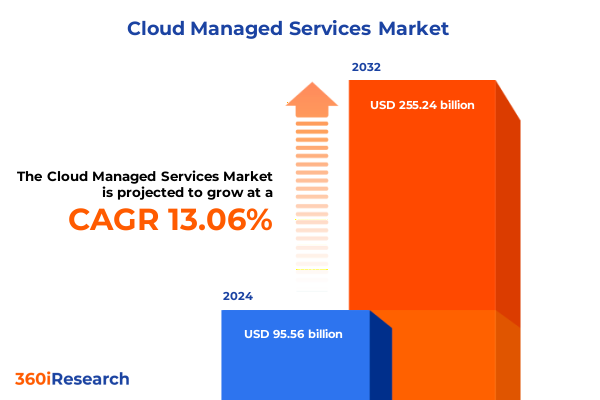

The Cloud Managed Services Market size was estimated at USD 106.17 billion in 2025 and expected to reach USD 117.97 billion in 2026, at a CAGR of 13.34% to reach USD 255.24 billion by 2032.

Navigating the Cloud Managed Services Revolution with Emerging Technologies to Accelerate Agility, Optimize Operations, and Elevate Business Performance

The imperative for organizations to seamlessly adopt and manage cloud environments has never been more pronounced, as digital transformation initiatives accelerate across every industry. Cloud managed services have emerged as a cornerstone for enterprises seeking to optimize performance, streamline operations, and reduce overhead associated with in-house infrastructure management. By leveraging specialized providers, organizations can offload tasks such as monitoring, security, and maintenance, enabling internal teams to focus on core business objectives and innovation. The growing complexity of multi-cloud and hybrid ecosystems further underscores the demand for expert stewardship, as keeping pace with patch cycles, compliance mandates, and evolving best practices can overwhelm even the most proficient IT departments. Consequently, a strategic approach to cloud management has become a differentiator, empowering businesses to respond rapidly to market shifts and capitalize on emerging opportunities.

How Accelerated Digital Transformation and Cloud Native Architectures Are Redefining Managed Services to Future-Proof Enterprise Operations and Innovation

Enterprise infrastructures are undergoing a profound metamorphosis driven by the convergence of advanced digital frameworks, cloud-native paradigms, and automation platforms. Traditional monolithic applications are being reimagined as containerized microservices architected for agility, scalability, and resilience. In addition, the proliferation of edge computing and distributed architectures is redefining where and how workloads are hosted, enabling real-time processing closer to end users and devices. As organizations embrace DevSecOps practices, security integration shifts left in the development pipeline, ensuring that managed service providers embed robust protection mechanisms from inception through deployment. Furthermore, the rise of artificial intelligence and machine learning in operations-commonly referred to as AIOps-has introduced predictive analytics to detect anomalies, forecast capacity constraints, and automate response workflows. As a result, service portfolios are evolving to offer intelligent monitoring, self-healing capabilities, and closed-loop orchestration that collectively reduce downtime and optimize resource utilization.

Assessing the Ripple Effects of United States 2025 Tariff Policies on Cloud Infrastructure Costs, Service Provider Strategies, and Supply Chain Dynamics

The implementation of new United States tariff measures in 2025 has introduced material considerations for cloud managed services providers and end users alike. With duties imposed on a broad range of data center hardware components-encompassing servers, network switches, and storage arrays-the cost structures of on-premises and co-location offerings have been appreciably impacted. Moreover, supply chain disruptions have been exacerbated by manufacturers’ need to recalibrate sourcing strategies, driving lengthier lead times and inventory constraints for critical infrastructure. Consequently, many service providers have accelerated partnerships with domestic OEMs or intensified cloud-native, software-defined solutions to mitigate dependency on tariff-affected imports. In parallel, end users are reassessing hybrid cloud architectures, embedding greater flexibility to shift workloads across multi-regional cloud platforms in pursuit of cost efficiency and compliance. Ultimately, this environment has catalyzed innovation in hardware abstraction and virtualization strategies, underpinning a new generation of integrated, tariff-resilient service models.

