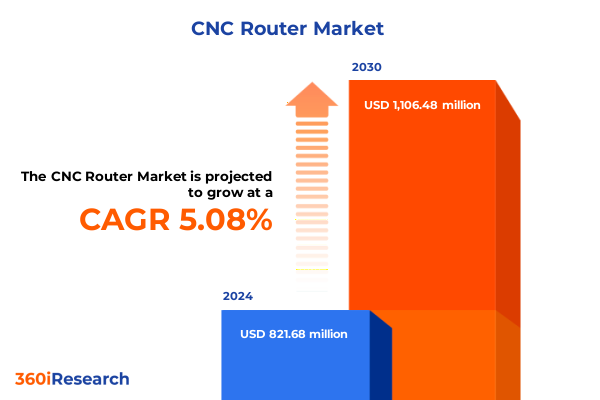

The CNC Router Market size was estimated at USD 821.68 million in 2024 and expected to reach USD 861.45 million in 2025, at a CAGR of 5.08% to reach USD 1,106.48 million by 2030.

Navigating the Dynamic World of CNC Routers with a Forward-Looking Perspective on Technological Innovation, Market Relevance, and Competitive Advantage

The CNC router industry is at a pivotal juncture, shaped by technological breakthroughs, evolving customer demands, and a global focus on efficiency. Advances in digital control systems and the integration of artificial intelligence have shifted perceptions of what is possible on the factory floor. Leading manufacturers are no longer competing on hardware alone; they are vying to deliver holistic solutions that seamlessly connect machines to enterprise resource planning systems, foster predictive maintenance, and optimize throughput across diverse production environments.

Amid this transformation, decision makers face a complex landscape where agility and foresight are paramount. Traditional fabrication methods give way to hybrid workflows that blend subtractive and additive machining, enabling novel applications for composites, metals, plastics, and stone. At the same time, sustainability mandates and the push toward localized production require equipment that can adapt rapidly to changing material sets and batch sizes. Understanding these converging forces is essential for executives seeking to align their capital investments with long-term market trajectories, ensure operational resilience, and secure a competitive edge in a fiercely dynamic arena.

Harnessing Digital Convergence and Adaptive Machining Technologies to Redefine Product Complexity and Operational Resilience

This industry is experiencing a wave of transformative shifts driven by digitalization, modular design, and the growing importance of data-driven decision making. The proliferation of IoT-enabled routers has elevated machine health monitoring from reactive troubleshooting to proactive orchestration, reducing downtime and improving overall equipment effectiveness. Concurrently, the emergence of modular tooling systems allows rapid reconfiguration of spindles and cutting heads, unlocking new agility for manufacturers as they pivot among composite, metal, and wood projects.

Another critical shift is the blending of artificial intelligence with advanced motion control to autonomously adapt feed rates and tool paths in real time. This capability empowers the machining of complex geometries, such as carbon fiber layups or intricate stone contours, with unprecedented precision. As these technological trends coalesce, they challenge traditional silos between engineering, operations, and IT, prompting organizations to adopt cross-functional approaches to machine deployment and process optimization. The result is a market landscape in which nimble innovators can outpace established incumbents by harnessing interconnected ecosystems that drive continuous performance improvement.

Evaluating the Cumulative Impact of US Trade Measures on CNC Router Cost Structures, Supply Chain Strategies, and Domestic Manufacturing Incentives

Over the course of 2025, the United States has maintained tariffs on key components and finished CNC routers under Section 301 and Section 232 provisions, impacting both imports of advanced spindle units and specialized tooling modules. These measures have cumulatively increased landed costs for machine buyers, prompting many to reconsider global sourcing strategies and to explore alternative suppliers in tariff-exempt jurisdictions. Rising import duties have also accelerated investments in domestic manufacturing capacities, as end users seek to insulate themselves from volatile trade environments.

Consequently, supply chain managers are diversifying procurement channels, embracing dual-sourcing agreements for critical subsystems, and forming strategic partnerships with regional equipment providers. While some high-end machine tool suppliers have absorbed a portion of the tariff burden to maintain competitiveness, smaller aftermarket vendors face margin pressure that could restrict innovation. In response, OEMs are developing integrated service plans that bundle training, spare parts, and remote diagnostics to offset cost increases and preserve customer loyalty in a market where every fraction of a percentage point in total cost of ownership can sway procurement decisions.

Unveiling Critical Patterns in CNC Router Market Segmentation to Unlock Specialized Opportunities Across Diverse Industry Needs and Profit Potential

Segmenting the CNC router market reveals differentiated requirements that shape product roadmaps and service offerings. Applications in composite machining demand high spindle speeds and reinforced frames to handle carbon fiber and fiberglass without vibration, whereas metalworking sectors-spanning aerospace, automotive, and defense-prioritize thermal stability and heavy-duty power to mill aluminum alloys, steel plate, and hardened components. In plastics processing, packaging and signage industries seek routers capable of producing fine edge quality on ABS and acrylic sheets, while stone fabricators require machines optimized for countertop, monument, and tile contours. Woodworking applications focus on cabinet, flooring, and furniture production, trading off raw power for precision finishes on hardwoods and softwoods alike.

