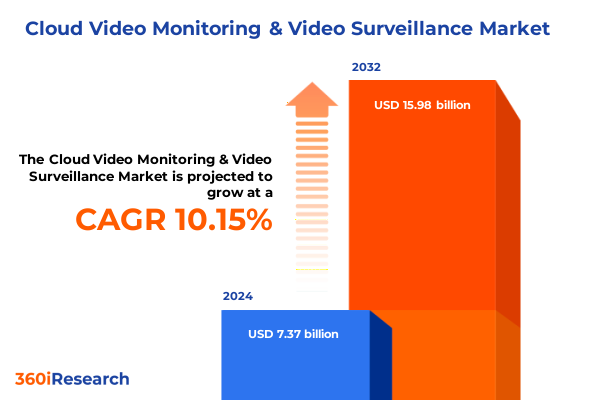

The Cloud Video Monitoring & Video Surveillance Market size was estimated at USD 7.88 billion in 2025 and expected to reach USD 8.75 billion in 2026, at a CAGR of 10.62% to reach USD 15.98 billion by 2032.

Rapid Evolution of Video Surveillance: Embracing Cloud-Native Architectures and Intelligent Video Monitoring for Next-Gen Security Operations

The video surveillance landscape is experiencing an unprecedented transformation fueled by the convergence of cloud-native technologies, artificial intelligence, and heightened security demands. As organizations across sectors seek to strengthen their operational resilience, the shift from traditional on-premise architectures toward scalable, cloud-powered video monitoring has become a strategic imperative. This evolution is driven by the need for real-time insights, remote accessibility, and cost-effective scalability, enabling security teams to respond proactively rather than reactively. Additionally, these modern systems facilitate seamless integration with other enterprise applications, fostering a unified security ecosystem that extends beyond mere risk detection.

Transitioning to cloud-based models also addresses key challenges surrounding data management and infrastructure maintenance. By shifting storage and processing to robust cloud platforms, organizations can eliminate substantial capital expenditures on servers and maintenance, instead adopting an operational expenditure approach that aligns with fluctuating business needs and dynamic threat landscapes. Moreover, the enhanced agility provided by cloud architectures empowers decision-makers to deploy new analytics capabilities rapidly, fostering continuous innovation. As a result, this introduction sets the stage for exploring the transformative forces reshaping video surveillance and the strategic insights contained within this executive summary to guide future investments and operational frameworks.

Transformative Technological Convergence: AI-Powered Analytics, Edge Computing, and Hybrid Cloud Models Driving the Next Era of Video Surveillance

The modern video surveillance ecosystem is being redefined by the fusion of advanced analytics, edge computing, and hybrid cloud deployments, collectively ushering in a new era of intelligent security. Across industries, organizations are embedding artificial intelligence into both camera hardware and centralized platforms to enhance object detection, facial recognition, and predictive analytics. This trend is exemplified by deployments that leverage generative AI capabilities to autonomously identify events of interest, significantly reducing false alarms and manual monitoring burdens. Furthermore, the move toward edge computing has enabled on-device inference, cutting down latency and bandwidth consumption by processing video streams locally before relaying only metadata and critical alerts to the cloud for comprehensive analysis.

Moreover, hybrid cloud models are rapidly gaining traction as enterprises seek to balance performance with compliance. By architecting systems that process sensitive data on-premise while utilizing public cloud services for non-critical workloads, organizations achieve both stringent data governance and the scalability of cloud storage. Meanwhile, the rise of hybrid ecosystems extends surveillance beyond fixed cameras to include IoT sensors, access controls, and environmental monitoring devices, creating unified situational awareness platforms. As regulatory frameworks evolve globally to address privacy and data security, vendors are embedding robust encryption and audit capabilities by design, ensuring compliance without compromising operational agility.

Assessing the Cumulative Impact of U.S. Tariff Measures on Global Video Surveillance Component Costs and Supply Chain Resilience

In April 2025, the U.S. administration implemented a 34% tariff increase on Chinese technology imports, encompassing critical video surveillance components such as image sensors, semiconductors, and network hardware. These reciprocal “Liberation Day” measures, alongside duties ranging from 20% to 50% on products from other major exporters, have injected significant cost pressures into global supply chains. As manufacturers confront elevated import costs, production expenses have increased, prompting many to absorb margins or pass on price hikes to end users. In the professional AV sector, integrators have reported up to 10% rises in equipment prices as vendors adjust for tariff impacts and logistical challenges.

These elevated tariffs have also disrupted traditional supply chain configurations, accelerating the shift of manufacturing and assembly operations to alternative regions such as Southeast Asia and Mexico. While diversification has mitigated long-term dependencies, the initial transition introduced delays, component shortages, and extended lead times for critical security projects. Recognizing these strains, the Security Industry Association petitioned the U.S. Trade Representative and Secretary of Commerce for product-specific tariff relief, highlighting the risk of reduced availability and higher costs for vital life safety systems. Consequently, stakeholders are developing strategic sourcing strategies, exploring domestic and nearshore solutions, and investing in tariff-exemption processes to safeguard both supply continuity and competitive pricing.

