers invest heavily in global infrastructure build-outs, focusing on low-latency interconnects and next-level sustainability initiatives that resonate with environmentally conscious customers.

At the same time, regional players differentiate themselves through specialized compliance certifications and localized support ecosystems. By aligning closely with government directives and sectoral partnerships, these firms cater to highly regulated industries such as finance and healthcare. Their advantage lies in tailored offerings that address specific regulatory and operational requirements without the complexity of global-scale solutions.

Furthermore, a wave of agile disruptors is making inroads by emphasizing software-defined infrastructure and open-source interoperability. These next-generation entrants leverage microservices architectures and container orchestration platforms to deliver plug-and-play capabilities, enabling rapid integration with existing enterprise systems. Their lean operational models allow them to undercut traditional pricing structures while maintaining high levels of customizability and developer enablement.

Across all tiers, collaboration between providers and channel partners has emerged as a critical enabler of market penetration. Joint go-to-market initiatives and co-innovation programs allow ecosystem participants to coalesce around end-to-end solutions, blending infrastructure, platform services, and managed operations in a unified offering.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Infrastructure Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akamai Technologies, Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- DigitalOcean Holdings, Inc.

- DigitalOcean, Inc.

- Fujitsu Limited

- Google LLC

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- OVH Groupe SAS

- Rackspace Technology, Inc.

- Salesforce, Inc.

- SAP SE

- Tencent Holdings Limited

- Tencent Holdings Ltd.

- VMware, Inc.

Proposing Strategic Priorities and Tactical Roadmaps for Industry Leaders to Capitalize on Emerging Cloud Infrastructure Trends and Strengthen Long-Term Resilience

Industry leaders must prioritize agility and resilience in their strategic roadmaps to stay ahead. First, rearchitecting applications to adopt container-native and serverless models will enhance portability and auto-scaling capabilities, ensuring optimal resource utilization under variable workloads. In parallel, integrating AI-powered observability tools can deliver proactive performance management and security threat detection, reducing downtime and fortifying operational resilience.

Second, forging strategic alliances with regional data center operators can mitigate geopolitical risks and tariff impacts while adhering to localization requirements. These partnerships should focus on co-developing sovereign cloud offerings and sustainable infrastructure deployments, aligning with regulatory imperatives and corporate social responsibility goals. Such collaborations will also unlock opportunities for joint innovation in edge computing and network optimization.

Third, refining pricing methodologies through granular consumption analytics will empower providers to deliver more transparent, usage-based billing that resonates with customer expectations. By leveraging machine learning algorithms to model consumption patterns, organizations can propose flexible contractual structures that scale alongside evolving demand.

Finally, cultivating an ecosystem mindset will accelerate market penetration. Engaging with independent software vendors, system integrators, and developer communities fosters co-innovation and drives adoption of complementary tools and services. A robust partner network not only amplifies solution reach but also enriches the portfolio with specialized capabilities that address vertical-specific challenges.

Elucidating Robust Research Frameworks and Data Collection Techniques Underpinning Rigorous Analysis of the Global Cloud Infrastructure Services Landscape

This analysis leverages a hybrid research approach combining primary and secondary data sources to ensure rigor and depth. Primary research involved in-depth interviews with cloud architects, IT procurement leaders, and regulatory experts to capture nuanced perspectives on adoption drivers and pain points. These insights were supplemented by detailed surveys targeting decision-makers across key verticals to quantify deployment preferences and investment priorities.

Secondary research entailed extensive review of industry white papers, financial reports, and public filings to contextualize primary findings within broader market dynamics. Proprietary databases provided historical data on infrastructure utilization patterns, while real-time telemetry from cloud management platforms informed trend analyses around resource consumption and service adoption rates.

A multi-layered validation process was applied, wherein preliminary findings were cross-checked with expert panels comprising technology consultants and vendor representatives. This iterative feedback loop ensured that the final insights accurately reflect on-the-ground realities and emerging inflection points. Wherever applicable, regional nuances and regulatory developments were integrated to present a holistic view of the global market.

Analytical models were employed to interpret complex data sets, segmenting the market by deployment model, component, organization size, and end-user industry. Qualitative triangulation further enhanced the robustness of conclusions, enabling triangulated recommendations that address both strategic imperatives and operational feasibilities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Infrastructure Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Infrastructure Services Market, by Component

- Cloud Infrastructure Services Market, by Organization Size

- Cloud Infrastructure Services Market, by Deployment Model

- Cloud Infrastructure Services Market, by End-User Industry

- Cloud Infrastructure Services Market, by Region

- Cloud Infrastructure Services Market, by Group

- Cloud Infrastructure Services Market, by Country

- United States Cloud Infrastructure Services Market

- China Cloud Infrastructure Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Strategic Implications from the Cloud Infrastructure Services Analysis to Guide Executive Decision-Making and Future Growth Initiatives

In synthesizing the findings, it is clear that cloud infrastructure services will continue to serve as the linchpin of digital transformation initiatives. Deployment models will evolve to meet hybrid and sovereign requirements, while component innovations in compute, network, and storage will support new workloads powered by AI and real-time analytics. Platform services will remain the catalyst for developer productivity, driving faster time-to-value across industries.

Tariff shifts have underscored the importance of supply chain agility, encouraging closer collaboration between providers and local partners. Organizations that adopt flexible sourcing strategies and invest in edge infrastructure will be best positioned to navigate regulatory headwinds and maintain cost efficiency.

Segmentation insights reveal that no single model or service layer dominates universally; instead, success will stem from orchestrating a cohesive ecosystem that aligns deployment options, service portfolios, and partner networks with the specific needs of each organization size and vertical. Regional nuances, from data localization to digital maturity, further underscore the need for tailored market approaches.

Ultimately, the providers that combine technological leadership with strategic agility, transparent pricing, and deep ecosystem engagement will capture the most value. For decision-makers, the path forward lies in balancing innovation with pragmatism, leveraging the full spectrum of cloud infrastructure capabilities to accelerate business objectives and maintain a competitive edge.

Engage with Ketan Rohom to Secure Comprehensive Cloud Infrastructure Service Market Intelligence and Empower Informed Strategic Investments with Our In-Depth Report

To unlock unparalleled visibility into cloud infrastructure service trends and establish a competitive edge, engage with Ketan Rohom, our Associate Director of Sales & Marketing. His deep understanding of market dynamics and strategic imperatives will guide you to the most relevant insights tailor-made for your organization’s objectives. By partnering with Ketan, you gain priority access to the full market research report, complete with customized query support and advisory sessions designed to accelerate your decision-making.

This report offers a detailed exploration of disruptive innovations, regulatory headwinds, segmentation nuances, and regional growth catalysts. Ketan will walk you through specific sections that align with your strategic priorities-be it cost optimization in light of tariff shifts, identifying high-value verticals, or benchmarking against leading providers. His consultative approach ensures that you translate raw data into actionable strategies, refining your roadmap in real time.

Reach out to set up a personalized briefing and secure your copy of the definitive market intelligence report. Equip your leadership team with the foresight to navigate a rapidly evolving cloud infrastructure landscape. Partner with Ketan Rohom to transform insights into impact and drive your organization toward sustainable growth and innovation

- How big is the Cloud Infrastructure Services Market?

- What is the Cloud Infrastructure Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?