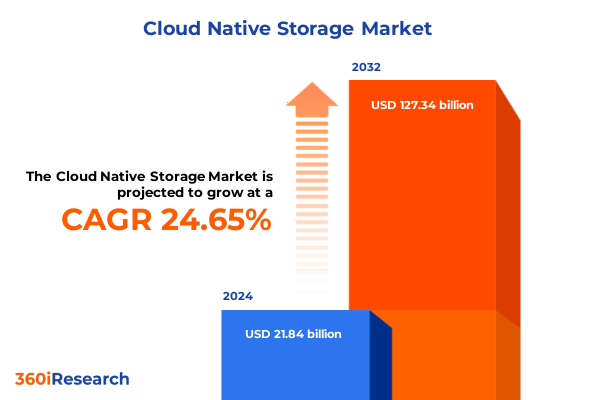

The Cloud Native Storage Market size was estimated at USD 26.83 billion in 2025 and expected to reach USD 32.97 billion in 2026, at a CAGR of 24.91% to reach USD 127.34 billion by 2032.

For decision-makers seeking clarity in an evolving technological era, understanding the pivotal role and emergence of cloud native storage solutions today

Cloud native storage has emerged as a foundational element in modern IT architectures, responding to the accelerating shift toward containerized applications, microservices and dynamic infrastructure orchestration. By decoupling storage services from underlying hardware constraints and embracing API-driven interfaces, organizations can achieve unprecedented agility and scalability. This transition supports a wide array of data workloads-from ephemeral caching layers in microservices to durable object repositories for large-scale analytics-while ensuring consistent performance across heterogeneous environments. Furthermore, the maturation of container orchestration platforms, notably Kubernetes, has catalyzed deeper integration between compute and storage, enabling persistent volumes to be provisioned, scaled and secured alongside application lifecycles.

As digital transformation initiatives proliferate, IT leaders face pressure to optimize resource utilization, accelerate feature delivery and maintain high availability in distributed deployments. Cloud native storage solutions address these imperatives by leveraging software-defined abstractions that unify management across public, private and hybrid cloud deployments. This unified approach simplifies data mobility, disaster recovery and policy enforcement, bridging the gap between traditional enterprise storage silos and modern cloud-native environments. In parallel, advances in storage networking-such as NVMe over Fabrics and software-defined data paths-further enhance throughput and reduce latency, ensuring that mission-critical applications receive consistent data services regardless of topology.

This executive summary presents a concise yet comprehensive overview of the cloud native storage landscape, delving into transformative shifts, regulatory impacts, segmentation dynamics, regional insights and vendor strategies. Through this lens, decision-makers will gain a holistic understanding of the key drivers and challenges shaping this rapidly evolving market, enabling informed strategic planning and investment prioritization.

Identifying the disruptive technologies and architectures that are redefining performance scalability and resilience in cloud native storage environments

The cloud native storage landscape has undergone transformative shifts driven by the industry’s move toward distributed architectures and container-first design paradigms. In recent years, the consolidation of microservices at scale has underscored the need for storage that can match the agility of ephemeral compute instances while providing consistent persistence. This has given rise to scalable file systems optimized for container orchestration platforms and S3-compatible object stores that natively integrate with serverless workflows. Simultaneously, the proliferation of edge computing requires lightweight, resilient storage endpoints capable of local processing with intermittent connectivity to central data centers.

Technological innovations have played a pivotal role in reshaping storage architectures. Software-defined storage fabrics now abstract underlying hardware, allowing teams to define service levels, replication policies and encryption settings programmatically. The adoption of NVMe over Fabrics and RDMA protocols has drastically reduced I/O latency, bringing networked storage performance closer to direct-attached configurations. Moreover, emerging data management layers leverage AI-driven analytics to automate tiering decisions, capacity forecasting and anomaly detection, thereby reducing manual intervention and operational overhead.

Industry alliances and open source communities have also accelerated the pace of innovation. CNCF projects such as Rook, Longhorn and KubeVirt have fostered a collaborative ecosystem where vendors and end users coalesce around shared standards and interoperability goals. This collaborative environment not only drives rapid feature adoption but also ensures that new storage capabilities align with the broader cloud native toolkit. As a result, organizations can integrate cutting-edge data services without sacrificing the flexibility and extensibility they require for evolving workloads.

Examining how United States 2025 tariffs reshape cost structures, supply chains and competition in cloud native storage

The introduction of updated United States tariffs in 2025 has exerted a profound influence on cost structures and supply chains for cloud native storage components. Tariffs on imported solid-state drives, advanced memory modules and specialized networking equipment have increased capital expenditures for on-premises and hybrid cloud deployments. As vendors navigate these elevated price points, procurement teams are compelled to reassess vendor contracts and inventory strategies, often seeking local assembly options or alternative suppliers to mitigate cost escalation.

Beyond direct hardware costs, the regulatory measures have triggered ripple effects across global logistics networks. Extended lead times for critical components have prompted storage solution providers to diversify their manufacturing footprints, shifting toward regional assembly hubs in North America and Asia-Pacific. This strategic realignment reduces vulnerability to single-source delays and aligns production closer to key demand centers in banking, healthcare and telecommunications industries.

