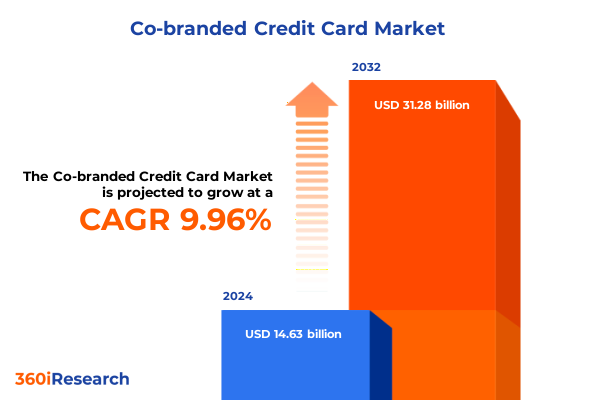

The Co-branded Credit Card Market size was estimated at USD 16.00 billion in 2025 and expected to reach USD 17.55 billion in 2026, at a CAGR of 10.04% to reach USD 31.28 billion by 2032.

Exploring the evolving co-branded credit card landscape and spotlighting drivers, innovations, and partnership strategies shaping future market success

The co-branded credit card sector stands at a pivotal juncture where strategic alliances between financial institutions and consumer brands are unlocking new opportunities for customer engagement and revenue growth. By blending the reach and loyalty of established brands with the financial expertise of card issuers, these partnerships have created a differentiated payment experience that resonates with today’s value-driven consumers. In turn, this model has proven resilient amid shifting economic conditions and evolving regulatory requirements, highlighting its long-term viability and strategic importance.

As digital transformation accelerates across banking and retail, co-branded credit cards are evolving beyond traditional plastic into seamless, integrated financial solutions. Issuers are embedding advanced analytics, personalized offers and real-time rewards into mobile apps, elevating the user experience. Meanwhile, brand partners are deepening consumer loyalty by offering exclusive perks, targeted promotions and tailored engagement strategies. This convergence of technology and partnership has shifted the competitive landscape, positioning co-branded cards not merely as payment instruments but as gateways to immersive brand ecosystems.

Looking ahead, the intersection of consumer empowerment, data-driven personalization and strategic collaboration will define the next wave of innovation in this space. Issuers and their partners must adapt to rapidly changing consumer behaviors, heightened security expectations and novel distribution channels. By understanding the dynamic forces shaping the market and embracing a customer-centric approach, stakeholders can chart a path to sustainable growth, differentiation and shared value creation.

Illuminating transformative shifts reshaping co-branded credit card offerings through technological advances, consumer behavior evolution and regulatory shifts

Rapid technological innovation has catalyzed transformative shifts in how co-branded credit cards are designed, delivered and adopted. The proliferation of contactless payments, digital wallets and embedded finance has empowered consumers to pay effortlessly across a variety of channels. As a result, traditional co-brand programs must integrate seamlessly with emerging ecosystems-ranging from super apps to closed-loop merchant platforms-to maintain relevance and capture incremental spend.

Consumer expectations have also evolved, with demand for hyper-personalization and instant gratification rising sharply. Data analytics platforms now enable issuers to tailor reward structures, spending thresholds and promotional offers at the individual level. This shift from broad-brush to precision marketing elevates engagement metrics and fosters deeper loyalty, placing a premium on data-privacy compliance and transparent customer communications.

Concurrently, regulatory frameworks around data security, open banking and sustainability are reshaping program architectures. Issuers and brand partners are adapting to stricter authentication protocols, more rigorous disclosure standards and the growing importance of environmental, social and corporate governance (ESG) criteria. These regulatory dynamics require agile governance structures and proactive stakeholder collaboration, ensuring that co-branded credit cards adhere to evolving legal requirements while delivering seamless consumer experiences.

