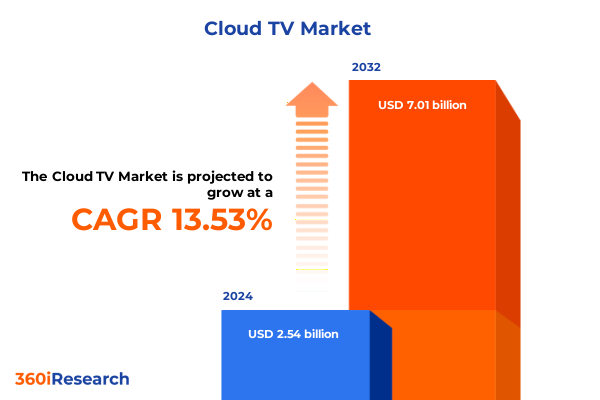

The Cloud TV Market size was estimated at USD 2.88 billion in 2025 and expected to reach USD 3.28 billion in 2026, at a CAGR of 14.41% to reach USD 7.41 billion by 2032.

Revolutionizing Entertainment Delivery through Cloud Television in 2025 and Beyond: Unpacking its Disruptive Potential for Modern Viewers and Enterprises Globally

Cloud television is redefining the way audiences consume entertainment by shifting the traditional broadcast and cable paradigms into a fully virtualized, software-driven model. This evolution, which originally emerged with the advent of cloud DVRs and hybrid streaming solutions, now encompasses end-to-end cloud-native workflows that enable providers to manage, deliver, and monetize content without reliance on local hardware. By decoupling content storage, encoding, and distribution from physical infrastructure, cloud TV platforms can dynamically scale capacity to handle peak events, offer instant on-demand access, and simplify network operations through a unified control plane. Such flexibility has been pivotal in meeting the growing expectations for high-quality, low-latency streaming across an ever-expanding array of devices.

How AI-Driven Personalization, 5G Rollouts, Edge Computing, and FAST Models Are Redefining the Cloud Television Landscape in Real Time

The Cloud TV market is being reshaped by an unprecedented convergence of technologies and business models that are collectively redefining content creation, distribution, and monetization. Foremost among these is artificial intelligence, which powers advanced recommendation engines, dynamic ad insertion, and automated production tools that transform how viewers discover and engage with content. AI-driven personalization is now extending beyond on-demand catalogs to live programming, enabling addressable advertising and context-aware promotions that adapt in real time to audience behavior and preferences. This shift is fueling the emergence of personalized FAST channels, where viewers receive curated linear streams tailored to their unique interests.

Assessing the Ripple Effects of U.S. Section 301 Tariffs in 2025 on Cloud Television Hardware, Content Delivery Networks, and Stakeholder Economics

The implementation of Section 301 tariff adjustments by the United States in early 2025 has introduced significant cost pressures on hardware and semiconductor imports critical to Cloud TV ecosystems. Semiconductors, which now face a 50% duty, underpin set-top boxes, smart televisions, and edge compute nodes that process low-latency video streams. These escalated tariffs raise the landed cost of devices imported from China, squeezing the margins of consumer electronics manufacturers and compelling service providers to reconsider device subsidy models and subscription bundles. Hardware vendors are exploring alternative supply chains and expanding regional manufacturing to mitigate these new levies, yet the transition requires substantial capital expenditure and logistical realignment.

Deep Dive into Platform, Service, Device, Content, Revenue, and End User Segmentation Reveals Nuanced Dynamics Shaping the Cloud TV Market

A multi-layered segmentation framework offers a granular view of the Cloud TV domain, capturing unique dynamics across platform, service, device, content, revenue, and end-user dimensions. From a platform standpoint, Cable and Satellite continue to serve legacy audiences while IPTV services deliver catch-up television, live channels, and cloud-based video-on-demand, and Over-the-Top offerings differentiate between advertising-supported, subscription-based, and transactional models. Each of these platform categories demands specialized delivery pipelines that optimize for bandwidth efficiency, content protection, and integration with legacy broadcast systems.

Considering service type, catch-up television bridges the gap between linear and on-demand, live television retains real-time engagement for news and sports, and video-on-demand-whether ad-based, subscription-based, or transactional-provides choice and convenience for deep catalog exploration. These service variations influence everything from encoder configurations to user interface design and ad-monetization strategies. On the device front, audiences engage via smart televisions with embedded cloud clients, set-top boxes that offload processing to the network edge, mobile devices capitalizing on 5G networks, and gaming consoles that leverage cloud gaming architectures to blend interactive and video services. Each device type imposes distinct requirements on streaming protocols, DRM schemes, and user experience flows, driving providers to adopt flexible architectures that can seamlessly adapt to evolving form factors.

