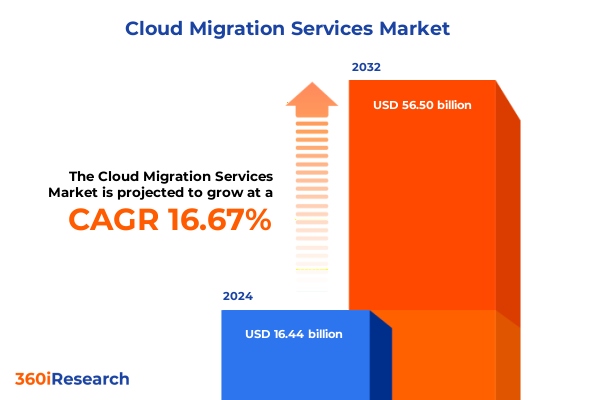

The Cloud Migration Services Market size was estimated at USD 19.02 billion in 2025 and expected to reach USD 22.01 billion in 2026, at a CAGR of 16.82% to reach USD 56.50 billion by 2032.

Unveiling the Strategic Imperative of Cloud Migration Services as Organizations Accelerate Digital Modernization and Seek Operational Resilience Amid Disruption

In an era defined by rapid technological innovation and heightened competitive pressures, the migration to cloud environments has emerged as a strategic imperative for enterprises seeking to modernize their infrastructure and accelerate business agility. Organizations are navigating complex digital landscapes where legacy systems hinder the ability to respond to market dynamics, drive cost efficiencies, and deliver seamless customer experiences. Migrating workloads to cloud platforms offers a pathway to unlock new capabilities, including elastic scalability, automated provisioning, and advanced analytics. These benefits are crucial for companies aiming to achieve operational resilience and gain a competitive edge in an increasingly digital-first world.

The introduction of cloud migration services has catalyzed a shift from traditional on-premises models to hybrid and multi-cloud architectures, empowering enterprises to optimize performance while maintaining control over sensitive data. As regulatory frameworks evolve and cybersecurity threats grow more sophisticated, migration engagements now emphasize security and compliance controls integrated directly into cloud infrastructures. Moreover, the proliferation of artificial intelligence and machine learning workloads has underscored the need for flexible and high-performance cloud environments. Against this backdrop, service providers are crafting offerings that blend professional services, managed monitoring, and ongoing support to guide clients through every phase of the migration journey, from initial assessment to post-deployment optimization.

Looking ahead, the role of cloud migration services will continue to expand, driven by evolving business models, emerging technologies and the relentless pursuit of digital transformation. Organizations that strategically partner with experienced providers to navigate technical complexities and governance requirements will be best positioned to harness the full potential of cloud platforms and secure sustainable growth.

Examining the Catalyst of Cloud-First Adoption Driven by Emerging Technologies Procedural Shifts and Business Model Reinvention Redefining IT Infrastructure

The landscape of cloud migration has been reshaped by a convergence of forces, including the ascendancy of hybrid and multi-cloud deployments, the integration of DevOps and infrastructure-as-code practices, and the growing demand for zero-downtime migration methodologies. As enterprises pursue transformational objectives, they are adopting re-architecting and re-factoring approaches alongside more traditional re-hosting and re-platforming techniques to align application portfolios with cloud-native architectures. This shift enables organizations to fully leverage containerization, microservices frameworks, and serverless computing, driving faster time-to-market and more efficient resource utilization.

Concurrently, the professional services component of migration engagements has expanded beyond mere assessment and planning to encompass deep expertise in data migration, security policy design, and workload optimization. Modern service offerings now integrate optimization and cost management modules that continuously analyze resource utilization, identify inefficiencies, and recommend right-sizing measures. Security and compliance considerations have become foundational, with providers embedding continuous monitoring, threat detection, and automated policy enforcement to maintain robust safeguards across heterogeneous cloud environments.

These transformative shifts have redefined the partnerships between clients and service providers, emphasizing collaborative models that merge domain expertise with advanced toolchains and automation capabilities. As businesses strive to pivot quickly, they require migration strategies that not only move workloads to the cloud but also ensure enduring performance, governance and innovation across their application ecosystems.

Investigating the Far-Reaching Effects of 2025 United States Tariff Policies on Cloud Migration Services Infrastructure Costs and Supply Chain Resilience

In 2025, newly imposed United States tariffs on imported technology hardware have introduced significant cost pressures across the cloud migration ecosystem. Reciprocal duties on data center equipment-imposed at rates of up to 34 percent on Chinese imports, 32 percent on Taiwanese components, and 25 percent on South Korean goods-have driven up the capital expenditures of cloud service providers and enterprise IT teams alike. These heightened equipment costs have prompted some major cloud operators to delay or scale back planned data center expansions, disrupting the timeline for migrating critical workloads and extending project durations.

The impact of tariffs extends beyond hardware inflation, exacerbating existing supply chain fragilities that first emerged during global semiconductor shortages. With China responsible for an estimated 30 percent of global server manufacturing, organizations are accelerating efforts to diversify sourcing to alternative regions such as Vietnam, Taiwan and Mexico. While this nearshoring trend promises long-term resilience, establishing new supplier relationships involves logistical realignment, regulatory approvals and quality requalification, contributing to average infrastructure deployment delays of 20 to 30 percent.

