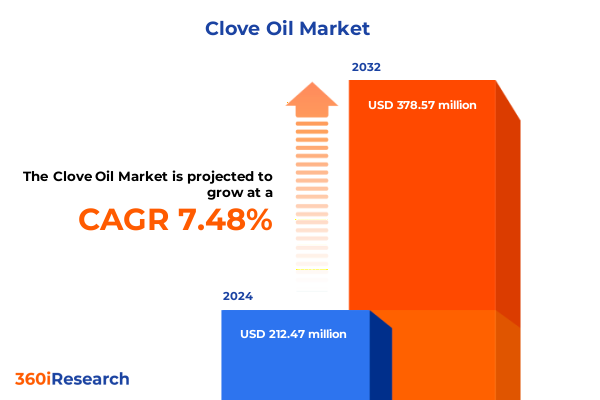

The Clove Oil Market size was estimated at USD 227.48 million in 2025 and expected to reach USD 247.44 million in 2026, at a CAGR of 7.54% to reach USD 378.57 million by 2032.

Unlocking the Aromatic Power of Clove Oil Through a Comprehensive Exploration of Its Origins, Benefits, Market Dynamics, and Emerging Opportunities

Clove oil, derived from the flower buds of the Syzygium aromaticum tree, boasts a rich history stretching back centuries. Indigenous to the Maluku Islands of Indonesia, this aromatic extract was traditionally valued for its potent antimicrobial, analgesic, and fragrant properties. The hot, humid climate of regions such as North Sulawesi and Madagascar fosters ideal growing conditions, yielding buds that are then harvested and distilled to release their essential compounds.

Over time, clove oil’s applications have expanded well beyond its historical medicinal roots. Today, it plays a critical role in flavoring bakery and confectionery products, enriching beverages with its signature warmth, and imparting savory depth to sauces and marinades. Personal care formulations leverage its antibacterial and aromatic qualities in haircare, oral care, and skincare products, while pharmaceutical and over-the-counter treatments incorporate clove oil for its analgesic properties. This diverse utility underscores its enduring prominence in the global essential oils market.

Emerging Innovations and Sustainability Initiatives Reshaping the Global Clove Oil Landscape and Driving Industry Transformation

The clove oil industry is experiencing a paradigm shift driven by sustainable sourcing practices and innovative traceability solutions. Leading producers are adopting blockchain and digital ledger technologies to ensure end-to-end visibility, from smallholder farms in Indonesia and Madagascar to distillation facilities, promoting ethical harvesting and reducing risks of adulteration.

Simultaneously, extraction technologies are evolving to enhance yield, purity, and cost efficiency. Supercritical CO₂ extraction is gaining traction for its solvent-free process, while traditional steam distillation and cold press techniques are being refined with advanced equipment and energy-recovery systems to minimize environmental impact and operating expenses. This technological diversification allows producers to tailor oil profiles for specific applications, from high-purity pharmaceutical grades to richly complex flavor extracts.

Finally, consumer preferences are accelerating these transformations. As demand intensifies for clean-label, organic, and sustainably sourced ingredients, clove oil manufacturers are responding with premium, certified organic offerings and transparent supply chain certifications. This premiumization trend not only elevates product positioning in food, personal care, and wellness sectors but also incentivizes investments in research and development to maintain competitive differentiation.

Assessing the Far-Reaching Effects of Recent United States Tariffs on the Global Clove Oil Supply Chain, Cost Structures, and Industry Economics

The United States has significantly altered its spice import tariffs in 2025, including duties on cloves, creating a ripple effect across the global clove oil market. Initial measures introduced a 10% base tariff earlier in the year, followed by steep 50% tariffs on spice imports from select countries effective August 1, 2025. These dramatic rate hikes apply to over a dozen non-agreement jurisdictions, directly impacting the cost of raw clove inputs for oil producers.

As a result, distillers and formulators face sharply increased input costs, with smaller spice ink oil houses being the most vulnerable. Many have petitioned U.S. authorities for exemptions on spices that cannot be commercially grown domestically, such as cloves, citing the necessity of these imports for hundreds of billions of pounds of food and personal care products. Without relief, these providers will be compelled to pass costs onto downstream customers or absorb them, compressing margins and potentially limiting investment in capacity expansion.

Over the long term, the industry is likely to pursue strategic realignment. Producers may seek to diversify sourcing toward non-tariff nations or invest in domestic extraction and downstream processing to mitigate duty exposure. Some manufacturers will explore blending lower-cost oleoresins or adopt botanical alternatives that circumvent high tariffs. Collectively, these adjustments will reshape trade flows, supplier relationships, and product cost structures, redefining competitive dynamics on a global scale.

