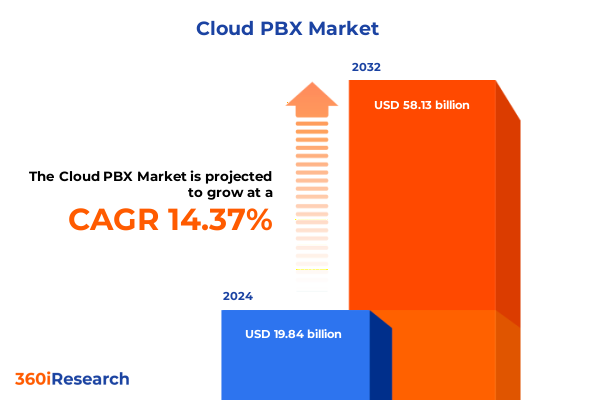

The Cloud PBX Market size was estimated at USD 22.62 billion in 2025 and expected to reach USD 25.84 billion in 2026, at a CAGR of 14.42% to reach USD 58.13 billion by 2032.

Unveiling the Strategic Importance of Cloud PBX Solutions in Shaping Next-Generation Business Communication and Operational Agility

Cloud-based private branch exchange solutions have rapidly evolved from niche offerings to critical enablers of modern business communications. In today’s environment, enterprises are seeking platforms that seamlessly integrate voice, video, and collaboration tools into unified experiences accessible from any location. The transition toward remote and hybrid work models has accelerated investments in virtual telephony systems, driven by the need to maintain productivity, ensure business continuity, and deliver high-quality customer engagement. As organizations recalibrate their operational strategies, Cloud PBX emerges as a cornerstone technology that not only supports scalable growth but also fosters digital transformation across diverse functional areas.

Furthermore, Cloud PBX platforms provide a compelling alternative to legacy on-premises telephony infrastructure by reducing capital expenditures and simplifying maintenance through subscription-based pricing and continuous feature updates. This demand for agility extends beyond core voice services, encompassing advanced capabilities such as network traffic management, change configuration controls, emergency routing services, and virtual deployment frameworks. As businesses navigate geopolitical uncertainties, service providers are emphasizing flexibility in deployment, robust security protocols, compliance with regulatory mandates, and integration with unified communications ecosystems. Consequently, Cloud PBX is increasingly positioned as a strategic asset, enabling organizations to drive operational efficiency, enhance end-user experience, and lay the foundation for future innovations.

Examining Pivotal Technological, Operational, and Regulatory Shifts Reshaping the Cloud PBX Ecosystem Across Global Enterprises

The Cloud PBX landscape is undergoing transformative shifts prompted by technological breakthroughs, evolving user expectations, and changing regulatory environments. Artificial intelligence and machine learning are now being embedded into telephony platforms to deliver real-time call analytics, intelligent routing, and sentiment analysis, empowering organizations to derive actionable insights from every conversation. These capabilities are complemented by the proliferation of 5G networks and edge computing, which reduce latency and enable richer media interactions in locations previously constrained by limited bandwidth. Consequently, service providers are investing heavily in distributed architectures that deliver high-availability voice services over global networks, ensuring consistent performance across urban and remote regions alike.

Simultaneously, the blurred lines between telephony, messaging, and collaboration applications have driven the convergence of Cloud PBX with unified communications as a service models. End-users now expect seamless transitions between voice calls, video conferences, and instant messaging, supported by intuitive interfaces and mobile-first design philosophies. In parallel, tighter regulations around emergency call routing, data protection, and cross-border data flows are compelling providers to enhance compliance frameworks and regionalize service delivery. These combined pressures are forcing incumbents and new entrants alike to innovate rapidly, forging strategic partnerships with infrastructure vendors, cybersecurity firms, and application developers to deliver differentiated offerings that resonate with today’s digitally empowered workforce.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Cloud PBX Supply Chains, Cost Structures, and Service Delivery Models

In 2025, the imposition of new tariffs by the United States government has exerted significant influence on the cost structures and supply chain dynamics of Cloud PBX hardware and service providers. These levies, targeting telecommunications equipment and network components, have triggered a reassessment of procurement strategies as manufacturers face higher import costs. In turn, service operators are evaluating options to absorb incremental expenses, renegotiate vendor contracts, or shift to more software-driven deployment models that minimize reliance on physical infrastructure. This dynamic has accelerated the adoption of virtualized PBX instances, reducing the capital intensity of rolling out new sites and enabling more agile responses to evolving customer demands.

