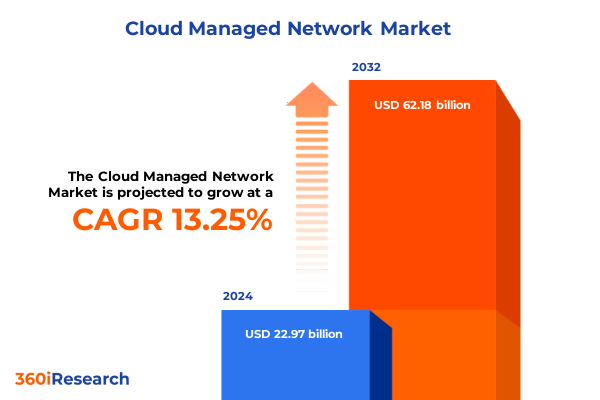

The Cloud Managed Network Market size was estimated at USD 26.03 billion in 2025 and expected to reach USD 29.18 billion in 2026, at a CAGR of 13.24% to reach USD 62.18 billion by 2032.

Establishing a Foundational Understanding of Cloud Managed Networks Amidst Rapid Digital Transformation and Emergent Connectivity Demands

In today’s rapidly evolving digital ecosystem, cloud managed networks have emerged as the backbone of enterprise connectivity, driven by the imperative to balance agility, security, and scalability. As organizations navigate an increasingly complex landscape of hybrid work models, multi-cloud architectures, and edge computing demands, centralized management platforms have become essential to ensure seamless performance across geographic and technological boundaries.

This executive summary illuminates the strategic significance of cloud managed networks, highlighting how they enable IT leaders to consolidate visibility, automate routine tasks, and proactively address performance issues before they impact end users. By integrating orchestration tools, advanced analytics, and policy-driven security controls within a unified interface, enterprises can accelerate deployment cycles and reduce operational overhead. Transitioning from manual configurations to policy-based management not only enhances reliability but also future-proofs network investments as organizations pursue digital transformation and strive to deliver exceptional user experiences.

Uncovering the Fundamental Shifts Redefining the Cloud Managed Network Environment Driven by Technological Innovation and Market Dynamics

Over the past few years, rapid advancements in software-defined networking, artificial intelligence, and cloud-native architectures have fundamentally altered the way enterprises architect and manage their networks. Traditional approaches centered on on-premises hardware are giving way to dynamic, software-driven landscapes in which network functions can be provisioned and scaled on demand, enabling organizations to respond swiftly to shifting business priorities.

Simultaneously, the proliferation of remote work and distributed applications has placed new emphasis on edge computing and secure connectivity across public, private, and hybrid cloud environments. Network teams are embracing automation platforms that leverage machine learning to predict traffic patterns, optimize resource allocation, and detect anomalies in real time. As security threats evolve, integrated threat intelligence and zero-trust frameworks are being woven directly into network management solutions, ensuring that resilience and compliance become inherent rather than added layers. These transformative shifts lay the groundwork for organizations to harness the full potential of cloud managed networks in an agile and secure manner.

Examining the Collective Consequences of 2025 United States Tariffs on Cloud Managed Network Solutions and Industry Supply Chains

Throughout 2025, cumulative tariff measures implemented by the United States have exerted considerable influence on the cost structures and supply chains supporting cloud managed network infrastructure. Heightened duties on imported network hardware components have prompted vendors and service providers to reevaluate sourcing strategies, seeking alternative manufacturing locations and pursuing nearshoring arrangements to mitigate the risk of supply disruptions. These adjustments have, in turn, impacted lead times and procurement cycles, compelling end users to adopt more flexible procurement frameworks and explore as-a-service consumption models.

The tariff-driven environment has also accelerated investment in software-centric approaches, as organizations look to offset rising capital expenditures on physical equipment with solutions that emphasize virtualization, containerization, and policy-based orchestration. Moreover, regional manufacturing hubs have begun to emerge, driven by both government incentives and vendor commitments to localize production. Consequently, stakeholders across the ecosystem are realigning partnerships and reengineering their value chains to preserve margin stability while maintaining the high levels of performance and reliability that modern digital operations demand.

Deriving Strategic Insights from Multidimensional Market Segmentation Spanning Organization Size Deployment Mode Component Solution Type and Industry Vertical

Market segmentation reveals nuanced demand patterns that can inform targeted product strategies and customer engagements. Within organization size, large enterprises continue to prioritize sophisticated orchestration platforms capable of supporting global branch networks and multiple service provider integrations, whereas small enterprises and micro entities often seek turnkey managed services with intuitive dashboards and minimal in-house expertise. Meanwhile, medium SMEs frequently occupy a transitional space, adopting hybrid models that blend cloud-based control planes with select on-premises appliances to balance performance and cost efficiency.