Integrated Segmentation Perspectives Revealing the Synergistic Dynamics Among Components, Deployments, Verticals, Applications, and Technologies

A nuanced market perspective emerges when examining surveillance components, deployment models, end-user verticals, applications, and underlying technologies in concert. Historically, hardware elements-cameras, recorders, encoders, and storage infrastructure-have formed foundational investments, but the rapid appetite for intelligent systems has propelled software segments like video management platforms and advanced analytics solutions to the forefront. Concurrently, service offerings encompassing managed services, professional integrations, and support frameworks are gaining ascendancy as organizations outsource complexity to specialized security expertise. This layered interplay between components and services underscores a strategic migration from traditional capital-intensive models toward subscription-based and outcomes-oriented engagements

Deployment strategies reveal a clear dichotomy: on-premise solutions persist in scenarios demanding full data control and low-latency response, while cloud-based and hybrid architectures satisfy the need for rapid scalability, cross-location visibility, and unified management portals. End-user adoption spans critical sectors: financial institutions prioritize compliance and fraud prevention, healthcare providers leverage video for patient safety and operational analytics, and retail and logistics operations harness surveillance for loss prevention and process optimization. Further, broadening application domains-ranging from access control and intrusion detection to people counting and behavioral analytics-reflect the expansion of surveillance from security to business intelligence use cases. Underpinning these shifts, analog systems remain in legacy environments, whereas IP networks dominate greenfield deployments, supplemented by thermal imaging for sensitive installations and wireless solutions, including cellular and Wi-Fi, to facilitate rapid, flexible site coverage.

This comprehensive research report categorizes the Cloud Video Monitoring & Video Surveillance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment

- Application

- End User

Key Regional Dynamics Demonstrating How Local Regulations, Infrastructure Maturity, and Smart City Strategies Shape Video Surveillance Investments

Regional dynamics in the Americas continue to reflect robust adoption of cloud-based video monitoring, supported by mature IT infrastructures and evolving regulatory frameworks that emphasize data security and privacy. In North America, leading-edge enterprises and municipal authorities are championing video analytics and unified security platforms, benefiting from high-bandwidth connectivity and established standards for data protection. Meanwhile, distributions and integrators across Latin America are accelerating investments in flexible, subscription-based surveillance solutions to offset capital constraints and address rising urbanization challenges.

In Europe, the Middle East, and Africa, stringent data privacy regulations such as GDPR and NIS2 are catalyzing demand for compliant, encrypted surveillance systems deployed within controlled data sovereignty parameters. Public safety initiatives and smart city deployments in Western Europe leverage multi-vendor interoperability, while emerging economies in Eastern Europe and the Gulf region fluctuate between rapid infrastructure expansion and cautious technology standardization. These diverse regulatory and market maturity levels drive a balanced mix of on-premise and cloud architectures tailored to localized imperatives.

Across Asia-Pacific, escalating urbanization and government-led smart city agendas are propelling demand for scalable, integrated surveillance platforms. Nations such as India have implemented rigorous certification protocols for CCTV devices, aiming to mitigate espionage risks by mandating hardware and software audits for all imported cameras-a move that has temporarily tightened supply availability. Meanwhile, Southeast Asian and Australasian markets are witnessing accelerated uptake of AI-enabled edge cameras and hybrid-cloud orchestration, driven by both public safety concerns and commercial use cases in retail, manufacturing, and transportation.

This comprehensive research report examines key regions that drive the evolution of the Cloud Video Monitoring & Video Surveillance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Innovation Pathways of Leading Providers Shaping User Expectations in Cloud-Based and AI-Driven Video Surveillance

A handful of industry leaders are steering the next phase of video surveillance innovation through differentiated strategies and robust ecosystem collaborations. Hanwha Vision, for instance, is at the vanguard of embedding generative AI agents into edge cameras, enabling on-device scenario assessment and real-time alert generation that transcend basic detection roles. Genetec has solidified its leadership by advancing hybrid cloud architectures paired with outcome-driven analytics workflows, facilitating automated event classification and streamlined emergency dispatch features while ensuring rigorous compliance with global privacy regulations.

On the open platform front, Axis Communications continues to expand its ecosystem through modular network cameras and comprehensive IoT integrations, catering to enterprises that prioritize high-resolution imaging and third-party interoperability. Synology’s recent launch of its C2 Surveillance VSaaS offering underscores the rise of serverless, license-free cloud deployments designed for multi-site scalability and rapid, non-disruptive rollouts. Meanwhile, emerging disruptors such as Wyze are democratizing advanced AI capabilities by providing descriptive motion alerts and cost-effective subscription models that broaden market accessibility. Collectively, these leading companies are reshaping market expectations around usability, intelligence, and licensing flexibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Video Monitoring & Video Surveillance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3dEYE Inc.

