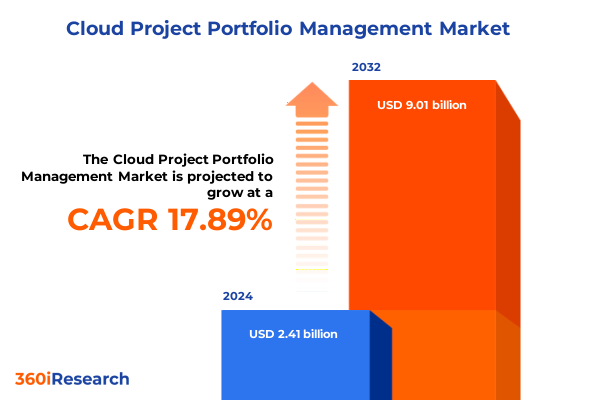

The Cloud Project Portfolio Management Market size was estimated at USD 2.84 billion in 2025 and expected to reach USD 3.35 billion in 2026, at a CAGR of 17.91% to reach USD 9.01 billion by 2032.

Understanding the Strategic Imperative of Cloud-Based Project Portfolio Management to Drive Organizational Agility and Effective Resource Allocation

Cloud-enabled project portfolio management has emerged as a cornerstone for organizations seeking to modernize their approach to project governance and resource optimization. With enterprises increasingly adopting cloud infrastructures to accelerate digital transformation initiatives, a strategic framework for managing portfolios of projects has become essential. This paradigm shift drives the need for unified visibility across diverse initiatives, enabling leadership to align investments with overarching business objectives and adapt dynamically to market changes.

By leveraging cloud-based platforms, decision-makers gain real-time insights into project performance, resource utilization, and financial metrics. These capabilities empower organizations to streamline approvals, enforce governance standards, and anticipate risks before they materialize. Moreover, the scalability and flexibility inherent in cloud solutions ensure that enterprises can expand or contract their portfolio management capabilities in response to evolving strategic priorities or changing economic conditions. In essence, modern cloud project portfolio management transcends traditional spreadsheet-based approaches, offering a robust foundation for agile operations and data-driven decision-making.

Navigating the Evolution of Cloud Project Management Through Digital Transformation, AI Integration, and Agile Remote Collaboration Architectures

The landscape of cloud project portfolio management is undergoing profound transformation as organizations embrace digital innovation, remote collaboration, and artificial intelligence. What was once confined to isolated on-premises systems now spans global clouds, third-party integrations, and sophisticated analytics engines. This convergence redefines how projects are prioritized, tracked, and delivered, ushering in an era of continuous planning and execution.

Furthermore, the rise of DevOps and microservices architectures has accelerated the pace of project releases, requiring portfolio managers to adopt adaptive governance models that balance speed with compliance. AI-driven predictive analytics surface potential bottlenecks and resource conflicts before they impact delivery timelines, while collaborative workspaces enable distributed teams to coordinate tasks and share insights seamlessly. As a result, organizations that harness these transformative technologies are better positioned to navigate disruptions, capitalize on emerging opportunities, and sustain competitive advantage in an ever-changing digital ecosystem.

Assessing the Multifaceted Influence of United States 2025 Tariffs on Cloud Portfolio Investments and Technology Procurement Strategies

In 2025, a series of tariff adjustments enacted by the United States government has had cascading effects on the cost structure of cloud-based project portfolio management solutions. Tariffs targeting imported server hardware, networking components, and specialized semiconductors have incrementally increased operational expenses for hyperscale providers and enterprise data centers alike. Consequently, these cost pressures are now rippling through licensing fees, managed service contracts, and professional services engagements.

Although some cloud service providers have absorbed portions of the tariff-induced expense to maintain competitive pricing, many are passing through higher costs to end customers. This dynamic compels organizations to scrutinize total cost of ownership more rigorously and explore strategies such as multi-cloud arbitration, bulk procurement agreements, or geographic load distribution to mitigate financial impact. Moreover, enterprise procurement teams are renegotiating service level agreements and exploring alternative configurations, ensuring that portfolio management capabilities remain robust even as input costs fluctuate. As organizations adapt to this new tariff landscape, the ability to forecast and absorb incremental costs will become a critical competency for sustaining innovation.

Given the continued regulatory uncertainty, many firms are building tariff scenario analyses into their budget planning cycles. By quantifying the potential impacts of further tariff escalations, executives can prioritize investments in cloud resilience, negotiate flexible contract terms, and evaluate emerging open-source or domestically manufactured technology options. Such proactive measures will define the winners in a market increasingly influenced by trade policy.

Unlocking Actionable Segmentation Insights Spanning Enterprise Sizes, Diverse Service Offerings, Deployment Models, and Industry Verticals

When evaluating cloud project portfolio management offerings, enterprise size emerges as a defining factor in platform selection and deployment complexity. Large enterprises with extensive global operations often require feature-rich suites that provide advanced analytics, governance frameworks, and integration with existing ERP and CRM systems. Conversely, small and medium enterprises tend to prioritize ease of use, rapid deployment, and cost predictability to accelerate time to value without incurring steep infrastructure overhead.