Unveiling Critical Market Segment Insights Shaping Demand Across Diverse Service Types Platforms Organization Sizes and End User Verticals

A nuanced examination of the cloud managed services landscape reveals distinct demand drivers and service preferences that vary markedly by service type, platform, organizational scale, and end user vertical. Reflecting service type segmentation, demand for infrastructure services continues to dominate investments while momentum for security services has surged in response to evolving cyberthreats, alongside robust interest in communication & collaboration tools and mobility services to sustain distributed workforces. Turning to platform deployment models, hybrid cloud adoption stands out as enterprises seek to balance control with scalability, whereas private cloud environments appeal to regulated industries requiring stringent data sovereignty, and public cloud offerings remain indispensable for elastic, on-demand compute. Organizational size introduces another layer of complexity: large enterprises often engage providers for comprehensive, end-to-end management across global estates, yet small and medium enterprises increasingly leverage modular service bundles to optimize operational costs without compromising quality or support. Meanwhile, end user demand is strongest within banking, financial services, and insurance institutions that require rigorous compliance and security, followed by healthcare and life sciences entities prioritizing data privacy; manufacturing and automotive sectors pursuing Industry 4.0 initiatives; and retail and e-commerce players focused on delivering seamless, omnichannel experiences. This layered segmentation underscores the importance of tailoring service portfolios to diverse operational imperatives, regulatory landscapes, and growth trajectories.

This comprehensive research report categorizes the Cloud Managed Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Platform

- Organization Size

- End User

Exploring Regional Dynamics Driving Growth Opportunities and Competitive Landscapes Across Americas EMEA and Asia-Pacific Markets

Regional market dynamics in the cloud managed services arena are characterized by unique regulatory, technological, and competitive factors that influence strategic priorities. In the Americas, robust digitization efforts across financial services and healthcare sectors continue to drive investments, supported by an extensive partner ecosystem and mature network infrastructure that facilitates rapid deployment of edge and multi-cloud solutions. Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory environments, where stringent data protection laws compel providers to innovate privacy-centric managed offerings and localize service delivery through sovereign cloud clusters. In the Asia-Pacific region, explosive growth in digital commerce and the proliferation of smart city initiatives have fostered demand for low-latency, distributed computing frameworks, prompting providers to establish regional data centers and strategic alliances with telcos. Furthermore, economic diversification in emerging markets has accelerated cloud adoption in manufacturing, energy, and public sector operations, highlighting the importance of scalable solutions that can adapt to variable bandwidth and connectivity constraints. These regional distinctions call for a calibrated approach to service design, ecosystem partnerships, and compliance strategies to fully capitalize on geographically specific growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Cloud Managed Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud Managed Services Providers and Their Strategic Initiatives for Capturing Emerging Market Opportunities

A review of the competitive landscape reveals that leading cloud managed services providers are differentiating through a combination of strategic acquisitions, technology partnerships, and proprietary service innovations. Global hyperscalers have expanded their managed services portfolios by integrating specialized third-party tools and forging alliances with independent software vendors to deliver verticalized solutions. Traditional systems integrators and consulting firms are enhancing their cloud service lines with automation platforms and advanced security operations centers, thereby delivering end-to-end capabilities across design, migration, and run phases. At the same time, niche providers are gaining traction by focusing on high-value specialties such as compliance management, IoT orchestration, and AIOps-driven performance optimization. These divergent strategies reflect an evolving ecosystem in which scale, domain expertise, and local presence each contribute to competitive advantage. Consequently, the ability to seamlessly blend global delivery models with regional insights and tailored solution sets has emerged as a critical success factor in capturing emerging opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Managed Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alibaba Group

- Amazon Web Services, Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Cloudian Inc.

- Cloudticity LLC

- Coalfire Systems, Inc.

- Cognizant Technology Solutions Corp.

- DXC Technology Company

- Eviden SAS

- Google LLC by Alphabet Inc.

- HashiCorp, Inc.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co., Ltd.

- Informatica Inc.

- Infosys Ltd.

- International Business Machines Corporation

- Kyndryl Inc.

- Linode LLC

- Microsoft Corporation

- NTT Limited

- OVH SAS

- Salesforce, Inc.

- SAP SE

- ServiceNow

- Spinnaker Support, LLC

- Tata Consultancy Services Ltd.

- Tencent Cloud

- UpCloud Ltd.

- Veritis Group Inc.

- Wipro Ltd.