Across deployment modes, fully cloud-native solutions are gaining traction among digital-native businesses seeking rapid scalability, while regulated industries gravitate toward private cloud offerings that deliver enhanced data sovereignty and granular compliance controls. Hybrid architectures, which blend private environments with public cloud services, appeal to organizations requiring gradual migration paths. In the component landscape, hardware performance enhancements remain critical for latency-sensitive applications, yet managed services are experiencing accelerated growth as enterprises offload routine operations. Professional services maintain strategic importance by providing the customized integrations and training needed to maximize tool adoption.

The solution type dimension underscores the proliferation of software-defined wide area networking as a cornerstone for digital transformation, complemented by integrated security services that enforce policy consistency across disparate sites. Routing and switching continue as foundational layers, but user demand for seamless wireless LAN coverage has surged in response to flexible work arrangements. Industry vertical analysis highlights that financial services organizations demand ultra-resilient architectures with real-time analytics, while healthcare and government sectors emphasize stringent security and regulatory compliance. Manufacturing enterprises focus on IoT-enabled connectivity, and retail businesses seek agile network frameworks that can support rapidly changing customer-facing technologies.

This comprehensive research report categorizes the Cloud Managed Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Component

- Solution Type

- Organization Size

- Industry Vertical

Illuminating Regional Market Opportunities and Challenges in the Americas Europe Middle East and Africa and Asia Pacific through Comparative Analysis

Regional dynamics play a pivotal role in shaping adoption strategies and investment priorities. In the Americas, enterprises benefit from mature cloud ecosystems and advanced managed service offerings, with North American organizations leading in early deployment of AI-driven network analytics. Latin American markets are following suit, driven by digital infrastructure investments and regional cloud service expansions. This geographic cluster enjoys robust vendor support networks, but regulatory complexities around data privacy and cross-border traffic occasionally necessitate specialized compliance modules.

In Europe, Middle East and Africa, stringent data protection regulations and a strong focus on energy efficiency drive the adoption of private cloud deployments and network virtualization, especially among financial institutions and public sector bodies. The Middle East is witnessing a surge in smart city initiatives that integrate cloud managed networking with IoT frameworks, whereas parts of Africa are experiencing accelerated uptake through public-private partnerships that aim to bridge digital divides. Across this combined region, sustainability imperatives and geopolitical considerations inform vendor selection and deployment architectures.

Asia Pacific remains a hotbed of innovation and growth, with diverse market maturity levels. China and India represent significant volume opportunities due to large enterprise and government modernization programs, although ongoing tariff considerations influence hardware import decisions and local partner strategies. Southeast Asian countries are investing heavily in cloud infrastructure to support e-commerce and digital services, and established markets such as Australia and Japan prioritize hybrid models to leverage existing on-premises investments alongside new public cloud capabilities.

This comprehensive research report examines key regions that drive the evolution of the Cloud Managed Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Vendors Strategic Innovations and Competitive Approaches Shaping the Evolving Cloud Managed Network Services Ecosystem

A range of established and emerging vendors shape the competitive landscape, each differentiating through distinct value propositions. Leading network equipment providers have augmented their portfolios with cloud-native management platforms that leverage artificial intelligence to automate configuration and support predictive maintenance. Some pure-play software vendors have carved out niche positions by focusing on seamless integrations with major hypervisors and container orchestration frameworks, thereby accelerating adoption among DevOps-centric teams.

Strategic alliances and acquisitions further illustrate the market’s dynamism. Vendors are partnering with global system integrators and managed service providers to extend managed offerings and bolster implementation expertise. Meanwhile, challenger firms emphasize open standards and developer-friendly APIs to win over digital-native enterprises seeking to avoid vendor lock-in. Across the board, roadmaps are converging toward unified management consoles that consolidate network, security, and application performance monitoring-underscoring the industry’s drive toward holistic, policy-driven connectivity solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Managed Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerohive Networks

- Cambium Networks, Ltd.

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Cradlepoint, Inc. (Ericsson)

- Extreme Networks, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Juniper Networks, Inc.

- Meraki

- Mist Systems, Inc.

- NETGEAR, Inc.

- Palo Alto Networks, Inc.

- TP-Link Corporation Limited

- Ubiquiti Inc.