Analyzing the impact of 2025 U.S. tariffs on the co-branded credit card ecosystem, shifting consumer spending habits and issuer profitability pressures

Escalating U.S. tariffs in 2025 are exerting mounting pressure on consumer prices, with inflationary ripples influencing spending behaviors across co-branded credit card portfolios. Consumer prices rose by 0.3 percent in June, marking the largest monthly uptick in five months and underscoring the impact of trade measures on everyday costs. As essential goods and fuel become more expensive, cardholders are recalibrating their discretionary budgets and reallocating spend toward necessities, dampening non-essential category volumes, particularly within retail and dining partnerships.

Major issuers note that while overall credit performance remains resilient, intermittent volatility has emerged in charge-off rates among cards tied to discretionary merchants. Consumer card spending grew seven percent year-over-year in Q2, yet the pace of growth has decelerated compared to earlier quarters, suggesting that tariff-driven inflation is tempering purchase frequency and ticket sizes. Surveys indicate that over three-quarters of U.S. consumers plan to reduce non-essential purchases if tariffs push prices further upward, a trend that could slow reward point accumulation and redemption activity on co-branded programs.

On the issuer side, higher operational costs-stemming from increased terminal hardware expenses and elevated compliance requirements-are compressing net interest margins and swipe fee yields. Banks are responding by refining underwriting criteria for new co-brand partnerships, adjusting benefit structures to balance value and profitability, and exploring tiered fee models to offset cost pressures. Looking ahead, the cumulative effect of these tariffs will hinge on macroeconomic resilience, consumer sentiment and potential policy reversals, but the near-term landscape demands prudent risk management and strategic program recalibration.

Revealing how segmentation across card types, issuer profiles, reward structures, usage intensity and end user demographics drives credit card strategies

Segmentation insights reveal that the form factor of co-branded credit cards directly influences issuance strategies, as physical cards continue to serve as tangible brand touchpoints while virtual cards drive digital engagement and program scalability. Within issuer types, bank-issued co-branded cards-spanning private-sector and public-sector institutions-leverage established balance-sheet capabilities, whereas non-bank issuers capitalize on niche agility and brand alignment. Reward structures further differentiate offerings, with cashback models appealing to value-seeking consumers, discount cards reinforcing merchant loyalty and points-or-miles programs targeting aspirational spenders.

Usage intensity segments uncover varying engagement dynamics: daily users seek seamless reward accumulation on routine transactions, emergency users prioritize instant access and credit buffers for unforeseen expenses, and occasional users require compelling promotional incentives to activate their cards more frequently. Security segmentation underscores the divergence between secured options, which mitigate risk in underbanked populations, and unsecured cards, which cater to mainstream credit profiles with elevated benefit tiers. Partnership profiles span from large corporations with global consumer footprints to small and medium partnerships that deliver localized relevance and community-centric programs.

End user analysis demonstrates that verticals such as dining and entertainment bifurcate into entertainment seekers craving event-based rewards and food enthusiasts valuing restaurant-centric benefits. Education cardholders split between educational professionals leveraging transaction data for institutional spend and students seeking tuition-related perks. Gaming audiences range from casual enthusiasts to professional gamers driven by hardware discounts and esports partnerships. Hospitality segments distinguish business travelers from luxury travelers, while petroleum users contrast fleet operators with frequent drivers. Retail cardholders divide into brand loyalists and regular shoppers, and travel participants encompass frequent travelers alongside occasional planners. Across all segments, the dichotomy of corporate versus personal user type shapes credit line structures, reporting capabilities and reward redemption ecosystems.

This comprehensive research report categorizes the Co-branded Credit Card market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Credit Card Type

- Issuer Type

- Reward Structure

- Usage Intensity

- Type

- Partnership Profile

- End User

- User Type

Highlighting unique trends, consumer preferences and partnership ecosystems across Americas, EMEA and Asia-Pacific co-branded credit card markets

Regional analysis shows that the Americas lead in established co-branded credit card penetration, driven by mature issuer networks and long-standing retail and travel partnerships. Consumers in the United States and Canada exhibit strong affinity for travel-centric rewards, with airline and hotel brands dominating co-brand preferences. Latin American markets are witnessing accelerated adoption of digital wallet integrations and virtual card issuance, reflecting broader fintech innovation across the region.

