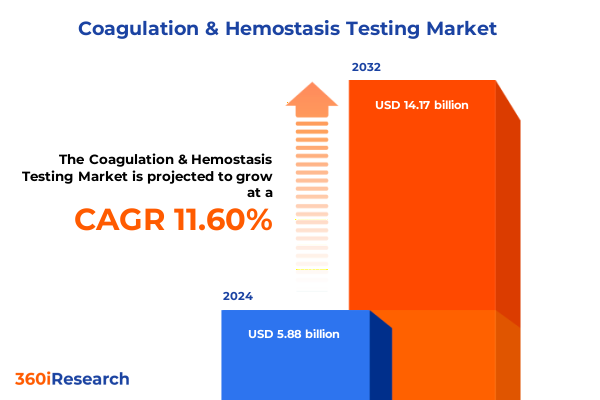

The Coagulation & Hemostasis Testing Market size was estimated at USD 6.56 billion in 2025 and expected to reach USD 7.28 billion in 2026, at a CAGR of 11.61% to reach USD 14.17 billion by 2032.

Understanding The Crucial Role Of Coagulation And Hemostasis Testing Amid Shifting Clinical, Technological, And Regulatory Paradigms In Healthcare

Coagulation and hemostasis testing stands at the very heart of clinical diagnostics, serving as an indispensable tool for assessing blood clotting function and guiding patient management across a myriad of therapeutic areas. Far beyond simple laboratory measurements, these assays inform critical decisions ranging from anticoagulant dosing in atrial fibrillation to the evaluation of bleeding disorders in surgical settings. As healthcare delivery becomes increasingly personalized, the precision and reliability of these tests have emerged as essential components in reducing adverse events and optimizing patient outcomes.

Against the backdrop of rising prevalence of thrombotic and hemorrhagic conditions, laboratories and point-of-care providers are under growing pressure to deliver rapid, accurate, and cost-effective diagnostic solutions. Innovations in assay design and instrument automation now enable faster turnaround times without sacrificing analytical sensitivity. Consequently, clinicians can intervene more swiftly, minimizing hospital stays and averting complications. This dynamic underscores the fundamental role of coagulation and hemostasis testing as both a clinical necessity and an operational priority in modern healthcare.

Looking ahead, the integration of digital health platforms and data analytics promises to further elevate the strategic value of these diagnostics. Real-time data exchange between point-of-care devices and electronic health records enhances clinical workflows and fosters a more cohesive care continuum. This convergence of technology, data, and clinical acumen sets the stage for transformative improvements in patient management and institutional efficiency, making coagulation and hemostasis testing a cornerstone of evidence-based medicine.

Exploring How Rapid Technological Innovations And Evolving Clinical Practices Are Revolutionizing Coagulation And Hemostasis Testing Landscapes

The pace of innovation in coagulation and hemostasis testing has accelerated in recent years, driven in part by breakthroughs in microfluidics, immunoassays, and digital analytics. Lab platforms that once relied exclusively on bulk reagents and manual pipetting are now outfitted with automated sample processing and advanced detection modalities, enabling higher throughput and greater reproducibility. Meanwhile, portable point-of-care analyzers leverage microfluidic chips and optical sensors to deliver critical results at the patient’s bedside, supporting rapid decision-making in emergency and critical care environments.

Concurrently, the rise of personalized medicine has spurred demand for assays capable of nuanced coagulation profiling. Enhanced immunoturbidimetric and ELISA-based technologies provide quantitative insights into specific clotting factor levels, allowing clinicians to tailor therapies with unprecedented precision. Integration with machine learning algorithms further refines test interpretation, identifying subtle hemostatic imbalances that may predict adverse events before they manifest clinically. As a result, laboratories are transitioning from purely reactive diagnostic services to proactive partners in preventive care.

Regulatory frameworks and reimbursement policies have adapted to these advancements, offering clearer pathways for the validation and market introduction of novel assays. Regulatory bodies now emphasize real-world evidence and post-market surveillance to ensure ongoing analytical performance and patient safety. In this evolving landscape, manufacturers and healthcare providers must collaborate closely to meet stringent quality standards while delivering innovative solutions that address the unmet needs of patients and practitioners alike.

