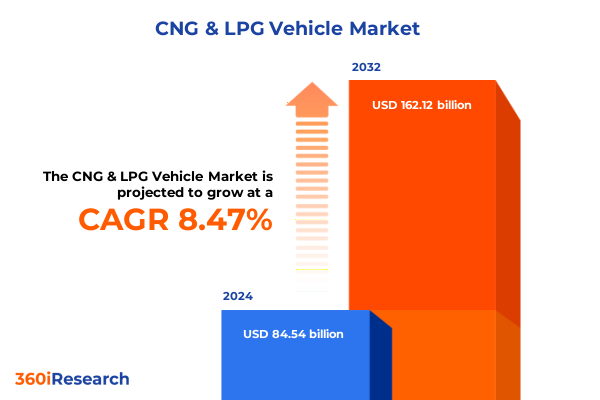

The CNG & LPG Vehicle Market size was estimated at USD 91.39 billion in 2025 and expected to reach USD 98.79 billion in 2026, at a CAGR of 8.53% to reach USD 162.12 billion by 2032.

Accelerating the Shift to Sustainable Mobility through Enhanced CNG and LPG Vehicle Technologies and Infrastructure Innovations Reshaping Transportation

As global priorities shift decisively toward reducing carbon emissions and enhancing energy security, compressed natural gas (CNG) and liquefied petroleum gas (LPG) vehicles have emerged as pivotal contributors to a cleaner transportation paradigm. These alternative fuel vehicles leverage the abundant availability of natural gas and propane to offer a more cost-effective and environmentally friendly solution compared to conventional gasoline and diesel counterparts. With mounting regulatory pressures on tailpipe emissions and the pursuit of net-zero targets, fleets and private owners alike are increasingly drawn to the inherent benefits of CNG and LPG technologies. This introduction explores the key drivers behind the accelerating interest and adoption of these vehicles, setting the stage for a deeper examination of market dynamics.

The adoption of CNG and LPG applications in transportation is underpinned by a confluence of factors, including favorable government policies, advances in engine conversion technology, and a growing network of refueling infrastructure. Incentive mechanisms, such as tax credits, rebates, and low-emission zones, have motivated fleet operators and individual consumers to transition to natural gas and propane powertrains. Meanwhile, original equipment manufacturers and aftermarket specialists have refined conversion systems to deliver performance metrics that closely parallel those of traditional fuel vehicles. This symbiotic evolution of policy and technology has forged a robust ecosystem supportive of sustained growth in CNG and LPG mobility solutions.

This executive summary provides a concise yet comprehensive overview of the CNG and LPG vehicle landscape. Through a series of analytically driven sections, it navigates transformative shifts within the sector, assesses the impact of United States tariff changes, distills segmentation and regional insights, profiles leading market players, and concludes with actionable recommendations. Readers will emerge with a clear understanding of the strategic imperatives shaping the future of alternative-fuel transportation and the critical considerations for capitalizing on the opportunities presented by the CNG and LPG vehicle market.

Revolutionary Advances in Engine Management, Infrastructure, and Renewable Gas Integration Driving Next-Generation CNG and LPG Vehicle Adoption

Over the past decade, the CNG and LPG vehicle landscape has undergone a remarkable transformation driven by technological breakthroughs and evolving policy frameworks. Initially perceived as niche solutions, these vehicles have now attained mainstream relevance as stakeholders recognize their capacity to mitigate greenhouse gas emissions and reduce dependence on liquid hydrocarbons. Innovations in onboard storage systems, regulator designs, and engine management units have enhanced fuel efficiency and performance consistency, narrowing the gap between gaseous fuel vehicles and their liquid-fuel peers. Concurrently, digital monitoring platforms and predictive maintenance tools have optimized operational uptime for commercial fleets leveraging CNG and LPG platforms.

In parallel, policy shifts at national and subnational levels have galvanized market momentum. Governments in Europe and North America have introduced stringent emissions targets alongside financial incentives to spur adoption. Moreover, public–private partnerships have accelerated the rollout of refueling networks, alleviating range anxiety and improving route planning. In emerging markets across Asia-Pacific, public sector-led initiatives have prioritized clean transportation solutions, integrating CNG and LPG deployments within broader urban air quality improvement programs. These policy-driven developments have created a virtuous cycle, where higher adoption rates justify infrastructure investments, which in turn lower barriers for subsequent users.

The integration of renewable natural gas (RNG) into supply chains represents a particularly transformative shift. By upgrading biogas from agricultural and waste processing facilities to pipeline-quality specs, RNG delivers a carbon-negative alternative that aligns with circular economy principles. As regulators promulgate low-carbon fuel standards and carbon credit mechanisms, the entry of RNG into the transport fuel mix is poised to enhance the sustainability credentials of CNG and LPG vehicles significantly. This confluence of technological advancement, policy evolution, and renewable inputs heralds a new era of growth and innovation in the alternative-fuel vehicle domain.