In Europe, Middle East and Africa, program structures vary widely by market sophistication. Western Europe aligns with the Americas in prioritizing premium travel and lifestyle benefits, underpinned by robust regulatory frameworks that mandate stringent consumer protections. Meanwhile, emerging markets in Central and Eastern Europe, along with the Middle East and Africa, are characterized by rapid growth in cashback and discount-focused cards, as consumers seek tangible value amid variable income profiles. Digital onboarding and embedded finance partnerships are particularly prominent, enabling issuers to reach underpenetrated segments.

Asia-Pacific demonstrates the fastest growth rate, propelled by expanding middle-class populations and accelerating smartphone penetration. Co-branded programs in China, India and Southeast Asia integrate with super apps, mobile payment ecosystems and loyalty platforms, delivering instant redemption and gamified user experiences. Strategic alliances between issuers and major e-commerce players, ride-hailing services and digital entertainment providers have redefined co-brand value propositions, positioning the region as a hotbed for next-generation program innovation.

This comprehensive research report examines key regions that drive the evolution of the Co-branded Credit Card market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering key company dynamics showcasing partnership alliances, innovation leadership and competitive advantages among top co-branded credit card issuers

Leading financial institutions and global brands are executing differentiated strategies to capture co-brand market share and deepen customer engagement. Top issuers are forging exclusive partnerships with airlines, hotel chains and digital platforms to deliver tiered loyalty benefits, such as up-front elite status and accelerated point accrual. Simultaneously, network providers are enhancing tokenization and biometric authentication capabilities to bolster security and streamline digital wallet integrations.

Retail and lifestyle brands have sharpened their value propositions by embedding co-branded credit options directly into e-commerce checkouts and in-store point-of-sale systems. This seamless integration not only reduces friction but also harvests real-time consumer data for personalized marketing. Tech-savvy players and fintech challengers are entering the space with flexible issuance models, rapid digital onboarding and innovative reward structures that target underbanked and younger demographics.

Large issuers are responding to competitive pressures by investing in advanced analytics platforms, enabling more precise segmentation, dynamic pricing and adaptive underwriting. Joint venture partnerships between banks and non-bank technology firms are emerging to combine scale economics with agile product development. As brands and issuers navigate the complex regulatory landscape-balancing privacy requirements with open banking mandates-collaboration on standardized data frameworks is becoming a critical enabler of cross-border program expansion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Co-branded Credit Card market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- JPMorgan Chase & Co.

- American Express Company

- Citigroup Inc.

- Capital One Financial Corporation

- Bank of America Corporation

- Wells Fargo & Company

- Visa Inc.

- Barclays PLC

- Mastercard International Incorporated

- HDFC Bank Limited

- Arab National Bank

- AU Small Finance Bank

- Axis Bank Limited

- BNP Paribas Group

- Cardless, Inc.

- Concerto Card Company

- CTBC Bank (Philippines) Corp.

- Discover Bank

- First Abu Dhabi Bank

- ICICI Bank Limited

- IDBI Bank Ltd.

- Marqeta, Inc.

- SAI GON THUONG TIN COMMERCIAL JOINT STOCK BANK

- Santander Group

- Saudi Awwal Bank

- Scotiabank

- Standard Chartered PLC

- State Bank of India

- Synchrony Bank

- The Goldman Sachs Group, Inc.

- U.S. Bancorp

Actionable recommendations for industry leaders to drive growth in co-branded credit card programs through digital innovation and partnership expansion

To drive sustained growth, industry leaders should prioritize the integration of advanced data analytics and machine learning algorithms into loyalty and reward engines. By harnessing predictive insights, issuers can tailor benefits in real time, optimize promotional timing and preemptively identify at-risk segments. In parallel, expanding digital issuance platforms and virtual card capabilities will meet the rising demand for mobile-first payment experiences and reduce dependency on physical card production.

Partnership diversification remains essential: beyond traditional travel and retail alliances, issuers should explore collaborations with emerging sectors such as ride-hailing, subscription services and digital entertainment. These unconventional partners offer access to new consumer cohorts and create unique reward redemptions that differentiate co-branded programs. At the same time, establishing modular partnership frameworks can streamline onboarding processes and enable rapid rollout of co-brand offerings in response to market signals.