In terms of functional capabilities, platforms that excel in data analysis and predictive forecasting are highly sought after by organizations aiming to anticipate resource constraints and optimize delivery schedules. Meanwhile, solutions focused on collaboration and task management facilitate cross-functional team alignment and real-time status updates. Cost management and control features help financial stakeholders monitor budget adherence, while program-level reporting modules offer executives consolidated views of interrelated project outcomes. Project asset management functions ensure that digital assets, licenses, and equipment are tracked efficiently, and resource management tools enable portfolio managers to allocate skilled personnel across initiatives in accordance with shifting priorities.

The choice of deployment model further influences adoption patterns. Hybrid cloud environments appeal to organizations balancing on-premises security requirements with cloud scalability, whereas private cloud deployments attract sectors with stringent compliance mandates. Public cloud models continue to gain momentum where organizations seek rapid scalability and consumption-based pricing. Across industry verticals, banking, financial services, and insurance firms leverage comprehensive risk and compliance features, government and defense entities prioritize secure private deployments, and healthcare providers emphasize data privacy and interoperability. Information technology and telecommunications organizations capitalize on cloud-native integrations, manufacturing firms focus on digital twins and process optimization, and retail and consumer goods enterprises leverage resource management to coordinate omnichannel product launches.

This comprehensive research report categorizes the Cloud Project Portfolio Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Enterprise Size

- offerings

- Deployment Model

- Industry Vertical

Gaining Comprehensive Regional Perspectives Across the Americas, Europe Middle East Africa, and Asia Pacific Technology Adoption Patterns

Diverse regulatory frameworks, infrastructure maturity, and digital adoption rates drive regional variations in cloud project portfolio management uptake. In the Americas, strong demand stems from North American enterprises pursuing digital reinvention and Latin American firms modernizing legacy systems. Investment in integrated analytics and user-friendly collaboration features characterizes this region, where organizations often embed portfolio management within broader digital transformation initiatives.

Moving eastward, Europe, the Middle East, and Africa exhibit a complex tapestry of cloud adoption drivers. Data sovereignty regulations in Europe bolster interest in hybrid and private cloud models, prompting firms to opt for solutions that ensure local compliance while enabling cross-border coordination. In the Middle East, public cloud adoption accelerates as government programs advance digital public services, whereas in Africa, cloud-based portfolio management emerges as an enabler for infrastructure modernization and agile service delivery, often in resource-constrained environments.

Across the Asia-Pacific region, rapid digitalization trends underpin robust growth in cloud portfolio management platforms. Leading technology hubs prioritize AI-enhanced analytics and mobile-enabled collaboration to support distributed workforces. Meanwhile, emerging markets leverage cost management and control features to maximize the efficiency of limited budgets. As enterprises in Asia-Pacific continue to diversify their deployment strategies, a hybrid approach combining local private clouds with global hyperscale public cloud platforms is becoming increasingly prevalent.

This comprehensive research report examines key regions that drive the evolution of the Cloud Project Portfolio Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Market Landscape Through the Strategic Initiatives and Competitive Positioning of Leading Cloud Portfolio Management Providers

The competitive landscape of cloud project portfolio management is defined by vendors that balance platform extensibility, integration capabilities, and customer-centric innovation. Prominent providers are enhancing their ecosystems through strategic partnerships with hyperscale cloud operators and independent software vendors to offer seamless interoperability with enterprise resource planning, customer relationship management, and DevOps toolchains.

Many leading organizations are differentiating their offerings by embedding machine learning algorithms that surface predictive risk assessments and resource bottleneck warnings. Others invest heavily in intuitive user interfaces and low-code customization capabilities to accelerate time to deployment and minimize dependence on specialized technical staff. Pricing models continue to evolve, with trendsetting providers introducing usage-based billing and modular subscription tiers that cater to a diverse range of enterprise sizes and use cases.

Customer support and professional services remain key differentiators. Top-tier vendors are establishing global centers of excellence and cultivating user communities to facilitate best practice sharing and accelerate adoption. Through rigorous certification programs, these companies ensure that partner and customer teams can deploy and manage complex portfolio architectures efficiently. As the market matures, ongoing platform innovation, integration depth, and ecosystem engagement will dictate vendor success and inform enterprise selection processes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Project Portfolio Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Amazon Web Services, Inc.

- Asana, Inc.

- Atlassian Corporation Plc

- Broadcom, Inc.

- Celoxis Technologies Pvt. Ltd.

- Cloudbyz, Inc.

- Hewlett Packard Enterprise Company

- Hexagon AB

- International Business Machines Corporation

- Kantata, Inc.

- KeyedIn Solutions Limited

- Microsoft Corporation

- Oracle Corporation

- Planforge GmbH

- Planisware SAS

- Planview Inc.

- SAP SE

- ServiceNow Inc.

- Smartsheet Inc.