Unveiling Critical Segmentation Dimensions That Illuminate Strategic Opportunities Across Applications, Extraction Methods, and Distribution Channels

A nuanced understanding of the clove oil market emerges when examining its segmentation across applications, extraction methods, product types, distribution channels, and purity grades. Within applications, opportunities range widely from animal nutrition to aromatherapy, spanning food and beverage categories such as bakery and confectionery, beverages, and savory foods, extending into personal care formulations for haircare, oral care, and skincare, as well as agricultural pesticides and pharmaceutical products divided between over-the-counter and prescription treatments.

Extraction method distinctions further clarify market niches. CO₂ extraction delivers ultra-pure profiles suitable for high-end pharmaceutical and aromatherapy uses, whereas cold press extraction preserves volatile compounds for premium cosmetic and flavor applications, and steam distillation remains the industry workhorse for large-volume food and industrial needs.

Product type segmentation delineates fractionated clove oil, prized for its fixed composition, organic clove oil, commanding price premiums in health and wellness channels, and refined clove oil, widely adopted in large-scale manufacturing for its consistent performance and cost efficiency.

Distribution channel analysis underscores the multiplicity of go-to-market routes. Direct sales and distributor partnerships serve industrial and large corporate buyers, whereas online retail-both through e-commerce platforms and manufacturer websites-caters to specialty and consumer audiences. Traditional retail channels, including specialty stores and supermarkets or hypermarkets, remain vital for mass-market penetration.

Finally, purity grade segmentation addresses varying regulatory and application demands. Cosmetic grade clove oil adheres to stringent safety and sensory requirements, food grade meets rigorous edible standards, and industrial grade prioritizes functional efficacy over organoleptic properties, enabling its use in cleaning, agrochemical, and technical formulations.

This comprehensive research report categorizes the Clove Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Extraction Method

- Product Type

- Distribution Channel

- Purity Grade

Evaluating Regional Dynamics, Regulatory Landscapes, and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific Clove Oil Markets

In the Americas, North America leads in both production of value-added clove oil formulations and consumption in the aromatherapy, personal care, and nutraceutical sectors. Stringent FDA guidelines and growing consumer inclination toward natural wellness products drive innovation in certified organic and therapeutic grades. Meanwhile, Latin American markets, particularly Brazil and Mexico, are expanding both in food flavoring and cosmetic applications, buoyed by rising disposable incomes and a cultural affinity for spice-infused cuisine.

Across Europe, Middle East & Africa, regulatory frameworks in the European Union emphasize sustainability and traceability, compelling suppliers to secure certifications such as COSMOS and organic designations. Western Europe’s demand for premium aromatic oils contrasts with the Middle East’s focus on robust, traditional essences. In Africa, emerging processing hubs in Madagascar and Tanzania are leveraging Fair Trade initiatives to enhance economic development, while local consumption grows in personal care and traditional medicine contexts.

The Asia-Pacific region remains the epicenter of raw material supply, with Indonesia alone contributing approximately 75% of global clove output and India ranking as another major producer. Government incentives in Indonesia encourage domestic distillation capacity expansion, whereas India’s pharmaceutical sector increasingly incorporates clove oil into analgesic and oral care formulations. Simultaneously, Australia and Japan drive demand for ultra-high-purity grades in both food and cosmetic segments, reflecting advanced regulatory standards and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Clove Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Advantages of Leading Clove Oil Producers and Suppliers Within the Global Essential Oils Ecosystem

Givaudan leverages its extensive research and development infrastructure to integrate advanced extraction technologies and sustainable sourcing protocols, thereby ensuring the high quality and consistency of its clove oil offerings across food, flavor, and fragrance applications. The company’s commitment to traceability and ethical supply chain practices reinforces its position among leading flavor and fragrance conglomerates.

Symrise and Robertet employ complementary strategies, with Symrise investing in innovative green chemistry extraction methods to produce eco-friendly clove oil variants, while Robertet's focus on premium aromatherapy and pharmaceutical applications hinges on rigorous quality control and proprietary distillation techniques. Both firms cultivate strategic partnerships with key spice-growing communities to secure stable raw material flows.

Market leaders in the aromatherapy consumer space, Young Living Essential Oils and doTERRA International, capitalize on vertically integrated supply chains and direct-to-consumer distribution models. Young Living’s Seed to Seal quality commitment and doTERRA’s stringent raw material vetting lend these brands a competitive edge in the therapeutic and personal care segments, bolstered by robust consumer education initiatives and global sales networks.