Furthermore, the prospect of additional duties on semiconductors and electronic components has spurred enterprise procurement teams to lock in hardware orders ahead of tariff escalations, resulting in uneven demand spikes and temporary supply constraints. Smaller cloud migration specialists, which lack the scale to absorb elevated import duties, are facing margin compression and must either pass costs to clients or absorb losses, potentially stalling service delivery and undermining competitiveness. Collectively, these tariff dynamics underscore the critical need for strategic planning and supply chain flexibility when orchestrating large-scale cloud migrations in 2025.

Unlocking Deep Market Understanding Through Multifaceted Segmentation of Cloud Migration Services Spanning Service Offerings, Migration Approaches, Deployment Models and Vertical Focus

A nuanced examination of market segmentation reveals that migration services span managed offerings such as monitoring and management, optimization and cost management, and security and compliance, alongside professional services that include application migration, assessment and planning, data migration, and post-migration support. Service providers tailor their engagements based on migration type, from lift-and-shift re-hosting to application-level re-platforming, full-scale re-architecting, code re-factoring, complete solution replacement and rebuilding efforts. Deployment models further diversify solutions, encompassing hybrid environments that blend on-premises and public cloud resources, multi-cloud architectures for enhanced redundancy, private cloud infrastructures for enhanced control, and public cloud platforms for rapid scalability.

The breadth of industry verticals served underscores the versatility of cloud migration services. Financial institutions leverage specialized migration frameworks tailored to banking, capital markets and insurance, while government and public sector entities emphasize stringent compliance and data sovereignty requirements. Healthcare organizations deploy custom approaches for health insurance payers, hospitals and clinics, and pharmaceuticals and biotechnology firms. Manufacturing enterprises navigate sector-specific workflows in automotive, consumer goods and electronics, and retail and e-commerce businesses optimize omnichannel and online retail capabilities alongside traditional brick-and-mortar environments. Across all verticals, enterprises of all sizes-from global conglomerates to nimble small and medium businesses-partner with an array of cloud service providers, consulting firms, independent software vendors, managed service providers and system integrators to execute migration roadmaps that align with strategic objectives.

This comprehensive research report categorizes the Cloud Migration Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Enterprise Size

- Service Provider

- Deployment Model

- Industry Vertical

Mapping Regional Dynamics Shaping Cloud Migration Demand Across the Americas EMEA and Asia Pacific in Response to Regulatory, Technological and Economic Forces

Regionally, the Americas continue to drive cloud migration momentum, as enterprises harness digital transformation initiatives and benefit from mature public cloud infrastructures supported by robust connectivity. The United States leads in adoption of advanced migration tools and managed services, with Canada and Latin American markets following suit through targeted government and telecom modernization projects. Conversely, Europe, the Middle East and Africa exhibit a heterogeneous landscape, where regulatory frameworks and data sovereignty mandates inform migration strategies, particularly within the financial services, healthcare and public sector segments. Organizations in these regions emphasize compliance controls and localized deployment models, balancing the benefits of global cloud platforms with strict governance requirements.

In the Asia-Pacific region, rapid digitalization across both developed and emerging economies fuels demand for cloud migration expertise. Enterprises in countries such as Australia, Japan and Singapore leverage multi-cloud architectures to foster innovation, while Indian and Southeast Asian markets adopt hybrid strategies to accommodate on-premises legacy systems and public cloud scalability. Across all regions, service providers are expanding local data center footprints and forging partnerships with regional integrators to mitigate latency concerns, adhere to evolving privacy regulations, and deliver culturally attuned migration services. These regional dynamics shape the competitive landscape, driving continuous refinement of go-to-market strategies to address diverse customer requirements and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Cloud Migration Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Alliances Driving Innovation Competition and Service Excellence in the Cloud Migration Services Ecosystem

Key companies in the cloud migration space are distinguished by their breadth of service portfolios, strategic partnerships, and technology alliances. Leading hyperscale providers have integrated professional services arms that collaborate on complex migrations, while boutique consultancies deliver specialized expertise in vertical-specific compliance and application modernization. Major IT services firms leverage deep systems integration capabilities and proprietary migration toolkits to streamline transitions, and independent software vendors innovate automation frameworks that reduce cutover windows and minimize disruption. Managed service providers differentiate through end-to-end support models encompassing infrastructure management, security operations and cost optimization. In parallel, emerging players focus on automation-driven migration accelerators and artificial intelligence–powered assessment platforms, attracting clients seeking rapid proofs of concept and minimal manual intervention.

Competition within this ecosystem is further intensified by strategic alliances between service providers and public cloud platforms. Joint go-to-market initiatives underscore the importance of integrated solutions that span infrastructure provisioning, data pipeline orchestration and post-migration performance tuning. Through continuous investment in partner networks, leading companies enhance their ability to deliver scalable, repeatable migration engagements while ensuring compatibility with evolving cloud-native services and governance frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Migration Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Amazon Web Services, Inc.,

- Broadcom Inc.

