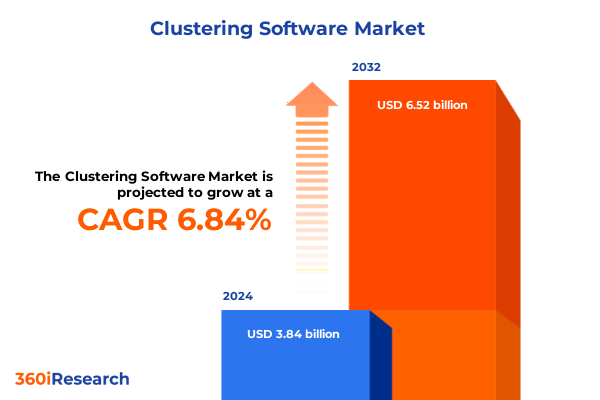

The Clustering Software Market size was estimated at USD 4.06 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 6.99% to reach USD 6.52 billion by 2032.

Discover the Role of Clustering Software in Modern Data Ecosystems and the Imperative for Innovative Solutions to Drive Competitive Advantage

In an era defined by exponential data growth and a constant push for more sophisticated analytics, clustering software has emerged as a foundational technology enabling organizations to uncover hidden patterns, segment data efficiently, and enhance decision-making processes. As enterprises grapple with increasingly complex datasets generated from transactions, IoT devices, social media, and myriad digital interactions, the ability to group similar data points becomes a vital capability. This report offers an in-depth exploration of how clustering solutions are evolving to meet modern demands, highlighting the convergence of advanced algorithms, scalable deployment options, and service-driven delivery models.

By examining the current landscape, we provide clarity on how organizations are integrating clustering into their broader data architecture, addressing pain points such as performance bottlenecks, data silos, and regulatory compliance. This introduction lays the groundwork for understanding why clustering is no longer a niche computational method but rather a strategic imperative. It sets the stage for subsequent sections that delve into transformative shifts, tariff implications, segmentation analyses, regional trends, competitive dynamics, actionable recommendations, and methodological rigor, creating a holistic view of the market’s trajectory and practical implications.

Examining the Pivotal Technological and Operational Shifts Reshaping Clustering Software Solutions Across Diverse Industry Verticals Worldwide

The clustering software landscape has undergone a profound metamorphosis driven by leaps in machine learning capabilities, the proliferation of cloud computing, and an intensified focus on real-time analytics. What was once dominated by traditional algorithms designed for relatively small datasets has expanded to accommodate high-dimensional, streaming data from myriad sources. Organizations now expect clustering platforms to integrate natively with AI engines, automate parameter tuning, and scale dynamically in response to fluctuating workloads without manual intervention.

Moreover, deployment modes have shifted dramatically. Whereas on-premises environments were once the default, there is now a clear trend toward cloud-hosted solutions, with many enterprises opting for a hybrid approach that balances performance, security, and cost. The emergence of public, private, and multi-cloud strategies has put a premium on interoperability and seamless data migration. As a result, vendors are refactoring architectures to support containerization, microservices, and serverless frameworks.

Concurrently, growing regulatory scrutiny over data privacy and cross-border data flow is prompting solution providers to embed compliance controls and transparent governance features into their offerings. In turn, buyers are demanding granular audit trails, role-based access controls, and robust encryption. Collectively, these shifts are transforming clustering software from a specialized analytical tool into a strategic platform central to enterprise data management and competitive differentiation.

Analyzing How the United States’ 2025 Tariff Adjustments on Software and Services Are Reshaping Supply Chains Cost Structures and Adoption Dynamics

The United States introduced targeted tariffs in early 2025 aimed at software imports and related IT services components, with the dual intent of safeguarding domestic providers and addressing perceived trade imbalances. While hardware-focused duties have been common, this new wave of levies specifically affects specialized clustering software solutions and the professional and managed services that often accompany their deployment. As a direct consequence, subscription costs for cloud-hosted clustering platforms have seen upward pressure, prompting end users to re-evaluate vendor agreements and total cost of ownership.