Berje Inc. and Ultra International B.V. distinguish themselves through expansive distribution infrastructures that serve industrial and food-service clientele. Their ability to offer customized clove oil grades and volume discounts supports large-scale food manufacturers and cosmetic formulators, while Ultra International’s partnership programs simplify procurement for multinational buyers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clove Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. G. Organica Pvt Ltd

- Aarnav Global Exports

- D G Boys & Company

- Dabur India Limited

- Dr. Jain Forest Herbals Pvt Ltd

- Durgas Ayurvedic Pharmacy

- Earth Expo Company

- Eastern Agencies Aromatics Pvt Ltd

- Expo Essential Oils

- Gogia Chemical Industries Pvt Ltd

- Green Leaf Industries

- India Aroma Oils And Company

- Katyani Exports

- Kazima Perfumers

- Manomay Biochem

- Natural Aroma Products Private Limited

- Shubham Natural Fragrances

- Simmi Enterprises

- Sivaroma Naturals Private Limited

- Vikram Aromatics

Formulating Actionable Strategies for Industry Leaders to Navigate Tariff Challenges, Optimize Segmentation, and Capitalize on Regional Growth Opportunities

To mitigate the impact of punitive import duties, industry leaders should diversify their sourcing portfolios, establishing relationships with non-tariff jurisdictions and exploring joint ventures with emerging producers in Africa and Southeast Asia. Parallel investments in advanced extraction technologies-such as closed-loop CO₂ systems-will offset cost pressures and safeguard margins.

Optimization of segmentation strategies is crucial. Prioritizing development of specialty blends tailored to the bakery and confectionery sectors can unlock incremental revenues, while expanded product lines in organic and refined grades will address rising demand among premium personal care brands.

Regionally calibrated initiatives will maximize growth. In the Americas, strategic partnerships with contract manufacturers can accelerate market entry for novel clove oil derivatives, whereas in EMEA, secured certifications and traceability platforms can differentiate offerings within discerning EU markets. In APAC, co-investment in local distillation capacity will enhance supply chain resilience and reduce freight lead times.

Finally, embedding sustainability as a core operating principle through fair trade sourcing agreements, carbon-neutral production commitments, and transparent supply chain reporting will strengthen brand equity, foster customer loyalty, and align with the evolving expectations of stakeholders, regulators, and end consumers.

Explaining the Rigorous Research Methodology Underpinning This Clove Oil Market Analysis and Its Comprehensive Multidimensional Approach

This analysis combines primary research-conducted through in-depth interviews with supply chain participants, industry executives, and subject matter experts-with secondary sources such as trade association publications, regulatory filings, and reputable industry news outlets. Insights were validated through cross-referencing of quantitative data and qualitative inputs.

Secondary research incorporated public disclosures from major clove oil producers, reports from the American Spice Trade Association on import flows, and proprietary market intelligence on extraction technologies. Triangulation of these data points ensured consistency and robustness of findings.

Segmentation modeling embraced a bottom-up approach, mapping application demand across food and beverage, personal care, aromatherapy, pesticides, and pharmaceutical domains. Extraction method analysis was informed by technical specifications from leading equipment suppliers and sustainability frameworks.

Finally, regional and company-level profiles were developed through synthesis of export statistics, corporate disclosures, and geo-economic assessments to deliver a holistic perspective on market structure and competitive positioning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clove Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clove Oil Market, by Application

- Clove Oil Market, by Extraction Method

- Clove Oil Market, by Product Type

- Clove Oil Market, by Distribution Channel

- Clove Oil Market, by Purity Grade

- Clove Oil Market, by Region

- Clove Oil Market, by Group

- Clove Oil Market, by Country

- United States Clove Oil Market

- China Clove Oil Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights on Market Dynamics, Strategic Imperatives, and Future Pathways for Stakeholders in the Clove Oil Industry

The clove oil industry stands at a crossroads where geopolitical policies, technological innovation, and sustainability imperatives converge. Recent tariff adjustments have underscored the need for agile supply chain strategies, while premiumization and clean-label trends continue to drive product development.

Stakeholders must navigate a complex landscape that demands both localized insight and global perspective. By aligning segmentation priorities with regional growth drivers and investing in advanced extraction capabilities, participants can unlock new avenues of value while mitigating external uncertainties.

Ultimately, the market’s future growth will be shaped by the ability of producers, distributors, and end-users to collaborate on transparent sourcing, efficient production, and differentiated product offerings. The strategic choices made today will define competitive leadership in the evolving clove oil ecosystem.

Connect with Ketan Rohom Associate Director Sales & Marketing to Secure Your Copy of This In-Depth Clove Oil Market Research Report Today

To access the full breadth of insights, proprietary data, and strategic analysis featured in this report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with him, you can secure the comprehensive research deliverable that will equip your team with the knowledge needed to make informed decisions, capitalize on emerging clove oil opportunities, and navigate market challenges effectively.

- How big is the Clove Oil Market?

- What is the Clove Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?