Moreover, these tariff measures have intensified scrutiny on global logistics networks, prolonging lead times for critical peripherals and necessitating diversified sourcing from non-tariffed regions. Some providers have opted to relocate assembly operations to neighboring free-trade zones or leverage regional data centers to sidestep tariff impacts entirely. As a result, Cloud PBX vendors are increasingly embracing software-defined architectures that decouple service delivery from localized hardware dependencies. By migrating key functions to containerized environments and leveraging open-source telephony platforms, businesses can mitigate future trade policy risks while preserving service quality and continuity.

Uncovering Critical Insights Across Service Type Enterprise Size Deployment Model and Vertical Segments Driving Cloud PBX Market Dynamics

A granular examination of Cloud PBX market segmentation reveals differentiated drivers and adoption patterns across multiple dimensions. When considering services, enterprises are prioritizing configuration and change management modules to enable swift policy updates and rapid feature rollouts without disrupting active communications flows. Emergency call routing services have also elevated in importance as regulatory bodies mandate precise geolocation accuracy for 911 and equivalent emergency calls, compelling providers to integrate advanced mapping and verification tools. Simultaneously, network traffic management solutions are critical to guarantee call quality amid fluctuating bandwidth demands, while virtual deployment and setup offerings ensure organizations can stand up new sites in hours rather than weeks.

Turning to solution types, integrated Cloud PBX platforms are capturing interest from mid-market and large corporations seeking pre-bundled feature suites, comprehensive vendor support, and seamless interoperability with unified communications solutions. Conversely, standalone Cloud PBX systems appeal to technology-savvy small and medium enterprises that demand customization and modularity, often choosing to orchestrate separate third-party applications for video conferencing, chat, and workflow automation to maintain granular control over tooling. Enterprise size also influences purchase decisions: large enterprises leverage extensive contractual relationships to negotiate volume pricing, global service level agreements, and professional services engagements, whereas small and medium businesses favor lean subscription models with minimal upfront commitment and simplified user management consoles.

The choice of deployment model further stratifies the market, as hybrid cloud approaches allow organizations to retain sensitive voice traffic on private infrastructure while offloading noncritical functions to public cloud providers. Private cloud environments are preferred by industries with stringent compliance requirements, such as healthcare, financial services, and government, where data residency and auditability are paramount. Public cloud offerings, meanwhile, serve cost-conscious businesses that prioritize rapid scalability and pay-as-you-grow economics. Lastly, vertical segmentation underscores varied use cases: aerospace and defense entities demand ultra-secure communication channels, automotive and transportation firms require integration with IoT telematics, while banking, financial services, and insurance companies focus on encryption and fraud-prevention mechanisms. Sectors such as building, construction, and real estate leverage mobile PBX features for field operations, consumer goods and retail players use call analytics to optimize customer service, educational institutions deploy virtual classrooms, energy and utilities companies implement robust outage notification systems, government and public sector agencies enhance citizen services, healthcare and life sciences providers secure teleconsultations, and information technology and telecommunication leaders champion end-to-end digital transformation initiatives.

This comprehensive research report categorizes the Cloud PBX market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Services

- Model

- Pricing Model

- Functionality

- Application

- Industry Vertical

- Enterprise Size

Evaluating Regional Drivers and Adoption Patterns of Cloud PBX Solutions Across the Americas EMEA and Asia-Pacific Markets

Regional market dynamics illustrate how adoption of Cloud PBX varies according to economic maturity, regulatory complexity, and technological infrastructure. In the Americas, widespread fiber networks, stable regulatory frameworks, and high digital literacy have spurred rapid uptake among both commercial and public sector organizations. North American enterprises have led the shift toward integrated unified communications, leveraging domestic data centers to ensure low-latency performance and compliance with emergency call regulations. Latin America, meanwhile, has seen enthusiastic adoption among telecommunications operators aiming to extend next-generation voice services to underserved communities, capitalizing on partnerships with local internet service providers to reach remote locations.