Supply chains have also felt the ripple effects. Components such as specialized accelerators and high-performance storage arrays, frequently bundled into managed services contracts, are now subject to adjusted duty rates. This has led some global vendors to explore nearshoring strategies and to diversify manufacturing footprints across Latin America and select African markets to mitigate escalating costs. Simultaneously, procurement specialists are negotiating longer-term price locks and seeking multi-year service discounts to offset the new tariff-induced expenses.

From an adoption perspective, these duties have nudged certain mid-market and small and medium enterprises toward open source and density-based clustering frameworks, which offer greater flexibility and reduced licensing fees. Conversely, large enterprises with substantial analytics budgets are leveraging professional services agreements to secure fixed rates and service-level guarantees. Ultimately, the 2025 tariff adjustments have introduced an added layer of complexity into the clustering software procurement process, compelling organizations to refine their sourcing strategies and vendor risk assessments.

Unveiling Critical Insights from Component to Industry Vertical Segmentation That Illuminate Varied Adoption Patterns and Strategic Prioritizations

Understanding adoption patterns in clustering software demands a nuanced examination of multiple segmentation dimensions, each revealing distinct buyer priorities and solution preferences. Component segmentation highlights a bifurcation between software licenses, prioritized for their algorithmic prowess and integration features, and services that ensure seamless deployment and ongoing system optimization. Within the services sphere, managed service agreements are attracting businesses seeking hands-off scalability, while professional services engagements appeal to organizations requiring bespoke implementation and specialized expertise.

Deployment mode segmentation underscores a decisive tilt toward cloud offerings, with private cloud instances chosen for heightened data governance and public cloud deployments leveraged for their elastic scaling. On premises environments persist among risk-averse enterprises, particularly in industries with stringent data residency mandates. When examining clustering methodologies themselves, density-based and hierarchical clustering continue to find traction where clear partitioning into natural clusters is critical, while model-based and grid-based approaches are selected for scenarios demanding predictive accuracy and computational efficiency.

Organization size illustrates divergent buying behaviors: large enterprises often pursue comprehensive end-to-end solutions with robust support agreements, whereas small and medium enterprises opt for modular, cost-effective packages that can expand over time. Industry vertical segmentation reveals pronounced uptake in banking, financial services and insurance, where risk modeling and fraud detection are paramount, and in healthcare, where patient segmentation drives personalized treatments. Meanwhile, information technology and telecommunications firms exploit clustering for network optimization, and retail entities apply these techniques to customer segmentation and inventory management. Collectively, these segmentation insights furnish a powerful lens through which to tailor product roadmaps and go-to-market strategies.

This comprehensive research report categorizes the Clustering Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Deployment Mode

- Organization Size

- Industry Vertical

Comparative Regional Dynamics Revealed as Key Drivers in the Growth and Deployment Preferences of Clustering Software Across Major Global Markets

Regional analysis reveals that the Americas continue to dominate clustering software consumption, driven by mature cloud infrastructure, a robust ecosystem of managed service providers, and high levels of data governance maturity. North American enterprises particularly favor integrated software platforms complemented by professional services to accelerate deployment. Latin American markets are on an upward trajectory as enterprises in Brazil and Mexico increasingly adopt public cloud solutions to capitalize on cost efficiencies and regional data centers.

In Europe, Middle East & Africa, regulatory frameworks such as GDPR and emerging data sovereignty laws are key determinants of deployment mode choice. Private cloud and on premises solutions are prevalent among financial services firms in the European Union seeking strict compliance. Meanwhile, the Middle East observes a growing appetite for public cloud-hosted clustering services, supported by government-driven digital transformation initiatives. In select African markets, managed service providers are stepping in to bridge infrastructure gaps, enabling local enterprises to harness clustering capabilities.

