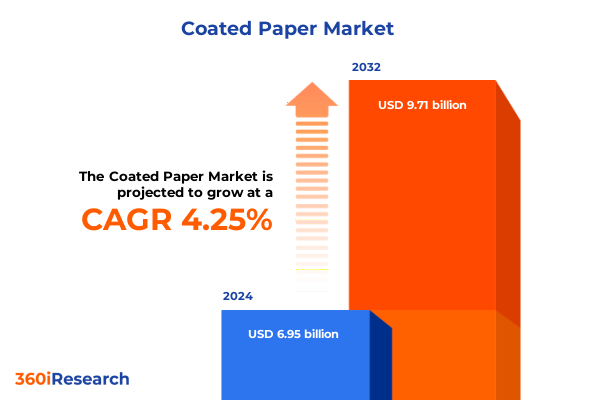

The Coated Paper Market size was estimated at USD 7.23 billion in 2025 and expected to reach USD 7.51 billion in 2026, at a CAGR of 4.30% to reach USD 9.71 billion by 2032.

Introduction to the Coated Paper Industry’s Strategic Outlook Amidst Evolving Demand Drivers and Technological Innovations

The coated paper industry occupies a unique intersection between traditional print media and modern packaging applications, blending centuries-old production processes with cutting-edge surface technologies. Coated papers are engineered with one or more layers of coating material to enhance attributes such as brightness, smoothness, ink receptivity, and barrier protection. As consumption patterns evolve, coated paper remains integral to high-quality commercial printing, premium publications, and packaging solutions that demand superior print fidelity and durability.

In recent years, a confluence of factors has reshaped the strategic outlook for coated paper manufacturers and end users alike. On one hand, environmental imperatives have accelerated the adoption of sustainable raw materials and closed-loop production cycles. On the other, rapid digitalization of marketing channels has elevated the importance of bespoke print applications that reinforce brand storytelling. Together, these demand drivers have catalyzed investments in advanced coating chemistries, automated finishing lines, and real-time quality control systems.

However, the coated paper value chain also faces multifaceted challenges, ranging from fluctuating pulp prices to volatile trade policies and shifting regulatory frameworks. Embedded within this complexity are opportunities to leverage novel barrier coatings for flexible packaging, integrate nanotechnology for functionalized surfaces, and harness data analytics to optimize yield and reduce waste. This introduction sets the stage for a deeper exploration of transformative trends, market segment dynamics, and strategic imperatives that define the coated paper landscape today.

Examining the Most Influential Transformations That Are Reshaping Coated Paper Production Processes Distribution Patterns and Market Dynamics Globally

Over the past decade, technological breakthroughs have redefined coated paper manufacture and application, prompting publishers and brand owners to rethink how they deploy print media in an increasingly digital world. Innovative surface treatments now enable coatings that balance high gloss appeal with rapid ink absorption, while next-generation matte finishes offer tactile luxury without compromising image clarity. These advancements underscore a broader shift toward customization, as producers implement modular coating lines and digital print presses to respond swiftly to dynamic order requirements.

Concurrently, sustainability has emerged as a pivotal transformation driver. Leading mills have adopted bio-based pigments, recycled cellulose fibers, and waterborne coating systems to reduce carbon footprints and achieve circularity objectives. These eco-centric initiatives are complemented by smart manufacturing solutions-leveraging IoT sensors, predictive maintenance algorithms, and automated process controls-to optimize energy use and minimize waste. As a result, the industry is witnessing a convergence of performance enhancement and environmental responsibility, reshaping value propositions across the coated paper supply chain.

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Coated Paper Trade Flows Industry Costs and Supply Chains

In early 2025, the United States introduced revised tariff schedules specifically targeting coated paper imports, raising duty rates on selected categories by as much as 25 percent. These measures, intended to protect domestic manufacturers and address perceived unfair trade practices, have triggered a cumulative impact on the cost structure and sourcing strategies of North American converters and printing houses. Since coated paper is heavily traded globally, the imposition of higher duties has rippled through procurement cycles and forced end users to reassess supplier relationships.

Importers have experienced immediate cost pressures as landed prices climbed, prompting some to absorb additional premiums to maintain supply continuity, while others shifted volumes to exempt or lower-duty jurisdictions. Moreover, the new tariff regime has intensified conversations around near-shoring and capacity expansion within U.S. borders, with a handful of domestic mills accelerating planned investments to capitalize on gaps left by higher-priced imports. Yet the transitional phase has not been seamless; logistical rerouting, elongated lead times, and elevated working capital requirements have collectively weighed on operational margins and created windows of opportunity for alternative material innovations.