Hardware types further refine customer needs, as fixed-bed and sliding-bed flatbed routers cater to high-volume panel processing, and bridge and moving-gantry designs serve medium to large workpieces with variable footprint constraints. The rise of articulated-arm and delta-arm robotic systems offers flexibility for multi-axis carving and three-dimensional sculpting tasks. End users range from large automotive plants and OEM manufacturing hubs to technical schools and research universities, signage-focused workshops, and home-based or independent woodworking artisans. Across these user profiles, material preferences vary from aluminum and steel to granite and marble, each requiring tailored toolpath strategies and coolant delivery methods. Manufacturers also differentiate on axis capabilities-three, four, or five axis-and on operation modes that span fully automatic networks, semi-automatic setups with user intervention, or manual tables for prototyping.

Distribution channels play a pivotal role in segmentation, as direct sales enable bespoke configurations and service-level agreements, authorized resellers and third parties offer localized support and flexible financing, and e-commerce platforms-both manufacturer-owned storefronts and third-party marketplaces-drive transactional volume for off-the-shelf router modules. Understanding these intersecting dimensions helps vendors align product roadmaps with specific customer pain points, optimizing both feature sets and value propositions for each market segment.

This comprehensive research report categorizes the CNC Router market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Axis Configuration

- Material Processed

- Motor System

- Machine Configuration

- Application

- End User

- Distribution Channel

Decoding Regional CNC Router Market Dynamics by Examining Innovation Drivers, Regulatory Frameworks, and Growth Hotspots Across Three Global Zones

Regional dynamics in the CNC router market underscore distinct growth trajectories and strategic priorities. In the Americas, robust demand from aerospace clusters and automotive manufacturers is complemented by government incentives that bolster advanced manufacturing hubs. North American fabricators emphasize integration with digital twin platforms and additive manufacturing ecosystems to reduce prototyping cycles, while Latin American enterprises leverage modular equipment designs to support emerging infrastructure projects and small-batch furniture production.

Across Europe, the Middle East & Africa, regulatory harmonization and precision engineering traditions drive adoption of high-performance routers for defense, energy, and luxury goods applications. European vendors lead in multi-axis configurations and software integration, whereas Middle Eastern investments in infrastructure and monument restoration spur demand for stone machining solutions. In Africa, localized training programs supported by technical schools introduce new entrants to digital fabrication, sowing seeds for future growth.

In the Asia-Pacific region, a proliferation of electronics manufacturers, signage workshops, and packaging plants fuels a surge in three-axis routers optimized for high-speed panel processing. China and India, in particular, are expanding domestic production lines to serve growing consumer markets, while Japan and South Korea focus on precision five-axis systems for automotive and aerospace subcontractors. Cross-border supply chain networks in ASEAN countries benefit from tariff agreements, enabling a fluid exchange of components, software, and service expertise that accelerates regional innovation.

This comprehensive research report examines key regions that drive the evolution of the CNC Router market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Who Are Reimagining CNC Router Capabilities Through Modular Systems, Integrated Services, and Strategic Alliances

Prominent players are redefining competitive benchmarks through differentiated product portfolios and value-added services. Leading OEMs prioritize modular architectures that allow end users to upgrade spindle kits, axis configurations, and control software as needs evolve. Service excellence is another key differentiator, with top vendors deploying remote monitoring platforms that deliver predictive maintenance alerts, spare-parts-on-demand fulfillment, and virtual training modules.

Strategic alliances between machine tool manufacturers and software providers are also reshaping the competitive landscape. Collaborative efforts yield optimized CAM toolchains and companion analytics dashboards that empower operators with real-time performance insights. Additionally, regional distributors with deep local expertise are forging co-investment partnerships to fund application labs and demonstration centers. These facilities serve as collaborative incubators for prototyping next-generation composite tooling, validating robotic-arm machining strategies, and testing high-pressure coolant systems. Such initiatives not only drive incremental revenue through services and consumables but also cement long-term customer relationships in markets where customized support can dictate purchase decisions.

This comprehensive research report delivers an in-depth overview of the principal market players in the CNC Router market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anderson Group, Inc.

- AXYZ Automation Group

- Bacci S.r.l.

- BCAMCNC Machinery Group

- Biesse S.p.A.

- CMS Nordest srl

- DMG MORI Co., Ltd.

- FANUC Corporation

- Forest Scientific Corporation

- Heian Corporation

- HOMAG Group AG

- Hurco Companies

- Jadayu India CNC Private Limited.

- Jinan Blue Elephant CNC Machinery Co., Ltd.