Assessing The Cumulative Consequences Of Recent U.S. Tariff Policies On Coagulation And Hemostasis Testing Supply Chains And Cost Structures

In 2025, the United States government implemented additional tariffs on imported diagnostic instruments and reagents, a policy shift that has produced downstream effects throughout the coagulation and hemostasis supply chain. Manufacturers reliant on overseas component sourcing have faced increased input costs, which in turn have pressured instrument pricing and reagent margins. Laboratory operators have responded by revising procurement strategies, including exploring alternative suppliers and bulk purchasing agreements to mitigate the impact of tariffs.

Beyond immediate cost considerations, the tariff environment has encouraged a reevaluation of domestic manufacturing capabilities. Several industry players have accelerated investments in local production facilities, prioritizing supply chain resilience and reducing exposure to geopolitical fluctuations. This trend has the potential to shorten lead times and enhance quality control, albeit at the expense of initial capital outlays and potential shifts in cost structures.

Service providers and distributors have likewise adapted, offering value-added packages that bundle installation, training, and maintenance with reagents and analyzers. By leveraging these integrated offerings, laboratories can stabilize overall operating expenses and secure predictable pricing models. As stakeholders continue to navigate the evolving policy landscape, strategic partnerships that emphasize shared risk and supply continuity will become increasingly essential.

Unveiling Critical Segmentation Insights Across Diverse End Users Technologies Workflows Products And Test Types Shaping Coagulation And Hemostasis Testing

An examination of end users reveals distinct usage patterns and growth trajectories across diagnostic laboratories, hospital-based clinical labs, physician office testing services, and research institutes. Diagnostic laboratories maintain a strong focus on high-volume screening and routine monitoring, leveraging robust analyzer platforms to support diverse patient populations. Hospital clinical laboratories, by contrast, prioritize rapid turnaround and integrated workflows that align with intensive care units and surgical suites. Physician offices are gravitating toward compact point-of-care coagulometers that enable immediate insights during patient consultations. Meanwhile, research institutions are at the forefront of assay refinement, experimenting with novel biomarkers and advanced technologies to push the boundaries of hemostasis understanding.

From a technology standpoint, immunoassays have remained a staple method for quantifying key clotting factors, with ELISA and immunoturbidimetric approaches offering complementary strengths in specificity and throughput. Optical detection systems deliver high-resolution measurement capabilities, particularly when applied in conjunction with microfluidic sample handling. Emerging electrochemical detection methods promise to enhance sensitivity in miniaturized devices, facilitating true point-of-care convenience without compromising analytical fidelity.

The workflow segmentation into laboratory-based and point-of-care paradigms underscores an important dichotomy in solution design. Central laboratories focus on extensive test menus and batch processing efficiencies, whereas point-of-care workflows emphasize ease of use, minimal sample preparation, and rapid result delivery. This bifurcation drives product development strategies that optimize for either scale or portability, with hybrid offerings increasingly bridging the gap.

On the product front, instrument portfolios encompass both high-precision coagulation analyzers and portable coagulometers designed for non-laboratory environments. Reagents and consumables comprise specialized chemistries for activated partial thromboplastin time, D-dimer, fibrinogen, and prothrombin time/international normalized ratio assays, each calibrated to exacting performance standards. Complementing these hardware and chemistry components are software and services offerings, which include in vitro diagnostics informatics platforms and comprehensive maintenance and support agreements. This integrated approach ensures that laboratories and care providers can maintain operational continuity while benefiting from the latest analytical improvements.

Finally, distinct test types such as aPTT, D-dimer, fibrinogen, and PT/INR assays form the core of diagnostic and monitoring protocols. Each assay plays a unique clinical role, from detecting active clot formation to ensuring therapeutic anticoagulation remains within safe and effective ranges. Together, these test categories create a holistic framework that underpins patient management and drives ongoing innovation in assay performance and workflow integration.

This comprehensive research report categorizes the Coagulation & Hemostasis Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Workflow

- Products

- Test Type

- End User

Highlighting Key Regional Dynamics Influencing Adoption Regulatory Landscapes And Technological Uptake In Coagulation And Hemostasis Testing Globally

In the Americas, established healthcare infrastructures and mature reimbursement systems support widespread adoption of advanced coagulation and hemostasis testing solutions. Major markets have seen steady integration of digital laboratory information systems, and ongoing consolidation among laboratory networks has heightened demand for interoperable analytical platforms. Nevertheless, cost pressures and competitive bidding processes continue to incentivize efficiency improvements across the supply chain, prompting vendors to offer bundled service agreements and reagent lease programs.