- Capgemini

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Concise Software International GmbH

- DXC Technology

- Evolve IP, LLC

- Flexera Software LLC

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- International Business Machines Corporation

- Kyndryl

- N-iX LLC

- NaviSite, Inc.

- NTT DATA Corporation

- Oracle Corporation

- Rackspace Technology

- SAP SE

- Tata Communications

- Tech Mahindra

- Vertis Technology Solutions Ltd.

- Wipro

- WSM International

Presenting Actionable Strategic Initiatives for Technology and Business Leaders to Capitalize on Cloud Migration Trends Strengthen Capabilities and Mitigate Risks

To capitalize on the accelerating shift toward cloud-first architectures, organizations should prioritize the development of a comprehensive migration blueprint that aligns IT objectives with business goals. This approach entails early engagement with executive stakeholders to define success criteria, articulate value drivers and secure organizational buy-in. Invest in building in-house cloud competency centers to foster cross-functional expertise in platform selection, security policy design and cost governance. Concurrently, evaluate service providers not only for technical capabilities but also for proven methodologies in managing regulatory compliance, automated testing and workload optimization.

Enterprises should adopt a modular migration strategy that segments applications by complexity and criticality, enabling rapid wins through lift-and-shift for low-risk workloads while dedicating specialized resources to more complex re-platforming and re-architecting efforts. Embrace hybrid and multi-cloud environments to avoid vendor lock-in and optimize resilience, leveraging unified management tools to ensure consistent policy enforcement. Strengthen supply chain resilience by establishing flexible contract terms with hardware vendors and cultivating secondary manufacturing partnerships in non-tariff-impacted regions. Finally, embed continuous improvement mechanisms post-migration, utilizing monitoring and analytics platforms to capture performance metrics, refine cost-management controls and iterate on security configurations.

Outlining Rigorous Mixed-Method Research Methodology Combining Primary Engagements, Secondary Intelligence Gathering and Data Triangulation Ensuring Comprehensive Market Insights

This research integrates both primary and secondary methodologies to ensure a holistic view of the cloud migration landscape. Primary insights were gathered through in-depth interviews with decision-makers at leading service providers, technology executives at enterprise adopters, and independent industry analysts. These qualitative engagements informed our understanding of strategic drivers, solution architectures, and operational challenges encountered during migrations. Secondary research included a comprehensive review of public filings, vendor announcements, technical white papers and thought leadership publications to validate emerging trends and technology benchmarks.

Quantitative data points were triangulated from multiple sources, including industry surveys, migration project databases and patent filings, to establish patterns in service adoption and innovation hotspots. Rigorous data cleansing and consistency checks were applied to reconcile discrepancies, while statistical techniques were employed to detect outliers and ensure the robustness of thematic insights. The combined methodology delivers a data-driven, practitioner-focused perspective on the cloud migration services market, equipping stakeholders with actionable intelligence and strategic frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Migration Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Migration Services Market, by Service Type

- Cloud Migration Services Market, by Enterprise Size

- Cloud Migration Services Market, by Service Provider

- Cloud Migration Services Market, by Deployment Model

- Cloud Migration Services Market, by Industry Vertical

- Cloud Migration Services Market, by Region

- Cloud Migration Services Market, by Group

- Cloud Migration Services Market, by Country

- United States Cloud Migration Services Market

- China Cloud Migration Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Implications to Reinforce the Critical Role of Cloud Migration Services in Enabling Digital Transformation and Competitive Advantage

Our analysis underscores that cloud migration services are no longer optional but foundational to modern enterprise strategies. The convergence of emerging technologies, evolving compliance mandates and competitive imperatives demands that organizations accelerate their migration journeys with precision and purpose. Segmentation analysis reveals tailored approaches for diverse service types, migration methods, deployment paradigms and industry verticals, highlighting the need for customized roadmaps rather than one-size-fits-all solutions. Regional nuances further dictate the selection of service models, vendor partnerships and governance architectures.

As U.S. tariff policies in 2025 introduce additional cost considerations, supply chain agility and vendor diversification become critical enablers of successful migrations. Leading companies distinguish themselves through integrated toolchains, strategic alliances and innovative automation frameworks that reduce friction points and enhance migration velocity. By adopting the recommended best practices and leveraging the insights presented herein, enterprises can navigate technical complexities, optimize resource allocation and realize the full potential of cloud platforms to drive innovation, enhance resilience and sustain competitive advantage.

Inspire Immediate Engagement with Ketan Rohom for Customized Cloud Migration Research Tailored to Drive Your Digital Transformation Goals

To obtain a comprehensive deep-dive into cloud migration strategies, competitive benchmarking and actionable insights tailored to your organization’s needs, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you gain personalized guidance on how to leverage our detailed market research to optimize your migration roadmap, strengthen vendor negotiations, and align IT initiatives with business objectives. Connect today to secure your copy of the full Cloud Migration Services report and unlock strategic advantages that will propel your digital transformation efforts forward.

- How big is the Cloud Migration Services Market?

- What is the Cloud Migration Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?