Navigating the 2025 United States Tariff Adjustments on CNG Cylinders and LPG Conversion Kits to Foster Local Manufacturing Resilience

The landscape for CNG and LPG vehicles in the United States has been further shaped by the introduction of new tariff policies in 2025, affecting the import and domestic manufacturing costs of key components. With the government applying adjusted tariff rates on compressed natural gas storage cylinders and LPG conversion kits, suppliers have been compelled to reevaluate their sourcing strategies and cost models. Consequently, several manufacturers have accelerated localization of component production-a strategic pivot aimed at insulating supply chains from tariff volatility and currency fluctuations.

Meanwhile, the recalibrated tariff regime has stimulated negotiations for long-term contracts with domestic steel producers and pressure vessel fabricators. Tier-one suppliers are forging alliances that leverage economies of scale, mitigating the impact of higher import duties while ensuring compliance with stringent safety and performance standards. As a result, infrastructure players are investing in capacity expansions and certification processes to meet the burgeoning demand for domestically produced refueling stations and retrofit solutions.

Despite transitional cost pressures, the market response has been constructive. Stakeholders have reported that shorter lead times for locally sourced parts have improved project timelines and reduced logistical complexities. Moreover, the emphasis on domestic production has spurred innovation hubs focused on advanced materials, hybrid cylinder designs, and automated assembly lines. These developments not only counterbalance the tariff burden but also catalyze a competitive environment conducive to continuous improvement and long-term value creation.

Differentiating Market Dynamics Revealed through Engine Configuration Preferences and Divergent Commercial-Versus-Passenger Vehicle Adoption Patterns

The CNG and LPG vehicle market exhibits pronounced differentiation when assessed through the lens of engine type and vehicle application. Within the realm of engine configurations, bi-fuel systems have gained momentum, particularly among fleet operators seeking operational flexibility. Bi-fuel vehicles, capable of seamlessly switching between gaseous and liquid fuels, address concerns around infrastructure gaps while offering lower carbon emissions during daily operations. Conversely, single-fuel vehicles, which rely solely on CNG or LPG, have found favor in tightly controlled routes where dedicated refueling stations are assured.

Vehicle type segmentation underscores divergent adoption patterns between commercial and passenger applications. Heavy-duty commercial fleets, encompassing transit buses, refuse trucks, and last-mile delivery vans, have driven the initial wave of investments due to high utilization rates and predictable refueling itineraries. In contrast, passenger vehicles-ranging from sedans to light-duty SUVs-are capturing incremental growth as urban centers deploy public-access refilling stations and OEMs expand factory-installed gaseous fuel offerings. This dual-pronged evolution reinforces the importance of tailored strategies, where bi-fuel flexibility and single-fuel efficiency are leveraged according to the operational profile of the end user.

This comprehensive research report categorizes the CNG & LPG Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Engine System

- Cylinder Type

- Sales Channel

- Vehicle Type

Analyzing Regional Policy Landscapes and Infrastructure Initiatives That Differentiate CNG and LPG Vehicle Adoption Across the Americas, EMEA, and Asia-Pacific

Regional variations have profoundly influenced the trajectory of CNG and LPG vehicle deployment across the globe. In the Americas, policy advocacy has been paramount, with federal incentives in the United States complemented by state-level grant programs supporting infrastructure development. Canada’s provincial initiatives have similarly prioritized low-emission solutions for public transportation, catalyzing collaborative pilot projects. Mexico’s transition strategy combines natural gas pipeline expansions and urban fleet conversions, positioning the region as a laboratory for multi-jurisdictional policy coordination.

Across Europe, the Middle East, and Africa, the landscape is nuanced by regulatory divergence and energy security considerations. Western European nations are advancing low-emission zones and direct subsidies for clean fuel vehicles, while Eastern European markets prioritize energy diversification amid geopolitical tensions. In the Middle East, abundant gas reserves are fostering domestic LPG distribution networks, with several Gulf Cooperation Council countries incentivizing fleet conversions. African markets are exploring CNG solutions for public transit, though infrastructure constraints remain a hurdle. In the Asia-Pacific region, robust growth in India and China is underpinned by strong government mandates, and public investment in green corridors is accelerating conversions for buses and taxis. Meanwhile, Southeast Asian nations are establishing public-private frameworks to expand LPG station networks, demonstrating the region’s strategic commitment to sustainable mobility.

This comprehensive research report examines key regions that drive the evolution of the CNG & LPG Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evolving Competitive Dynamics as OEMs, Aftermarket Leaders, and Technology Innovators Forge Partnerships to Enhance CNG and LPG Vehicle Solutions

The competitive landscape in the CNG and LPG vehicle sector is characterized by a mix of established engine and component manufacturers alongside nimble retrofit specialists. Leading original equipment manufacturers continue to integrate factory-built gaseous fuel powertrains within new vehicle platforms, leveraging synergies with broader alternative-energy initiatives. At the same time, aftermarket providers are expanding their service portfolios to include turnkey conversion solutions, remote diagnostics, and performance optimization packages.

