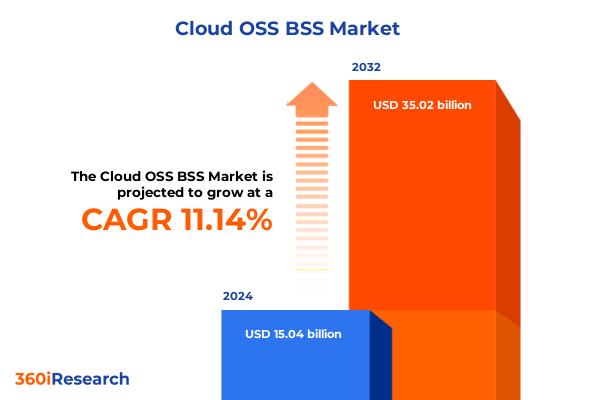

The Cloud OSS BSS Market size was estimated at USD 16.62 billion in 2025 and expected to reach USD 18.40 billion in 2026, at a CAGR of 11.23% to reach USD 35.02 billion by 2032.

Unveiling the Strategic Importance of Cloud OSS and BSS Platforms in Enabling Telecom Operators to Drive Agility and Customer-Centric Innovation

Cloud-native architectures are fundamentally transforming how telecommunications operators and service providers manage their operational support systems (OSS) and business support systems (BSS). By migrating legacy platforms to elastic, on-demand environments, organizations can streamline workflows, automate critical processes, and accelerate the rollout of new service offerings. This transition not only reduces dependency on complex on-premises infrastructure but also fosters a culture of continuous delivery, enabling rapid feature enhancements that directly address evolving customer needs.

Moreover, the convergence of OSS and BSS onto unified cloud infrastructures is driving unprecedented levels of collaboration between network operations, customer care, and revenue management teams. Service providers are now leveraging unified data models to gain end-to-end visibility into service performance, customer interactions, and billing cycles. As a result, decision-makers can derive actionable insights from real-time data, improving service assurance and accelerating time-to-revenue. In doing so, organizations cultivate a more agile, resilient, and customer-centric operational environment that is well-suited to the fast-paced demands of the digital economy.

Disruptive Technological Advances and Market Forces Reshaping the Cloud OSS/BSS Landscape into an Agile, AI-Driven Ecosystem

The cloud OSS/BSS landscape is undergoing a profound reinvention, fueled by disruptive technologies such as microservices, containerization, and open-source frameworks. These architectural shifts enable modular deployments, reducing time-to-market for new capabilities and allowing service providers to experiment with emerging functionality without overhauling entire systems. At the same time, the proliferation of 5G networks and edge computing is expanding the scope of OSS/BSS platforms beyond core data centers into distributed environments, where real-time orchestration and localized policy enforcement become critical.

Concurrently, artificial intelligence and machine learning are being embedded into cloud OSS/BSS solutions to optimize network performance and enhance customer experience. Predictive analytics help anticipate faults and automate root-cause diagnoses, while intelligent revenue management systems dynamically adjust pricing based on usage patterns and market conditions. These innovations collectively empower organizations to move from reactive operations to proactive service delivery, thereby establishing new benchmarks for reliability, efficiency, and customer satisfaction.

Assessing the Cumulative Economic and Operational Effects of 2025 United States Tariff Measures on Cloud OSS/BSS Infrastructure and Services

Since the introduction of additional United States tariffs in early 2025, cloud OSS/BSS providers have confronted elevated costs across hardware and infrastructure components. Equipment such as servers, routers, and specialized appliances-many of which are manufactured in China-have seen import duties rise to 25 percent, imposing a direct financial burden on service delivery and maintenance operations. These levies extend beyond compute and networking hardware to include foundational construction materials like steel and aluminum, which underpin data center infrastructure and are subject to supplementary tariff measures.

In response to these pressures, organizations are diversifying their supply chains by sourcing from alternative manufacturing hubs in Southeast Asia and North America, including Vietnam, Taiwan, and Mexico. While this strategic realignment enhances long-term resilience, it also introduces short-term complexity through extended lead times and requalification processes for new vendors. Additionally, project timelines for data center expansion and technology refresh cycles have been extended by an average of 20 to 30 percent, as procurement teams navigate both tariff-related delays and the global semiconductor shortage.

These cumulative impacts necessitate a reevaluation of capital expenditure plans and pricing models. Fixed-price service contracts are under scrutiny, as providers weigh the risk of margin erosion against the imperative to maintain market competitiveness. Consequently, many leading and midsize providers are now considering hybrid cost-recovery strategies that combine selective surcharge implementations with operational efficiency programs.