Within Europe, Middle East & Africa, adoption is influenced by a complex tapestry of data privacy mandates, cross-border connectivity challenges, and divergent economic conditions. Western European countries are at the forefront, driven by comprehensive digital transformation agendas and robust cloud ecosystems, whereas emerging markets in Eastern Europe and parts of the Middle East are experiencing incremental growth hampered by infrastructure gaps and slower policy harmonization. Africa’s telecommunications landscape presents both an opportunity and a challenge, with mobile network operators exploring Cloud PBX as a path to deliver business-grade services in markets where on-premises solutions have traditionally dominated.

The Asia-Pacific region stands out for its diverse maturity levels and ambitious digitalization goals. Advanced economies like Japan, South Korea, and Australia have moved toward full integration of Cloud PBX with AI-powered contact centers and IoT telephony applications. Simultaneously, China and India are witnessing expansive deployments by e-commerce players, call center operators, and government agencies seeking scalable, cost-effective solutions. Southeast Asian nations are embracing public and hybrid cloud models to support burgeoning small and medium enterprise segments, while regional partnerships facilitate data sovereignty compliance and localized support offerings.

This comprehensive research report examines key regions that drive the evolution of the Cloud PBX market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cloud PBX Providers and Their Strategic Innovations Partnerships and Competitive Positioning in a Rapidly Evolving Market

Leading providers in the Cloud PBX landscape have distinguished themselves through unique combinations of innovation, strategic partnerships, and market coverage. One prominent vendor has built a reputation for its robust AI-driven analytics suite, enabling real-time speech transcription, sentiment scoring, and proactive quality-of-service optimization. Another competitor has focused on ecosystem integration, forging alliances with major unified communications platforms and CRM vendors to deliver seamless workflows that span voice, video, and messaging channels. A third organization has prioritized security, obtaining advanced certifications and embedding end-to-end encryption, secure SIP trunking, and periodic compliance audits within its core offering to serve highly regulated industries.

Meanwhile, select providers have doubled down on global expansion, operating a network of geographically distributed data centers to guarantee regional data sovereignty and low-latency connectivity. These firms often offer turnkey professional services, guiding enterprises through migration from legacy PBX infrastructures and customizing deployment scenarios to align with specific operational requirements. In the open-source arena, several emerging players are disrupting traditional pricing models by enabling organizations to deploy containerized PBX instances in their preferred cloud environments, accompanied by vibrant developer communities that contribute extensions and rapid feature innovation. Collectively, these competitive strategies reflect a market in which differentiation hinges on a blend of technological excellence, regulatory compliance, and customer-centric ecosystem collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud PBX market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CX

- 8x8, Inc.

- astTECS Communications Pvt. Ltd.

- AT&T Inc.

- Avaya LLC

- Barracuda Networks, Inc.

- CallHippo

- Cisco Systems, Inc.

- D-Link Corporation

- Deutsche Telekom AG

- DialerHQ

- DIALPAD, INC.

- DigitalWell

- Epygi Technologies LLC

- Freshworks Inc.

- Google LLC by Alphabet Inc.

- GoTo Technologies USA, Inc.

- Lingo Telecom, LLC

- Microsoft Corporation

- Mitel Networks Corporation

- Nextiva, Inc.

- Ooma, Inc.

- Oracle Corporation

- PBXGlobal

- PortaOne, Inc.

- PortSIP Solutions, Inc.

- RingCentral, Inc.

- RingQ

- SoftBank Group Corp.

- Tata Teleservices Limited

- The Real PBX Limited

- TollFreeForwarding.com

- TPx Communications

- TrioPBX

- UniTel Voice, LLC

- Verizon Communications Inc.

- VirtualPBX.Com, Inc.

- Vodafone Group PLC

- Vonage Holdings Corp. by Telefonaktiebolaget LM Ericsson

- Wildix OÜ

- Xiamen Yeastar Information Technology Co., Ltd.

- Zoom Video Communications, Inc.

Delivering Actionable Recommendations and Strategic Initiatives for Industry Leaders to Optimize Cloud PBX Adoption Performance and Cost Efficiency

To capitalize on the momentum in Cloud PBX adoption, industry leaders should prioritize investments in AI-enabled call management and predictive analytics capabilities that deliver tangible operational benefits. By harnessing machine learning algorithms to forecast usage patterns, identify service bottlenecks, and optimize routing logic in real time, organizations can enhance customer satisfaction and reduce total cost of ownership. Furthermore, executives should consider forging joint ventures with cybersecurity specialists to fortify PBX environments against increasingly sophisticated voice-based attacks and to achieve compliance with evolving emergency call and data protection regulations.