Competitive dynamics have also shifted in response to the tariff landscape. Legacy storage manufacturers with established domestic facilities have leveraged their operational advantages to negotiate more favorable pricing, while newer entrants invest in software innovation to offset hardware premium pressures. Cloud native storage providers, in turn, have emphasized SaaS-based management layers and containerized data services, enabling customers to decouple licensing costs from hardware expenditures. These combined strategies reflect an industry adapting to a more complex trade environment while maintaining a focus on performance, reliability and feature velocity.

Unveiling how product categories, cloud deployment models, industry sectors, application uses, and enterprise scale drive the adoption of cloud native storage

Insight into market segmentation reveals that product type distinctions profoundly influence deployment decisions. Block storage options-comprising direct attached storage for high-performance local workloads and SAN configurations for shared data services-cater to applications demanding predictable latency and transactional integrity. Conversely, file storage solutions offer distributed file systems that support container clusters and NAS architectures tailored to enterprise file sharing, while object storage platforms deliver S3-compatible interfaces ideal for unstructured data, backup and archival use cases.

Deployment model preferences further shape adoption trajectories, with hybrid cloud strategies emerging as a dominant pattern among organizations seeking to balance operational control and cloud agility. Multi-cloud approaches enable workload portability and risk mitigation, whereas private cloud environments built on Nutanix, OpenStack or VMware deliver dedicated resource governance. Public cloud options such as Alibaba Cloud, Amazon Web Services, Google Cloud Platform and Microsoft Azure appeal to teams that prioritize global reach and native service integrations, often leveraging managed storage tiers and serverless data processing.

An analysis of end user industries underscores divergent priorities: financial services demand stringent compliance and encryption capabilities, healthcare organizations emphasize secure patient data management, IT and telecom providers seek low-latency access for real-time services, manufacturing firms focus on operational resilience, and retail enterprises deploy scalable architectures to support fluctuating e-commerce workloads. Application use cases range from backup and recovery through big data analytics and containerized environments to data archiving and DevOps automation, each imposing distinct performance profiles and integration requirements. Organization size, from large enterprises with complex multi-tier estates to small and medium enterprises requiring lean yet robust solutions, further informs feature selection and vendor engagement models.

This comprehensive research report categorizes the Cloud Native Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Model

- End User Industry

- Application

- Organization Size

Exploring cloud native storage regional dynamics across Americas, EMEA and Asia Pacific while highlighting growth drivers, challenges and opportunities

A regional lens illuminates how cloud native storage adoption varies across key geographies. In the Americas, aggressive digital transformation initiatives and the presence of hyperscale cloud providers drive advanced use cases, particularly around real-time analytics and container orchestration at scale. Organizations in the United States and Canada prioritize data sovereignty and hybrid integration, often requiring seamless interoperability between on-premises arrays and public cloud object stores.

Within Europe Middle East & Africa, regulatory frameworks such as GDPR and emerging data protection legislation shape procurement patterns, with enterprises seeking encryption and policy-based governance features. The region’s diverse infrastructure maturity levels result in heterogeneous deployments, from established financial hubs in Western Europe to nascent digital ecosystems in the Gulf Cooperation Council. Collaborative ventures between local system integrators and global vendors facilitate tailored offerings that balance performance and compliance.

Asia Pacific exhibits robust growth driven by e-commerce expansion, digital government programs and telecommunications modernization. Rapid urbanization and the rollout of high-speed 5G networks have sparked demand for edge-optimized storage solutions capable of supporting IoT, real-time video analytics and AI-enabled applications. Countries such as India, China and Australia are investing in localized data centers, while regional champions partner with global cloud platforms to deliver resiliency across dispersed geographies.

This comprehensive research report examines key regions that drive the evolution of the Cloud Native Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring how leading cloud native storage vendors and innovators leverage tactics product differentiators and strategic partnerships to drive market leadership

Leading market participants are advancing cloud native storage through differentiated strategies that leverage core competencies and ecosystem alliances. Public cloud giants enhance their managed storage portfolios with native integrations for container services, serverless computing and advanced data analytics, streamlining end-to-end workflows for application developers. Infrastructure incumbents focus on software-defined storage platforms optimized for hybrid environments, embedding automation and AI-driven performance tuning into their management consoles.

Emerging specialists differentiate through microservices-native architectures, offering distributed storage controllers that can be deployed on commodity hardware or as lightweight containers. By providing open source reference implementations and extensible APIs, these innovators foster vibrant developer communities that accelerate feature adoption. Partnerships between storage vendors and orchestration platform maintainers ensure tight integration, enabling seamless persistence for stateful workloads within Kubernetes and similar ecosystems.

Furthermore, strategic alliances between hardware manufacturers and software providers deliver turnkey solutions that prevalidate performance profiles for target use cases. This cooperative approach reduces time to deployment and enhances support for compliance requirements across industries. As a result, the competitive landscape is characterized by a balance between established enterprises with extensive global reach and nimble entrants who excel in niche, cloud-native design patterns.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Native Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akamai Technologies, Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Cloud Software Group, Inc.