The Asia-Pacific region exhibits a dynamic and heterogeneous market. Leading economies like China, Japan, and Australia show robust demand for hierarchical and model-based clustering in manufacturing and telecommunications applications, while Southeast Asian nations are rapidly embracing cloud-native, grid-based deployments for e-commerce and fintech use cases. In all APAC subregions, partnerships with global cloud hyperscalers have accelerated solution availability, driving competitive pricing and innovation. These regional nuances underscore the importance of tailored market entry strategies and localized service offerings.

This comprehensive research report examines key regions that drive the evolution of the Clustering Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players’ Strategic Moves in Clustering Software Through Partnerships, Innovation Roadmaps, and Market Positioning Approaches

Competitive positioning in the clustering software arena is shaped by an interplay of technological innovation, strategic partnerships, and service portfolio breadth. Major cloud hyperscalers have embedded clustering capabilities within their analytics suites, offering out-of-the-box integrations with complementary AI and data warehousing services. These players leverage global infrastructure footprints to provide low-latency regional offerings, positioning themselves as one-stop shops for enterprises migrating analytics workloads to the cloud.

Traditional enterprise software providers are reinforcing their clustering modules through targeted acquisitions of specialized analytics startups. By integrating these niche technologies, they enhance their algorithm libraries and improve platform interoperability. Additionally, these incumbents often bundle clustering functionalities within broader data management suites, offering compelling value propositions to existing customer bases. A number of pure-play clustering vendors distinguish themselves through open source community engagement, providing extensible frameworks that attract developer evangelism and foster rapid innovation cycles.

Partnerships between solution providers and managed service firms are also on the rise, enabling end users to select fully managed clustering deployments backed by stringent service level agreements. This trend is particularly evident among organizations lacking deep in-house data science capabilities, as it allows them to harness advanced analytics without the burden of extensive personnel investments. Ultimately, the convergence of cloud-native innovation, strategic alliances, and targeted M&A activity is redefining competitive dynamics, compelling vendors to continuously enhance their clustering offerings to maintain market relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Clustering Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Clustering Technologies, Inc.

- Aspen Systems Inc.

- Cisco Systems, Inc.

- Cluster Software Inc.

- Databricks, Inc.

- DH2i Company

- DotActiv (Pty) Ltd.

- Evidian

- Fujitsu Limited

- GlobalSpec, LLC.

- Hewlett-Packard Development Company, L.P.

- IBM Corporation

- Microsoft Corporation

- NEC Corporation

- NetApp, Inc.

- Nutanix, Inc.

- Oracle Corporation

- Percona LLC.

- Red Hat, Inc.

- Rocket Software, Inc.

- SIOS Technology Corp.

- Software AG

- Veritas Technologies LLC

- VMware, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Clustering Software Trends While Mitigating Operational and Regulatory Risks

Industry leaders seeking to harness the full potential of clustering software should embrace a cloud-first mindset that balances private and public cloud strategies to optimize performance and compliance. By prioritizing interoperability, organizations can avoid vendor lock-in and ensure data portability across hybrid environments. Cultivating internal expertise in both density-based and model-based clustering methods will empower teams to select the most appropriate algorithmic approach for varied use cases, from customer segmentation to anomaly detection.

Furthermore, enterprises must establish rigorous governance frameworks that embed privacy controls and encryption protocols at every stage of the clustering pipeline. Engaging managed service providers can mitigate skill gaps and accelerate time to insights, while customized professional services engagements ensure precise alignment with business objectives. To counteract potential cost escalations stemming from tariffs or fluctuating cloud pricing, buyers should negotiate multi-year agreements and explore usage-based pricing models that align with cyclical demand patterns.

Finally, fostering cross-functional collaboration between data science, IT, and business units will drive more effective deployment strategies and ensure that clustering outcomes translate into actionable intelligence. By implementing these actionable recommendations, organizations will be better positioned to navigate evolving market pressures, capitalize on emerging opportunities, and sustain a competitive edge in data-driven decision making.