- TechnologyAdvice, LLC

- TRISKELL SOFTWARE CORPORATION, S.L.

- Upland Software, Inc.

- Wipro Limited

Implementing Actionable Strategies to Enhance Cloud Portfolio Governance, Optimize Costs, and Accelerate Project Delivery for Industry Leaders

To realize the full potential of cloud-based project portfolio management, industry leaders should adopt a multi-pronged approach grounded in governance, operational alignment, and continuous improvement. Establishing a centralized governance framework with clear decision rights and escalation paths will ensure that project investments are evaluated through consistent criteria aligned to strategic objectives. Coupling this governance model with robust cost-management protocols enables finance and IT stakeholders to forecast expenditures and enforce budget discipline.

Furthermore, organizations should leverage advanced analytics to monitor performance metrics and forecast resource requirements dynamically. By integrating predictive intelligence into portfolio planning, decision-makers can preemptively identify schedule risks and skill shortages, allowing teams to reallocate resources proactively. This analytical rigor must be complemented by a culture of collaboration, where cross-functional teams utilize integrated task management and knowledge-sharing workspaces to break down silos and accelerate issue resolution.

Finally, to maintain agility in an evolving tariff environment and shifting regulatory landscape, enterprises should implement an ongoing evaluation cycle for their technology stack. This entails regular vendor performance reviews, tariff impact assessments, and capability gap analyses. By institutionalizing a continuous feedback loop, leaders can refine their portfolio strategy, optimize cost structures, and sustain a resilient project pipeline that adapts to emerging market demands.

Illuminating Research Approach Combining Robust Primary Fieldwork and Comprehensive Secondary Analysis for Market Intelligence

The research underpinning this report combines structured engagements with senior project portfolio managers, IT directors, and industry practitioners alongside rigorous secondary source analysis. Primary research comprised in-depth interviews conducted with a cross-section of organizations spanning enterprise sizes, deployment models, and industry verticals. These conversations probed strategic objectives, platform selection criteria, deployment challenges, and lessons learned, providing firsthand insights into adoption drivers and roadblocks.

Secondary research encompassed a comprehensive review of vendor whitepapers, financial filings, regulatory publications, and technology trend reports. Data triangulation techniques were employed to validate key findings and ensure consistency across disparate information sources. A standardized questionnaire framework was used to capture quantitative and qualitative data points, while scenario-based analyses explored the implications of variables such as tariff adjustments, regulatory shifts, and emerging technology integrations.

Throughout the research process, rigorous quality checks were implemented, including peer reviews, data validation protocols, and expert panel consultations. This methodology ensures that the insights within this report reflect the latest industry developments, offer actionable intelligence for decision-makers, and stand up to the highest standards of market research rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Project Portfolio Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Project Portfolio Management Market, by Enterprise Size

- Cloud Project Portfolio Management Market, by offerings

- Cloud Project Portfolio Management Market, by Deployment Model

- Cloud Project Portfolio Management Market, by Industry Vertical

- Cloud Project Portfolio Management Market, by Region

- Cloud Project Portfolio Management Market, by Group

- Cloud Project Portfolio Management Market, by Country

- United States Cloud Project Portfolio Management Market

- China Cloud Project Portfolio Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Critical Findings to Reinforce Strategic Cloud Portfolio Decisions and Drive Sustainable Organizational Growth

Drawing together the core insights of this analysis, it is evident that cloud project portfolio management is a decisive enabler for organizational agility and strategic alignment. The convergence of transformative technologies such as AI, DevOps, and advanced analytics is reshaping how projects are planned, executed, and governed, while evolving tariff policies are adding new dimensions to cost management and procurement strategies.

Segmentation analysis underscores the importance of aligning solution capabilities with enterprise size, functional requirements, deployment preferences, and regulatory constraints inherent in industry verticals. Regional patterns further illustrate how local market dynamics, compliance frameworks, and infrastructure maturity inform adoption priorities and customization needs. Meanwhile, the competitive landscape continues to evolve, with vendors differentiating through ecosystem integrations, predictive analytics, and customer-centric service models.

As organizations position themselves for sustained growth, the actionable recommendations outlined herein provide a roadmap for enhancing governance, optimizing resource allocation, and embedding continuous improvement into portfolio management practices. By synthesizing these findings, decision-makers can chart a course toward more resilient, cost-efficient, and innovation-driven project delivery.

Engaging with Our Associate Director for Tailored Insights and To Secure Your Comprehensive Market Research Report Purchase Today

To secure access to the comprehensive Cloud Project Portfolio Management market research report or discuss how the findings can be tailored to your organization’s needs, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan brings deep domain expertise and can guide you through the report’s insights, ensuring you derive maximum value from the analysis and recommendations. Engage today to unlock strategic advantages, drive innovation in your project portfolio practices, and position your organization at the forefront of cloud-enabled project excellence. Elevate your market intelligence and accelerate decision-making by connecting with Ketan for a personalized briefing and immediate purchase options.

- How big is the Cloud Project Portfolio Management Market?

- What is the Cloud Project Portfolio Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?