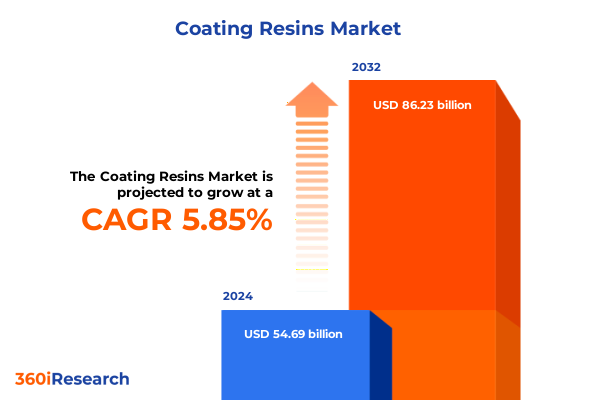

The Coating Resins Market size was estimated at USD 57.76 billion in 2025 and expected to reach USD 61.01 billion in 2026, at a CAGR of 5.89% to reach USD 86.23 billion by 2032.

A clear situational framing of coating resins that links raw-material chemistry, sustainability mandates, and supply-chain pressures to commercial decision-making

The coating resins landscape sits at the intersection of raw-material chemistry, downstream formulation innovation, and complex global supply chains. Regulatory pressure, customer-driven sustainability requirements, and evolving end‑use performance needs are converging to reshape what customers expect from acrylic, alkyd, epoxy, and polyurethane binders and the manufacturers that supply them. This introduction frames the market as a systems challenge: not only are formulators being asked to deliver durability, aesthetics, and cost-efficiency, but they must also demonstrate lower lifecycle impacts, secure feedstock availability, and adapt to an increasingly volatile trade environment.

As the industry moves forward, producers and consumers of resins are making decisions based on risk tolerance, access to advanced chemistries, and the ability to translate material science into differentiated coatings. Those that integrate supply‑chain intelligence with application-driven R&D will capture disproportionate value. This opening lays out the context for the analysis that follows, explaining why resin selection, end‑use demand patterns, tariffs, and regional policy shifts are the primary vectors shaping competitive advantage today and next year.

How sustainability mandates, supply-chain resilience, and advanced polymer innovations are permanently altering resin product roadmaps and commercial models

The past three years have produced a cascade of transformative shifts that are redrawing the rules for resin manufacturers, formulators, and downstream coaters. First, sustainability is no longer a niche selling point but a structural demand driver: buyers across architectural, automotive, and industrial segments expect lower‑VOC, lower‑embodied‑carbon formulations and clearer end‑of‑life stories. In parallel, advances in polymer chemistry and crosslinking technologies are enabling higher‑performance waterborne and hybrid systems, allowing many legacy solvent‑borne applications to transition without sacrificing durability. This technical pathway has broad commercial implications because it compresses time‑to‑market for greener alternatives and raises the bar for incumbent chemistries.

Second, supply‑chain architecture has shifted from “just‑in‑time” toward a resilient, diversified model. Firms are expanding dual‑sourcing strategies, regionalizing inventory, and investing in domestic intermediate production where feasible. These choices are being driven by both geopolitics and commercial calculus: the need to avoid single‑point failures and to preserve formulation consistency for OEM and industrial customers. Third, digitization and analytics are moving from pilot projects to production use; predictive demand models, quality‑by‑analysis tools, and integrated procurement platforms are helping purchasing teams quantify tariff exposure and raw‑material substitution options more rapidly.

Finally, customer expectations are more integrated than before. Architectural specifiers want low‑emission materials that also deliver maintenance savings; automotive OEMs require coatings that satisfy both sustainability commitments and long service lives; and industrial end users prioritize coatings that reduce downtime and lifecycle costs. Together, these trends compel resin producers to align R&D, commercial strategy, and upstream sourcing decisions so that product roadmaps reflect both performance and risk mitigation imperatives. Evidence from industry coverage shows that chemical and coatings firms are actively recalibrating procurement and investment plans in light of recent trade actions and market dynamics, underscoring the permanence of the new operating environment.