Content types such as movies, news, series, and sports each present unique production, licensing, and rights management challenges. Live sports streaming demands ultra-low latency and real-time analytics for personalized highlights, series require sophisticated metadata and content scheduling, news workflows prioritize live-to-VOD pipelines, and movie libraries hinge on robust digital rights enforcement. Providers structure revenue models accordingly, trading off between advertising yields, subscription retention, and pay-per-view transactional spikes tied to premium premieres. Finally, end-user segmentation into commercial and residential sectors underscores divergent quality-of-service expectations, contractual agreements, and usage patterns, with commercial deployments often requiring SLA-backed uptime and multi-screen synchronization for public venues, while residential subscribers emphasize immediate access, intuitive interfaces, and cost predictability.

This comprehensive research report categorizes the Cloud TV market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Service Type

- Device Type

- Content Type

- Revenue Model

- End User

Divergent Growth Patterns and Strategic Priorities in Americas, EMEA, and Asia-Pacific That Are Shaping the Future of Cloud Television Adoption

In the Americas, the United States and Canada lead global Cloud TV uptake, driven by advanced broadband infrastructure and early adoption of FAST services. North American providers are pioneering addressable ad insertion, cross-platform bundling initiatives, and cloud-based broadcast operations centers that deliver seamless content orchestration at scale. The region’s robust venture capital ecosystem continues to fund startups that leverage machine learning to optimize video encoding, audience analytics, and interactive features, further entrenching Cloud TV as a mainstream entertainment pillar.

Europe, Middle East & Africa is witnessing accelerated FAST channel proliferation and evolving content licensing frameworks. Europe in particular has seen a tenfold increase in FAST channels over recent years, reflecting both demand for free ad-supported services and investments in cloud-native distribution platforms. Regulatory developments around data privacy and cross-border licensing are prompting collaboration between broadcasters and telcos to deliver hybrid Unicast/IPTV offerings. Meanwhile, the Middle East’s rapid 5G rollouts are enabling live event streaming innovations, and Africa’s mobile-first consumer base is driving Cloud TV services optimized for low-bandwidth environments, supported by edge caching and adaptive bitrate technologies.

In Asia-Pacific, mass smartphone penetration and expansive 5G networks have created fertile ground for Cloud TV expansion. Content platforms in Japan, South Korea, and India are integrating cloud DVR, interactive features, and real-time engagement tools into their offerings. The region’s blend of OTT disruptors and incumbent broadcasters is fostering hybrid models that marry linear channel packages with Cloud TV capabilities. Innovation hubs in Singapore and Australia are also collaborating with global CDN and cloud providers to pilot next-generation broadcasting standards such as ATSC 3.0 and DVB-I, positioning Asia-Pacific at the forefront of Cloud TV technology adoption and service experimentation.

This comprehensive research report examines key regions that drive the evolution of the Cloud TV market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Cloud TV Innovators and Service Providers Driving Technological Advancements and Competitive Differentiation in 2025

Key industry players are driving the Cloud TV revolution through a combination of platform services, cloud infrastructure, and specialized media workflows. Amazon Web Services stands out with its Cloud-Native Agile Production program, unveiling Time-addressable Media Store APIs and fast-turnaround media workflows to streamline news, sports, and entertainment delivery. Its partnership with Warner Bros. Discovery on the Cycling Central Intelligence platform underscores AWS’s role in generative AI and real-time data-driven storytelling in live sports broadcasting.

Amagi’s cloud-native broadcast solutions are gaining traction in the United States and EMEA, offering unified streaming platform management and AI-powered scheduling tools that optimize channel lineups and ad revenue. Its expansion of network operations centers reflects growing demand for fully cloud-based channel origination and playout services. Chyron’s successful completion of the AWS Foundational Technical Review for its cloud-native live production solution further highlights the shift toward scalable, browser-accessible broadcast tools that reduce reliance on on-premises hardware. Collectively, these companies represent a new breed of Cloud TV enablers focused on interoperability, reliability, and advanced analytics to power personalized viewer experiences at scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud TV market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Amino Communications Ltd

- Apple Inc.

- Brightcove, Inc.

- Comcast Corporation

- Dish Network Corporation

- Google LLC

- International Business Machines Corporation

- Kaltura, Inc.

- Netflix, Inc.

- Paramount Global

- Roku, Inc.

- SeaChange International, Inc.

- The Walt Disney Company

- Warner Bros. Discovery, Inc.