Europe, the Middle East, and Africa present a heterogeneous regulatory and market landscape. Western Europe benefits from harmonized standards under the In Vitro Diagnostic Regulation, driving consistent quality and performance requirements. In contrast, portions of Eastern Europe, the Middle East, and Africa are characterized by nascent reimbursement frameworks and variable infrastructure, creating pockets of high growth potential for portable and cost-effective diagnostic solutions. Regional collaborations and public–private partnerships have emerged as pivotal mechanisms to expand testing access and strengthen local manufacturing capacities.

Across Asia-Pacific, increased healthcare spending and rising prevalences of cardiovascular and thrombotic diseases are fueling demand for both centralized and decentralized testing modalities. In markets such as Japan and Australia, advanced laboratories continue to adopt fully automated analyzer suites, while emerging economies like India and Southeast Asia are witnessing rapid uptake of point-of-care devices that deliver timely insights in outpatient and remote clinic settings. Government initiatives aimed at enhancing rural healthcare access have further boosted the appeal of portable platforms, creating new channels for growth and innovation.

This comprehensive research report examines key regions that drive the evolution of the Coagulation & Hemostasis Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves Market Positioning And Innovation Efforts Among Leading Players Driving The Coagulation And Hemostasis Testing Sector

Leading diagnostic companies are actively pursuing integrated portfolio strategies that encompass instruments, reagents, and informatics solutions to differentiate their offerings in a competitive environment. One major player has focused on consolidating its coagulation analyzer lineup with companion software modules that deliver real-time analytics and remote monitoring capabilities. Another global competitor has strengthened its point-of-care presence through strategic acquisitions of microfluidics innovators, enabling a more seamless transition from central laboratories to patient-side testing.

Several established firms are prioritizing reagent innovation, expanding their chemistries to address emerging biomarkers and novel anticoagulant therapies. These companies leverage their extensive distribution networks to bundle consumables with tailored service agreements, enhancing customer loyalty and creating recurring revenue streams. Meanwhile, a select group of regional providers is capitalizing on cost-sensitive markets by offering streamlined instrument designs that balance affordability with core performance requirements.

Collaborative partnerships between diagnostic specialists and cloud-based informatics firms have emerged as a noteworthy trend, with co-developed digital platforms offering predictive maintenance alerts and automated quality control checks. Such alliances aim to reduce downtime and maintain consistent assay performance, particularly in high-throughput settings. Across the board, market leaders are reinforcing their global footprints through targeted investments in local manufacturing and service delivery infrastructures, ensuring that they can respond to evolving regulatory demands and logistical challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coagulation & Hemostasis Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Autobio Diagnostics Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Diagnostica Stago SAS

- F. Hoffmann-La Roche Ltd

- Haemonetics Corporation

- Helena Laboratories Corporation

- HemoSonics LLC

- HORIBA, Ltd.

- Instrumentation Laboratory Company

- Mindray Medical International Limited

- QuidelOrtho Corporation

- Randox Laboratories Ltd

- Sekisui Medical Co., Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Universal Biosensors Pty Ltd

- Werfen S.A.

Actionable Strategic Recommendations For Industry Leaders To Navigate Market Complexities And Capitalize On Opportunities In Coagulation And Hemostasis Testing

As the coagulation and hemostasis testing arena becomes increasingly complex, industry leaders should prioritize a multifaceted strategy that balances innovation with operational agility. Investing in end-to-end digital integration will enable more streamlined data management, connecting laboratory instruments with enterprise systems to facilitate real-time quality control and remote diagnostics. This digital backbone should be complemented by modular product designs that allow customers to scale testing capabilities in alignment with evolving clinical demands.

To mitigate supply chain volatility, executives must diversify their sourcing strategies by engaging with multiple suppliers and expanding domestic manufacturing initiatives. Strategic alliances with reagent and instrument providers can further distribute risk and foster joint development of localized solutions. Concurrently, companies should enhance their service portfolios, offering comprehensive maintenance contracts and training programs that reduce customer burden and strengthen long-term relationships.