Deriving Actionable Insights from Multi-Dimensional Segmentation Analyses of Cloud OSS/BSS Across Applications, Models, Deployments, End Users, and Organization Size

Analyzing the market through the lens of application type reveals distinct trajectories for BSS and OSS platforms. Billing and revenue management modules are experiencing heightened demand due to the need for flexible monetization models, including usage-based and subscription billing, while charging and rating engines are being enhanced with real-time analytics to support dynamic pricing. Customer relationship management is evolving to integrate behavioral insights across digital touchpoints, and order management systems are being rearchitected for instant fulfillment in both consumer and enterprise segments. On the OSS side, network inventory management tools are becoming more intelligent, leveraging geospatial analytics to optimize asset utilization, while network planning and design suites incorporate AI-driven simulation to forecast traffic loads. Service assurance is being refined into specialized domains-configuration management is centralized in the cloud for unified policy enforcement, fault management systems are adopting automated remediation workflows, and performance management relies on machine learning to detect anomalies before they impact service quality.

Cloud model segmentation offers further clarity on deployment strategies. Public cloud environments cater to providers seeking rapid elasticity and global footprint, while private cloud implementations attract organizations demanding heightened control, security, and compliance. Hybrid cloud architectures serve as a bridge, enabling operators to place sensitive functions on private infrastructure and burst into public capacity during peak demand, whereas community cloud setups foster collaborative ecosystems among multiple stakeholders. These nuanced distinctions guide capital allocation and operational planning.

Deployment type segmentation underscores the role of service providers in hosting and managing OSS/BSS platforms. Hosted models can be fully vendor managed or partner managed, offering turnkey operations for organizations lacking in-house expertise, while self-managed options empower enterprises to retain full operational control. The distinction between hosted and on-premises deployments informs strategic decisions around risk, governance, and total cost of ownership. Finally, end users span cloud service providers, enterprises, government agencies, and telecom operators-with large enterprises and small to medium enterprises exhibiting divergent maturity levels and budget priorities-while overall organization size influences both project scope and adoption cadence.

This comprehensive research report categorizes the Cloud OSS BSS market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering Type

- Type of System

- Technology

- Deployment Type

- Organization Size

- End User

Exploring Regional Variations in Cloud OSS/BSS Demand and Adoption Patterns Across the Americas, EMEA, and Asia-Pacific Territories

In the Americas, established telecom operators and hyperscale cloud service providers are driving adoption of cloud OSS/BSS solutions, focusing on scalability and integration with advanced analytics platforms. The region benefits from robust cloud infrastructure investments, supportive regulatory frameworks, and a mature market for digital services, which collectively accelerate deployments and foster innovation. Enterprises in banking, retail, and healthcare are also migrating core support systems to the cloud to streamline operations and enhance customer engagement.

Europe, Middle East, and Africa present a heterogeneous picture, with Western European markets prioritizing data sovereignty and compliance, prompting a greater uptake of private and community cloud models. In contrast, growth markets in the Middle East and Africa are embracing public cloud offerings to leapfrog traditional infrastructure constraints, often in partnership with global cloud providers. Regulatory initiatives such as GDPR and emerging data residency rules continue to influence deployment strategies, requiring solution providers to offer tailored configurations that meet regional compliance demands.

Asia-Pacific is characterized by rapid digital transformation initiatives led by telecom operators in mature markets like Japan and South Korea, where 5G deployments are already fueling new use cases for cloud-native OSS/BSS platforms. Meanwhile, emerging economies in Southeast Asia and India are investing in hybrid and public cloud frameworks to support large-scale mobile broadband rollouts. Government programs to foster digital inclusion and smart city projects are creating a diverse array of deployment scenarios, positioning the region as a key growth engine for cloud OSS/BSS innovations.

This comprehensive research report examines key regions that drive the evolution of the Cloud OSS BSS market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Cloud OSS/BSS Providers and Strategic Partnerships Driving Competitive Differentiation in the Global Market

Leading cloud OSS/BSS vendors are undertaking strategic partnerships, acquisitions, and platform enhancements to differentiate their offerings. Amdocs has accelerated its move toward microservices-based BSS, integrating AI-driven customer management modules that enable predictive engagement. Ericsson is focusing on cloud-native orchestration for 5G network slicing, partnering with hyperscalers to co-develop scalable service assurance tools. Nokia’s strategy emphasizes open interfaces and interoperability, enabling operators to integrate third-party network planning and design applications seamlessly.

Netcracker has enhanced its digital BSS suite with a componentized architecture that supports rapid upgrades and custom workflows, while Oracle is embedding advanced analytics directly into its OSS portfolio to provide real-time visibility into network health and resource allocation. Cisco is leaning into its cloud infrastructure expertise to bundle service fulfillment with secure connectivity overlays, appealing to enterprise and government clients. These leadership moves underscore an industry-wide emphasis on modularity, platform extensibility, and ecosystem integration as critical differentiators in a crowded competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud OSS BSS market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Amdocs Group

- Capgemini Services SAS

- Cerillion Technologies Limited

- Cisco Systems, Inc.