Finally, proactive risk management is critical in the face of macroeconomic and geopolitical uncertainties. Leaders must refine credit underwriting models to account for tariff-driven inflationary pressures, incorporate real-time spend monitoring and adopt stress-testing protocols that simulate a range of economic scenarios. By balancing innovation with robust governance, issuers and their brand partners can safeguard portfolio health while delivering compelling value to cardholders.

Describing the research methodology combining primary interviews and secondary data analysis to produce co-branded credit card market insights

The research methodology underpinning this executive summary blends qualitative and quantitative approaches to ensure comprehensive market coverage and actionable insights. Secondary research encompassed an extensive review of industry reports, regulatory filings and proprietary databases to map the historical evolution of co-branded credit card programs and identify prevailing trends.

Primary research involved structured interviews with senior executives from leading card issuers, brand partners and payment networks. These conversations provided direct perspectives on program design, risk management, partnership negotiation and growth strategies. In addition, expert validation sessions were conducted with industry analysts and regulatory specialists to cross-verify key findings and refine analytical assumptions.

Data triangulation was achieved by synthesizing insights from multiple sources-public disclosures, industry surveys and third-party research-to mitigate bias and enhance reliability. The segmentation and regional frameworks were developed using a combination of transaction data analysis, consumer surveys and market intelligence, ensuring that the insights reflect both macroeconomic dynamics and granular behavioral patterns. This rigorous methodology guarantees that the conclusions and recommendations presented are grounded in empirical evidence and practical experience.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Co-branded Credit Card market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Co-branded Credit Card Market, by Credit Card Type

- Co-branded Credit Card Market, by Issuer Type

- Co-branded Credit Card Market, by Reward Structure

- Co-branded Credit Card Market, by Usage Intensity

- Co-branded Credit Card Market, by Type

- Co-branded Credit Card Market, by Partnership Profile

- Co-branded Credit Card Market, by End User

- Co-branded Credit Card Market, by User Type

- Co-branded Credit Card Market, by Region

- Co-branded Credit Card Market, by Group

- Co-branded Credit Card Market, by Country

- United States Co-branded Credit Card Market

- China Co-branded Credit Card Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Summarizing strategic imperatives and opportunities that define the future direction of the co-branded credit card market in a financial context

The co-branded credit card market is defined by a confluence of strategic collaboration, technological innovation and evolving consumer expectations. As market participants navigate the twin challenges of heightened competition and macroeconomic uncertainty, a clear roadmap emerges: embrace digital transformation, deepen partnership synergies and deploy data-driven personalization at scale.

Emerging opportunities abound in virtual card issuance, super app integrations and alternative reward ecosystems, while regulatory momentum around data privacy and open finance necessitates agile governance and transparent customer engagement. Simultaneously, nuanced segmentation strategies unlock growth by aligning product attributes with the distinct needs of everyday spenders, high-frequency travelers and specialized vertical users.

By prioritizing adaptive risk management and proactive program recalibration in response to tariff-driven inflationary pressures, issuers and brand partners can preserve portfolio quality and maintain customer trust. Ultimately, the strategic imperatives distilled in this summary chart a course for co-branded credit card stakeholders to achieve sustainable differentiation, foster long-term loyalty and capture new avenues of value creation in an ever-changing financial landscape.

Contact Ketan Rohom to secure your full co-branded credit card market report and access exclusive strategic insights for competitive advantage

To access the full depth of analysis, strategic frameworks and actionable insights that will empower your organization to navigate the co-branded credit card market with confidence, contact Ketan Rohom. As Associate Director, Sales & Marketing, he will guide you through the comprehensive report’s offerings, demonstrate how it addresses your unique strategic objectives, and ensure you receive tailored recommendations that align with your growth ambitions. Reach out today to secure your copy of the co-branded credit card market research report and gain the competitive advantage that drives informed decision-making and sustained market leadership

- How big is the Co-branded Credit Card Market?

- What is the Co-branded Credit Card Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?