- JPW Industries, Inc.

- Kataria Tech Zone

- Komo Machine Inc

- Kongsberg Precision Cutting Systems

- Laguna Tools, Inc.

- Maslow CNC, Inc.

- Mehta Hitech Industries Limited

- Multicam Inc.

- Nihar Industries

- Ningbo Leyan Machinery Technology Co., Ltd

- Quintax by Ferry Industries, Inc.

- SCM Group S.p.A.

- ShopBot Tools, Inc.

- Suresh Indu Lasers Private Limited.

- Techno CNC Systems

- Thermwood Corporation

- Unistar Industries

- Velox CNC, Inc.

- Vision Engraving & Routing Systems, Inc.

- Weinig Group

- YAMAZAKI MAZAK CORPORATION

Driving Sustainable Growth by Embracing Digital Ecosystems, Workforce Empowerment, and Flexible Go-to-Market Frameworks for CNC Router Enterprises

Industry leaders should prioritize digital integration by embedding advanced analytics and machine-learning algorithms into router controls, thereby enabling auto-optimization of feed rates and spindle speeds in response to material characteristics. At the same time, cultivating partnerships with materials suppliers and software vendors can accelerate the co-development of hybrid tooling systems that serve emergent composite and metal-matrix applications.

Elevating workforce proficiency through targeted training programs at technical schools and customized on-site certifications will ensure that operators can fully leverage five-axis and robotic-arm capabilities. Coupling this talent development with strategic investments in local assembly and service centers can mitigate tariff-driven cost increases and improve customer responsiveness. Furthermore, adopting sustainable manufacturing practices-such as closed-loop coolant recycling and energy-efficient drives-will resonate with environmentally conscious end users and meet increasingly stringent emissions standards.

Finally, vendors should explore flexible channel strategies that blend direct sales relationships with an expanded network of authorized resellers and e-commerce offerings. This approach will broaden market access while preserving the ability to deliver tailored configurations and premium service agreements. By systematically executing on these initiatives, industry leaders can not only navigate current headwinds but also position themselves for accelerated growth in the next chapter of CNC router innovation.

Leveraging a Robust Hybrid Research Framework Blending Patent Analysis, Expert Interviews, and Data Triangulation to Ensure Comprehensive Insight Integrity

This analysis relies on a hybrid research approach that integrates comprehensive secondary research with targeted primary engagements. Secondary inputs include the review of patent filings, academic publications, and industry association reports to map technological evolution and regulatory developments. Simultaneously, a series of in-depth interviews with key stakeholders-including machine tool executives, application engineers, and procurement professionals-provides qualitative insights into emerging customer priorities and adoption barriers.

Quantitative validation is achieved through data triangulation, correlating supplier shipment records, import/export statistics, and end-user survey findings. An advisory panel of industry experts reviewed preliminary findings to ensure alignment with on-the-ground realities and to challenge assumptions around tariff impacts and regional dynamics. Throughout the study, rigorous data governance protocols were enforced to maintain objectivity, and all proprietary information was anonymized to protect confidentiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CNC Router market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CNC Router Market, by Type

- CNC Router Market, by Axis Configuration

- CNC Router Market, by Material Processed

- CNC Router Market, by Motor System

- CNC Router Market, by Machine Configuration

- CNC Router Market, by Application

- CNC Router Market, by End User

- CNC Router Market, by Distribution Channel

- CNC Router Market, by Region

- CNC Router Market, by Group

- CNC Router Market, by Country

- United States CNC Router Market

- China CNC Router Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Synthesizing Technological, Operational, and Market Insights to Chart the Future Trajectory of CNC Router Advancement Without Compromise on Flexibility and Performance

As CNC router technology matures, the confluence of digitalization, modularity, and strategic supply chain realignment defines the next era of industrial fabrication. Manufacturers poised to capitalize on these trends will be those that integrate machine intelligence with adaptive tooling, foster deep partnerships across the value chain, and build resilient operational models that counterbalance external cost pressures.

The segmentation and regional analyses underscore that no single approach fits all markets; rather, success hinges on tailoring solutions to application-specific demands, material nuances, and local regulatory conditions. By aligning product roadmaps with emerging end-user workflows and by investing in service ecosystems, equipment providers can cultivate enduring competitive advantages. It is through this blend of technological innovation, market segmentation acuity, and strategic foresight that the industry will navigate today’s complexities and unlock tomorrow’s growth potential.

Unlock Exclusive CNC Router Market Insights by Connecting with an Expert to Secure Your Comprehensive Research Report Today

To take your strategic planning to the next level, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With deep market intelligence and a track record of helping leading manufacturers optimize growth, Ketan and his team stand ready to tailor insights to your needs. Engage today to secure comprehensive analysis on CNC router trends, segmentation intelligence, and actionable recommendations that drive profitability and operational excellence.

- How big is the CNC Router Market?

- What is the CNC Router Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?