An evidence-based assessment of how 2025 United States tariff measures on imports and intermediates are reshaping procurement, formulation, and sourcing strategies in coatings

United States tariff activity in 2025 has introduced a material new variable into resin sourcing and cost dynamics for coatings producers and formulators. Policy measures enacted under Section 301 and other authorities have raised the cost of specific imported intermediates and created uncertainty around future access to some categories of feedstock. The immediate commercial effect is twofold: import‑exposed formulators face higher landed costs, and procurement teams must evaluate the value of deeper relationships with domestic suppliers, forward purchasing, or reformulation to alternative chemistries. Given the thin margins typical of many downstream coatings applications, even modest tariff moves can require operational and commercial adjustments across price negotiations, rebate structures, and product specifications.

Industry groups and trade bodies have been vocal about these impacts while urging policymakers to account for the interconnected nature of chemical supply chains. Public statements emphasize the risk that tariffs, when applied broadly to chemical inputs, can impair competitiveness and disrupt planned capital investments that underpin domestic capacity. At the same time, targeted tariff increases announced in late 2024 and implemented in 2025 for particular material categories demonstrate that the policy framework can be highly specific in which subsegments are affected, making detailed tariff-scenario planning an imperative for risk-averse firms.

As a consequence, coating manufacturers are employing three broad mitigation strategies. Some are accelerating qualification of alternative resins that rely on different intermediates or on locally abundant feedstocks, thereby reducing exposure to tariffed imports. Others are optimizing formulations to reduce total polymer content without degrading performance, a move that preserves cost competitiveness while meeting customer expectations. A third cohort is rebalancing logistics and inventory policies-holding critical intermediates in regional hubs and using hedging mechanisms to smooth short-term price spikes. These responses reflect the practical reality that tariffs in 2025 are a live factor in commercial planning, and firms that proactively test alternative suppliers and formulations will be better positioned to preserve margins and supply continuity.

Segment-focused insights that connect resin chemistries to application requirements and purchasing behavior across architectural, automotive, industrial, protective, and wood coatings

Segment-level dynamics in coating resins are defined by resin chemistry and by the varied performance demands of end‑use industries. Market activity differs across acrylic, alkyd, epoxy, and polyurethane chemistries because each class responds to distinct performance tradeoffs and raw‑material inputs; for example, epoxy systems are prioritized where corrosion resistance and chemical resistance are essential, while alkyd binders maintain relevance in maintenance painting and certain cost‑sensitive decorative applications. Across end uses, demand drivers diverge: architectural coatings prize low‑VOC and color retention, automotive coatings emphasize appearance, scratch resistance and OEM process compatibility, and industrial and protective coatings prioritize adhesion, cure kinetics, and long‑term substrate protection.

Within the architectural sector, commercial applications are increasingly specified for high‑durability and reduced maintenance over multi‑decade schedules, whereas residential projects often prioritize rapid cure, aesthetic options, and cost efficiency. Automotive demand splits between OEM coating systems-where stringent process control and corrosion performance are non‑negotiable-and refinish coatings, which require color matching and repairability. Industrial coatings present a layered structure: coil‑coating applications demand continuous processing and high throughput; general industrial coatings balance economics and protective performance for equipment and facilities; packaging coatings require regulatory compliance and food‑contact safety. Protective coatings bifurcate into heavy‑duty industrial protective systems used on infrastructure and plant equipment, and marine systems that must combine antifouling considerations, UV resistance, and extended immersion durability. In the wood segment, flooring coatings emphasize abrasion resistance and slip properties, while furniture coatings focus on aesthetic finish, touch, and chemical resistance.

These segmentation realities influence R&D pipelines, customer engagement models, and supply‑chain choices. Producers that map resin chemistries to precise application needs and procurement constraints can target innovations and manufacturing investments where they yield the greatest commercial return, while formulators gain competitive advantage by offering specifications that reduce total cost of ownership for end customers.