Uncovering Key Insights Across Diverse Market Segmentation Dimensions Including Finish Basis Weight End Use and Coating Type

A comprehensive understanding of the coated paper market necessitates an analysis across multiple segmentation dimensions that illuminate performance attributes and application suitability. When examining surface characteristics, finish subcategories reveal distinct user preferences and application performance. Gloss options span high gloss, medium gloss, and low gloss variants that cater to an array of visual intensities, while matte alternatives differentiate between soft matte and super matte textures for a refined aesthetic. Silk finishes offer intermediate tactile feels, with satin silk and soft silk options providing balanced surface smoothness and light reflectance.

Equally critical is the weight classification of coated paper, where heavy weight stocks deliver rigidity and structural integrity for premium packaging and display materials, medium weights balance cost and print quality for general commercial print runs, and light weight grades are optimized for high-volume catalogs, flyers, and posters requiring efficient handling and reduced environmental impact. Each basis weight segment aligns with specific operational priorities, from runnability on high-speed presses to stacking behavior and storage logistics.

End-use segmentation further refines market insight by delineating applications that drive demand. Within commercial printing, advertising material production, brochure and flyer creation, and poster printing each impose unique ink absorption and coating uniformity requirements to achieve crisp imagery and rapid finishing. The label and tag sector encompasses pressure sensitive labels, security label applications, and ticket printing, where adhesion properties and durability under varied conditions are paramount. Packaging uses include boxboard packaging for rigid containers, flexible packaging films for consumer goods, and folding carton substrates for retail-ready formats. Meanwhile, publication printing spans book, catalog, magazine, and newspaper outputs, each defining its own benchmarks for brightness, opacity, and fold endurance.

Coating type segmentation highlights the complexity of barrier and functional attributes. Single coated grades are typically leveraged for one-side print operations, while double coated stocks offer enhanced printability on both faces. Multi coated variants embed specialized layers that confer moisture resistance, grease repellency, or thermal insulating properties, satisfying the rigorous demands of food packaging and pharmaceutical labeling. Collectively, these segmentation dimensions provide a multifaceted lens through which stakeholders can tailor material specifications, optimize supply chains, and identify niche growth corridors.

This comprehensive research report categorizes the Coated Paper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Finish

- Basis Weight

- End Use

- Coating Type

Revealing Critical Variations in Demand Supply Chain Adaptations and Growth Drivers Across Americas Europe Middle East & Africa and Asia-Pacific Regions

Regional dynamics in the coated paper market are shaped by distinctive economic, regulatory, and consumer behavior patterns that vary across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, a robust e-commerce boom and heightened demand for sustainable packaging have propelled growth in coated paper demand for flexible pouch solutions and folding carton applications. Meanwhile, evolving environmental regulations in North America have encouraged the uptake of recycled fibers and waterborne coating formulations, influencing investment in local capacity expansions and retrofits of existing mills.

Across Europe Middle East & Africa, stringent regulatory frameworks on carbon emissions and single-use plastics have spurred innovation in biodegradable coatings and composite substrates that meet circular economy objectives. This region’s established publishing heritage also sustains a stable outlet for high-quality coated stocks, particularly in magazine and specialty book production. In contrast, Asia-Pacific continues to register the fastest volume growth, driven by expanding consumer goods markets, rapid urbanization, and rising printing penetration in educational and commercial sectors. Local paper manufacturers in China, India, and Southeast Asia are scaling production of both single and multi coated lines, while exporters recalibrate offerings to address the region’s price sensitivity and emerging demand for high-value barrier coatings.

This comprehensive research report examines key regions that drive the evolution of the Coated Paper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analytical Overview of Leading Corporations Driving Innovation Competitive Strategies and Collaborative Initiatives in the Coated Paper Market

Leading corporations in the coated paper ecosystem are deploying diverse strategies to secure competitive advantage, drive innovation, and reinforce sustainability credentials. Global forest products giants have accelerated acquisitions of specialist coating technology firms, integrating proprietary chemistries into their product portfolios to deliver enhanced print brightness and functional barrier properties. Simultaneously, select mill operators have forged strategic partnerships with digital press manufacturers, co-developing media that harmonize coating absorption characteristics with next-generation inkjet and electrophotographic platforms.

In addition to technology alliances, packaging converters and paper merchants are differentiating through vertical integration, establishing in-house coating lines that enable fast-track customization and tighter quality control. Companies investing heavily in renewable energy at production sites report significant reductions in greenhouse gas emissions per ton of coated output, strengthening their positioning with environmentally conscious brands. Moreover, several market leaders have embraced data analytics and automation, deploying machine learning models to predict coating performance, optimize chemical dosing, and reduce downtime, resulting in more agile operations and cost efficiencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coated Paper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahlstrom-Munksjö Oyj

- Asia Pulp & Paper Co., Ltd.

- Bo‑Tex Sales Co.