Methodological Framework Detailing the Rigorous Primary Research, Secondary Analysis, and Validation Processes Underpinning This Market Study

This market study is underpinned by a robust methodological approach that integrates primary research, secondary analysis, and rigorous validation protocols. Primary research comprised in-depth interviews with senior data scientists, IT decision-makers, and managed service providers across multiple industry verticals. These conversations yielded qualitative insights into deployment considerations, tariff-related challenges, and evolving preference for algorithmic approaches. Supplementing this, structured surveys were conducted with a statistically significant sample of IT professionals to capture quantifiable adoption trends and segmentation priorities.

Secondary research involved systematic review of public financial filings, vendor product documentation, and regulatory publications to contextualize cost dynamics and compliance frameworks influencing clustering software deployments. Complementary data was gathered from reputable cloud adoption studies and industry consortium reports to triangulate findings and ensure comprehensive coverage of regional nuances. All segmented insights were cross-referenced against real-world deployment case studies to validate applicability.

The final report underwent a multi-tiered editorial review process, including peer evaluation by subject matter experts and technical verification of algorithmic performance benchmarks. This methodological rigor ensures that the findings accurately reflect current market realities and provide a reliable foundation for strategic decision making. By combining diverse research modalities with stringent quality controls, this study delivers actionable intelligence with a high degree of confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Clustering Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Clustering Software Market, by Component

- Clustering Software Market, by Type

- Clustering Software Market, by Deployment Mode

- Clustering Software Market, by Organization Size

- Clustering Software Market, by Industry Vertical

- Clustering Software Market, by Region

- Clustering Software Market, by Group

- Clustering Software Market, by Country

- United States Clustering Software Market

- China Clustering Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Core Findings and Implications Emphasizing the Transformative Potential of Clustering Software in Data Management Landscapes

Throughout this report, we have illuminated the dynamic interplay of technological innovations, tariff-driven market shifts, and diverse segmentation landscapes that define the clustering software sector today. As clustering evolves from a specialized analytical function into a mission-critical platform capability, organizations must adapt their deployment strategies, governance frameworks, and vendor partnerships accordingly. The cumulative impact of the 2025 tariff adjustments underscores the need for agile procurement and cost management practices, while regional insights highlight the imperative of tailored go-to-market approaches.

Segmentation analysis reveals that no single configuration suits all enterprises; instead, successful adoption hinges on aligning component choices, deployment modes, algorithmic types, and service engagement models with specific business objectives. Competitive dynamics are intensifying as cloud hyperscalers, traditional software incumbents, and pure-play vendors vie for market share through innovation, strategic alliances, and expanding service portfolios. Against this backdrop, industry leaders must remain vigilant, continuously evaluating emerging capabilities and recalibrating strategies to sustain differentiation.

In conclusion, the clustering software landscape offers transformative potential for data-driven enterprises prepared to navigate complexity and invest in the right mix of technology, talent, and governance. The insights presented herein arm decision makers with a comprehensive understanding of critical trends and equip them to chart a strategic path forward in an environment marked by rapid change and opportunity.

Engage with Ketan Rohom to Access the Definitive Clustering Software Market Research Report and Empower Your Organization’s Strategic Decisions

If your organization is poised to leverage clustering software to unlock deeper insights, drive operational efficiency, and carve out distinct competitive advantages, your next step is just a conversation away. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to gain exclusive access to the comprehensive market research report that synthesizes the latest trends, regional dynamics, and strategic recommendations.

With expert stewardship and a deep understanding of evolving market forces, Ketan Rohom will guide you through tailored solutions designed to address your unique organizational challenges. Whether you seek to refine deployment strategies between cloud-hosted or on premises architectures, optimize the balance between managed services and professional services, or identify high-impact industry vertical opportunities, this report will serve as your strategic blueprint.

Connect with Ketan Rohom today to arrange a personalized briefing, discuss customized licensing packages, and start transforming your data management capabilities. Your organization’s journey toward clustering software excellence begins with one decisive step. Engage now and position your enterprise at the forefront of innovation in data clustering technologies

- How big is the Clustering Software Market?

- What is the Clustering Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?