Collaboration between technology innovators and traditional automotive suppliers has intensified, yielding modular conversion kits compatible with a wide range of engine families. These partnerships facilitate rapid market entry for new entrants while enabling legacy players to maintain relevance amid evolving fuel paradigms. Furthermore, supplier alliances are pooling research and development resources to refine methane slip control, thermal management, and cylinder durability-advancements that are critical for meeting forthcoming regulatory benchmarks and customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the CNG & LPG Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashok Leyland Limited by Hinduja Group

- ATUL Auto Limited

- Bajaj Auto Ltd.

- Daimler Truck AG

- Dongfeng Motor Corporation Ltd.

- Eicher Motors Limited

- Ford Motor Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Mahindra & Mahindra Limited

- Mazda Motor Corporation

- Piaggio & C. S.p.A.

- Renault Group

- Stellantis NV

- Suzuki Motor Corporation

- Tata Motors Limited

- Toyota Motor Corporation

- TVS Motor Company

- Volkswagen Ag

- Volvo AB

Executing Strategic Partnerships, Supply Chain Resilience Efforts, and Policy Engagement to Capture Emerging Growth Opportunities in the CNG and LPG Vehicle Segment

For industry leaders seeking to capitalize on the expanding CNG and LPG vehicle opportunity, a multi-faceted approach is essential. Prioritizing strategic partnerships with infrastructure providers will ensure comprehensive refueling coverage, alleviating one of the primary barriers to adoption. Simultaneously, investing in localized manufacturing capabilities and supply chain resilience will mitigate exposure to tariff fluctuations and logistics disruptions.

Moreover, stakeholders should engage proactively with regulatory bodies to shape conducive policy frameworks and secure incentive eligibility. Emphasizing data-driven performance metrics and total cost of ownership analyses will bolster stakeholder confidence and facilitate fleet integration decisions. Lastly, continuous innovation in conversion technology and materials science will distinguish market leaders, delivering improved efficiency, safety, and environmental performance that resonate with both commercial operators and individual consumers.

Integrating Primary Interviews, Field Observations, and Multisource Triangulation of Policy, Technical, and Operational Data to Ensure Comprehensive Market Insights

This research initiative synthesized a diverse range of primary and secondary data sources to construct a comprehensive view of the CNG and LPG vehicle market. Primary insights were garnered through structured interviews with industry executives, technology providers, fleet operators, and regulatory representatives. These qualitative engagements were supplemented by field visits to refueling stations and conversion workshops, providing firsthand observations of operational challenges and best practices.

Secondary research encompassed a systematic review of government policy documents, industry white papers, patent filings, and financial disclosures. Market dynamics were triangulated by cross-referencing publicly available data with proprietary databases and expert forecasts. Analytical rigor was maintained through iterative validation of findings, ensuring both the accuracy and relevance of the insights presented. This methodical approach underpins the reliability of the recommendations and conclusions delineated in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CNG & LPG Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CNG & LPG Vehicle Market, by Fuel Type

- CNG & LPG Vehicle Market, by Engine System

- CNG & LPG Vehicle Market, by Cylinder Type

- CNG & LPG Vehicle Market, by Sales Channel

- CNG & LPG Vehicle Market, by Vehicle Type

- CNG & LPG Vehicle Market, by Region

- CNG & LPG Vehicle Market, by Group

- CNG & LPG Vehicle Market, by Country

- United States CNG & LPG Vehicle Market

- China CNG & LPG Vehicle Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Embracing Collaborative Innovation and Policy Engagement as Cornerstones for Sustained Leadership in the Evolving CNG and LPG Vehicle Market

In summary, the confluence of environmental imperatives, technological advancements, and evolving policy landscapes is propelling the CNG and LPG vehicle market into a new phase of maturity. Stakeholders who embrace collaborative innovation, infrastructure partnerships, and proactive policy engagement will be best positioned to navigate tariff adjustments and regional nuances. As natural gas and propane continue to offer compelling pathways to decarbonization and energy security, the insights outlined herein provide a strategic foundation for informed decision-making and competitive differentiation.

Take Action Now to Unlock Strategic Insights and Position Your Organization at the Forefront of the CNG and LPG Vehicle Revolution

Ready to harness the power of comprehensive market intelligence on the CNG and LPG vehicle sector? Reach out today to Ketan Rohom (Associate Director, Sales & Marketing) to secure your copy of the detailed market research report and gain the strategic insights essential for navigating this dynamic industry landscape

- How big is the CNG & LPG Vehicle Market?

- What is the CNG & LPG Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?