- Burgo Group S.p.A.

- Cooley Group Holdings, Inc.

- Dickson Constant

- Endutex Coated Technical Textiles S.A.

- Graniteville Specialty Fabrics Co.

- Haartz Corporation

- Heytex Bramsche GmbH

- Industrial Sedo S.L.

- Isotex S.p.A.

- Lecta S.A.

- Mauritzon Inc.

- MehlerTexnologies

- Mondi plc

- Morbern Inc.

- Mount Vernon Mills, Inc.

- Nippon Paper Industries Co., Ltd.

- Obeikan Technical Fabrics Co. Ltd.

- Oji Holdings Corporation

- Sappi Limited

- Stora Enso Oyj

- Takata Corporation

- UPM-Kymmene Corporation

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Emerging Challenges and Capitalize on Growth Opportunities

Industry leaders aiming to thrive in the coated paper arena should prioritize investments in sustainable coating chemistries and energy-efficient manufacturing processes to meet tightening environmental mandates and corporate responsibility targets. Allocating R&D resources toward bio-based and recyclable coating technologies will not only enhance brand reputation but also mitigate risk against future regulatory shifts. Furthermore, cultivating strategic alliances with digital printing technology providers and packaging converters can unlock co-innovation opportunities, ensuring that new coated substrates are optimized for emerging applications and printing platforms.

Beyond product innovation, executives should focus on fortifying supply chain resilience by diversifying sourcing across regions and exploring near-shoring options to offset tariff exposures and logistical bottlenecks. Leveraging advanced analytics to forecast demand patterns at granular levels will enable proactive inventory management and reduce working capital strain. Finally, fostering a data-driven culture that integrates real-time quality monitoring and predictive maintenance will drive operational excellence, positioning organizations to respond swiftly to market changes while preserving margins.

Outlining the Rigorous Research Methodology Employed for Data Collection Analysis Validation and Market Insight Generation

The research presented in this report adopts a multi-tiered methodology to ensure the reliability and comprehensiveness of findings. Initially, secondary research was conducted, encompassing a review of peer-reviewed journals, patent databases, trade publications, and regulatory filings to map technological trends, environmental regulations, and historical trade patterns. Concurrently, corporate disclosures, annual reports, and financial statements provided insights into strategic initiatives, capacity expansions, and collaborative agreements among key industry participants.

To validate the secondary findings and enrich qualitative insights, primary research interviews were carried out with a cross-section of stakeholders, including coating formulators, mill engineers, procurement executives, and market analysts. These dialogues informed an analytical framework that triangulates quantitative trade data with expert perspectives. Advanced statistical techniques were applied to standardize data sets, identify outliers, and project scenario-based analyses. Throughout the process, rigorous quality checks and peer reviews were administered to uphold methodological integrity and ensure that conclusions accurately reflect the current coated paper landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coated Paper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coated Paper Market, by Finish

- Coated Paper Market, by Basis Weight

- Coated Paper Market, by End Use

- Coated Paper Market, by Coating Type

- Coated Paper Market, by Region

- Coated Paper Market, by Group

- Coated Paper Market, by Country

- United States Coated Paper Market

- China Coated Paper Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Strategic Implications to Frame the Future Trajectory of the Global Coated Paper Industry

The coated paper industry stands at a crossroads where technological innovation, environmental stewardship, and shifting trade policies converge to redefine competitive advantage. Enhanced coating functionalities and the emergence of bio-based materials signal a departure from conventional product formulations, while tariffs and regional regulatory frameworks continue to reshape global supply chains. Market segmentation analysis underscores the importance of aligning finish options, weight classes, and end-use applications to specific customer requirements, creating avenues for both incremental and breakthrough growth.

Regional variances highlight that no single strategy will suffice across geographies; success demands that organizations adopt localized approaches to production, source diversification, and product development. Leading companies are those that harness data-driven agility, invest strategically in sustainable technologies, and cultivate partnerships that accelerate time to market. By synthesizing these core findings and strategic implications, stakeholders can chart a course toward resilient and profitable expansion in the evolving coated paper market.

Engage with Ketan Rohom to Acquire In-Depth Coated Paper Market Insights and Secure Your Comprehensive Research Report for Strategic Advantage

To secure the comprehensive market research report on the coated paper industry and gain a competitive vantage, reach out to Ketan Rohom (Associate Director, Sales & Marketing) today. He can guide you through the report’s rich insights, assist in tailoring the deliverables to your strategic priorities, and ensure your organization captures the full spectrum of actionable data needed to thrive in this evolving market landscape. Don’t miss this opportunity to equip your leadership team with the critical intelligence required to make informed decisions and drive growth in the global coated paper sector.

- How big is the Coated Paper Market?

- What is the Coated Paper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?