In parallel, organizations should deepen their engagement with regulatory bodies and reimbursement stakeholders to stay ahead of policy shifts. Proactively contributing to standards development and real-world evidence collection will smooth market entry for novel assays and support broader adoption. Finally, prioritizing workforce development-inclusive of technical training for laboratory personnel and field service engineers-will ensure customers can fully leverage advanced testing platforms, maximizing clinical impact and operational efficiency.

Detailing The Robust Research Methodology And Data Triangulation Approaches Underpinning Comprehensive Coagulation And Hemostasis Testing Analysis

This analysis is underpinned by a rigorous research framework that combines primary interviews with laboratory directors, clinicians, and industry executives alongside secondary investigations into scientific literature, regulatory filings, and patent databases. Each data point undergoes validation through triangulation, ensuring coherence across diverse information sources and minimizing bias. Qualitative insights derived from expert panels are integrated with quantitative assessments to capture both emerging trends and established practices.

The segmentation schema employed in this study encompasses end user, technology, workflow, product, and test type dimensions, facilitating nuanced analysis of market dynamics and stakeholder requirements. Regional assessments leverage local regulatory frameworks and reimbursement landscapes to contextualize adoption patterns and growth vectors. Company profiles draw upon public disclosures, investor presentations, and proprietary customer feedback to evaluate competitive positioning and innovation pipelines.

To maintain methodological transparency, all assumptions and analytical parameters are documented in a comprehensive appendix, including definitions of key terms and the scope of data collection. This robust approach ensures that findings can be traced back to their original sources and adapted for future updates as market conditions evolve.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coagulation & Hemostasis Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coagulation & Hemostasis Testing Market, by Technology

- Coagulation & Hemostasis Testing Market, by Workflow

- Coagulation & Hemostasis Testing Market, by Products

- Coagulation & Hemostasis Testing Market, by Test Type

- Coagulation & Hemostasis Testing Market, by End User

- Coagulation & Hemostasis Testing Market, by Region

- Coagulation & Hemostasis Testing Market, by Group

- Coagulation & Hemostasis Testing Market, by Country

- United States Coagulation & Hemostasis Testing Market

- China Coagulation & Hemostasis Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings And Strategic Imperatives To Empower Stakeholders With Actionable Insights Into Coagulation And Hemostasis Testing Evolution

The landscape of coagulation and hemostasis testing is undergoing profound transformation, driven by technological innovation, shifting care delivery models, and evolving regulatory frameworks. Stakeholders must remain vigilant in monitoring upstream policy impacts, such as tariffs and supply chain adjustments, that can materially influence cost structures and access to critical diagnostics. At the same time, understanding nuanced segmentation across end users, technologies, and workflows will enable more targeted product development and market penetration strategies.

Regional dynamics highlight the need for tailored approaches that align with local infrastructure, reimbursement pathways, and disease burdens. Market leaders must balance global scale with local responsiveness, leveraging partnerships and investments to secure resilient supply chains and agile service networks. Simultaneously, collaboration with healthcare providers and regulators will facilitate streamlined adoption of advanced assays, ensuring that innovations translate into measurable improvements in patient care.

By synthesizing the key trends, challenges, and opportunities outlined throughout this summary, decision-makers can chart a path toward sustainable growth. The imperative for cohesive strategies that integrate digital capabilities, supply chain diversification, and regulatory engagement has never been clearer. As the demands of clinical practice evolve, so too must the solutions that support accurate, timely, and cost-effective coagulation and hemostasis testing.

Connect With Ketan Rohom To Gain Tailored Market Intelligence And Strategic Guidance On Coagulation And Hemostasis Testing Solutions And Opportunities

If you are seeking in-depth, actionable insights and bespoke strategic guidance on the rapidly evolving coagulation and hemostasis testing landscape, you are invited to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing. His extensive expertise in navigating complex diagnostic markets ensures you will receive tailored recommendations aligned with your organization’s unique objectives. By partnering with Ketan, you gain insider access to comprehensive analysis, competitive intelligence, and implementation roadmaps designed to accelerate innovation and drive sustainable growth. Reach out today to secure your copy of the market research report and unlock the full potential of your diagnostic testing strategy.

- How big is the Coagulation & Hemostasis Testing Market?

- What is the Coagulation & Hemostasis Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?