Additionally, service providers and enterprises must embrace modular architectures that decouple core telephony functions from peripheral applications, enabling rapid customization and seamless integration with third-party orchestration platforms. This approach not only accelerates time to value but also safeguards against potential future tariff shocks by shifting dependency away from proprietary hardware. Equally important is the cultivation of an internal center of excellence for Cloud PBX deployments, staffed with cross-functional experts who can design migration roadmaps, execute phased rollouts, and deliver user training to drive adoption. Finally, organizations should regularly engage with regional regulators and industry consortia to influence policy development, secure pilot programs, and establish best practices for emergency service compliance and data sovereignty. Through these strategic actions, leaders can position themselves at the forefront of digital communications transformation while mitigating risks and maximizing ROI.

Detailing Rigorous Research Methodology and Data Collection Techniques Underpinning the Cloud PBX Market Analysis and Insight Generation

This analysis is underpinned by a rigorous, multi-stage research methodology designed to ensure data accuracy, relevance, and depth. Secondary research included a comprehensive review of publicly available sources such as regulatory filings, technical white papers, vendor documentation, and industry standards publications. To capture the latest market developments, proprietary databases and trade journals were systematically examined, focusing on product announcements, merger and acquisition activities, and service innovation roadmaps. In parallel, a series of in-depth interviews were conducted with key stakeholders, including CIOs, telecommunications architects, procurement officers, and end-users, to validate emerging trends and uncover operational challenges associated with Cloud PBX deployments.

Quantitative data was triangulated through cross-referencing vendor self-reported figures, third-party technology surveys, and networking hardware shipment analyses to identify patterns in service adoption and technology preferences. Qualitative insights were enriched by workshop sessions with subject matter experts, where hypothetical use cases were stress-tested against evolving regulatory frameworks and tariff scenarios. All findings underwent multiple layers of peer review and methodological checks to eliminate bias and ensure reproducibility. This robust framework provides decision-makers with a transparent view of market dynamics, common pitfalls, and best-practice approaches for evaluating and deploying Cloud PBX solutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud PBX market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud PBX Market, by Services

- Cloud PBX Market, by Model

- Cloud PBX Market, by Pricing Model

- Cloud PBX Market, by Functionality

- Cloud PBX Market, by Application

- Cloud PBX Market, by Industry Vertical

- Cloud PBX Market, by Enterprise Size

- Cloud PBX Market, by Region

- Cloud PBX Market, by Group

- Cloud PBX Market, by Country

- United States Cloud PBX Market

- China Cloud PBX Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Implications of Cloud PBX Adoption to Empower Decision-Makers in an Increasingly Digital Business Environment

The convergence of digital transformation imperatives, hybrid work models, and advanced telephony technologies has firmly established Cloud PBX as a vital component of modern enterprise communications. Key findings underscore the importance of AI-driven analytics, the resilience conferred by hybrid and multi-cloud deployments, and the critical role of regulatory compliance in shaping vendor offerings and customer adoption. Organizations that proactively address emergency routing accuracy, data sovereignty requirements, and network performance optimization are best positioned to capitalize on the efficiency gains and user experiences enabled by Cloud PBX platforms.

Moving forward, decision-makers should remain vigilant to shifts in global trade policies, software-defined infrastructure trends, and evolving collaboration tool preferences. By leveraging the strategic recommendations outlined herein, enterprises can architect communication systems that not only meet current operational needs but also adapt fluidly to future technological advancements and market disruptions. Ultimately, embracing Cloud PBX with a holistic perspective-one that balances innovation, security, and cost-effectiveness-will empower organizations to sustain competitive advantage in an increasingly digital business environment.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Your Comprehensive Cloud PBX Market Research Report Today

To explore the comprehensive insights, trends, and opportunities detailed in this executive summary and obtain the full Cloud PBX market research report, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Your organization will gain immediate access to in-depth analyses, strategic recommendations, and data-driven guidance tailored to support executive decision-making. Reach out today to secure your copy of the definitive market intelligence that will drive your competitive advantage and shape your communications strategy moving forward

- How big is the Cloud PBX Market?

- What is the Cloud PBX Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?