- Cloudian, Inc.

- DataCore Software Corporation

- Dell Technologies Inc.

- Diamanti, Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- Hitachi Vantara LLC

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Lightbits Labs Ltd.

- LINBIT HA-Solutions GmbH

- Microsoft Corporation

- MinIO, Inc.

- Mirantis, Inc.

- NetApp, Inc.

- Nutanix, Inc.

- Pure Storage, Inc.

- Qumulo, Inc.

- Rackspace Technology, Inc.

- Red Hat, Inc.

- Scality SA

- SUSE S.A.

- Tencent Holdings Limited

- VMware, Inc.

- WekaIO, Inc.

Empowering enterprises with strategies to optimize adoption, enhance performance, mitigate risks and drive innovation in cloud native storage deployments

To capitalize on the evolving cloud native storage landscape, industry leaders must adopt a set of clear, actionable strategies. First, prioritizing abstraction and API-driven management layers enables rapid provisioning and consistent policy enforcement across diverse environments. By modularizing storage services, teams can integrate new data capabilities without disrupting legacy operations. Second, investing in unified orchestration tools that bridge public and private clouds simplifies workload mobility and disaster recovery planning, reducing risk and operational complexity.

Mitigating external pressures, such as tariff-induced cost increases, requires proactive vendor diversification and local sourcing strategies. Establishing relationships with multiple hardware suppliers and exploring regional manufacturing partnerships can offset supply chain disruptions, ensuring continuity for critical infrastructure projects. Moreover, embedding encryption and compliance features at the storage layer empowers organizations to address stringent regulatory requirements without incurring performance penalties.

Driving innovation in data services calls for cross-functional collaboration between infrastructure teams, application developers and security professionals. By adopting DevOps and GitOps principles for storage configuration and deployment, organizations can accelerate release cycles, automate routine tasks and implement immutable infrastructure patterns. Finally, cultivating in-house expertise through targeted training and certification programs ensures that personnel remain proficient in emerging technologies, from NVMe over Fabrics to cloud-native object protocols. These combined actions position enterprises to realize the full strategic value of cloud native storage.

Summarizing methodological foundations through mixed-method research, expert interviews and data triangulation to ensure rigor of cloud native storage findings

Summarizing methodological foundations through mixed-method research, expert interviews and data triangulation to ensure rigor of cloud native storage findings

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Native Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Native Storage Market, by Product Type

- Cloud Native Storage Market, by Deployment Model

- Cloud Native Storage Market, by End User Industry

- Cloud Native Storage Market, by Application

- Cloud Native Storage Market, by Organization Size

- Cloud Native Storage Market, by Region

- Cloud Native Storage Market, by Group

- Cloud Native Storage Market, by Country

- United States Cloud Native Storage Market

- China Cloud Native Storage Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing strategic imperatives and illustrating why cloud native storage will remain a transformative force in digital infrastructure landscapes

As cloud native storage cements its role as a critical enabler of digital transformation, strategic imperatives emerge with clarity. Organizations must modernize infrastructure alongside application architectures, embracing programmable storage services that scale seamlessly and adapt to fluctuating workloads. Equally important is the refinement of procurement processes to address evolving regulatory and tariff landscapes, ensuring that cost structures align with long-term innovation goals.

The future outlook underscores the necessity of continuous collaboration with open source communities, ecosystem partners and cross-industry consortia. By engaging in shared development efforts and aligning on interoperability standards, enterprises can reduce vendor lock-in and accelerate the delivery of advanced features. Ultimately, cloud native storage will remain a transformative force by uniting performance, flexibility and resilience in a single, cohesive framework.

This synthesis of strategic insights and operational guidance empowers decision-makers to navigate complexity with confidence. With a clear roadmap grounded in robust analysis, organizations are well-positioned to harness the full potential of cloud native storage, driving sustainable growth and competitive differentiation in the digital era.

Innovative leaders can connect with Ketan Rohom to secure the market research report, unlock insights and gain a competitive edge in cloud native storage

Innovative leaders seeking an informed perspective on cloud native storage are encouraged to connect directly with Ketan Rohom, who brings in-depth knowledge of industry dynamics and strategic market positioning. Engaging with this seasoned professional provides a streamlined path to secure the comprehensive market research report, gaining immediate access to nuanced analysis, actionable insights and expert guidance. By leveraging this direct channel, organizations can expedite their decision-making process, aligning infrastructure investments with emerging trends and avoiding common pitfalls. Ketan’s collaborative approach ensures that each inquiry is met with personalized attention, clarifying complex topics such as data resilience, tariff implications and deployment best practices. This tailored engagement not only accelerates time to value but also empowers stakeholders to negotiate with vendors more effectively and shape roadmaps with confidence. Reach out today to unlock the full potential of your cloud native storage strategy and establish a lasting competitive advantage in an increasingly dynamic technological landscape.

- How big is the Cloud Native Storage Market?

- What is the Cloud Native Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?