- Comarch SA

- Comviva Technologies Limited

- CSG Systems International, Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- Infosys Limited

- Infovista SAS

- International Business Machines Corporation

- NetCracker Technology Corporation

- Nokia Corporation

- Optiva, Inc

- Oracle Corporation

- Sigma Software Solutions Inc. by Hansen Technologies Limited

- Sterlite Technologies Limited

- Subex Limited

- Tata Consultancy Services Limited

- Telefonaktiebolaget LM Ericsson

- Whale Cloud Technology Co., Ltd.

- Wipro Limited

- ZTE Corporation

Implementing Targeted Strategies for Telecom Leaders to Capitalize on Cloud OSS/BSS Innovations and Navigate Evolving Market Dynamics

To capitalize on emerging opportunities, industry leaders should adopt a cloud-native-first mindset, prioritizing microservices and containerization to enable modular upgrades and continuous delivery. Strategic alliances with hyperscale cloud providers and specialized system integrators can accelerate time-to-market and reduce integration complexity. Additionally, embedding AI and automation into both OSS and BSS workflows will deliver predictive insights, automated remediation, and dynamic monetization models, driving operational efficiency and improved customer experiences.

Moreover, leaders must cultivate resilient supply chains by diversifying hardware and component sourcing to mitigate tariff and geopolitical risks. Leveraging regional cloud marketplaces and local data center partnerships can address compliance requirements while optimizing cost structures. On the organizational front, upskilling in DevOps and site reliability engineering practices will ensure that teams can manage distributed, cloud-native environments effectively. Finally, investment in robust security frameworks-spanning access controls, encryption, and continuous monitoring-will protect critical systems and customer data, fostering trust and long-term adoption.

Employing Robust Mixed-Methods Research Methodology to Deliver Comprehensive and Reliable Cloud OSS/BSS Market Intelligence

This research combines primary interviews with senior executives at telecom operators, cloud providers, and technology vendors to capture firsthand insights into adoption drivers, challenges, and strategic priorities. Secondary research included a review of industry publications, regulatory filings, and technical white papers to validate market trends and technology evolutions. A bottom-up analysis of solution deployments was used to identify emerging use cases, while a top-down evaluation of global spending patterns provided context on investment priorities.

Data triangulation was performed to reconcile findings from disparate sources, ensuring that conclusions are grounded in verifiable evidence. Qualitative insights from expert panels were complemented by quantitative models that track deployment volumes and technology diffusion rates. The methodology also incorporated an iterative validation process, engaging stakeholders at multiple stages to refine assumptions and ensure the report’s accuracy, comprehensiveness, and practical relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud OSS BSS market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud OSS BSS Market, by Offering Type

- Cloud OSS BSS Market, by Type of System

- Cloud OSS BSS Market, by Technology

- Cloud OSS BSS Market, by Deployment Type

- Cloud OSS BSS Market, by Organization Size

- Cloud OSS BSS Market, by End User

- Cloud OSS BSS Market, by Region

- Cloud OSS BSS Market, by Group

- Cloud OSS BSS Market, by Country

- United States Cloud OSS BSS Market

- China Cloud OSS BSS Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Transformative Trajectory and Strategic Imperatives Driving Global Cloud OSS/BSS Evolution and Competitive Advantage

The cloud OSS/BSS market stands at an inflection point, shaped by converging trends in digital transformation, next-generation network architectures, and evolving customer expectations. As service providers navigate a complex landscape of regulatory pressures, supply chain uncertainties, and cost optimization imperatives, the ability to deploy flexible, cloud-native support systems will be a defining factor in their success. Integrating AI-driven capabilities into every stage of the service lifecycle-from network planning and fault management to customer engagement and revenue assurance-will unlock new operational efficiencies and revenue streams.

Looking ahead, the organizations that leverage open architectures, cultivate strategic partnerships, and embrace continuous innovation will be best positioned to differentiate their offerings and capture emerging market opportunities. As cloud OSS/BSS platforms evolve to support the demands of 5G, edge computing, and enterprise digital services, agility and customer-centricity will remain at the core of competitive advantage. This executive summary underscores the critical need for decision-makers to align their technology roadmaps with these transformative imperatives, ensuring resilient, scalable, and future-ready support systems.

Seize Competitive Advantage with Exclusive Cloud OSS/BSS Market Intelligence – Connect with Ketan Rohom to Acquire the Full Report

To seize the full benefits of in-depth market intelligence on cloud-based OSS/BSS solutions, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s expertise in articulating tailored research packages ensures you receive the precise insights your organization needs to gain a competitive edge. Engage with Ketan to explore customizable options, secure early access to deliverables, and unlock exclusive advisory sessions designed to accelerate your strategic roadmap. Elevate your decision-making with this comprehensive analysis-connect today to acquire the full report and position your team at the forefront of cloud OSS/BSS innovation

- How big is the Cloud OSS BSS Market?

- What is the Cloud OSS BSS Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?