- Axis Communications AB

- Costar Video Systems, LLC

- D-Link Corporation

- Eagle Eye Networks

- Genetec Inc.

- Hanwha Vision Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Johnson Controls International plc

- Milestone Systems A/S.

- MOBOTIX AG

- Motorola Solutions, Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Shenzhen Hikvision Digital Technology Co., Ltd.

- The Infinova Group

- TimeTec Cloud Sdn. Bhd.

- Vivotek Inc.

- Zhejiang Dahua Technology Co., Ltd.

Actionable Recommendations for Developing Resilient Hybrid Architectures and Secure, Scalable Analytics Ecosystems in the Video Surveillance Sector

To navigate the complexities of the evolving video surveillance landscape, industry leaders should prioritize developing hybrid architectures that blend the strengths of edge processing with cloud scalability. Establishing partnerships with diversified manufacturing and assembly partners will mitigate tariff-related supply disruptions while fostering local supply chain resilience. Additionally, integrating video analytics platforms with enterprise IT and operational systems will unlock new value streams, transforming passive surveillance into active business intelligence tools.

Organizations must also embed cybersecurity and data privacy by design, incorporating encryption, access controls, and transparent audit trails into every system layer to meet tightening global regulations and maintain stakeholder trust. Investing in modular software licensing and subscription services can accelerate deployment cycles and generate predictable revenue models, aligning vendor offerings with customer needs for operational agility. Lastly, building collaborative ecosystems with technology partners and end users will accelerate innovation pipelines, ensuring that emerging trends-such as generative AI, 5G-enabled wireless cameras, and deepfake detection-are rapidly tested, validated, and delivered to market.

Overview of Research Methodology Incorporating Primary Interviews, Secondary Data Sources, and Expert Validation to Ensure Analytical Rigor

This report synthesizes insights through a rigorous, dual-phase approach combining primary interviews with industry practitioners, technology integrators, and end-user executives, alongside comprehensive secondary research spanning regulatory filings, patent databases, and public financial disclosures. Through iterative data triangulation, segmentation hypotheses were tested against real-world deployments to ensure alignment between theoretical constructs and operational realities.

Expert validation panels provided qualitative checks on emerging trends, while quantitative models were refined through sensitivity analysis to examine the potential impact of variables such as tariff changes, cloud adoption rates, and regulatory shifts. The methodology integrates cross-verification of vendor claims with third-party benchmarks, ensuring that the findings are both empirically grounded and industry relevant. This systematic approach underpins the robustness and credibility of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Video Monitoring & Video Surveillance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Video Monitoring & Video Surveillance Market, by Component

- Cloud Video Monitoring & Video Surveillance Market, by Technology

- Cloud Video Monitoring & Video Surveillance Market, by Deployment

- Cloud Video Monitoring & Video Surveillance Market, by Application

- Cloud Video Monitoring & Video Surveillance Market, by End User

- Cloud Video Monitoring & Video Surveillance Market, by Region

- Cloud Video Monitoring & Video Surveillance Market, by Group

- Cloud Video Monitoring & Video Surveillance Market, by Country

- United States Cloud Video Monitoring & Video Surveillance Market

- China Cloud Video Monitoring & Video Surveillance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Comprehensive Conclusion Highlighting the Strategic Intersection of Technological Innovation, Regulatory Shifts, and Market Segmentation Driving Future Success in Video Surveillance

In summary, the video surveillance industry is at an inflection point driven by the integration of cloud-native infrastructures, AI-driven analytics, and evolving global regulations. Technological convergence is enabling security organizations to transition from reactive monitoring toward proactive threat detection and operational optimization. Market segmentation dynamics underscore the interdependence of hardware, software, deployment models, and vertical use cases in shaping adoption strategies. Meanwhile, regional nuances-from privacy mandates in Europe to smart city certification regimes in Asia-Pacific-are driving localized priorities.

Leading companies are responding through differentiated strategies that emphasize generative AI, open platforms, and flexible licensing constructs, while industry leaders must balance innovation investments with supply chain resilience measures amid tariff headwinds. By following data-driven recommendations and leveraging the methodological rigor of this report, decision-makers will be equipped to navigate market disruptions and capitalize on the transformative potential of next-generation video surveillance systems.

Unlock Comprehensive Insights on Cloud Video Monitoring and Surveillance with Expert Guidance and a Customized Research Report Offering Strategic Value

Engaging with Ketan Rohom will connect you directly to an industry expert who can demonstrate how this report equips you with the analytical depth and strategic foresight needed to navigate the evolving video surveillance ecosystem. His guidance will ensure you leverage the research insights effectively, whether you are evaluating technology partnerships, optimizing deployment strategies, or assessing the impact of regulatory and tariff developments. To secure early access to tailored findings, customized data tables, and priority support, reach out to Ketan Rohom and transform these actionable insights into a competitive advantage for your organization.

- How big is the Cloud Video Monitoring & Video Surveillance Market?

- What is the Cloud Video Monitoring & Video Surveillance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?