This comprehensive research report categorizes the Coating Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- End-Use Industry

- Distribution Channel

How divergent regulatory regimes, tariff frameworks, and feedstock availability across the Americas, Europe Middle East & Africa, and Asia‑Pacific are redefining regional competitive advantage

Regional forces are reconfiguring supply chains and commercial opportunities for resin suppliers and coaters in distinct ways across the Americas, Europe, Middle East & Africa, and Asia‑Pacific. In the Americas, policy shifts and a push for nearshoring have increased interest in building domestic intermediate capacity and in securing reliable North American supply corridors that serve both OEMs and industrial users. This trend responds to both tariff risk and the desire for shorter lead times and tighter quality control for high‑value formulations.

In Europe, Middle East & Africa, regulatory stringency around emissions, recyclability, and chemical safety is a central market force; as a result, suppliers that can substantiate lower environmental footprints and regulatory compliance gain preferential access to major commercial and public‑sector procurement programs. At the same time, emerging trade arrangements and reciprocal tariff frameworks have altered cost dynamics for imports and exports, requiring a more rigorous assessment of cross‑border sourcing decisions. In Asia‑Pacific, the pace of industrialization and infrastructure investment continues to underpin demand for protective and industrial coatings, while local chemical producers and regional logistic efficiencies sustain a competitive cost base. The geography of feedstock availability, regional energy prices, and tariff regimes combine to create differentiated windows for competitive advantage in each region.

Recent transatlantic trade developments have introduced specific tariff ceilings and conditional tariff arrangements that directly affect sourcing decisions for European origin goods into the United States. Such arrangements make it essential for multinational firms to model multi‑region scenarios and to align manufacturing footprints with both commercial demand and evolving trade policy.

This comprehensive research report examines key regions that drive the evolution of the Coating Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive behaviors among resin and coatings manufacturers driven by vertical integration, targeted M&A, and focused investment in sustainable and high‑performance chemistries

Competitive dynamics among major resin and coatings players are shaped by vertical integration, strategic alliances with chemical intermediates suppliers, and targeted investments in sustainable product platforms. Large multinational producers are leveraging their scale to invest in next‑generation waterborne and high‑solids chemistries, while simultaneously using purchasing power to secure long‑term supply contracts for critical intermediates. Mid‑sized specialty players are carving out niches in high‑performance segments-such as corrosion protection, marine systems, or fast‑curing automotive primers-by coupling domain expertise with formulation agility.

Mergers, joint ventures, and capacity realignments are being used selectively to access complementary technologies and to de‑risk feedstock exposure. At the same time, suppliers that invest in application engineering and rigorous field validation of alternative resins win faster OEM qualification and adoption. Industry commentary from chemical trade publications and associations reinforces that tariffs and trade uncertainty are accelerating tactical consolidation and prompting firms to re-evaluate their capital allocation for new intermediate production versus downstream coating assets. This environment rewards companies that combine technical depth, flexible manufacturing footprints, and disciplined go‑to‑market strategies to meet evolving end‑use demands while managing geopolitical risk.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coating Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Allnex Belgium SA

- Arkema SA

- BASF SE

- Covestro AG

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Hexion Inc.

- PPG Industries, Inc.

- The Sherwin-Williams Company

Practical and immediate actions for resin and coatings executives to mitigate tariff exposure, accelerate sustainable product adoption, and strengthen supply‑chain resilience

Industry leaders should adopt a pragmatic, multi‑track response to the intersecting pressures of tariffs, sustainability, and performance expectations. First, establish a cross‑functional tariff and supply‑risk cell that combines procurement, R&D and commercial teams to quantify exposure at the resin and SKU level, model supplier substitution scenarios, and determine the true elasticity of demand. Embedding regular scenario drills will reduce reaction time when policy changes occur and improve the accuracy of cost‑pass‑through decisions.

Second, prioritize product platforms that reduce dependency on single intermediates and encourage modular formulation approaches that enable rapid switching between chemistries when feedstock constraints arise. Investing in formulation toolkits and accelerated qualification protocols lowers the time and cost of switching suppliers. Third, accelerate sustainability credentials where they offer both regulatory protection and commercial differentiation; this includes life‑cycle assessments, third‑party verification, and transparent supply‑chain traceability that resonate with architects, OEMs and institutional buyers.