- VMware, Inc.

Formulating Actionable Strategic Recommendations for Industry Leaders to Unlock Value and Drive Innovation in Cloud Managed Network Deployments

To capitalize on evolving market conditions and technological advancements, industry leaders should prioritize the integration of AI-driven operational analytics into their service portfolios, enabling proactive network optimization and rapid anomaly resolution. By offering managed services that blend real-time insights with flexible consumption models, providers can meet the needs of both resource-constrained SMEs and large enterprises with complex topologies. Cultivating partnerships with local system integrators and regional cloud service providers will also prove instrumental in navigating diverse regulatory environments and accelerating time-to-value.

Additionally, vendors and end users alike should explore hybrid deployment options that allow sensitive workloads to remain on-premises while non-critical traffic leverages public cloud scalability. Strengthening supply chain resilience by diversifying hardware sourcing locations can mitigate the risks associated with evolving tariff regimes. Finally, embedding sustainability goals into network architectures-through energy-efficient hardware choices and carbon-aware workload scheduling-will not only address environmental mandates but also resonate with increasingly conscientious customers.

Detailing a Rigorous Research Methodology Combining Primary Insights and Secondary Analysis to Ensure Comprehensive Market Intelligence

This report synthesizes insights derived from a rigorous research framework combining primary and secondary methodologies. The primary phase encompassed in-depth interviews with CIOs, IT directors, and network architects across multiple industry verticals, ensuring a diverse perspective on deployment challenges and strategic priorities. Complementing these discussions, structured surveys captured quantitative data on adoption drivers, spending behaviors, and satisfaction levels with existing network management solutions.

Secondary research involved a thorough examination of company filings, regulatory publications, technology white papers, and reputable industry journals to validate findings and identify emerging trends. Data triangulation techniques were applied to reconcile disparate sources and maintain accuracy, while ongoing dialogue with industry associations and standards bodies reinforced the credibility of projections and scenario analyses. Quality control procedures, including peer reviews and expert validation workshops, underpinned the final deliverables to ensure actionable and reliable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Managed Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Managed Network Market, by Deployment Mode

- Cloud Managed Network Market, by Component

- Cloud Managed Network Market, by Solution Type

- Cloud Managed Network Market, by Organization Size

- Cloud Managed Network Market, by Industry Vertical

- Cloud Managed Network Market, by Region

- Cloud Managed Network Market, by Group

- Cloud Managed Network Market, by Country

- United States Cloud Managed Network Market

- China Cloud Managed Network Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Findings and Insights to Chart the Future Trajectory of Cloud Managed Network Solutions in a Dynamic Market Environment

In sum, cloud managed networks represent a critical enabler of digital transformation, offering centralized visibility, automated operations, and adaptive security capabilities that align with modern enterprise requirements. Segmentation insights reveal differentiated needs across organization sizes, deployment preferences, and industry verticals, highlighting opportunities for tailored offerings that address the unique constraints of SMEs and large global corporations alike.

Regional analysis underscores the importance of localized strategies-from the Americas’ embrace of AI-driven analytics to EMEA’s focus on regulatory compliance and sustainable architectures, and Asia Pacific’s rapidly expanding cloud ecosystems tempered by trade considerations. Vendor dynamics illustrate a market in flux, driven by collaborative partnerships, software-first innovations, and the unification of network and security management. By adhering to the actionable recommendations laid out herein, stakeholders are well-positioned to harness emerging technologies, navigate evolving tariff landscapes, and deliver resilient, high-performance connectivity solutions that meet the demands of today’s digital economy.

Empower Your Strategic Decisions with Our Comprehensive Cloud Managed Network Research—Contact Ketan Rohom Today to Secure Your Customized Market Insights

Take the next step toward informed decision-making by leveraging our in-depth analysis and expert insights tailored for cloud managed network strategies. Partner with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who is dedicated to understanding your organization’s unique challenges and guiding you toward the ideal research solutions. This report offers a holistic view of market segmentation dynamics, regional nuances, tariff impacts, and vendor innovations, ensuring that you can align your network initiatives with the latest industry developments.

Secure exclusive access to comprehensive data, practical recommendations, and actionable intelligence designed to empower your teams and drive sustainable growth. To request a customized briefing or to purchase the full market research report, reach out to Ketan Rohom today. Don’t miss this opportunity to position your organization at the forefront of cloud managed network innovation-connect now to transform insights into strategic advantage.

- How big is the Cloud Managed Network Market?

- What is the Cloud Managed Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?