Actionable Strategies for Industry Leaders to Enhance Service Portfolios Drive Innovation and Mitigate Operational Risks in Cloud Environments

To thrive amidst intensifying competition and rapidly evolving technology landscapes, industry leaders must pursue a combination of targeted investments and strategic partnerships that align with customer priorities. Providers should prioritize the development of AI-driven operations platforms to enable predictive monitoring and automated remediation, thereby reducing mean time to resolution and enhancing service reliability. Moreover, embedding robust security frameworks across multi-cloud environments is imperative, with zero-trust architectures and continuous compliance monitoring serving as foundational pillars. Cultivating deep alliances with platform vendors and niche ISVs can unlock access to specialized capabilities and facilitate co-innovation efforts tailored to key verticals. Simultaneously, expediting the rollout of sustainability initiatives-such as carbon-aware workload scheduling and green data center certifications-will resonate with increasingly eco-conscious stakeholders. Finally, investing in customer success programs and outcome-based pricing models can strengthen retention and foster long-term partnerships. By executing these recommendations with precision and agility, service providers can reinforce their value proposition, anticipate market shifts, and sustain competitive momentum.

Combining Quantitative and Qualitative Methods to Uncover Comprehensive Insights into the Cloud Managed Services Ecosystem

This research draws upon a comprehensive framework that blends quantitative data analysis with qualitative insights to deliver a holistic view of the cloud managed services sector. Primary research encompassed in-depth interviews with C-level executives, IT decision-makers, and service delivery managers, supplemented by focus groups that explored emerging use cases and pain points. Secondary research involved systematic reviews of industry publications, regulatory filings, and reputable technology news outlets, ensuring that the analytical foundation reflects current trends and regulatory changes. Data points were triangulated across multiple sources, including vendor solution briefs, open-source community discussions, and benchmarking studies, to validate findings and mitigate bias. The segmentation analysis was informed by a rigorous categorization of service types, deployment platforms, organization sizes, and end user verticals, while regional insights were contextualized through comparative assessments of regulatory frameworks, infrastructure maturity, and economic priorities. Finally, competitive profiling leveraged both public disclosures and proprietary interviews to map strategic initiatives and service innovations. This layered methodology ensures that the insights presented are robust, actionable, and grounded in real-world evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Managed Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Managed Services Market, by Service Type

- Cloud Managed Services Market, by Platform

- Cloud Managed Services Market, by Organization Size

- Cloud Managed Services Market, by End User

- Cloud Managed Services Market, by Region

- Cloud Managed Services Market, by Group

- Cloud Managed Services Market, by Country

- United States Cloud Managed Services Market

- China Cloud Managed Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings to Illuminate the Path Forward for Stakeholders in the Evolving Cloud Managed Services Ecosystem

The rapid evolution of cloud managed services underscores a fundamental shift in how enterprises architect, operate, and secure their digital assets. Key technology trends-including containerization, edge computing, and AIOps-are reshaping service portfolios and driving efficiency gains, while shifting regulatory landscapes, such as data sovereignty mandates and tariff adjustments, impose new parameters for cost management and infrastructure sourcing. Moreover, the nuanced segmentation across service type, platform, organization size, and vertical industry highlights the necessity for providers to tailor offerings that meet diverse operational, compliance, and innovation requirements. Regional market dynamics further reinforce the importance of localized strategies that account for regulatory heterogeneity and infrastructure maturity. As competition intensifies, leading providers are distinguishing themselves through strategic alliances, acquisitions, and the integration of advanced automation and security capabilities. Consequently, stakeholders across the ecosystem must remain vigilant, embrace data-driven decision making, and pursue adaptive service models to maintain agility and resilience. Ultimately, those who integrate these insights into their strategic planning will be best positioned to capture growth opportunities and deliver sustained value in the dynamic cloud managed services arena.

Unlock Deeper Market Intelligence Today by Partnering with Ketan Rohom to Access the Comprehensive Cloud Managed Services Industry Report

Elevate your competitive edge by securing access to a meticulously researched Cloud Managed Services report that illuminates the most critical trends, opportunities, and challenges shaping the industry landscape. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke licensing options, volume discounts, and enterprise-wide access plans designed to align with your organization’s strategic objectives. Engage with expert consultants who can guide you through customized insights, ensuring that your leadership team is equipped with actionable intelligence to inform investment decisions, partnership strategies, and service innovation roadmaps. By partnering with Ketan, you will gain priority access to ongoing updates, bespoke analytical briefings, and executive summaries crafted to accelerate stakeholder alignment and drive sustainable growth. Don’t miss this opportunity to transform your understanding of the cloud managed services ecosystem and position your organization at the forefront of digital transformation initiatives.

- How big is the Cloud Managed Services Market?

- What is the Cloud Managed Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?