Strategic Imperatives for Cloud TV Industry Leaders to Embrace Emerging Technologies, Optimize Monetization Strategies, and Foster Sustainable Growth

To capitalize on the transformative opportunities within Cloud TV, industry leaders should prioritize the integration of AI-driven personalization engines across both live and on-demand services. By harnessing viewer data for real-time content recommendations and targeted ad insertion, providers can boost engagement and create differentiated ad packages that appeal to premium advertisers. Additionally, strategic partnerships with network carriers and edge computing vendors will be critical for delivering low-latency streams, particularly for live events and interactive broadcasts, ensuring seamless experiences regardless of end-user location and network conditions.

Moreover, addressing supply chain vulnerabilities exposed by newly implemented tariffs requires a dual approach of supply diversification and onshoring of key hardware components. Device manufacturers and platform operators should explore regional production facilities, secure alternative chipset sources, and collaborate on standardized hardware designs that reduce custom tooling costs. Concurrently, adopting open, interoperable media frameworks-such as Time-addressable Media Store APIs-will foster ecosystem alignment and accelerate the roll-out of cloud-native workflows for news, sports, and entertainment content pipelines.

Finally, cultivating a cohesive go-to-market strategy that blends FAST, subscription, and transactional models will allow providers to capture diverse revenue streams while meeting varying consumer preferences. Combining free ad-supported channels with bundled subscription tiers and premium pay-per-view offerings encourages upsell opportunities and retains users within the service ecosystem. Industry leaders must also invest in transparent data analytics platforms to measure campaign performance, content engagement, and churn drivers, enabling iterative refinements to service offerings and marketing approaches.

Robust Research Framework Incorporating Primary Interviews, Secondary Data Analysis, and Triangulation to Ensure Comprehensive Cloud TV Market Insights

Our research methodology leverages a blend of primary and secondary approaches to ensure comprehensive and accurate Cloud TV market insights. Primary research included in-depth interviews with senior executives across cloud infrastructure providers, content owners, and service operators to capture firsthand perspectives on technological adoption, operational challenges, and strategic roadmaps. These discussions were complemented by expert roundtables at leading industry events and customized surveys targeting technology implementers in broadcast and streaming environments, providing a robust, multi-stakeholder viewpoint on market dynamics.

Secondary research involved rigorous analysis of public filings, regulatory announcements, and vendor whitepapers to quantify tariff impacts, platform transitions, and innovation milestones. Government sources such as USTR press releases on Section 301 adjustments informed our assessment of supply chain risk, while technical blogs and case studies from cloud providers and standards bodies shaped our understanding of emerging media frameworks. Data triangulation techniques were applied to reconcile discrepancies across information sources, resulting in validated insights that reflect real-world market conditions and projected technology trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud TV market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud TV Market, by Platform

- Cloud TV Market, by Service Type

- Cloud TV Market, by Device Type

- Cloud TV Market, by Content Type

- Cloud TV Market, by Revenue Model

- Cloud TV Market, by End User

- Cloud TV Market, by Region

- Cloud TV Market, by Group

- Cloud TV Market, by Country

- United States Cloud TV Market

- China Cloud TV Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Consolidating Insights into a Cohesive Outlook on the Evolution, Challenges, and Opportunities Driving the Cloud Television Industry Forward

As Cloud TV continues its rapid ascent, the interplay of AI, 5G, edge computing, and evolving content monetization models is creating a fertile ground for innovation and competitive differentiation. Providers that embrace cloud-native workflows and open interoperability standards will be best positioned to deliver seamless, personalized experiences at scale, while those that effectively manage supply chain complexities and diversify revenue streams will secure operational resilience amid shifting tariff environments. The global market’s regional variations-from North America’s FAST leadership to Europe’s regulatory-driven bundling strategies and Asia-Pacific’s mobile-first growth-underscore the importance of tailored approaches that align with local market characteristics. By integrating advanced analytics, fostering strategic partnerships, and advancing hybrid cloud deployments, industry stakeholders can navigate the complex Cloud TV ecosystem and unlock new avenues for audience engagement and revenue generation.

Connect with Ketan Rohom to unlock exclusive Cloud TV insights and secure your comprehensive strategic report for informed decision-making

For detailed insights and an in-depth understanding of how these Cloud TV transformations can benefit your organization, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through customized research packages tailored to your strategic priorities, ensuring you leverage timely data and actionable intelligence to stay ahead in the rapidly evolving Cloud TV landscape. Engage directly to secure your comprehensive market research report and empower your next phase of growth.

- How big is the Cloud TV Market?

- What is the Cloud TV Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?