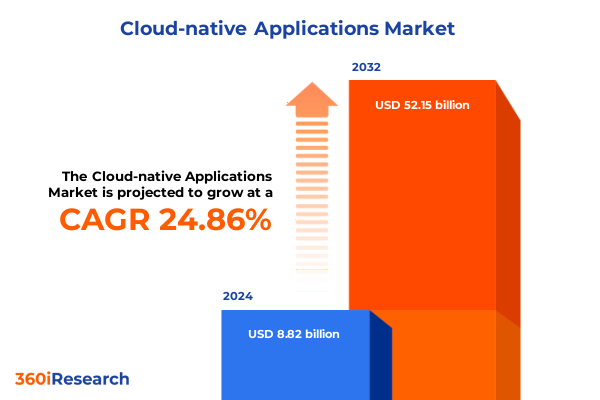

The Cloud-native Applications Market size was estimated at USD 11.00 billion in 2025 and expected to reach USD 13.45 billion in 2026, at a CAGR of 24.89% to reach USD 52.15 billion by 2032.

Setting the Stage for Cloud-Native Innovation Amid Rapid Technological Evolution, Market Disruption, and Emerging Operational Paradigms

The cloud-native paradigm has transcended its status as a mere buzzword to become the cornerstone of modern software development and deployment strategies. Organizations across industries are increasingly embracing containerization, microservices, and serverless architectures to accelerate innovation cycles and enhance operational agility. This shift is driven by a convergence of factors, including the escalating demand for rapid feature delivery, the need for scalable infrastructure to support unpredictable workloads, and the imperative to optimize resource utilization in a cost-conscious environment.

In parallel, cloud service providers continue to expand their portfolios of managed services, pushing the boundaries of automation and orchestration to simplify complexity for end users. This proliferation of tools, from container orchestration platforms to integrated DevOps pipelines, is democratizing the ability to build and run resilient, distributed applications at any scale. As a result, enterprises and startups alike are empowered to experiment with new architectural patterns that were previously feasible only for technology giants.

Moreover, the rise of hybrid and multi-cloud models is reshaping traditional vendor relationships. Businesses are no longer bound to a single infrastructure provider but instead can orchestrate workloads across private on-premises environments, public cloud regions, and edge locations. This transformative trend underscores the importance of a well-defined cloud-native strategy that balances innovation velocity with governance, security, and performance considerations.

Exploring Catalytic Trends That Are Revolutionizing Architecture, Automation, and Security in Cloud-Native Environments

The landscape of cloud-native applications is being reshaped by several catalytic trends that are redefining the boundaries of possibility. First, the democratization of container orchestration and service meshes is enabling organizations of all sizes to adopt highly resilient, microservices-based architectures. What once required extensive in-house expertise and significant infrastructure investment now comes pre-packaged with managed offerings and community-driven platforms.

In tandem, the maturation of function-as-a-service capabilities is allowing developers to focus on writing event-driven code without the overhead of server management. This shift toward a serverless-first mindset is accelerating time to market and reducing operational complexity, especially for bursty, event-centric workloads. At the same time, advances in cloud-native security frameworks and policy-as-code practices are enhancing the compliance posture and threat resilience of distributed systems, ensuring that security is baked into the delivery pipeline rather than bolted on post-deployment.

Additionally, the integration of artificial intelligence and machine learning services with cloud-native workflows is unlocking new dimensions of automation. From predictive scaling to anomaly detection and intelligent observability, these embedded intelligence capabilities are transforming how applications self-optimize and self-heal. Collectively, these transformative shifts are converging to create a more agile, secure, and intelligent infrastructure landscape that underpins the next wave of digital innovation.

Evaluating How New Trade Barriers Are Reshaping Hardware Costs, Vendor Strategies, and Operational Agility in Cloud-Native Infrastructure

The imposition of U.S. tariffs in 2025 has created substantial headwinds for cloud-native infrastructure, particularly in the procurement of hardware components that underpin data centers. Although key semiconductor chips are nominally exempt when imported directly, the prevailing practice of shipping them pre-installed in servers has subjected a wide range of critical AI and general-purpose compute assets to new duties, driving up the cost of colo leases and cloud services across the board.

Major cloud service providers have responded by issuing internal guidance to reassure customers and manage expectations around potential price adjustments. For example, Amazon Web Services has proactively prepared its account teams to address inquiries related to tariffs, data sovereignty concerns, and contractual pricing commitments, thereby mitigating customer anxiety while reinforcing its commitment to service continuity.