Finally, pursue pragmatic regional manufacturing realignment where total landed cost and tariff exposure justify capital spend. Combining regional hubs for critical intermediates with localized finishing capacity for high‑value coatings preserves the speed and customization customers demand while containing exposure to tariff fluctuations. These steps, taken together, create optionality and resilience while protecting margin and customer relationships.

A robust mixed-methods research design combining primary interviews, expert panels, and scenario analysis to validate supply‑chain impacts and resin application realities

The research methodology blends primary interviews with senior procurement and R&D leaders, structured expert panels, and quantitative supply‑chain mapping to produce actionable insights. Primary research included targeted conversations with formulators, purchasing managers, and application engineers across architectural, automotive, industrial, protective, and wood coatings end‑users to validate performance tradeoffs and procurement constraints. Secondary research relied on company filings, regulatory notices, trade‑association commentary, and reputable news coverage to build a timeline of policy developments, capacity announcements, and trade actions.

Analytical methods combined scenario analysis for tariff and trade policy permutations with sensitivity testing of raw‑material price pass‑through and margins at the formulation level. For segmentation insights, we mapped resin chemistries to application performance requirements and procurement behaviors to identify where reformulation or supplier diversification is practical. Data quality controls included cross‑validation of interview findings with public announcements and triangulation across independent industry sources. Where uncertainty persisted, conservative assumptions were applied and flagged in the appendices so that decision‑makers can adjust models to their specific commercial context.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coating Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coating Resins Market, by Resin Type

- Coating Resins Market, by End-Use Industry

- Coating Resins Market, by Distribution Channel

- Coating Resins Market, by Region

- Coating Resins Market, by Group

- Coating Resins Market, by Country

- United States Coating Resins Market

- China Coating Resins Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

A decisive summary that ties sustainability, innovation, and regional trade dynamics together and highlights the strategic steps needed to maintain resilience and competitiveness

In conclusion, the coating resins sector is navigating a period of structural change driven by sustainability expectations, polymer innovation, and an increasingly politicized trade environment. These forces are not transitory; they require a strategic recalibration that links material science, procurement discipline, and regional manufacturing logic. Firms that proactively diversify feedstock exposure, accelerate qualification of lower‑impact resins, and embed tariff‑scenario planning into their commercial processes will retain flexibility and protect margins in an uncertain policy landscape.

Conversely, those that postpone supplier diversification or overlook regional policy dynamics risk supply interruptions and margin compression. The path forward is clear: align R&D investments with resilient sourcing strategies, prioritize formulations that meet both environmental and durability demands, and use data‑driven scenario planning to make defensible commercial choices. Taken together, these measures will enable coating-resin stakeholders to convert disruption into competitive advantage.

Secure a personalized purchase and executive briefing with the Associate Director to access tailored tariff scenario analysis and resin supply-chain solutions

To acquire the full market research report and a tailored briefing, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who can coordinate an executive summary, bespoke competitive benchmarking, and licensing options for your organization. He will arrange a private walkthrough of the report’s key findings, enable access to the supporting datasets and methodology appendices, and propose subscription or single‑purchase terms that align with your strategic priorities and procurement rules.

When contacting Ketan, request an industry briefing focused on tariff exposure scenarios, resin-level product roadmaps, and regional supply‑chain stress tests to ensure the right level of detail for your team. For decision-makers planning capital allocation, ask for the custom due-diligence package that includes supplier risk scores, cost-pass-through modeling, and an implementation timeline for recommended mitigation steps. Ketan will also coordinate follow-up analyst sessions to unpack technical appendices and validate assumptions for internal use.

Act now to secure priority access to the report and any time-limited discount programs or bundled consulting hours. Booking a briefing with Ketan guarantees a rapid, actionable start to applying the research insights to procurement optimization, product innovation roadmaps, and tariff mitigation strategies tailored to your organization’s footprint and risk appetite.

- How big is the Coating Resins Market?

- What is the Coating Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?