Smaller cloud operators, lacking the economies of scale and supplier negotiation leverage of hyperscale players, have felt the strain most acutely. Elevated hardware costs have led to delayed infrastructure expansion and deferred feature rollouts, as reduced margins leave little financial buffer to absorb sudden price increases. In response, many are stockpiling critical components and exploring nearshoring strategies in regions such as Mexico and Southeast Asia to circumvent ongoing trade restrictions.

Looking ahead, the cumulative effect of these tariffs is reshaping supply chain strategies, prompting a renaissance of localized manufacturing initiatives and forcing cloud-native teams to reassess capacity planning models and cost assumptions. This evolving dynamic underscores the importance of agility in vendor management and the strategic value of hybrid, multi-vendor cloud deployments.

Synthesizing Multidimensional Segmentation Frameworks to Illuminate Varied Pathways for Cloud-Native Adoption and Optimization

The service model segmentation reveals that infrastructure-as-a-service remains foundational, with organizations investing heavily in compute, networking, and storage layers that can be dynamically provisioned. Meanwhile, platform-as-a-service offerings-encapsulating container and function as a service-are accelerating developer productivity by abstracting away orchestration complexities. In parallel, software-as-a-service portfolios are expanding to include integrated DevOps suites, monitoring platforms, and embedded security tools that enable continuous delivery and real-time observability.

From a deployment perspective, hybrid cloud architectures are emerging as the default strategy for enterprises seeking to balance control and flexibility. Privately managed infrastructure is leveraged for sensitive workloads, while public cloud capacity provides on-demand elasticity and geographic reach. This blended approach underscores the necessity of unified tooling and cross-environment automation to maintain consistency.

Architectural preferences are likewise converging around microservices and containerization, with serverless computing gaining traction for event-driven use cases that demand variable scaling. Developers are choosing between container runtimes such as Docker and its open alternatives, while orchestrators like Kubernetes are cementing their position as the de facto management layer. At the same time, serverless components-primarily function-as-a-service and backend-as-a-service modules-are enabling leaner, more modular app design.

In terms of application types, enterprise-grade solutions continue to dominate mission-critical workflows, while web and mobile applications span customer-facing portals, commerce platforms, and hybrid mobile experiences. Industry verticals such as banking and insurance, healthcare, IT and telecom, manufacturing, and retail each bring unique compliance, performance, and integration requirements. Finally, organizational size influences adoption patterns, with large enterprises funding extensive cloud migrations and advanced automation, while small and medium ventures prioritize rapid deployment and cost-effective managed services.

This comprehensive research report categorizes the Cloud-native Applications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Deployment Model

- Architecture

- Application Type

- Industry Vertical

- Organization Size

Unpacking Regional Nuances in Cloud-Native Uptake Across Diverse Regulatory, Economic, and Technological Ecosystems

Across the Americas, the cloud-native market is characterized by rapid innovation and high demand for advanced managed services. North American enterprises are pioneering edge computing deployments and integrating AI-driven optimization into core workloads. Meanwhile, Latin America is witnessing accelerated public cloud adoption among local businesses, driven by flexible pricing models and scalable infrastructure that mitigate on-premises constraints.

In the Europe, Middle East, and Africa region, regulatory considerations and data sovereignty mandates shape cloud strategies. Organizations are investing in private and hybrid clouds to comply with evolving privacy frameworks while tapping into cloud-native platforms that support localized deployments. Regional cloud service providers are differentiating through specialized compliance certifications and industry-tailored solutions.

The Asia-Pacific market is marked by heterogeneous adoption patterns, with developed economies advancing multi-cloud and containerized deployments, and emerging markets embracing serverless models for mobile-first applications. Partnerships between local system integrators and global public cloud providers are accelerating cloud-native transformation, particularly in telecommunications and manufacturing sectors.

This comprehensive research report examines key regions that drive the evolution of the Cloud-native Applications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning, Portfolio Differentiation, and Partnership Dynamics of Leading Cloud-Native Ecosystem Players

The competitive landscape is anchored by hyperscale cloud providers that continue to enhance their native offerings. Amazon Web Services leads with an expansive portfolio of managed services spanning compute, storage, analytics, and developer tooling. Microsoft Azure differentiates through seamless integration with enterprise productivity suites and hybrid cloud capabilities. Google Cloud Platform leverages its AI and data analytics heritage to deliver specialized machine learning pipelines and scalable big data solutions.

Beyond the hyperscalers, platform vendors and open source communities are gaining traction. Kubernetes distributions from leading software companies enable packaged, certified implementations that simplify cluster management. DevOps toolchains from major software-as-a-service players are integrating security and compliance features to meet enterprise requirements. Observability and monitoring providers are converging on unified data models to deliver actionable insights across complex, distributed systems.

Strategic partnerships and ecosystem alliances continue to shape market dynamics. From global system integrators embedding cloud-native best practices into digital transformation projects to emerging pure-play startups driving innovation in service meshes and edge orchestration, the vendor ecosystem offers myriad pathways for organizations to access specialized expertise and accelerate adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud-native Applications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Alibaba Cloud Computing Ltd.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- CrowdStrike Holdings, Inc.

- Databricks, Inc.

- DigitalOcean Holdings, Inc.

- Dropbox, Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks, Inc.

- Red Hat, Inc.

- salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- Snowflake Inc.

- VMware, Inc.

- Workday, Inc.

Actionable Strategic Imperatives for Culturally Embedding Cloud-Native Excellence and Ensuring Operational Resilience

Leaders seeking to harness cloud-native capabilities should begin by establishing a cross-functional governance framework that spans development, operations, and security teams. This integrated approach ensures that policy-as-code practices are embedded early in the software lifecycle, reducing rework and enhancing compliance.

Organizations must also reevaluate vendor portfolios through the lens of resilience and total cost of ownership. By diversifying infrastructure suppliers and exploring regional manufacturing or sourcing options, teams can mitigate the impact of potential trade restrictions and supply chain disruptions.

Investment in automated observability and predictive scaling tools is critical for maintaining performance and cost efficiency. Embedding intelligent telemetry into microservices architectures enables proactive issue resolution and adaptive resource allocation in dynamic environments.

Finally, leaders should foster a culture of continuous learning by investing in targeted training programs and collaborative initiatives with open source communities. This commitment to skills development accelerates time to proficiency with cloud-native frameworks and cultivates internal champions to drive ongoing innovation.

Employing a Rigorous Mixed-Methods Approach Combining Secondary Analysis and Executive-Level Qualitative Insights

This analysis draws on a robust research methodology that combines comprehensive secondary research with in-depth primary interviews. Global technology vendor filings, regulatory announcements, and industry news sources were systematically reviewed to capture the latest market developments. In addition, over 25 qualitative interviews were conducted with senior technology executives, cloud architects, and solution providers to validate key findings and uncover emerging use cases.

Quantitative data were gathered from publicly available infrastructure consumption reports and anonymized utilization metrics provided by leading cloud service providers. These data points were triangulated through statistical analyses to reveal adoption trends across service models, deployment patterns, and geographic regions.

The segmentation frameworks and regional insights were refined through iterative workshops with domain experts, ensuring that the final report reflects actionable perspectives and aligns with real-world decision-making processes. This blended methodological approach provides a balanced view of both macro-level industry shifts and micro-level operational considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud-native Applications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud-native Applications Market, by Service Model

- Cloud-native Applications Market, by Deployment Model

- Cloud-native Applications Market, by Architecture

- Cloud-native Applications Market, by Application Type

- Cloud-native Applications Market, by Industry Vertical

- Cloud-native Applications Market, by Organization Size

- Cloud-native Applications Market, by Region

- Cloud-native Applications Market, by Group

- Cloud-native Applications Market, by Country

- United States Cloud-native Applications Market

- China Cloud-native Applications Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Concluding Reflections on Harnessing Cloud-Native Paradigms and Strategic Adaptation in a Volatile Global Context

The evolution of cloud-native applications represents a pivotal juncture for technology-led organizations aiming to outpace competitors and drive digital transformation. The convergence of microservices, container orchestration, and serverless computing is empowering teams to innovate at unprecedented speed, while emerging trade and regulatory dynamics underscore the need for agile supply chain and vendor management strategies.

By leveraging the segmentation insights, regional nuances, and vendor analyses presented here, decision-makers can navigate complexity, optimize resource investments, and capitalize on new opportunities across industry verticals. The actionable recommendations offer a clear roadmap for embedding cloud-native excellence within organizational DNA, ensuring sustained innovation and resilience in an ever-evolving technology landscape.

Unlock Comprehensive Cloud-Native Market Intelligence by Engaging Directly with Our Associate Director to Propel Your Strategic Decision-Making

If you’re looking to navigate the complexities of cloud-native application strategies in the face of global trade shifts, our comprehensive market research report offers the critical insights you need. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through tailored solutions that align with your organization’s goals. Reach out today to secure your copy of the full analysis, explore customized data segments, and equip your teams with the knowledge to drive innovation, resilience, and competitive advantage in an evolving cloud-native ecosystem.

- How big is the Cloud-native Applications Market?

- What is the Cloud-native Applications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?